'Quality' ETFs under the microscope

Interest in the quality factor has been a recurring theme among the more popular factor ETFs, helped along by some very attractive returns.

Mentioned: VanEck China New Economy ETF (CNEW), BetaShares Global Quality Leaders ETF (QLTY), BetaShares India Quality ETF (IIND), BetaShares Global Quality Ldrs ETF Ccy H (HQLT), iShares Edge MSCI Australia Mltfctr ETF (AUMF), VanEck Morningstar Wide Moat ETF (MOAT), SPDR® MSCI World Quality Mix ETF (QMIX), Vaneck Msci International Quality Etf (QUAL), Global X Morningstar Global Tech ETF (TECH)

Factor investing is an investment approach that involves focusing on certain drivers of returns across asset classes. Globally, it has made inroads into retail and institutional investors’ portfolios alike, as a tool to enhance risk-adjusted performance in a relatively low-cost manner. The trend is alive and well in Australia, too.

Interest in the quality factor has been a recurring theme among the more popular factor ETFs, helped along by some very attractive returns.

What is quality?

The quality factor is characterised by stable earnings, robust financial positions measured by leverage, and higher profit margins. However, strategies can interpret and apply the quality factor in different ways. The index provider upon which the ETF is based can define quality in its own way depending on the source of company data and the emphasis placed on each data point. And ultimately portfolio-construction methods can vary.

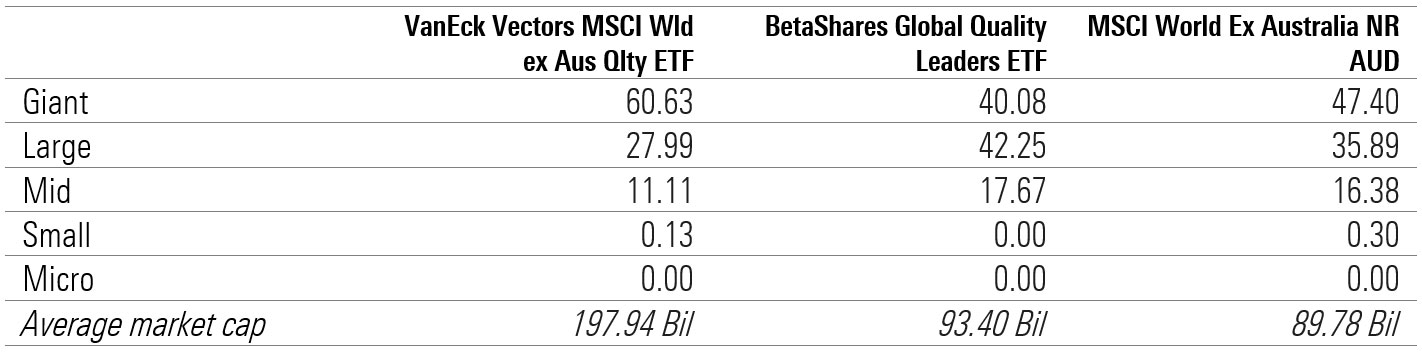

A lack of consensus on a comprehensive quality factor-focused index means that two strategies targeting the same quality factor can derive materially different portfolio attributes. For example, when comparing the VanEck Vectors MSCI Wld ex Aus Qlty ETF (ASX:QUAL) with the BetaShares Global Quality Leaders ETF (ASX:QLTY), the former has a significant size tilt toward giant-cap companies (61.5 per cent vs 40.0 per cent in the latter). For Australian investors, quality ETFs offer greater sectoral diversification—they typically have higher allocations to technology and healthcare names, and lower allocation to financials and materials.

Market cap | QUAL v QLTY

Source: Morningstar

Quality factor ETFs in Australia

For investors wanting to incorporate quality factors via an ETF as part of their equity portfolio, there are two types of investment avenues:

- Pure-play quality factor strategies

- Multifactor ETFs

The latter incorporates quality as one of the underlying factors in their portfolio construction. The two approaches can deliver noticeably different portfolio traits, as demonstrated by the Morningstar Factor Profile below.

Factor profiles of a multifactor ETF vs quality ETF

Source: Morningstar Premium

Morningstar’s Factor Profile can be a useful guide for investors in assessing factor-based equity strategies, displaying a strategy’s standing across seven investment attributes compared with its category peers and index, and thus helping to understand how different strategies can augment and complement their existing portfolios. Within the Morningstar Factor Profile framework, the Quality attribute is defined as a measure of profitability and leverage. Above1, we can see factor profiles of SPDR MSCI World Quality Mix (ASX: QMIX) (multifactor) and VanEck Vectors MSCI Wld ex Aus Qlty ETF (ASX: QUAL) (pure quality factor).

Defining quality

The Quality factor cohort is a small but heterogeneous group, and consequently the return profiles can be markedly different. The idiosyncratic return profiles are attributed to small yet critical divergences in certain portfolio traits that manifest based on the approach taken to define quality in constructing the portfolio.

