Economic outlook: Inflation concerns shouldn't knock recovery off-course

Australia's economy to perform well despite inflation concerns, says Morningstar analysts.

The Australian economy's strong recovery from the coronavirus pandemic is likely to continue for the remainder of 2022.

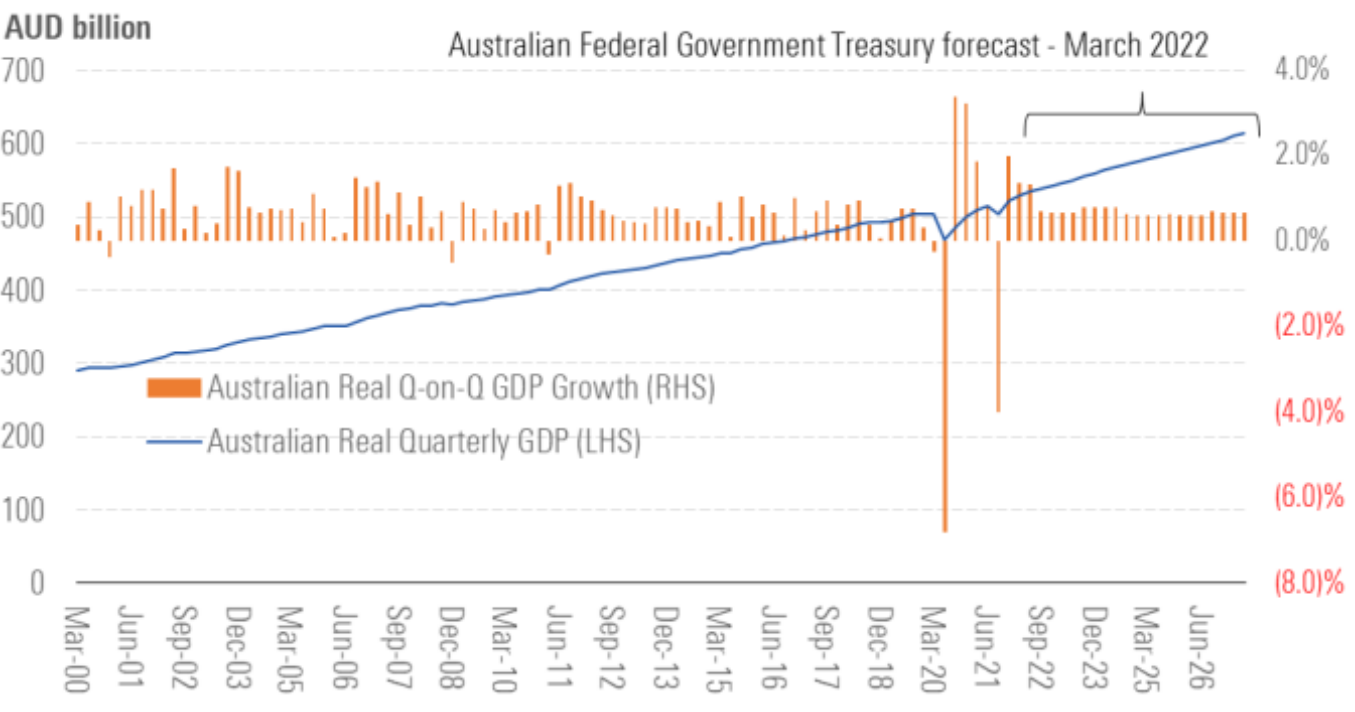

The Australian federal government forecasts real gross domestic product (GDP) growth of 4.25% in the year to June 2022 followed by 3.50% in fiscal 2023.

