Best funds for a value comeback

Value investing has enjoyed a resurgence so far this year. We look at the funds poised to benefit.

Mentioned: Investors Mutual WS Australian Share (5339), BetaShares FTSE RAFI Australia 200 ETF (QOZ)

Co-authored with Emma Rapaport, editorial manager, Morningstar.com.au

One of the big themes of the year so far has been the value comeback. What is behind this resurgence after a pretty dismal period?

Mathieu Caquineau, an analyst with Morningstar's manager research team, says the value rally for stocks started in last November when market participants started to price in a stronger than expected economic recovery partly based on vaccines, partly based on stimulus. The value rebound continued this year but has seesawed from week to week.

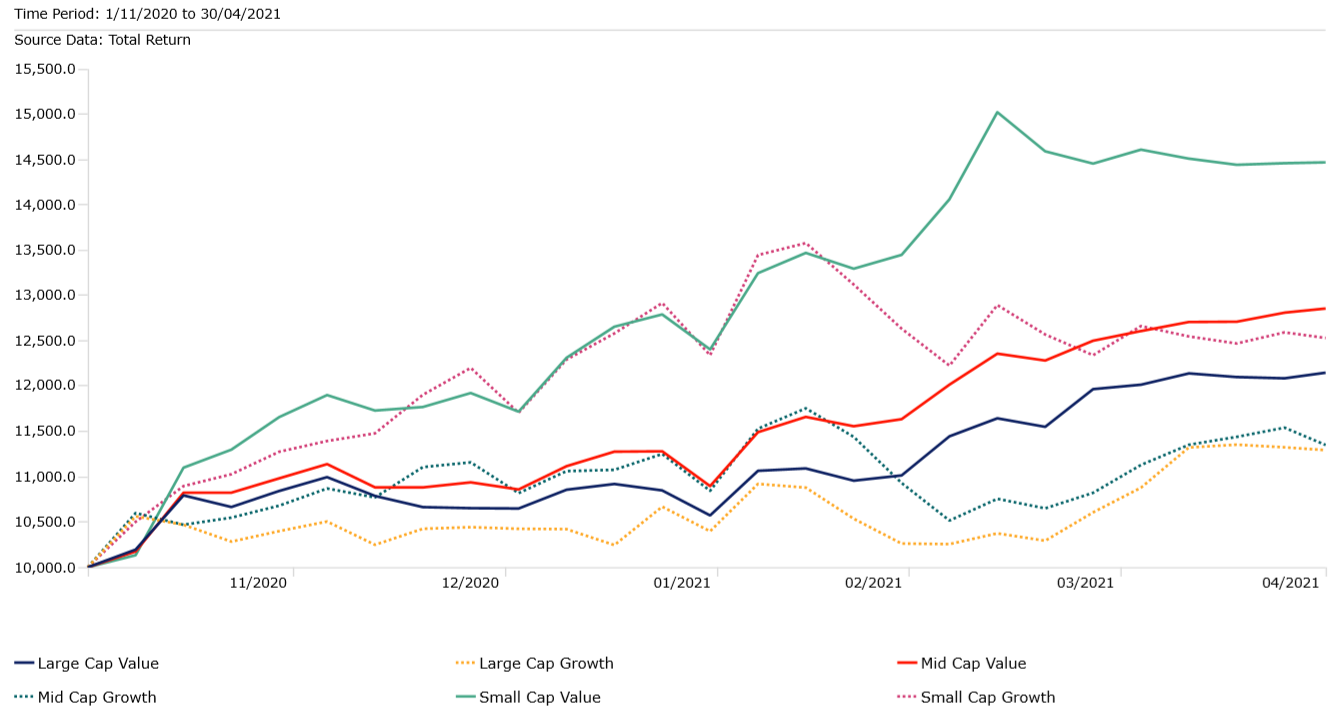

If you look at the past six months, the Russell Top 200 Growth TR Index is up 12.93 per cent whereas the Russell Top 200 Value TR Index is up 21.48 per cent in the same period. Value stocks tend to be economically sensitive. Energy, commodities, bank stocks have led the rally.

Investment Growth $10k 6-Mth | US Market Indexes by Style

Source: Morningstar

Caquineau says this short-term outperformance has not erased the large advent of growth funds versus value funds over the past decade.

"It has been such a difficult decade for value managers," he says. "It's going to take much more than a six months' outperformance to look good again. But any signs of rebound are fuelling hope that value is indeed back for good."

