5 steps to achieve the life you want through investing

Lessons learned from life and not an investing textbook.

I recently returned from leave which included a stop in Bangkok at my favourite hotel in the world. And I found myself floating in the hotel’s beautiful pool doing what I always seem to do there: think about investing.

I was thinking about investing, not investments. And there is a difference.

I wasn’t thinking about a share or an ETF. I was thinking about the process of sacrificing today for a better future. And that is investing - delayed gratification. Skipping a dinner out here and there to go on an amazing trip in 10 years.

Many people treat investing as a chore, and something that is separate from day-to-day life. But investing is tied to life. Our portfolios represent our hopes and dreams for the future - it may be security, the trip of a lifetime, or a better life for those we love.

Being a successful investor is not about finding the best ETF. It is about integrating your investment strategy and approach with your life to form a symbiotic relationship.

The investing lessons I’ve learned from my life consist of the following:

- Define your goals and develop a plan to achieve them

- Start saving and investing as early as possible

- Debt and other obligations can significantly impact your ability to achieve your goals

- Saving and investing provides options for an uncertain future

- Happiness is not based on your net worth

These factors do not come from an investment textbook. They are lessons I’ve learned from my life, and through my interactions with others.

And most importantly, they’re simple to follow.

Step 1. Define your goals and develop a plan to achieve them

People love talking about their dreams. And these discussions generally include the addendum that they will occur ‘when they have more money’. How they get more money is rather vague. Perhaps the lotto. Perhaps an inheritance from a long-lost relative. Or maybe an unexpected promotion to CEO.

And those things do happen. But for most of us the link between our present and a better future is investing. It is not an individual investment. It is having a plan and a process for turning the assets you have now – both financial and human capital - into the future you want.

If you haven’t set your goals yet we have some free resources to help you out:

I've written a comprehensive article on designing a portfolio to meet your objectives in life, starting with the following questions:

- What are my objectives in life?

- How much will it cost to fund these objectives?

- When do I need the money to pay for them?

- How much have I saved already to fund these objectives?

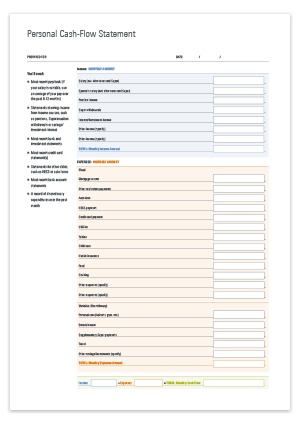

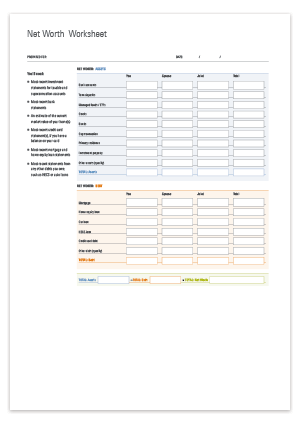

Before investing, it’s essential to have a handle on your income and expenses so you can get an overview of where your money goes. These resources can help you get started.

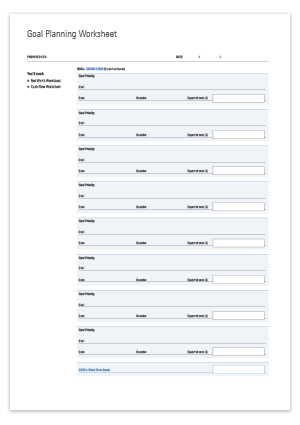

Goal-planning resources

Goal Planning Worksheet | Personal Cash Flow Statement | Net Worth Worksheet |

|---|---|---|

|  |  |

This webinar takes you through the process step-by-step.

Step 2. Start saving and investing as early as possible

My love for this particular hotel in Bangkok can be partially chalked up to nostalgia. I have been staying at this hotel my whole life and some of the nostalgia comes from my own happy memories. But some of it comes from a time before I was born and what unfolded afterwards.

In the early 70s my parents lived in the hotel when they first moved to Bangkok at the beginning of my father’s career. They had little experience outside of the United States and were early in their marriage. I can imagine how they must have felt. Everything was new and ahead of them. Like any new couple they must have seen the future as full of promise without a roadblock in sight.

This view of a future path without impediments is why many people fail to connect their dreams with an investing plan to achieve them. There is no substitute for time and no way to get it back as it slowly slips away. An adage that applies to investing just as much as life.

Keeping up with your peers and moving ahead often means acquiring ‘stuff’ - a house and the furnishing to go along with it, a car and all the other trapping of being a grown-up. But what is often delayed is establishing the real foundation for a great life. Time ticks away and there is an opportunity cost to procrastination.

Many have seen charts of how much you need to save each month to become a millionaire by 65 years old. At a 7% return you need to invest $405 a month starting at 25. At 35 you need to invest $855 a month. At 45 it requires an investment of $1.970.

The best time to save and invest is today.

Starting young enables long holding periods. This can be a driver of investing success. Learn more about the power of buy and hold investing.

