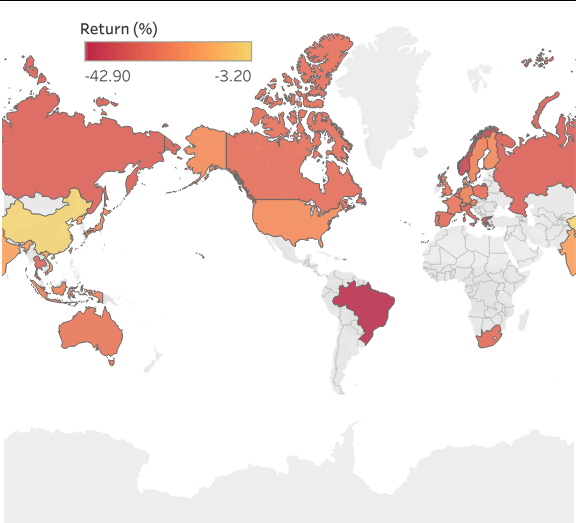

Coronavirus sell-off: regions hardest hit

As global stock markets spiral, we look at the best and worst performing regions of the year to date.

Global stock markets have been hit hard across the world in recent weeks as the spread of the coronavirus across the world has sparked panic among investors.

But Morningstar analysis shows the gaping chasm between the best- and worst-performing regions so far this year. While funds investing in export-led and commodity-dominated Brazil are down an eye-popping 42.9 per cent year to date, China funds have fallen, on average, just 3.2 per cent, despite this being the region where the virus first emerged.

China leads the pack

Considering the coronavirus outbreak started in China, it’s interesting to see that funds focused on the country have outperformed the rest of the world. This is, in part, due to the Chinese government taking quick and extreme measures to try to mitigate the spread of the virus. While many experts expect a hit to economic growth in country this year, they point out that it is already in recovery mode.

Meanwhile, Fiona O’Neill, deputy head of equity research at Fidelity, believes that since China was the first country afflicted by the virus it seems logical it will recover the fastest.

“But the time taken to resume business activity in countries struggling to cope with the outbreak will also depend in large part on the containment measures taken by individual governments,” O'Neill says.

What's more, many of the biggest stocks in the country are actually well-placed to benefit from the spread of the virus. Chinese internet giants such as Tencent, for example, could do well as more people work from home.

(Click image to view interactive map)

Source: Morningstar Direct

Elsewhere, India funds appear to not have been hit as hard in recent weeks as many others; the average fund in the region is down 15 per cent so far in 2020. Chetan Sehgal, manager of Templeton Emerging Markets Investment Trust (TEMIT) believes emerging markets could be resilient in the weeks to come.

“The structural themes remain unchanged, with information technology and consumers playing key role,” he says. “We have seen weak consumer sentiment impacting discretionary purchases and travel but e-commerce, internet and software companies are benefiting from an increase in online activity."

Semiconductor computer chips is another area he thinks will hold up well as, while supply chains have been disrupted, a fall in demand will not last forever.

Oil price plunge hurts exporters

At the other end of the spectrum, Latin America has endured some of the biggest losses in recent weeks. The region is heavily reliant on commodtiy exports, which are hit hard when borders are shut, trade is restricted and recession fears are rife.

Oil giant Petroleo Brasileiro has seens its shares plunge from 30 to 13 Brazilian Real over the past quarter alone. The woes of such stocks is further compounded as currencies in the region become weaker against the dollar.

Down 31 per cent, Russia has also been particularly hit by the plunge in the oil price; the Russian ruble fell to a four-year low against the dollar. Lukoil, Gazprom and Rosneft—all among the largest Russian companies by revenue—are just some of the oil and gas giants to have suffered in recent weeks. Funds focused on Norway, another major oil exporter, are down 37 per cent.

Jack Allardyce, oil and gas research analyst at Cantor Fitzgerald Europe, says there appears to have been no progress in attempts to mediate between Saudi Arabia and Russia and that “neither side appears likely to blink in the short term.” He adds: “April is expected to see record surplus production and we would expect downward pressure on prices to continue in the near-term."

No solace in safe havens

The Federal Reserve has taken bold steps to reassure markets, with two emergency interest rate cuts bringing the rate down to 0 per cent. Despite this, the region—often considered a safe haven in times of uncertainty—is down 20 per cent year to date. While oil giants such as ExxonMobil and EOG Resources have been hit by market turmoil, internet giant Amazon has announced 100,000 new jobs and plans to raise hourly wages as it copes with an increase in demand.

In the UK, where rates have also been cut to emergency levels of 0.25 per cent, the average fund is down 25.5 per cent. The FTSE 100 has endured some of its biggest one-day falls on record, not helped by the fact that it is dominated by commodity majors such as BP and Shell, which have been caught up in the oil price plunge.

But it is value funds that have been the hardest hit in the current sell-off, says Laura Suter, personal finance analyst at investment platform AJ Bell. “Those funds focused on ‘value’ style stocks that the fund managers believed were primed for recovery have been the biggest losers."

AJ Bell data shows the ASI UK Recovery fund has been the worst performing UK fund year to date, down almost 42 per cent. Other funds that focus on out of favour companies have also been hurt: GVQ Opportunities is down 33.5 per cent, M&G Recovery 32 per cent and Schroder Recovery 31 per cent.

For more, see ![]() Morningstar's coronavirus guide for Aussie investors

Morningstar's coronavirus guide for Aussie investors