US earnings: where’s all that expected bad news?

So far, it’s been a mixed picture: Tesla, General Motors come in strong, while Apple and Alphabet miss the mark.

As fourth-quarter US earnings season rolls on, the news for stock investors may not be all that great, but it’s shaping up to be better than many expected.

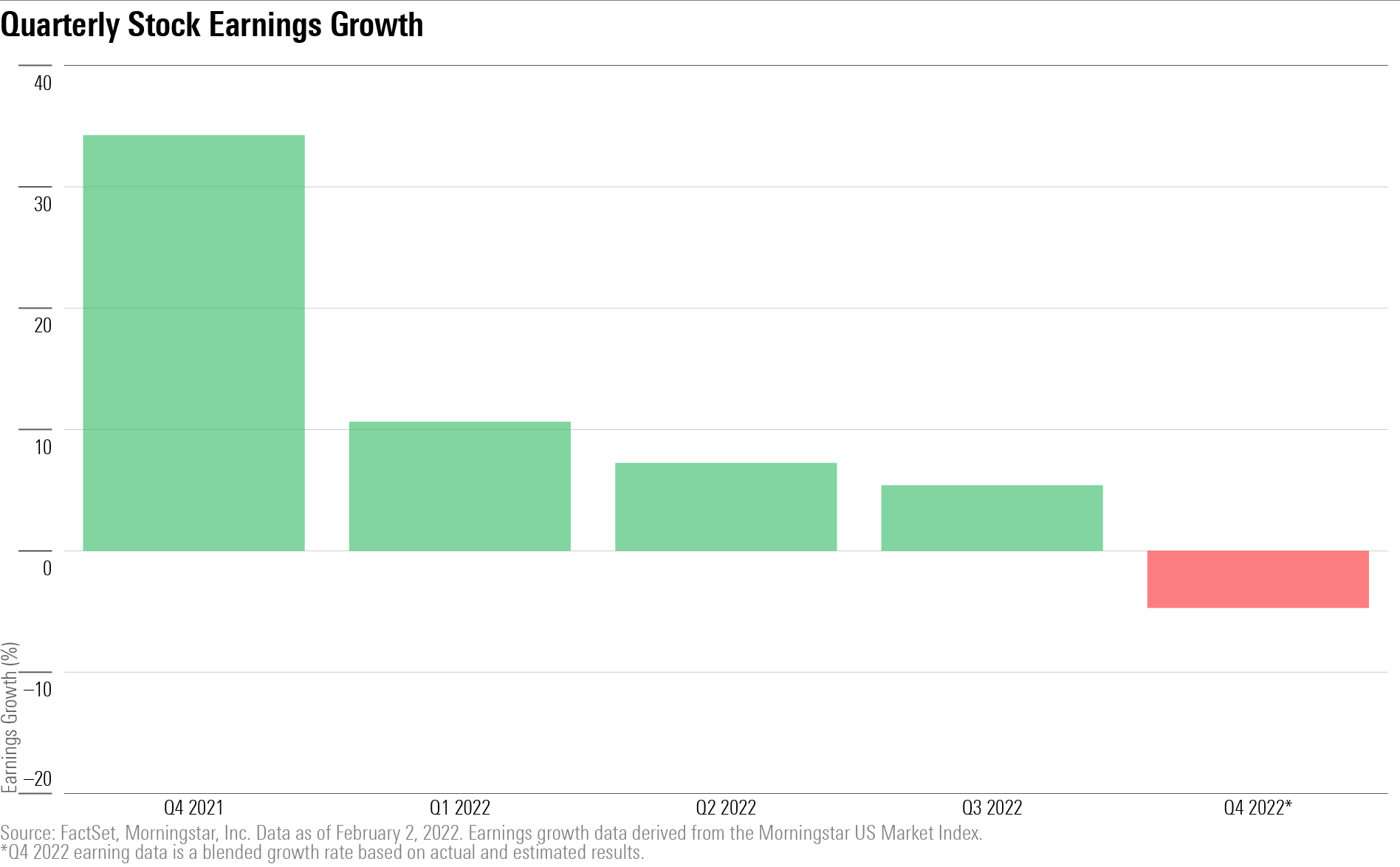

Forecasts had centered on stock market earnings posting an overall low- to mid-single-digit decline compared with a year ago, as companies wrestle with a tough mix of higher costs and worries about a recession.

