Rethinking income for 2023

As interest rates continue to climb, there are some emerging opportunities for yield-hungry investors, including one asset class worth reconsidering.

Mentioned: Yarra Australian Bond Fund (10858), Janus Henderson Tactical Income (17406), Challenger Ltd (CGF), Computershare Ltd (CPU)

Rising interest rates were a dominant investment theme for 2022. Australia had eight consecutive rate hikes. Today the cash rate stands at 3.10% – the highest in 10 years. Global central banks are also still tightening.

Despite the challenges for borrowers, the higher cash rate is a positive for yield-hungry investors, with a few asset classes now offering attractive returns, notably bonds and cash.

Bonds are back

Morningstar director of manager selection Aman Ramrakha says many bond managers he's spoken to are feeling optimistic about the rising interest rate environment.

"These bond managers believe they are now in a position to actually generate some decent returns because of the higher coupons now offered by bonds,” Ramrakha says.

A coupon is the annual interest rate paid on a bond. Ramrakha adds that with cash rates being artificially suppressed, this has been challenging. Now with cash rates ticking upwards, bonds should be generating higher income.

He warns that the caveat here is that on a market-to-market basis, bonds have posted paper losses. This means that the price of bonds has been determined by the current market conditions.

“There will still be market volatility which means the market-to-market pricing of these bonds may not improve. However, these losses will continue to be just paper losses," Ramrakha says.

"The good news is the income characteristics of bonds has improved. Bonds should still be able to provide better income for investors."

Ramrakha’s preference is for Australian bonds over global bonds, notably because the economic outlook is more positive domestically compared with overseas markets.

Quality bond managers under Morningstar’s research include the Janus Henderson Tactical Income Fund and the Yarra Australian Bond Fund.

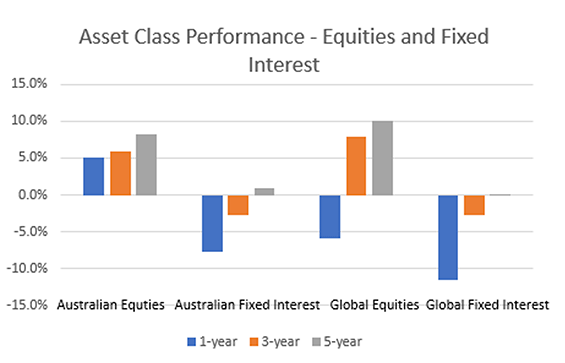

Ramrakha says bonds also play an important role in portfolio diversification given that this asset class is uncorrelated to equities over the long term as shown in the chart below.

Source: Morningstar; Asset class performance as at 30 November 2022

It’s a good hedge against equity despite the events of 2022 when bonds and equities were correlated. More forecasters expect there will be at least a mild recession, most likely for the US and Europe and here bonds are better placed as they are often perceived as a safe asset and could benefit from a flight to safety.

A fistful of cash

In an environment of anaemic interest rates, as seen in 2020 and 2021, term deposits delivered paltry returns.

While savers have been left behind at the big banks - with the RBA's rate hikes passed on in full to borrowers but not savers – there is some good news if investors are prepared to look for savings returns outside of the big four.

Comparison site RateCity says the highest ongoing savings rate available to all adults hit 4.60% in December, offered by Virgin Money. And for term deposits, AMP for example is offering rates above 4% on a 12-month fixed term.

“We are now seeing competition in the market both from annuity providers and other institutions, offering attractive rates on term deposits. These should be attractive for conservative investors," Ramrakha says.

Equities with appeal

Higher interest rates will also impact the outlook for many businesses. It was a theme highlighted in a recent adviser webinar with Morningstar director of equity research Mathew Hodge.

Sectors such as the AREITs and financials services are sensitive to rate rises, but Hodge believes a number of companies are well-placed for a rising rate environment, particularly those generating free flowing cash that will earn interest.

Hodge identified share registry business Computershare (CPU) and annuity provider Challenger (GGF) as examples.

The high interest rate environment boosts the appeal of annuity products and will likely allow Challenger to earn a higher return on annuity holder funds, Hodge says. In fact, the business reported a 50% increase in annuity sales in its September trading update.

Similarly, Computershare increased guidance on its margin in its trading update due to improvements in interest rates. Computershare has material exposure to interest rates by virture of the interest it earns on client-owned balances.

“These businesses are not super cheap, but they are worth considering in a portfolio given the uncertain outlook," Hodge says.