How asset classes have performed this year, and what’s next

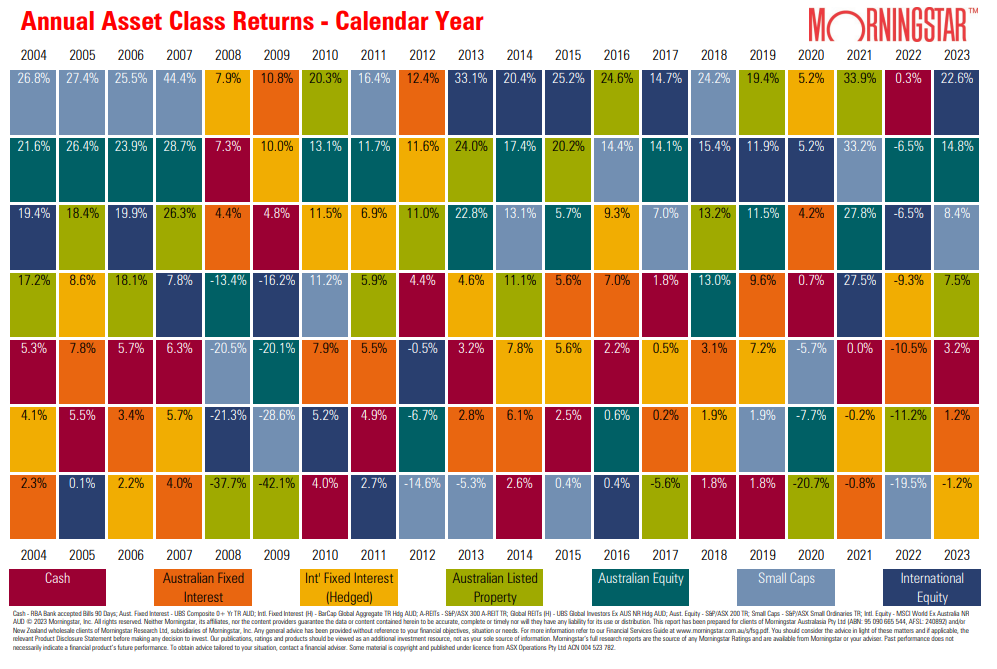

Morningstar has released its Asset Class Gameboard, showing this year’s winners and losers, and comparing the results to previous years.

Every six months, Morningstar releases its Asset Class Gameboard, showing the performance of seven major asset classes over the last 20 years. The gameboard does a good job of highlighting the winners and laggards of each year and how difficult it is to pick future winners. For instance, who would have thought that equities would come roaring back this year after the hiding they got in 2022?

Note that the figures are to June 30, 2023, and international returns are hedged into Australian dollars.

Note that the figures are to June 30, 2023, and international returns are hedged into Australian dollars.

Gameboard lessons

While the Gameboard won’t help identify future winners, it can provide some useful lessons for investors, including:

- Cash is gradually becoming more useful. Interest rates above zero will do that. Cash was at the top of the class in 2022 and though it slid in the first of this year, the 3.2% year-to-date return is the highest return on this asset since 2013.

- Fixed interest has had a poor two-and-a-half years. While it’s stopped the hemorrhaging of last year, it hasn’t bounced as much as some would have hoped. Given the steep hike in rates, perhaps the second half of this year may see a change in fortunes.

- International equities have had a stellar decade. It’s again the best performing asset class this year. No doubt, given the large weight of US equities in international indices, this has been driven by the S&P 500 and a handful of tech stocks which have skyrocketed on hype around AI. Surprisingly, Europe and Japan have also been strong performers, benefiting partly from a declining US dollar.

- Australian small caps have been all over the shop over the past decade. The key trend has been that they’ve underperformed large caps by a wide margin. In theory, small caps should offer higher long-term returns than large caps to compensate investors for the risks of investing in them. Yet that hasn’t proven the case in Australia for a long time. A contrarian bet, perhaps?

- Australian equities have been strong, consistent performers over the past five years. Yes, they significantly lagged international equities in the first half, though given headwinds from China, commodities, and bank margins/costs, the result should be more than satisfactory to investors.

- Australian listed property surprised me, being the fourth best performing asset class in 2023. The bounce in house prices has obviously helped developers such as Stockland and Mirvac. It’s worthwhile noting how volatile this asset class has been since 2015, moving from bottom to top and bottom again on a regular basis. I imagine many investors see property as a steady asset, but the Gameboard shows it’s anything but.

From 2004, the average annual return of each asset class is tabled below, from best to worst.

As you’d expect, equities come out on top over the long-term, albeit with greater volatility. It does make me wonder why so many Australians have their super in a default balanced fund given the underperformance of bonds and cash over long periods. Surely, volatility is less of a concern if super is being held for 10, 20 or 40 years?

James Gruber is an assistant editor at Firstlinks and Morningstar.com.au