Why this bull market can't last

Schroders' Australian equity team say investors piling into tech stocks again are ignoring a turning point in markets.

Mentioned: Coles Group Ltd (COL), Australian Clinical Labs Ltd (ACL), BHP Group Ltd (BHP), Commonwealth Bank of Australia (CBA), CSL Ltd (CSL), Macquarie Group Ltd (MQG), Healius Ltd (HLS), Ramsay Health Care Ltd (RHC), Rio Tinto Ltd (RIO), Sonic Healthcare Ltd (SHL), Woolworths Group Ltd (WOW)

The Australian equity team at Schroders believes current market bullishness can’t last. Head of Australian Equities, Martin Conlon, points to several factors:

Bond market prices have adjusted sharply to a new macroeconomic environment, yet stock markets haven’t.

Interest rates have increased 400 basis points in Australia and 500 basis points in the US, and equity markets have surged after wobbling last year. Conlon says it’s fascinating to see equity investors again loading up on technology stocks, especially in the US, like nothing has changed over the past two years. He says investors have gone back to an old playbook, one they’re familiar with, when a different era calls for a new playbook:

“… things like artificial intelligence have infatuated people and provided another leg again to that tech dominance that really is re-emphasizing that more of the same type argument where people are used to the success of these stocks. They keep on implementing those behaviors; I’d argue it's a little bit the same as real estate in Australia. People are so used to being on a good thing, that they're really not giving up on those things lightly."

Interest rates are just starting to bite, and it doesn't look great for consumers.