To illustrate this point, VanEck Vectors MSCI Wld ex Aus Qlty ETF (ASX: QUAL) and BetaShares Global Quality Leaders ETF (ASX: QLTY) both offer investors the quality factor exposure to global equities, but their distinct approaches can lead to nuanced contrast in the other factor exposures. For their current portfolios this is particularly the case across the size, yield, and growth factors. Other differences can be seen when compared with MSCI World ex Australia Index and the Morningstar category average.

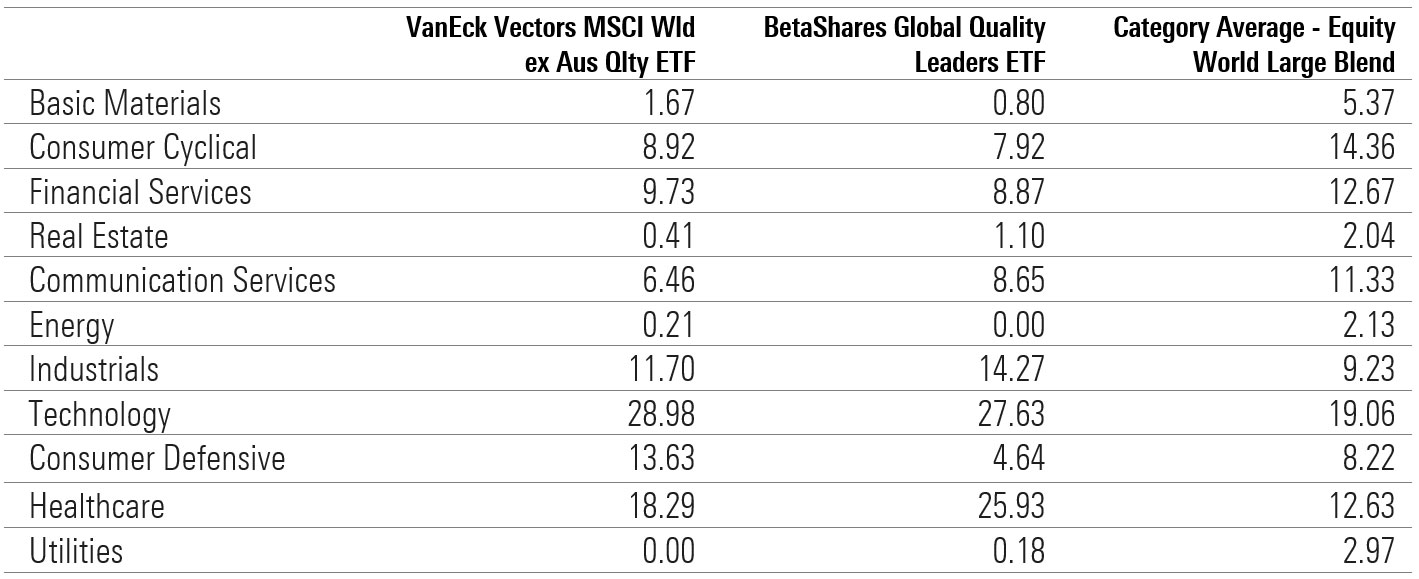

Furthermore, impacting the long-term performance is the sector exposures disparity. VanEck Vectors MSCI Wld ex Aus Qlty ETF (ASX: QUAL) allocation to consumer staples is almost twice of the Morningstar category average whereas healthcare is twice of the category average in BetaShares Global Quality Leaders ETF (ASX:QLTY).

Sector exposure | QUAL v QLTY

Source: Morningstar, AUD, as of Oct 31, 2020

Flows and outperformance

Based on net cash flow, investor interest in all factor ETFs in Australia has been subtle. However, assets in quality ETFs have grown markedly over the past three years, likely in part driven by strong performance. VanEck Vectors MSCI Wld ex Aus Qlty ETF (ASX: QUAL) dwarfs the similar factor funds and has the longest track record in which investors can take confidence.

In the domestic space, a pure-play Australian equity quality product is not yet available, so investors may look to a quality factor ETF via the multifactor approach offered by iShares Edge MSCI Australia Multifactor ETF (ASX: AUMF). Other highly niche products available are region-specific, such as China exposure with VanEck Vectors China New Economy ETF (ASX: CNEW) (Multifactor) and India exposure with Betashares India Quality ETF (ASX: IIND) (Quality).

Quality ETF market growth by fund, 5 Yr, fund size (comprehensive, monthly, AUD)

Source: Morningstar

Quality has been a clear winner in recent years, delivering impressive peer-relative performance across all three periods used for assessment. Specifically, the group's downside capture ratio during the first-quarter 2020 sell-off and upside capture ratio during the third-quarter 2020 recovery has been impressive.

Quality-based strategies have more than demonstrated their efficacy in withstanding the turbulent market conditions if recent times are anything to go by. However, investors should remember that all factors will have phases when they work and when they don’t, and a balance across a range of factors will ensure healthy portfolio diversification.

Quality ETFs snapshot

Source: Morningstar

Additional reporting from Emma Rapaport, Editorial Manager, Morningstar Australia.