A big week in normally sanguine bond markets - Firstlinks newsletter

+ Douglass and Lowy chat; Stagflation; RBA lets go of control; Bond yields; The 60/40 mix; SuperStream for SMSFs; and COVID-led resignations.

Hi all, Harry here, sitting in Graham’s editor chair (albeit virtually) for a couple of weeks while he enjoys a long-overdue break. I hope you backed a winner at the Melbourne Cup. Mine’s still running, suggesting that I’m better off sticking to investments over horseracing.

Having been a contributor to Firstlinks over the years, it’s very humbling to see the work of so many talented contributors from an editor’s perspective, rather than a writer. I hope you enjoy the thought-provoking pieces on offer in this edition.

Graham left me one tip; “If you want to avoid too much work, try not to transcribe interviews into Firstlinks pieces”. Yet when a podcast conversation between Magellan CIO and Chair Hamish Douglass and legendary businessman and philanthropist Sir Frank Lowy AC was made known, I jumped at the chance.

Graham was right, it was hard yakka editing down this fascinating conversation between two individuals who clearly have a high regard for each other, but I hope you’ll find it as informative, and inspirational, as I did.

The latest CPI data, released on 27 October, revealed the trimmed mean CPI rate rising from 1.6% to 2.1% for the year to September, and would have had many a market strategist nervously revisiting their mid-term forecasts for inflation. The rate now sits within the RBA’s target 2-3% inflation band, but the concern isn’t just for rising prices; it’s for prices rising in the absence of a commensurate rise in economic activity.

Lethargic economic growth combining with rising prices is something no economist wants to see become entrenched. This week David Lubin takes a look at inflation's much-reviled cousin, stagflation.

Don Stammer adds his formidable voice to the issue, while also looking at how the faster-than-expected vaccine rollout in developed economies is shaping the investment outlook for 2022 and beyond.

Perhaps it wasn’t a central bank capitulation in the manner of the Bank of England’s infamous 1992 defeat defending the British Pound against George Soros, but last week’s about face by the Reserve Bank was, in its own way, no less significant.

Having placed a 0.10% p.a. yield target for the April 2024 Bond back in July, the RBA had communicated its willingness to spend up to $4 billion each week in order to keep shorter-term rates constrained as part of a ‘yield control’ strategy.

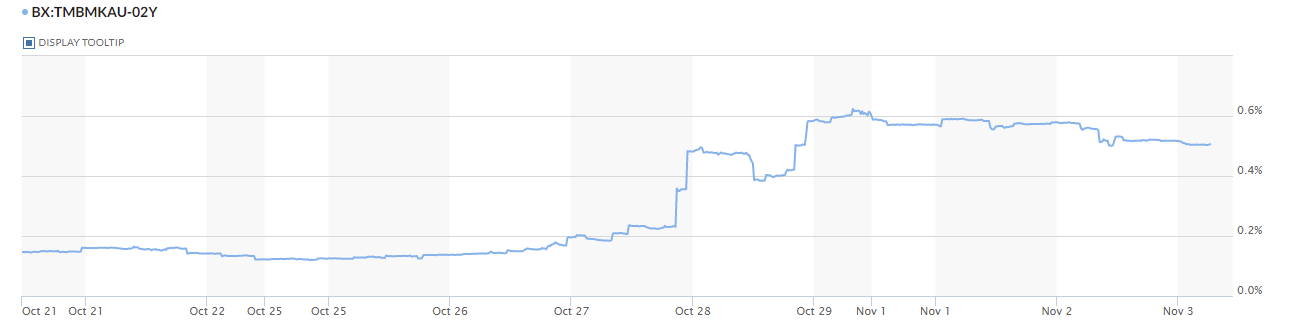

All seemed to be going to plan until late last week, when bond market disquiet over that inflation pick-up brought shorter dated securities under heavy selling pressure. The RBA blinked, the bond markets reacted and the yield on the two-year bond spiked precipitously, jumping from around the target level mid-week to over 0.60% by week’s end. A big week in the normally sanguine bond markets!

2-year Australian Government Bond Yield

Source: MarketWatch.com

Former RBA economist turned academic Isaac Gross picks up the story following the RBA’s Melbourne Cup day decision to abandon its strategy, what this might infer for near-term bank funding costs, and thus by extension mortgage interest rates.

The venerable ‘60/40’ portfolio has, in some ways, become the workhorse of modern-day investment management. A product of the golden age of Modern Portfolio Theory, its longevity has been a testament to the power of investment diversification. As rules-of-thumb go, 60% in ‘growth’ assets and 40% in ‘defensive’ assets has certainly stood the test of time. But what might happen to the ‘defensive 40’ if interest rates were to continue to percolate ever upward? Andrew Yap brings some ideas to bear on the issue.

New protocols for how SMSF trustees should communicate rollovers came into effect on 1 October. Julie Steed takes a look at the new SuperStream system and what it will now mean for you and your SMSF prior to accepting a member rollover from another fund.

And to round out the week's contributions, Craig James looks at “The Great Resignation” a phenomenon currently sweeping America, where ‘COVID epiphanies’ are resulting in a spike in resignations as people re-assess their career and lifestyle goals. Might the same thing happen here?

Craig turns his attention in particular to older Australians, and looks at the historic workforce participation of those 60 and beyond. I found this chart from his piece particularly interesting:

It’s always difficult to gauge individual intent and preferences, but I do wonder to what extent the high participation by Australians 60 and over reflects the positive social engagement benefits that come with being in the workforce, and how much of it is driven by economic necessity, particularly in reducing mortgage debt prior to retirement.

At a recent University of Melbourne talk, I presented the below chart on the rise in later life mortgage burdens, and it did warrant a pause for thought.

Source: Ong, R & Wood, G “More people are retiring with higher mortgage debts. The implications are huge” The Conversation, 12 June 2019

It’s certainly an issue set to become increasingly relevant, as Australians delay household formation and carry higher levels of mortgage debt into later life.

This week’s Comment of the Week comes from David Hellstrom in response to the article ‘Hey boomers, first home buyers and all the fuss’. It is a poignant reminder both of the escalation of Australian property prices over these past few decades, and of the fact that those who have benefitted aren’t blind to their good fortune and the travails of fellow Australians at the other end of the journey.

"I belong to the “silent generation as I am 87. My first house was built on a block of land at the northern beaches for £1,400 ($2800) and the little two bed house cost another $8,000 to build. Borrowing rates were around 6%.

After two years I moved to the North Shore and bought a nice block for £2,000 ($4,000) [and] built a little three bed double brick house for a further £6,000 ($12,000). Many years later in 2007 (having done major improvements on the house) I sold for $1.1 million and bought a three bed unit at the station for around the same.

Just recently I sold that [unit for] $2.8 million and bought into an old folks home which left me with a sizable pot to place into my retirement savings (which have since shown a 10% cap gain plus dividends). I have certainly lived through the lucky years."

This week’s white paper is available to you courtesy of Martin Currie, who take a look at how progressive fund managers can strive to deliver something beyond ‘Alpha’ (risk-adjusted investment outperformance), in focussing also on outcomes such as environmental, social (including diversity) and governance improvements. Very topical in the wake of the COP26 summit in Glasgow.