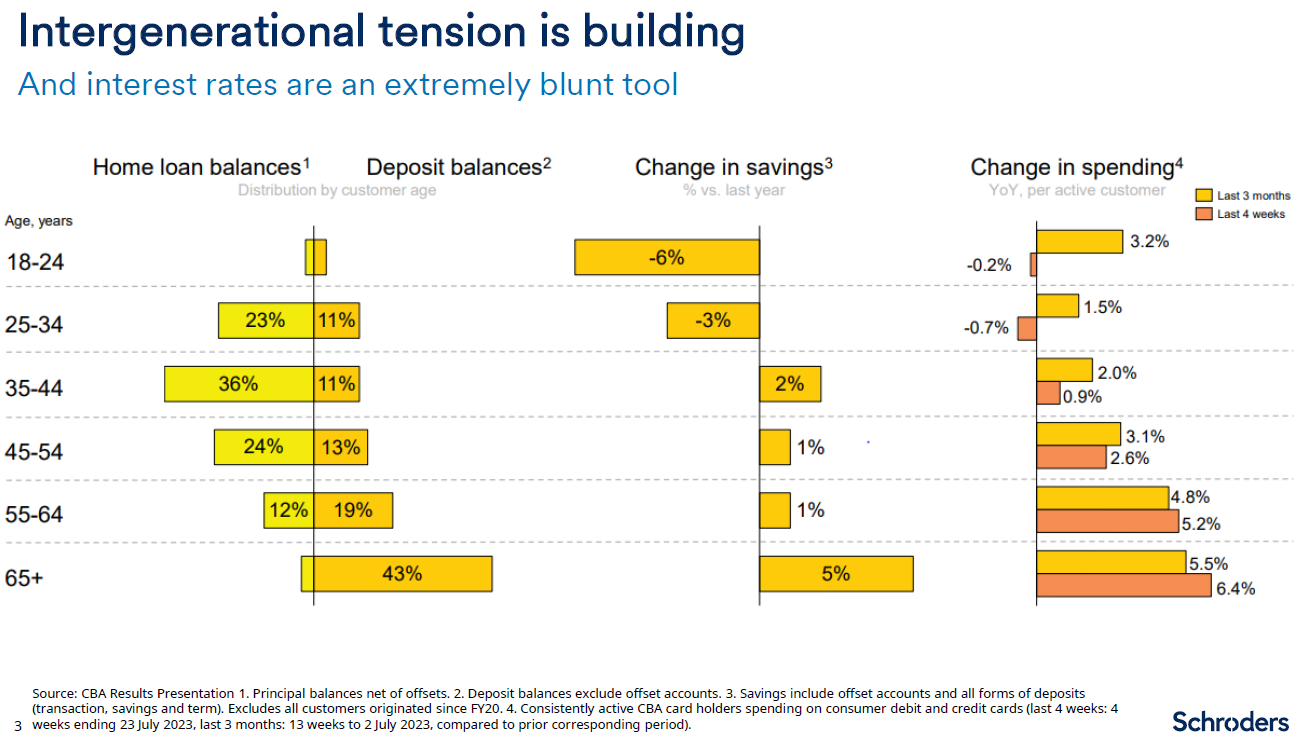

Conlon says intergenerational tension is rising as rates were kept so low for so long that it led to a massive wealth transfer to older Australians. He says this was highlighted in a slide that Commonwealth Bank presented at its recent earning presentation:

The left chart shows that it’s the younger generation that have the greatest home loan balances, while those over 65 have the largest deposit balances. Conlon says this is why sharply rising interest rates are hurting younger people. It’s probably why Coles (ASX: COL) and Woolworths (ASX: WOW) also reporting increases in theft, with many families doing it tough. That’s not the case for older Australians who are holding up consumption by spending on dining, travel and other things.

Conlon believes that though the economy is reasonable shape, cracks are starting to show.

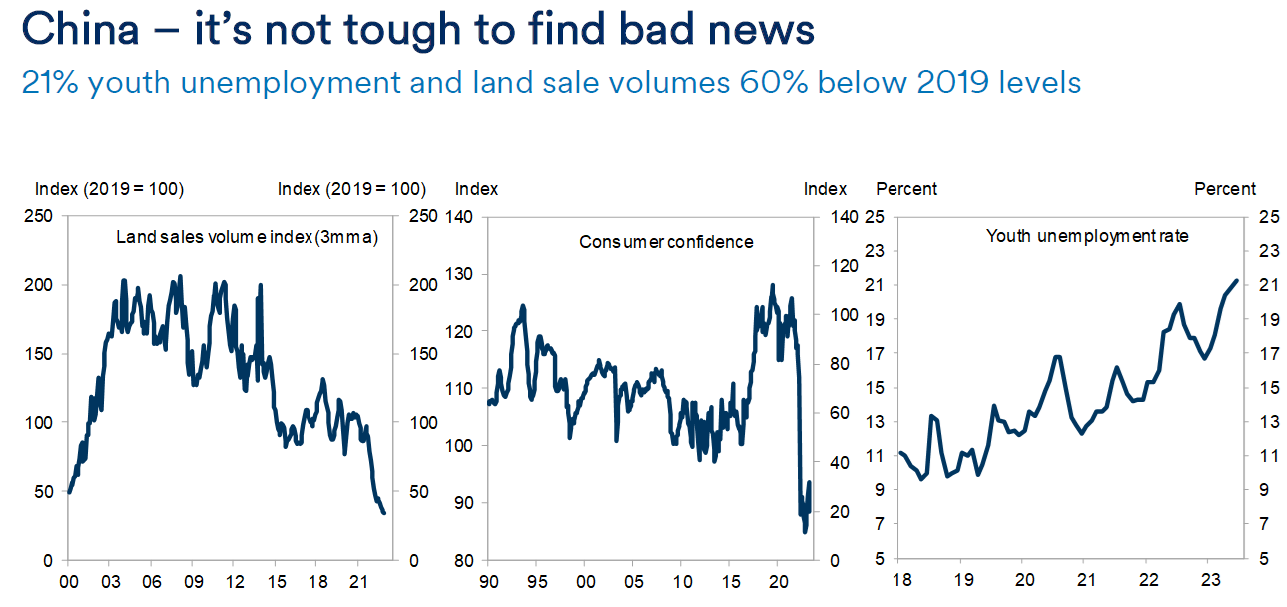

Chinese investment won’t come to the rescue this time.

Conlon says the current economic picture for China is “awful’. Land sales at two-decade lows and youth unemployment at record highs point to some of the problems. Yet he has a more nuanced view on the country’s long-term prospects. He says China’s problem is it’s been too reliant on investment at the expense of services, yet that’s likely to change over time. To take its economy to the next level, China needs its consumers to start spending. Conlon thinks Western countries, including Australia, have the opposite issue: they’re too reliant on services and debt, at the expense of production and investment. He implies that China’s issues may be easier to fix and that the long-term bearish picture painted by many may not be accurate.