With about one third of the US earnings season in the rearview mirror, companies that have reported results have instead posted a small gain in earnings. Even amid the big technology stocks, where investors have been especially concerned about the direction of earnings, the results have been mixed but not disastrous.

As of Feb. 2, about 30% of the companies in the Morningstar US Market Index have reported their results for the final quarter of 2022. Based on those reports, earnings are up 0.7% from a year prior. While this is subject to significant change as the rest of the market reports, it’s painting a different picture than expected.

However, results could quickly snap the other way, as indicated by the so-called blended earnings-growth rate of negative 4.7%, which calculates earnings growth using both actual data from reported companies from the Morningstar US Market Index and estimated data from those that haven’t. In that sense, there’s still negative sentiment toward companies that have yet to report.

Should earnings decline once all results are in, it would mark the end of the rapid earnings growth era brought on by the postpandemic economic resurgence. A negative quarter to close out 2022 would be the first decline in earnings since the third quarter of 2020.

Still, the somewhat better-than-expected results have helped extend a rally that has left the Morningstar US Market Index up 8.4% for the year to date.

“Given all the concerns going into this earnings season … it’s not as bad as we expected,” says Quincy Krosby, chief global strategist at LPL Financial.

One item to watch for as earnings season progresses is margin compression, Krosby says. So far that too has held up much better than expected. “Margins are coming down, there’s no doubt about it … but not enough to signal that the markets are going to have to pull back 20% to 25%,” she says. With less compression than expected, companies were able to better preserve their bottom line, which is contributing to more buoyant earnings growth.

