Lessons from market history

Learning from the past may lead to better decision making.

We are told ad nauseum that past performance is not an indicator of future performance. Past performance cannot be projected into the future as an indicator of how soon you will reach your financial goals. It cannot be used to solely determine asset allocation.

However, the past is how we learn. Examining the past provides personal growth – by understanding the triumphs and failures of past endeavours and learning from them. Mark has written about how historical patterns repeat themselves. And lessons from history show us the genesis of financial disasters lay in visions of limitless growth. James Gruber explores three lessons investors can learn from history in this article.

There have been many triumphs and failures in the investing world. Some are unfolding stories that are yet to play out, some are lessons that we have learnt that have informed our investing world view, and some inform how we approach achieving our financial goals.

Mark’s explores the lessons we can learn from some of the failures of the investing world in his webinar - the investing lessons we can garner from market crashes.

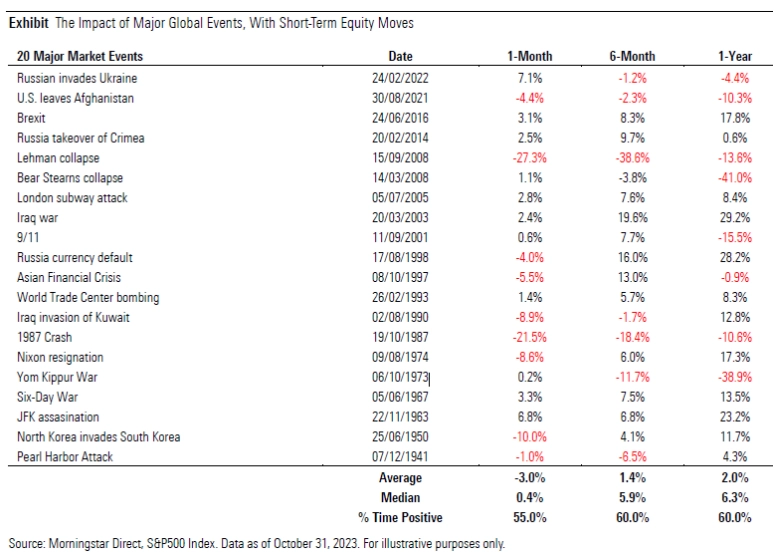

These lessons couldn’t come at a better time. Not only are we seeing geopolitical uncertainty, cost of living pressures, persistent inflation and market uncertainty, we’re also coming into a period of major global events. We will see the US, UK and Australia go to the polls. What lessons can we learn from major global events on equity markets?

The factors that investors should consider coming into this period are outlined in this article.

In terms of opportunities, here are some of the lessons that we’ve learned from Japanese market history that can lead to better investment decision making.