Source: GSIR, Schroders

Given these fragilities, ASX valuations remain high.

Conlon says stocks with decent growth outlooks are being more than fully priced. And growth stocks that don’t meet high expectations are punished, as WiseTech Global (ASX: WTC) and Iress (ASX: IRE) were during the recent reporting season.

Mining stocks

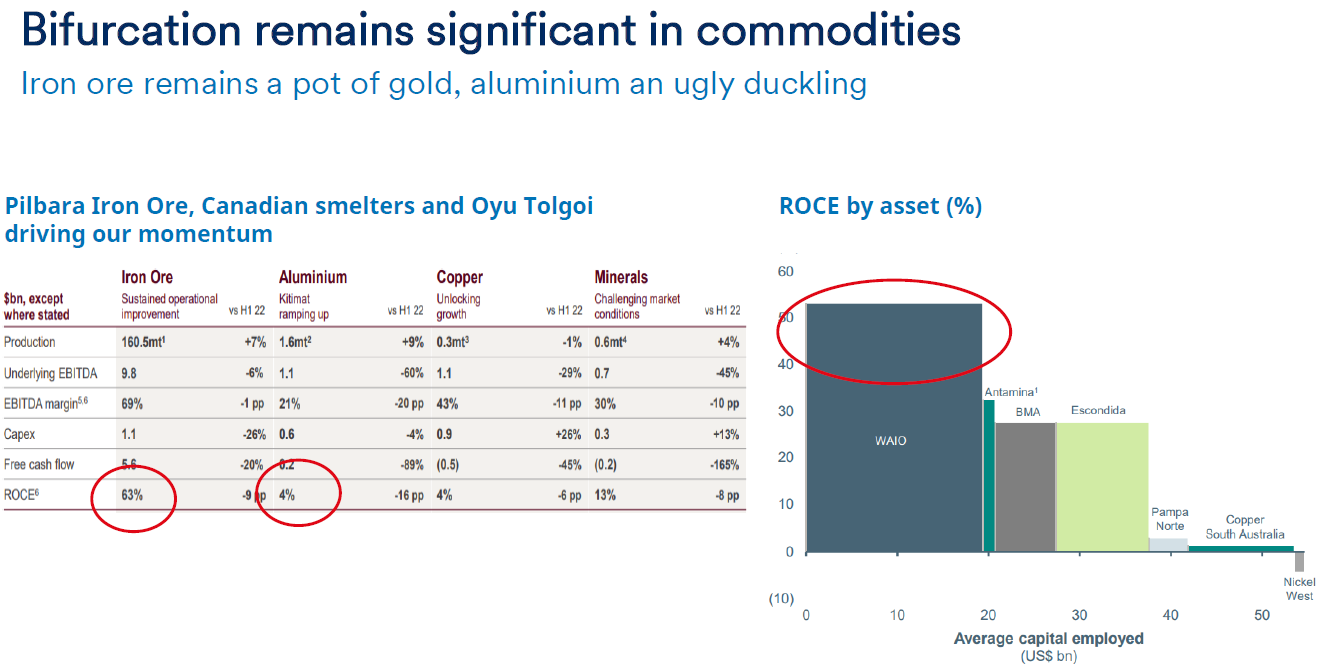

How does all of this feed into in Schroders’ fund portfolios then? On miners, Head of Australian Equities Research, Justin Halliwell, explains that it’s important to differentiate between the commodity prices and stocks.

On commodity prices, Halliwell looks at the current price versus the cost curve. For iron ore, the price of US$120/tonne is about 30% above the upper end of the cost curve. That makes it overpriced in his view, especially given China’s urgent need to reduce its over-investment.

Halliwell provides a fascinated comparison of the two big iron ore players, BHP (ASX: BHP) and Rio Tinto (ASX: RIO). He says the companies are more alike than investors realise. Halliwell says iron ore is around two-thirds of both businesses. And both have a share in the Chilean copper mine, Escondido. That means about 75% of both businesses have a similar makeup.