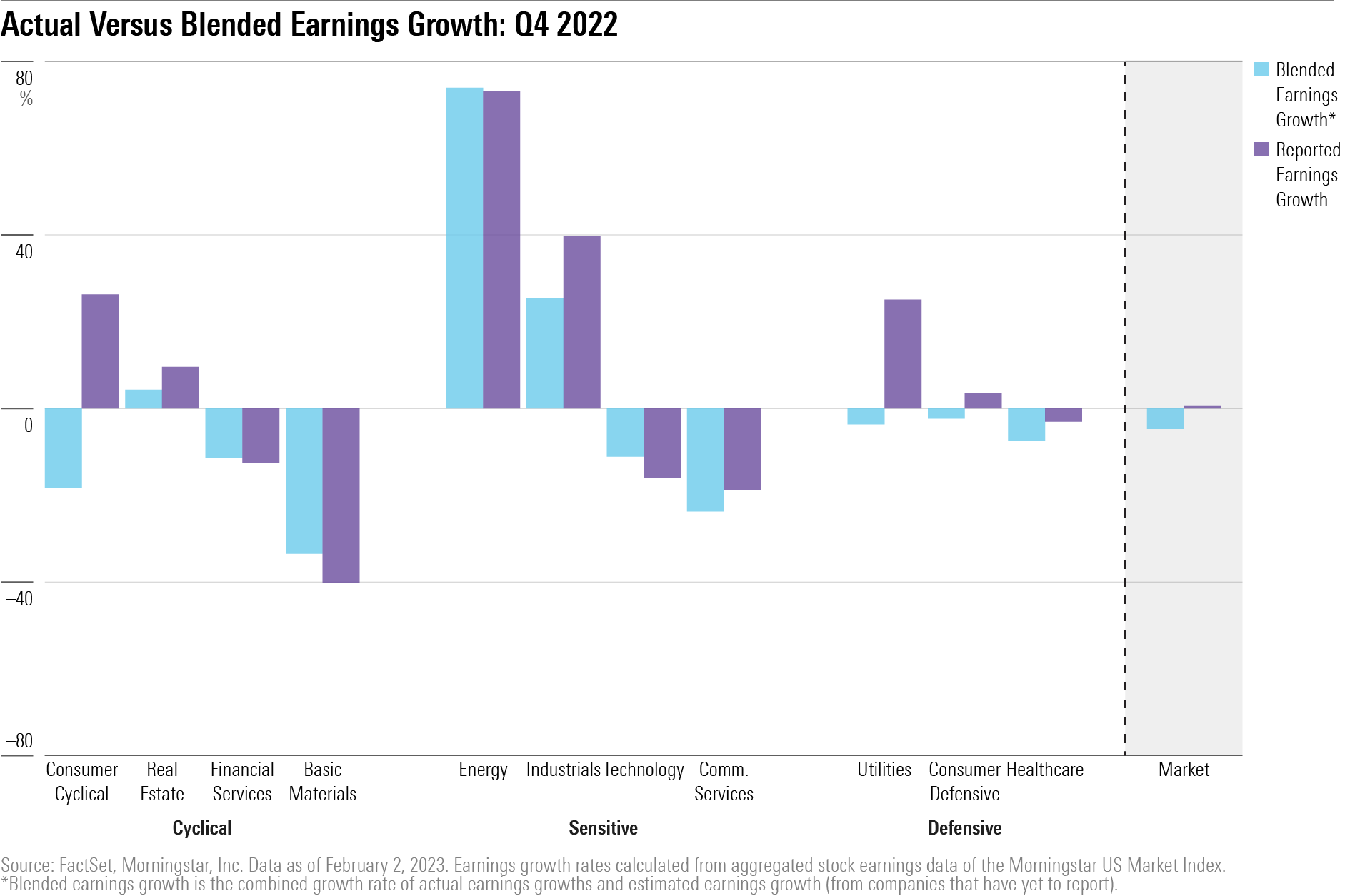

While aggregated reported results suggest that earnings are on track to be flat or increase slightly from a year prior, it’s a different story on a sector level. There, results have mostly tracked closely with negative expectations.

Most notably in the past week, Big Tech companies have reported negative earnings growth during the fourth quarter. Apple AAPL missed both earnings and revenue estimates, and net income declined 13.4% year-over-year following weaker sales during the quarter. Alphabet GOOGL earnings also fell short of estimates, as advertising revenue took a hit and costs rose 8%, leading to a net income decline of roughly 34%. Meanwhile, Amazon.com AMZN saw net income fall to $300 million from $14.3 billion, driven by pre-tax losses of $12.7 billion from its investment in Rivian Automotive RIVN.

That earnings are in positive territory has mainly been a function of stronger-than-expected consumer cyclical and utilities earnings.

Much of the strength in the consumer cyclical sector has come from the automobile industry, which is typically among the earliest to report. Companies with surprising positive earnings results included Tesla TSLA and General Motors GM, which both beat revenue and earnings estimates thanks to a higher volume of vehicle sales than expected.

The strength of consumer cyclical companies is likely reflecting the resilient U.S. economy. Many analysts have been anticipating a slowing in consumer spending ahead of a potentially tougher economic environment, says Krosby.

So far that isn’t the case. “People still have jobs … consumers are still spending,” she says. “This is where the U.S. economy is defying what we’re hearing from the companies.”

However, the consumer cyclical sector is far from having fully reported results. Retailers and travel companies make up the bulk of the 80% of companies that have yet to report in the sector, and expectations for those companies is deeply negative. Although reported results so far have shown consumer cyclicals’ earnings up 26.3%, the blended earnings-growth rate is currently at negative 18.4%, indicating significant downside.

“It would be prudent to wait for more earnings before we grade it,” Krosby says.

Utilities stocks, likewise, have been surpassing expectations. While only 11% of the utilities stocks in the Morningstar US Market Index have reported, their earnings have grown about 25.1%, led companies like NextEra Energy NEE and Xcel Energy XEL, which both beat estimates and reported earnings growth of more than 20%. On the other hand, the blended growth rate is negative 3.6%, which suggests an overall decline in earnings for utilities is still on its way.