Whether or not it’s back long-term is still a question mark. Over the past decade, value had a few episodes of short-lived rebounds, notably 2016, but none lasted very long. Caquineau notes however that style work in cycles.

"We have clearly been in a growth cycle for so long that now valuation for some growth stocks look stretched," he says. "Everything is in place for value to be back, especially if we see a stronger than expected economic recovery that could boost the earnings outlook for value stocks. But there is no certainty.

Periodic Table 10-Yr | US Market Indexes by Style

Source: Morningstar

He adds: "I think it makes sense for investors to look at their portfolios, see if they have an appropriate diversification in terms of style. If you've let your winners run in recent years, you might have a bigger, much bigger allocation to growth managers than what is desirable from a risk management standpoint."

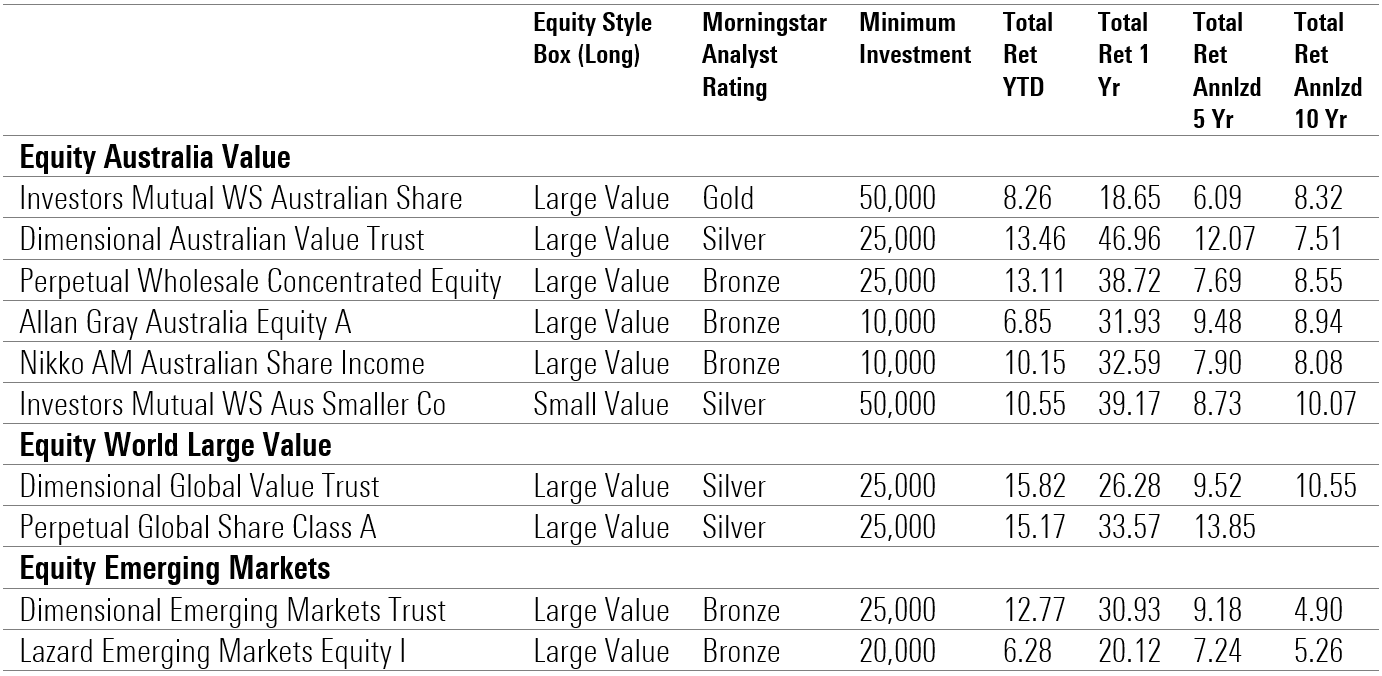

When it comes to selecting value funds, Caquineau notes that it is not just about choosing any growth fund or a value fund. It's about choosing a good manager that can deliver. Value investing is not as easy as you might think. Here are some equity strategies Morningstar analysts rate highly.

MORE ON VALUE UNDERPERFORMANCE:

Medalist value-style funds (unlisted)

Source: Morningstar. Total return numbers are month-end to April 2021. This is a selection of Morningstar medalist value funds (equity). ![]() View the full list here

View the full list here

Morningstar’s preferred manager in the Australian large-cap space is Investors Mutual.

