Corporate giants then and now: Chart

A journey from 1989 to today via Japan's property bubble.

The Emperor of Japan's main residence is the Imperial Palace in Tokyo. The palace sits on 3.4 square kilometers of land right in the centre of Tokyo. At the height of Japan's real estate bubble in the 1980s, the land under the Imperial Palace was notionally worth more than all the real estate in California. When the bubble burst in the early 90s it ushered in a "lost decade" of economic stagnation. Japanese banks were badly hit, and left saddled with billions in non-performing loans.

The chart below compares the top 20 companies in the world by market capitalisation in 1989, at the height of Japan's boom, and today. Japan went from having 13 on the list, to none.

Source: Berkshire Hathaway AGM, Bloomberg, EQS function

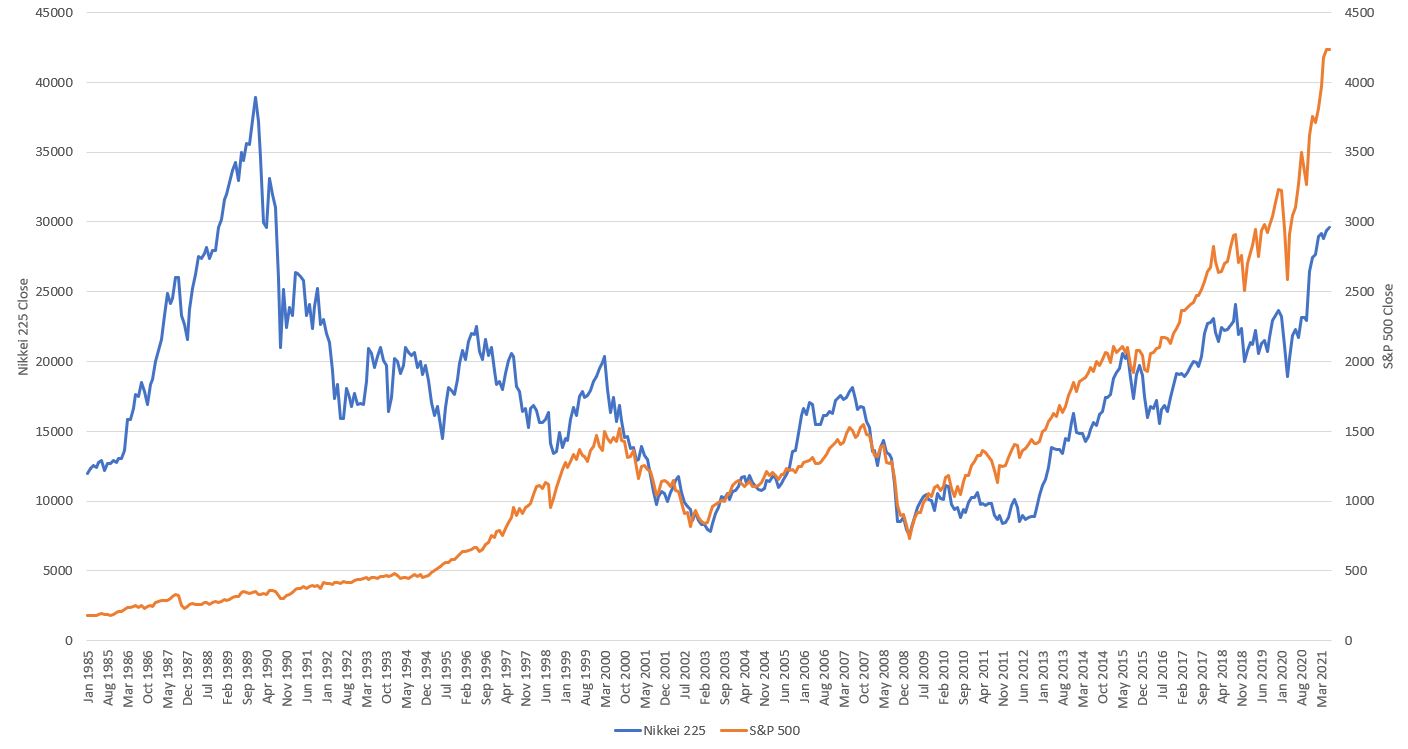

Thirty two years later, Japan's Nikkei 225 has still not scaled the heights it reached in the late 1980s. Compare that to the steady climb of the S&P 500 (1985-2021)

Source: Yahoo Finance