In the event earnings overall remain flat or positive, Krosby warns that even if companies may be holding up better than expected now, with margins somewhat guarded, “they are coming down.” Whether earnings swing the other way during this earnings season, or for the next, it will be critical to “hear what the companies are telling us. What are they doing to help the bottom line?”

Events Scheduled for the Coming Week Include:

- Tuesday: BP BP reports earnings.

- Wednesday: Walt Disney DIS and Uber Technologies UBER report earnings.

- Thursday: AbbVie ABBV, Lyft LYFT, and Cloudflare NET report earnings.

For the Trading Week Ended Feb. 3:

- The Morningstar US Market Index rose 1.8%.

- The best-performing sectors were communication services, up 4.5%, and technology, up 4.1%.

- The worst-performing sector was energy, down 5.8%, and utilities, down 1.1%.

- Yields on 10-year U.S. Treasuries remained flat at 3.53%.

- West Texas Intermediate crude prices fell 7.9% to $73.39 per barrel.

- Of the 847 U.S.-listed companies covered by Morningstar, 551, or 65%, were up, and 296, or 35%, declined.

What Stocks Are Up?

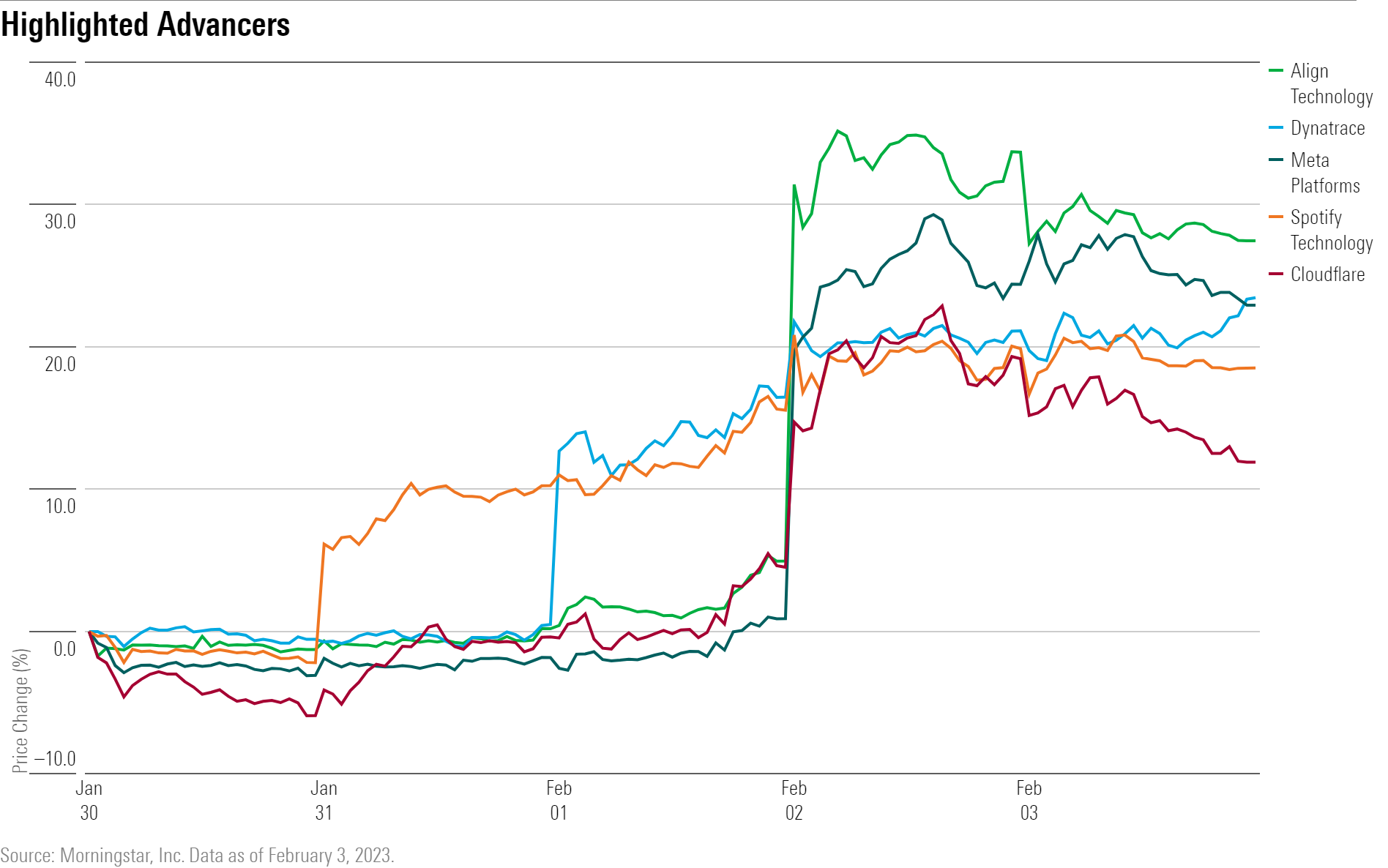

Meta Platforms META saw its stock surge after reporting better-than-expected earnings results for the fourth quarter. The firm showed a 4% year-over-year increase in user engagement on Facebook and 5% overall in all its apps. The company also saw advertising impressions, a measure of ad presence on the platform, increase by 23% from a year ago.

Following results, Ali Mogharabi, Morningstar sector strategist, sees Meta as “well-positioned to return to growth, likely in the second half of this year.”

Similarly, shares of Spotify SPOT jumped after fourth-quarter results showed an increase In monthly active users and premium subscribers that “bodes well for Spotify’s revenue in 2023 and beyond,” says Mogharabi.

Creator of Invisalign Align Technology‘s ALGN stock rallied after the firm delivered earnings results that beat estimates. Earnings per share clocked in at $1.73, beating FactSet estimates of $1.53. Revenue was also higher than expected, at $902 million versus estimates of $892 million.

Software companies broadly rose following a 25-basis-point rate hike from the Fed, as investors took it to mean that a pivot may be on the way. Among the best performers in the industry were Cloudflare and Dynatrace DT. Dynatrace also released its fiscal 2023 third-quarter results on Feb. 1, reporting earnings per share of 0.25, beating FactSet consensus estimates of $0.21.