Strong gross domestic product recovery to continue throughout 2022

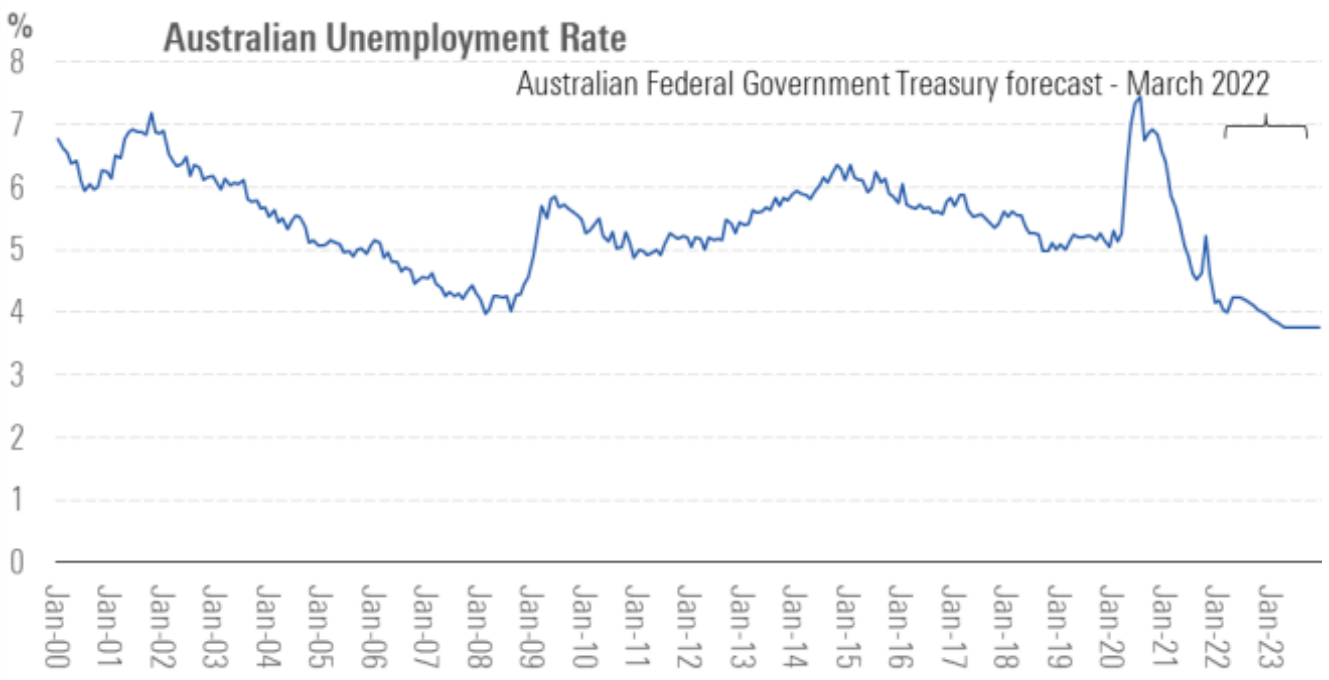

Unemployment remains very low at 4%. The federal government forecasts a decline to 3.75% in the September quarter of 2022 to its lowest level in around 50 years.

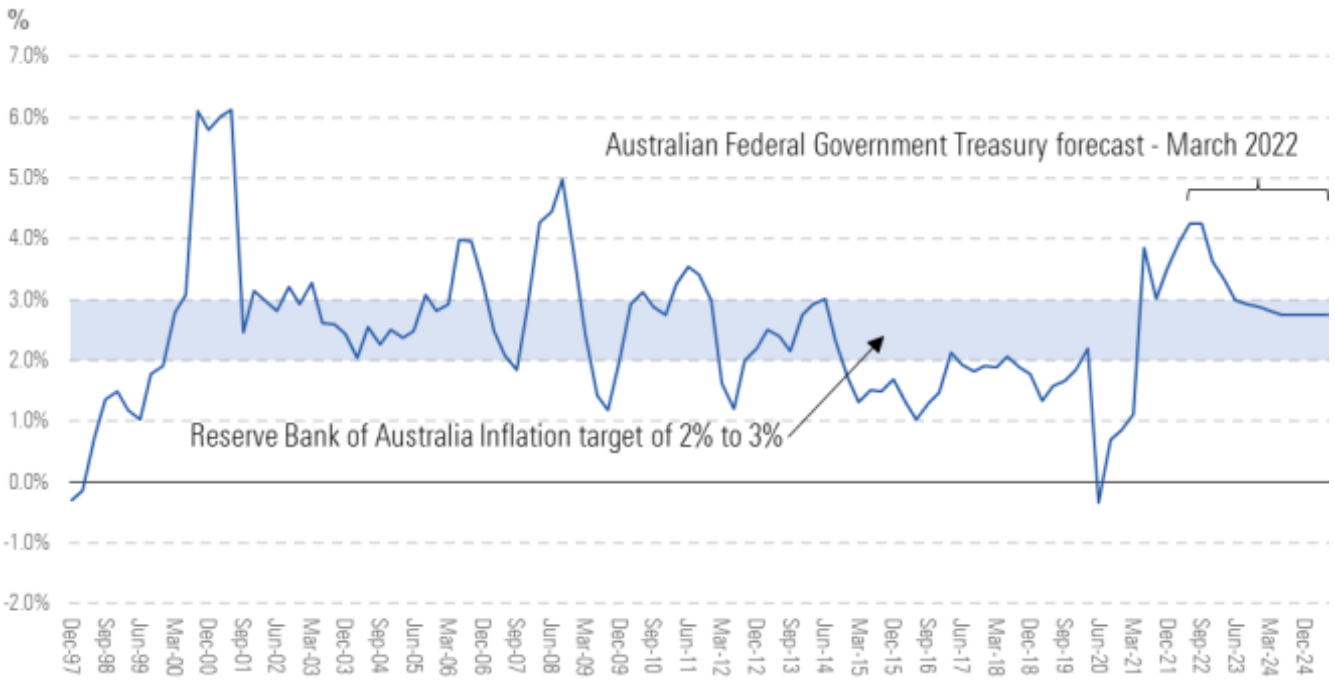

Wage and consumer price inflation pressures continue to build, due to fiscal and monetary stimulus, supply chain disruptions related to both the pandemic and the Ukrainian war, and strong commodity prices. The federal government now expects wage growth of 3.25% in fiscal 2023, above the 3% the Reserve Bank of Australia (RBA) previously said would be needed for consumer price inflation to persistently increase.