He suggests that main difference between the two lies in the remaining 25% component of their businesses. BHP’s primary other focus is coking coal, whereas its aluminium for Rio Tinto. Halliwell thinks decarbonization will challenge coking coal demand. Whereas aluminium is currently priced below the cost curve and Halliwell expects that to change. For these reasons, Schroders is underweight BHP and overweight Rio.

Source: RIO, BHP, Schroders

Banks outlook

On Australian banks, Halliwell says there’s little to get excited about. Bank revenue relies on loan growth and pricing. Loan growth has bene stellar for three decades, is now slowing, and will remain tepid. Meanwhile, bank net interest margins are essentially the price the banks get for loans. These margins are under pressure because of competition, among other factors. That means revenue is likely to be meek for the banks going forward. Halliwell says CBA (ASX: CBA) and Macquarie (ASX: MQG) are among the more expensive banks in the world and are key underweights.

Why CSL has some big issues

On healthcare stocks, Schroders’ equity analyst, Sally Warneford, notes that the sector has markedly underperformed the market this quarter. Curiously, the share prices of pathology laboratory stocks such as Sonic Healthcare (ASX: SHL), Healius (ASX: HLS), and Australian Clinical Labs (ASX: ACL) are below the levels reached prior to Covid-19. Yet, during Covid, these companies earned huge profits. Obviously, that’s now come off, though the share prices seem to have more than reflected this, in Warneford’s view.

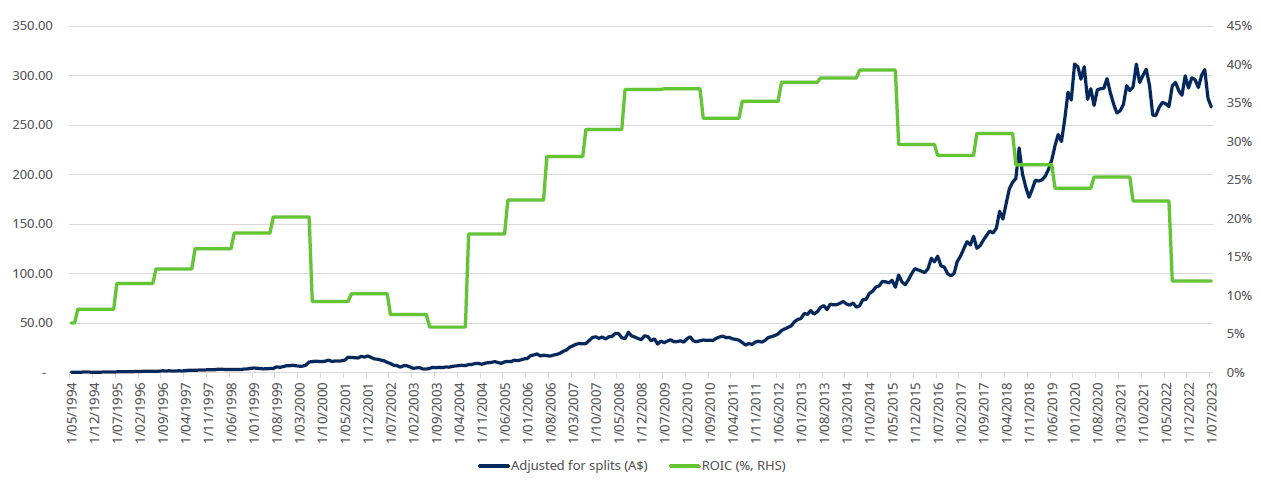

Meanwhile, heavyweight CSL (ASX: CSL) has been largely treading water over several years. Warneford says this shouldn’t surprise given the company’s return on capital peaked at around 40% in 2015 and is now down close to 10%. Part of this is due to digesting acquisitions and the time it takes to turn some of these operations around. Yet Warneford wonders whether size has become an issue for CSL.

CSL share price vs ROIC since IPO

Source: Company data, Refinitiv, SIMAL

As for Ramsay Health Care (ASX: RHC), it was hammered after recent earnings results. Warneford thinks the company was a classic Covid-19 loser as governments shut down hospitals. She expects hospital activity to gradually ramp up and for Ramsay to pay down some of its debt and address cost issues.

James Gruber is an assistant editor at Firstlinks and Morningstar.