US stock market outlook for 2023

As the saying goes; when Wall Street sneezes, the world catches a cold. And the US is set up for near-term turbulence - but there are clearer skies ahead.

- Stocks are trading at a deep discount to our fair value estimate.

- Volatility will remain high over the first half of 2023, but market should begin sustained recovery in second half.

- Headwinds identified at beginning of 2022 are forecast to turn into tailwinds in second half of 2023.

- High-quality companies with wide economic moats especially attractive.

2023 US Stock Market Outlook

Often, the market acts like a pendulum and can quickly swing from overvalued to undervalued.

Now is one of those times.

As much as we thought stocks were overvalued coming into 2022, we now see the markets as trading at a deep discount to our fair value estimate.

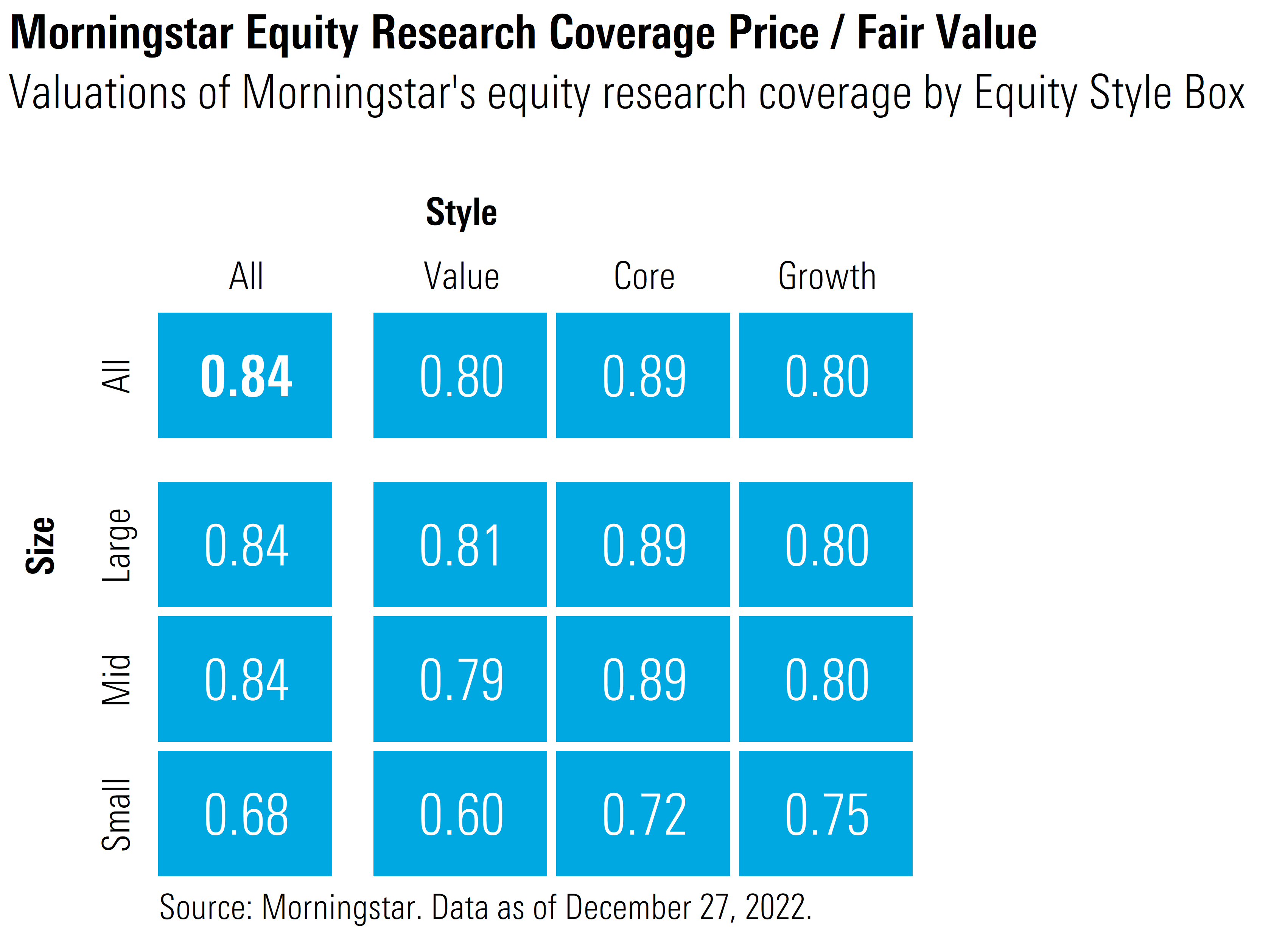

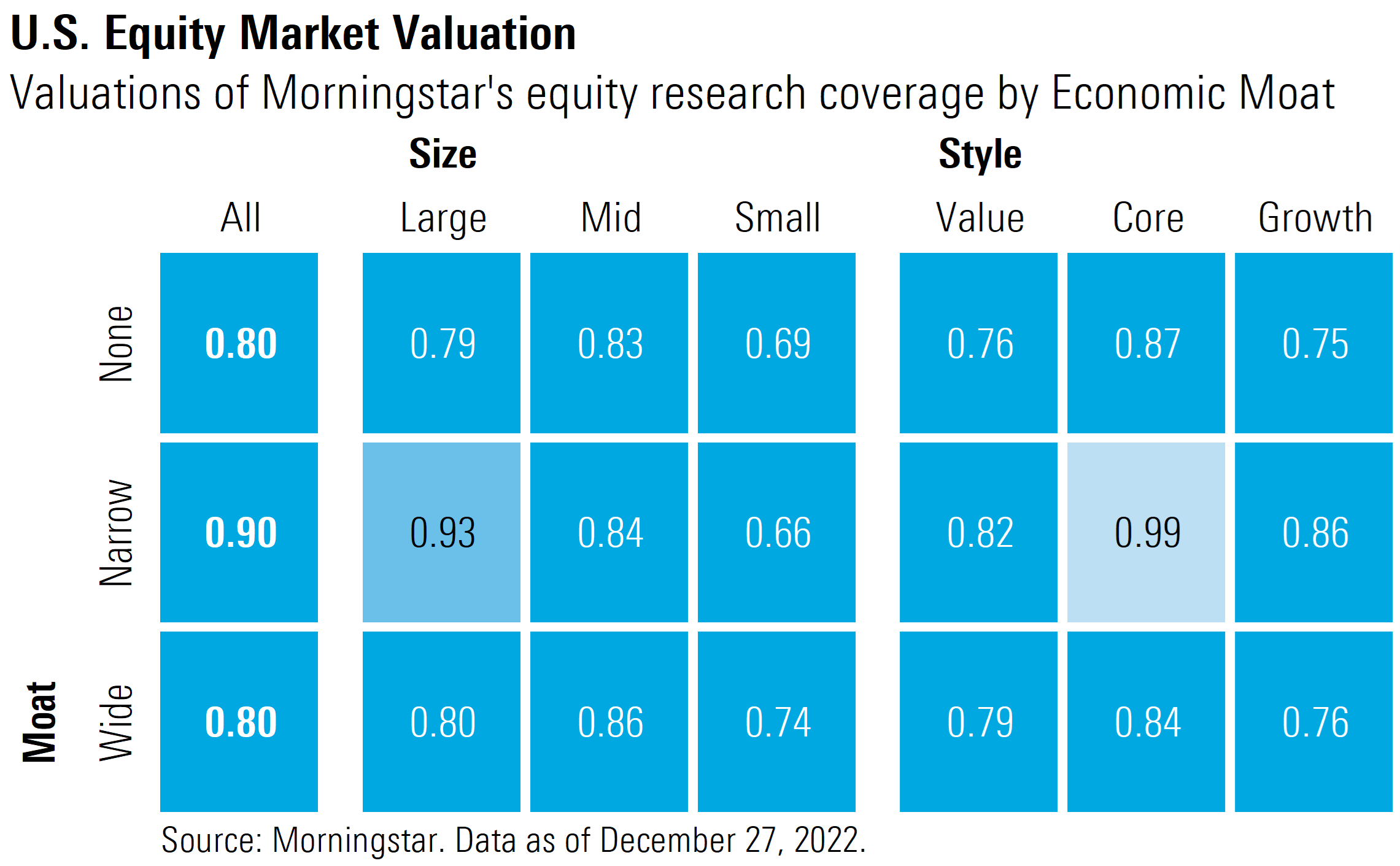

Compared with a composite of the more than 700 stocks we cover that trade on US exchanges, we calculate that the market is trading at a price/fair value of 0.84, a 16% discount to an aggregate of our intrinsic valuations.