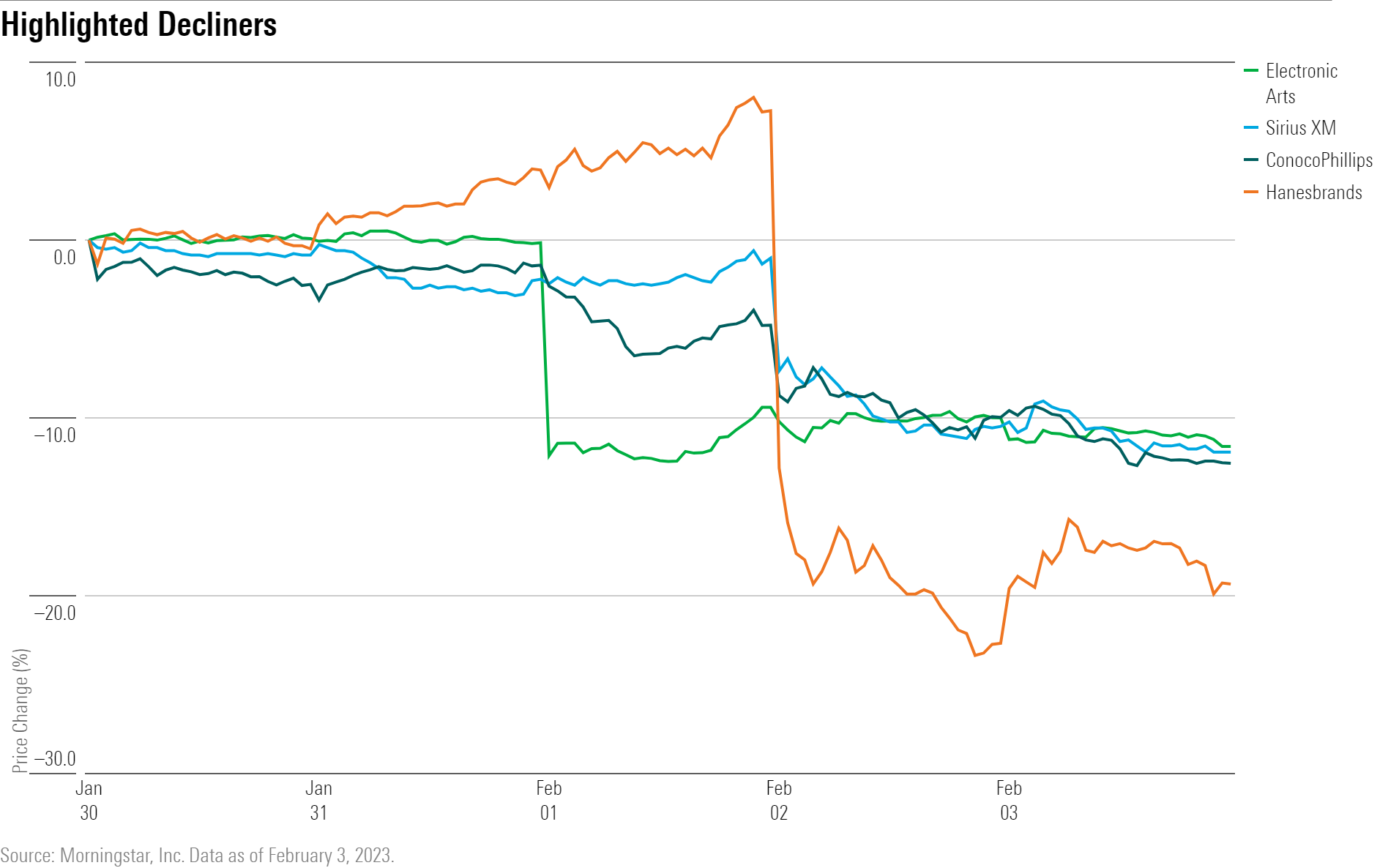

What Stocks Are Down?

Hanesbrands HBI stock tanked after the apparel maker announced a largely disappointing outlook for 2023 alongside fourth-quarter results. Sales declined 16%, which slightly beat Morningstar senior equity analyst David Swartz’s forecast of 18%. However, the company reported revenue guidance of $6.05 billion-$6.20 billion for 2023, versus Swartz’s expectations of $6.27 billion. Adjusted operating profits are also underwhelmed and are expected to be between $500 million and $550 million by the company, while Swartz estimated it to be $615 million.

“We had anticipated that Hanes would benefit from lower input costs and inventory replenishment by its mass retail partners, but soft consumer demand is expected to persist through the first half of the year,” says Swartz. He expects to lower his fair value estimate of $22 for the company by about 10% after updating his model.

Video game publisher Electronic Arts EA saw shares fall after the company reported its fiscal 2023 third-quarter results showing disappointing net bookings of $2.34 billion, below the guidance of $2.43 billion-$2.53 billion.

ConocoPhillips COP stock declined after it announced a “much higher-than-anticipated 2023 capital spending plan,” says Allen Good, Morningstar strategist. “Management expects to spend $10.7 billion-$11.3 billion in 2023, well above the $8.1 billion, excluding acquisitions, in 2022 and roughly the same level that was anticipated through 2030.”

Shares of Sirius XM SIRI fell after the company revealed a weaker-than-expected outlook for the company’s full-year revenue in 2023. Management expects revenue to reach $9.0 billion in 2023, below estimates of $9.25 billion, citing that softer auto sales would contribute to slower growth.