Step 3. Understand that debt can impact your ability to achieve your goals

The ‘stuff’ we acquire may superficially define adulthood but it also comes at a cost that exceeds the delay in savings and investing. This is not to say that you should not buy a home or a car or anything else that is important to you. It is simply an admonition to spend your resources intentionally.

The consequences of simply acquiring more possessions absent mindedly can be profound. You could find that more and more of your toil is required to simply to maintain possessions that are not aligned to your goals in life.

Bernard Salt told young people that the key to buying a house was skipping the avo toast. His take is a study of ignorance. Avo toast is not a commitment. It is a one-off purchase. It will not continue to drain your finances day after day for the next 30 years.

We like to classify debt as good and bad. Let me describe a scenario and classify it for yourself.

Someone will loan you money with a 30-year term. The interest rate will fluctuate over the life of the loan and is dictated by the whims of the market. If you can’t repay the loan the lender will go after you for every dollar you have until it is paid back.

The asset you purchase requires large initial outlays in addition to your contribution to the purchase price. The asset requires high annual and periodic outlays to maintain. It is illiquid and any sale comes with transaction fees. The premise for taking this loan is historical returns that occurred under an economic period that was relatively unique.

This is of course buying a home. A mortgage is neither good nor bad debt. That is based on your own circumstances.

I don’t believe it is the right decision for me, as I explored in this recent article on why I've chosen to rent for life. My personal circumstances will be very different to many readers - I do not have children which introduces more flexibility in decision making around renting as I’m not tied to a school or a particular area. Not having children also means that I can spend less of my salary on housing as I don’t require as much space.

For many people, purchasing a home will be the right decision. A home is exempt from capital gains tax, and isn't counted as an asset when calculating pension payments. The downsizing scheme also allows eligible Australians to contribute funds from the sale of their home into super.

Just remember that any debt will be a limiter of future options and future spending. Use it wisely and deliberately.

Step 4. Prepare for an uncertain future

Floating in the pool and rotating my head slightly to the left I turn my gaze from where my parents lived to the restaurant where I spent Christmas as a 21 year old. That night I got in a heated argument with my father after telling him that I was planning to move to New York after my university graduation.

I insisted there was nowhere else worth living. He countered that the world offered too many options to make such a blanket statement. But I knew better, and my decision was final.

Four months after that conversation I started dating my now-wife and followed her to Boston. I sit writing this article in Sydney after having lived for 9 years in Australia. I have never lived in New York as an adult.

Putting yourself in a strong financial position not only provides protection if things go wrong but also enables the choice to take advantage of opportunities that arise. And life presents an array of opportunities. Ones that most of us can’t or won’t be able to pursue.

Set yourself up with these two steps:

Build an emergency fund

The first step to enabling optionality is a basic one. Building a robust emergency fund.

Cash gets a bad rap. And I can recite all the reasons from low returns to loss of purchasing power through inflation.

But cash is important. It provides assurance that you get through the inevitable surprising that will occur throughout life. It enables you to put more money into volatile assets that will provide higher long-term returns.

The size of this emergency buffer is entirely personal, but a good rule of thumb is three to six months’ worth of living expenses. Remember it’s three to six months’ worth of essential living expenses, not income.

Invest for the life you want

The next step in enabling optionality is thinking about how you can leverage your financial assets to support the life you want to live.

I’ve contemplated this a great deal and it led me to income investing. I outline how investors can build an income portfolio here.

Owning 100 shares in a company can seem like a nebulous concept. Good investors understand they have an ownership stake in a business. But it is hard to escape the constant focus on the share price.

I wanted to translate the numbers in my brokerage statement to something tangible. And very early in life I started a dedicate travel account.

The dividends generated by my investments directly led to travel. The nebulous concept of investing became tangible. The trip that I was taking was paid for by the profits of the companies I owned. And this improved my investing.

The gyrations of the market mattered less. What mattered was that I find companies that would enable another night at my hotel and all the other adventures available in our world. This made me a better investor.

Step 5. Happiness is not based on your net worth

My mother recently moved into an assisted living facility. Time will tell if this is the final stop but she is far closer to the end of her life than those first heady days in Bangkok along the Chao Priya river.

My parent’s marriage evolved into acrimony and eventually divorce. The life they imagined at the start of their Thai adventure unfolded in ways they couldn’t foresee. Chances are she will never see Thailand again.

The residents wandering the halls of my mother’s new home have far more memories than possibilities for the future. Those memories are unlikely about things they owned. They are filled with thoughts of time with their friends and family. The experiences they’ve had and lament for opportunities they couldn’t take.

They achieved various levels of career and financial success. They amassed various levels of wealth. And they probably spent some time contemplating their net worth as a marker of success. At a certain level financial assets provide diminishing levels of security. They become a scoreboard in a game with no possible victory. I've written on the link between net worth and happiness.

The hotel opened in 1876. The hallways are lined with pictures of famous guests who briefly passed through during their journey through life. Perhaps I’m the first guest to contemplate investing while staying there. But I’m certainly not the first person to think about what I want in life and how to get it.

What investing lessons have you learned from your life? Let me know at mark.lamonica1@morningstar.com