According to our valuations, investors appear best positioned in a barbell-shaped portfolio by overweighting the value and growth categories and underweighting the core category. Across capitalizations, large-cap and mid-cap valuations are in line with the broad market average, whereas small-cap stocks are trading at an over-30% discount.

While we calculate that the market is significantly undervalued, we also expect the markets will remain turbulent over the foreseeable future. Based on our outlook that the economy will be stagnant—or even recessionary—in the first half of 2023, we expect volatility will remain high over the next two quarters. However, the combination of an economic recovery, moderating inflation, and prospects for an easier monetary policy in the second half of 2023 should allow equity markets to begin to recover toward our long-term, intrinsic valuations.

Stocks Trading at a Rarely Seen Discount to Our Valuations

Tightening monetary policy, a weak economy, high inflation, and rising interest rates took their toll on the markets in 2022. Yet, while near-term dynamics remain challenging, according to our long-term intrinsic valuations, the market is trading deep into rarely seen undervalued territory. Since the end of 2010, the market has traded at or below the current discount only 5% of the time.

2022 Headwinds Should Turn Into Tailwinds in the Second Half of 2023

In our 2022 Market Outlook, we noted that the US equity market was overvalued and would need to contend with four main headwinds this year:

- Slowing rate of economic growth

- Tightening monetary policy

- Inflation running hot

- Rising long-term interest rates

Here is what we see in 2023:

Economic Outlook

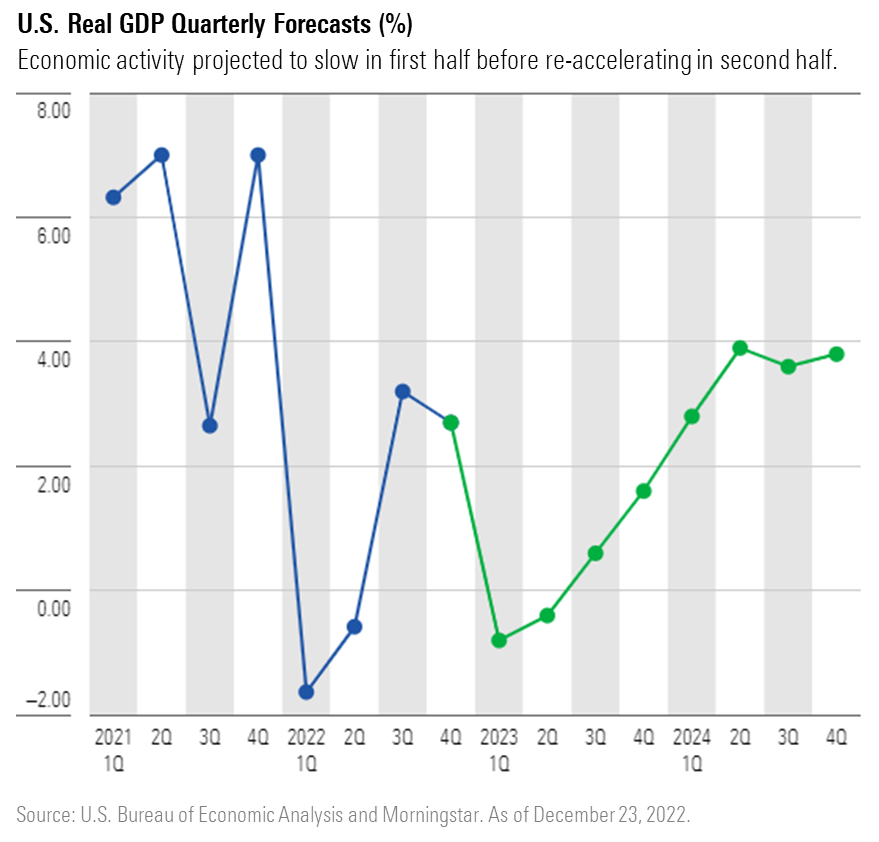

The US economy contracted in the first half of 2022 before starting to expand in the third quarter and it is projected to grow 2.7% in the fourth quarter. However, monetary policy acts with a lag and we expect higher interest rates will lead to stagnant economic growth, and possibly a recession, in the first half of 2023. According to our projections, economic activity should bottom out midyear and begin to rebound in the second half of the year.