Unemployment reaching multidecade lows

Similarly, the federal government expects unemployment to fall below the nonaccelerating inflation rate of unemployment (NAIRU) of 4.25%, meaning inflation is likely to exceed the RBA's target band of between 2% and 3% in the coming months at least.

Inflation is likely to exceed the RBA's target range in the short term at least

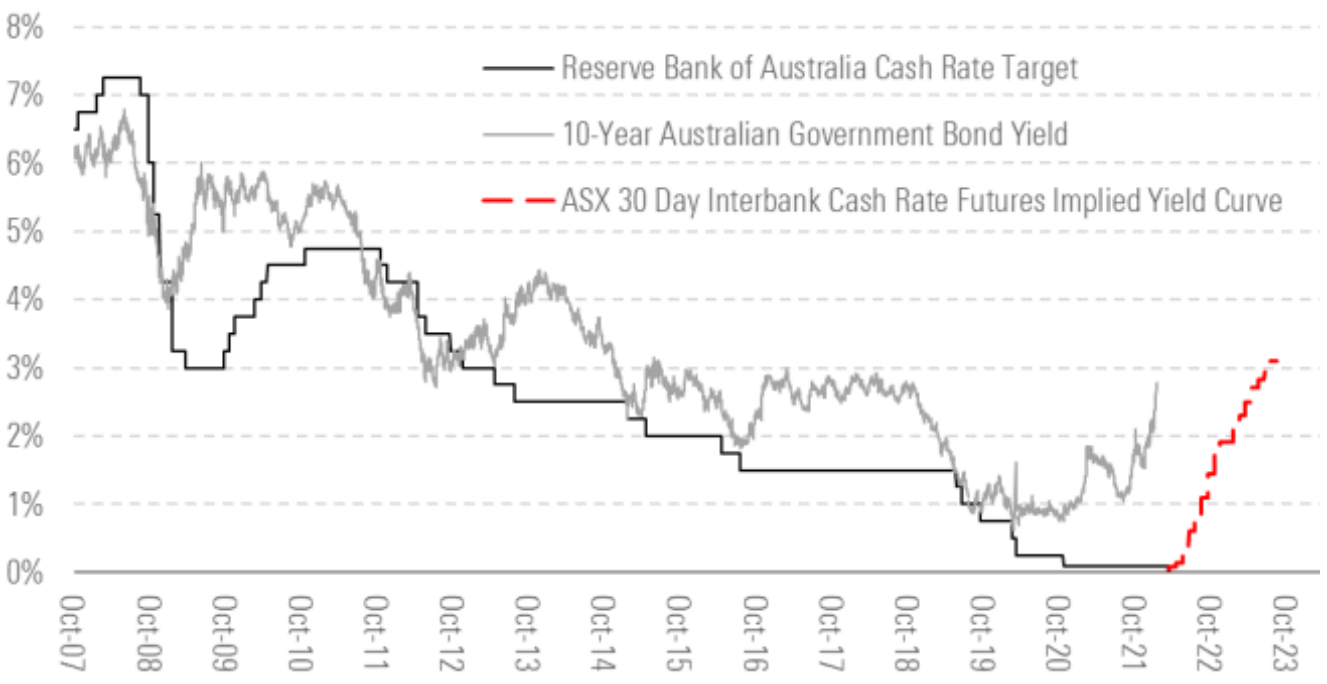

The extent to which inflation subsides in 2023, as envisaged by both the federal government and the RBA, and its impact on bond yields is an important consideration for equity markets. If the target cash rate increases to over 3% by 2023, as implied by futures, this could affect asset prices, particularly real estate, as well as building activity, consumer spending and ultimately GDP growth.

Interest rate futures imply a sharp increase in the RBA's target cash rate

Source: Morningstar, Australian Bureau of Statistics, Reserve Bank of Australia. Data as of March 25, 2022.

However, at this stage, our earnings forecasts and fair value estimates don't imply a sharp deterioration in the economy or stagflation. Currently, elevated commodity prices are notoriously volatile, and we forecast lower prices in the long term. A resolution of the Ukrainian war could also drive weaker energy and commodity prices in the short to medium term.

Supply chain issues are also likely to ease as Covid-19-related restrictions subside, interest rate rises should cool the economy and reduce inflationary pressures, and the normalisation of Australian immigration should alleviate pressure within the Australian employment market.

![]() This article forms part of Morningstar's Australia and New Zealand Equity Market Outlook Q2 2022. Download the full report.

This article forms part of Morningstar's Australia and New Zealand Equity Market Outlook Q2 2022. Download the full report.