“Investors Mutual Australian Share’s (5339) shrewd investors and a class-leading process make this strategy one of our favourites in the value space. IML was founded by Anton Tagliaferro in 1998 and has maintained the same value quality approach to a fault. The shop emphasises fundamental research, targeting well-managed companies with competitive advantages, predictable earnings, and cheap or reasonable prices. Portfolio positions are determined by price targets and the level of confidence.

“The portfolio is helmed by three experienced portfolio managers in Anton Tagliaferro, Hugh Giddy, and Daniel Moore, who run sleeves of 25 per cent, 50 per cent, and 25 per cent, respectively. They approach each of their sleeves through a slightly different lens, so there are some disparities, though broad holdings are largely similar.

“One of the hallmarks of the strategy is strong downside protection. This came to the fore during the recent coronavirus sell-off as IML’s strategies achieved the lowest decline amongst the category. However, IML missed out on the violent rebound as low-quality names and high-flying tech stocks outperformed, which IML typically avoids. We’re confident that when value returns to favour, IML Australian Share’s talented investors and rigorous process are best positioned to capture the value premium, making this one of our favourites.”

-- Edward Huynh, analyst, September 2020

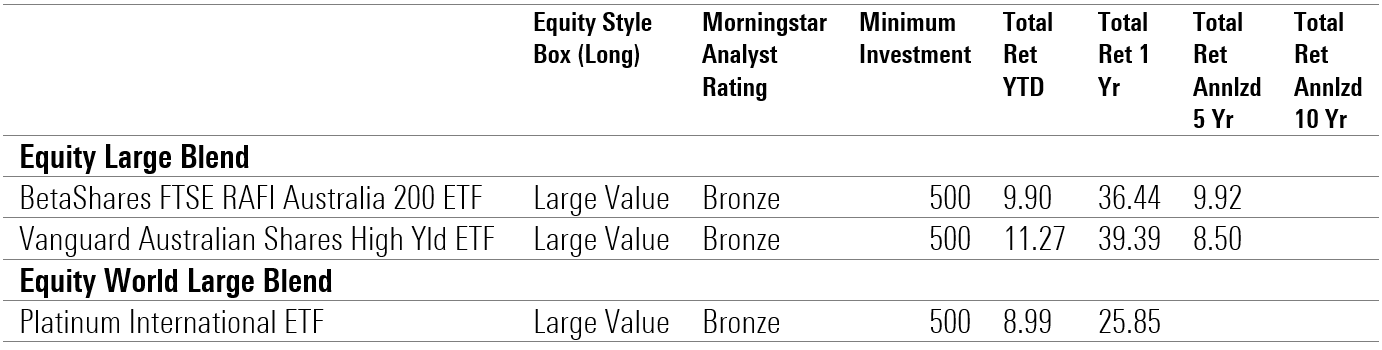

Medalist value-style funds (listed)

Source: Morningstar. Total return numbers are month-end to April 2021. This is a selection of Morningstar medalist value funds (equity). ![]() View the full list here.

View the full list here.

Among listed funds, analysts prefer three managers – Platinum, Vanguard and BetaShares.

"BetaShares FTSE RAFI Australia 200 ETF (ASX: QOZ) differentiates itself from the pack on the basis of its distinctive process and its competitive pricing. QOZ aims to track the FTSE RAFI Australia 200 Index before fees and expenses. The index construction is based on a four-factor method developed by US-based Research Affiliates. Based on the five-year average of the four metrics--book value, sales, cash flow, and dividend--the portfolio incorporates solid yet undervalued stocks. Conventional market-cap-weighted benchmarks mechanically devote a greater portion to stocks with rising share prices; however, QOZ implements a more cautious style, which may even reduce the exposure to rallying stocks if the other fundamentals such as earnings or sales do not rise commensurately. Thus, a bullish market presents challenges to QOZ’s contrarian methodology.

"The resulting portfolio has a value tilt and is heavy on sectors such as financial services, which comprised around 40 per cent of assets as at November 2020. Basic materials, at 20 per cent, is another meaningful sector weight. Thus, the portfolio is heavily skewed towards cyclicals, which form almost 75 per cent of the overall allocation. Value strategies have faced headwinds over the past decade, pulling down their relative performance attributes. However, it should be noted that such factor skews undergo cycles and may see an upturn when the macroeconomic environment changes."

-- Zunjar Sanzgiri, senior analyst, April 2021