Monetary Policy

As inflation has been anything but transitory, the Federal Reserve began to tighten monetary policy in March 2022. During 2022, the Fed conducted the fastest interest-rate-hiking cycle since the early 1980s, when inflation was in the double digits.

Compounding the impact of hiking interest rates, the Fed had also begun a quantitative tightening program that allows $95 billion of Treasuries and mortgage-backed securities roll off its balance sheet each month.

At this point, we expect the Fed will hike the federal-funds rate one or two more times in the beginning of 2023 but will halt additional tightening thereafter. In fact, considering that we expect the economy activity will be stagnant or recessionary in the first half and forecast inflation will continue to moderate, we anticipate that the Federal Reserve will reverse course and begin to ease monetary policy in the second half of the year.

Inflation Outlook

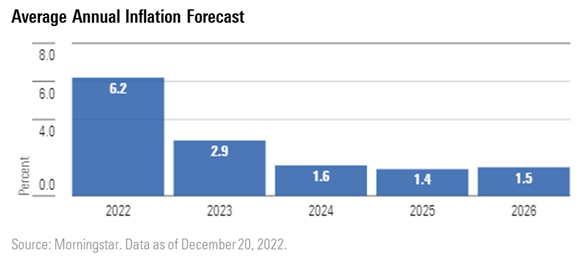

After pausing in fall 2021, inflation came roaring back in 2022. Rising oil prices, supply chain issues, and bottlenecks took their toll with inflation peaking at 9.1% in June 2022. However, inflation had been mainly concentrated in a few categories and as oil prices rolled over in the second half of 2022 and supply chains normalized, inflation has begun to decelerate. Furthermore, interest-rate hikes have begun to reduce activity in interest rate sensitive sectors, which will help to lower inflation. We forecast that inflation will continue to decelerate in 2023 and will average 2.9% and continue to decline into 2024.

Interest-Rate Outlook

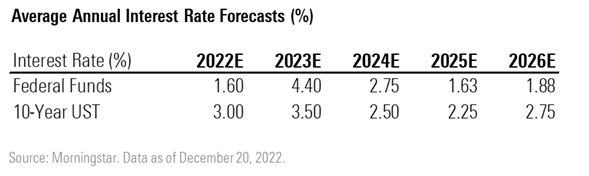

According to our forecasts, the preponderance of increases we expected in long-term interest rates in 2022 is behind us. The yields across the longer end of the curve may increase modestly in the near term as the Fed continues to hike interest rates and as inflation remains high, but in the face of a stagnant economy, moderating inflation, and a halt in further monetary policy tightening, we forecast interest rates will decrease slightly in the back half of the year.

We forecast the yield on the 10-year U.S. Treasury will average 3.50% in 2023, decline to 2.50% in 2024, and bottom out at an average of 2.25% in 2025 before beginning to increase toward a normalized level. For greater detail, our 2023 fixed-income outlook is here.

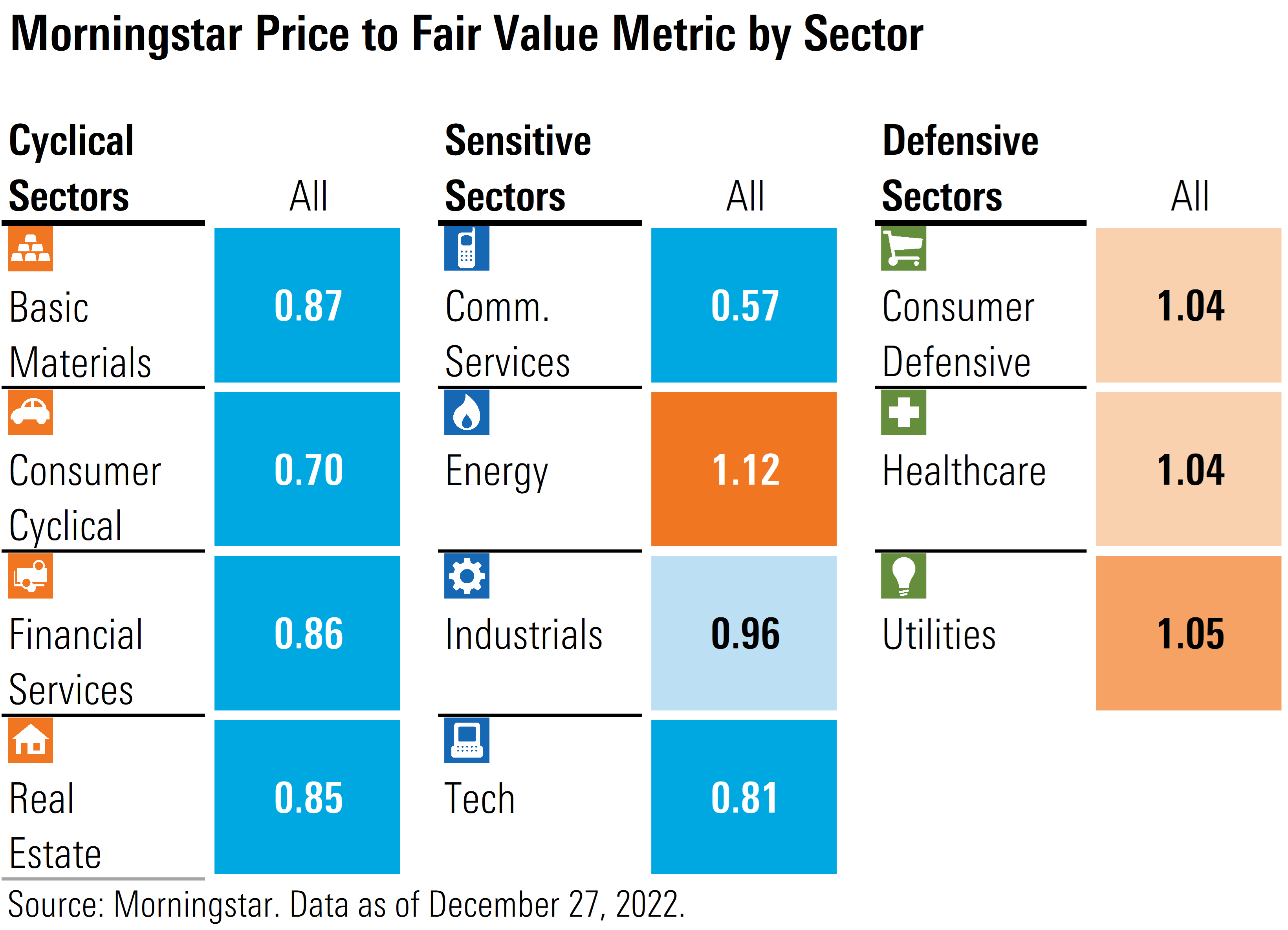

Sector Valuations

Across our sector coverage, communication services is the most undervalued by far, trading at a 43% discount to our fair value estimate. While almost all stocks in the sector fell, performance was led by Alphabet, which dropped 40% and Meta Platforms, which plunged 65%. These two stocks account for 42% and 10%, respectively, of the market capitalization of the sector.

Weak economic growth and rising interest rates have taken their toll on those sectors that we determined were some of the more overvalued coming into 2022. For example, technology, real estate, and consumer cyclicals, each with varying degrees of overvaluation at the beginning of the year, have all underperformed. Yet, in these same cases, we think the markets have overreacted. The consumer cyclical sector is now the second-most undervalued, trading at a 30% discount to fair value, technology trades at a 19% discount, and real estate at a 15% discount.

According to our valuations, energy was the most undervalued sector coming into 2022 and has soared almost 64% higher over the course of the year. Following this astounding return, in our view, the sector is now the most overvalued, and is trading at a 12% premium over our fair value estimate. Defensive sectors such as consumer defensive and healthcare have generally held up to the downside and utilities have edged out a small gain, but according to our valuations, each are trading at a slight premium.

Valuations by Economic Moat

2022 was a year in which valuation played a key determinant in divergence across performance. As a category, high-quality stocks with a wide economic moat have underperformed the broader market. Our economic moat rating identifies those companies that we deem to have the ability to generate excess returns on invested capital over the long term.

For example, the Morningstar Wide Moat Composite Index has fallen 21.92% through Dec. 27, 2022. However, when incorporating a valuation overlay, the Morningstar Wide Moat Focus Index has fallen less than the broad market, only decreasing 13.77% to date.

According to our valuations, it appears the market is undervaluing those companies that we rate with a wide economic moat. In addition to being able to generate excess returns on invested capital over the long term, wide-moat companies generally have greater pricing power. As such, they should be able to pass through any cost increases to clients and be able to better maintain their margins and thus maintain their valuations in an inflationary environment.

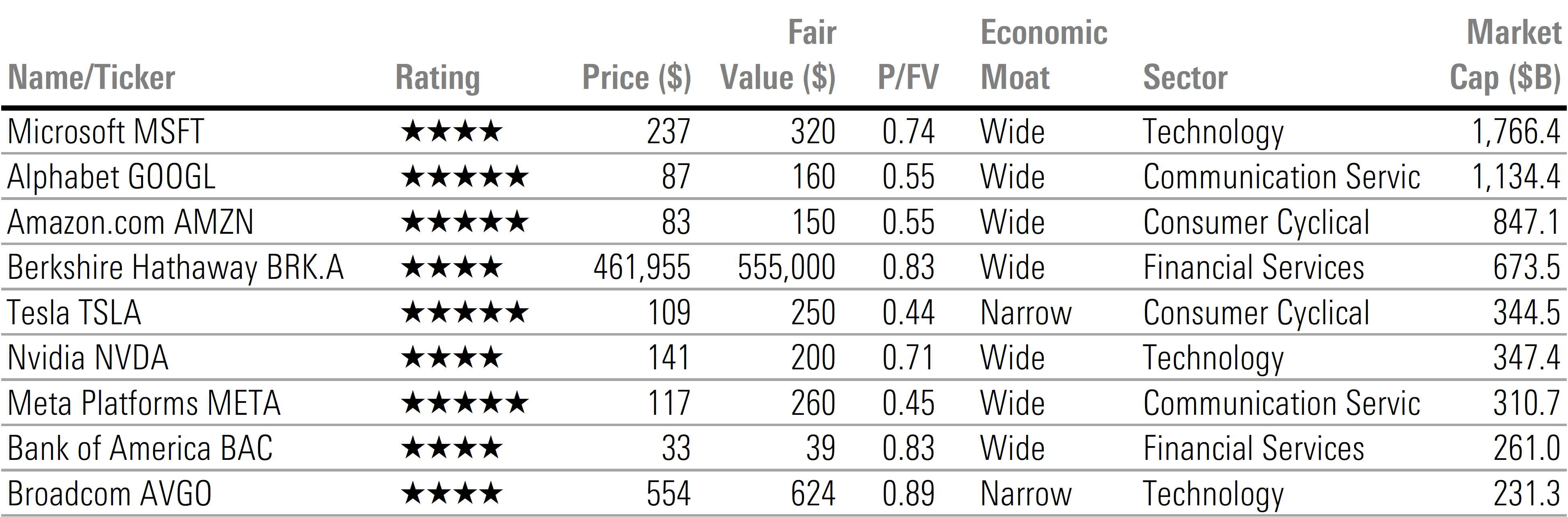

Stocks for 2023

Coming into 2022, we highlighted 15 overvalued mega-cap stocks that had skewed the broad market average higher. Over the course of the year, two thirds of these stocks have significantly underperformed the broad market. We are now finding that many mega-cap stocks are now undervalued. In fact, Tesla, Nvidia, Bank of America, and Broadcom, which were on the overvalued list at the beginning of the year, have all dropped so much that they are now on our list of undervalued mega-cap stocks.

Investment Takeaways

Over the next few months, we expect that stocks will remain highly volatile, surging on those days that positive news is reported and plunging when negative economic metrics are released. As we get closer to midyear 2023 and economic metrics begin to rebound and inflation continues to subside, we expect the markets will exit this period of volatility and will be able to begin a sustainable rally toward fair value.

For long-term investors who are able to withstand this short-term volatility, we think there is enough margin of safety in the market to use these periods of volatility to judiciously add to equity exposures.