From elation to exasperation; investing in volatile markets: Firstlinks Newsletter

Whither or wither financial advice; Housing too doomy off 20%; Don't be a bad investor; Not yet SMSF; Fixing gender gaps; Think like private equity.

Anyone who has played sport at a competitive level (is there any other?) knows how much emotions can swing during a game. In the course of a couple of hours, the mood can jump from optimism when your team takes an early lead, to frustration as the opposition equalises, to elation as you score again, to exasperation and fear as the other team takes control.

It's the same with investing in volatile markets. A fall of 30% may incite fear of further declines and even an assessment of future plans, pushing some to sell in panic. Then a recovery of 20% drives optimism and FOMO and jumping back in ready for the ongoing rise. This down 30%, up 20% is the actual experience of millions of investors in 2022. Now every analyst in town has a view on whether we've seen the bottom.

One of the most famous phrases in investing comes from Sir John Templeton who said,

“Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

The bull market died after the post-pandemic euphoria at the end of 2021, and the carcass rotted for six months, but then we have seen a strong recovery since mid-June. Anyone trying to guess whether a new bull is galloping should check the latest chart from JP Morgan with 20 years returns across asset classes. It demonstrates that equities and REITs were the place to be, so investors are obviously looking for entry points into the stockmarket. But look at the orange bar. The 'average investor' achieved poor returns due to bad timing of entry and exits, buying in euphoria and selling in pessimism.

Markets can be even more perverse as when things are bad - rising inflation and interest rates, wars, pandemics - stocks can rally when data shows conditions are not quite as bad as expected. Witness the reaction to the fall in the US CPI from 9.1% to 8.6% in July. News articles were quickly written about how inflation had peaked and it was off to the races.

Not so fast. Campbell Harvey, Head of Research at Research Affiliates in the US, gave a fascinating 10-minute video about the inflation outlook following the release of the July inflation number. Harvey points out that the US CPI depends on the size of the monthly number dropping out of annual statistic. You can see below that 0.48% dropped out and 0.01% came in, causing the optimistic fall in inflation. But for the next two months, the drop of the August 2021 number in September 2022 is only 0.21%, then 0.27% the following month. Even if inflation is a highly optimistic 3% per annum or 0.25% per month from here forward, the reported CPI will stay around 7.5% to 8.5% for the rest of 2022. This is at a time when markets are rallying because inflation is expected to fall quickly. Harvey makes other good points about the slow impact of the cost of 'dwelling' which makes up 32% of the CPI, where big rental increases have not been fully captured yet.

His final message is a warning about inflation optimism:

"The point is, this (dwelling) inflation has already happened but it's not reflected in the CPI and it will be reflected in the next year or maybe longer. Anyone who's telling the story, 'Oh well, this is just the supply chain or geopolitical risk and we'll quickly be back at 1%, 2%, 3%'. NO. You need to look at the structure of how inflation is calculated. We are unfortunately going to go through a period of prolonged, persistent, high inflation."

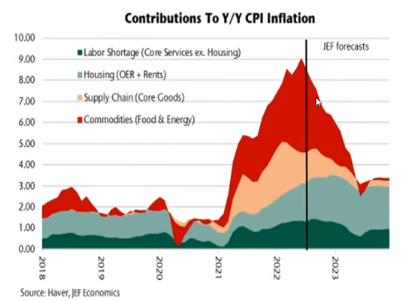

How long is prolonged? The chart below shows the contributions to US inflation, and to date, all four major components have pushed up. But the JEF Economics forecasts of falling food and energy prices and easing of supply chain pressures shows why there is optimism about inflation falls during 2023.

In this week's articles ...

At a time when thousands of Australians retire every week, billions of dollars will soon pass between generations, and the youngest Baby Boomer can retire with a pension, the need for financial advice has never been greater. An estimated 3.6 million Australians will transition to retirement in the next decade. The state of financial advice is a minefield of complex issues, and we check why thousands of advisers have left the industry.

This week, ANZ Bank economists became the latest pessimists predicting price falls in housing of around 20%, with Sydney down 14% in 2022 and a further 6% in 2023. They see a recovery of 6% in 2024 as rates decline. Dr Sam Wylie of the Melbourne Business School and University of Melbourne looks at the past resilience of residential property and doubts such extremes are likely. Lending some support to Sam's argument is the rise in national average rentals of 14% in the last 12 months, according to property researchers SQM. This is attracting investors back into the market. And immigration is expected to return rapidly to prior levels bringing thousands of new buyers into the market.

The 100th edition of Morningstar's podcast, Investing Compass, was released this week, and Shani Jayamanne is one of the two presenters, alongside Mark LaMonica. While her investing knowledge lends itself to placing her superannuation in an SMSF one day, she explains why she is not ready at this stage of her life. SMSFs continue their strong appeal, with one-third of all establishments in the last year set up by people under the age of 45. These young investors are now targets for brokers and wealth platforms.

Only one person can be Warren Buffett (okay, two if you count Charlie Munger) and few can be great investors, but everyone can learn not to be a bad investor. Robin Bowerman of Vanguard shows charts to justify some key lessons to guide investors.

There is increasing focus on private equity, especially following takeovers of companies such as Sydney Airport, Spark Infrastructure and AusNet. Private equity has the advantage of avoiding the prying eyes of public markets and thousands of analysts and investors, and an ability to take a longer-term view to building the business. Chris Demasi of Ophir makes the case for thinking about listed markets in the same way as the privateers.

The media has focused recently on many aspects of gender inequity, with progress reported on closing of the gender gaps in salaries, listed company board positions and unpaid work. However, ATO data shows big gaps remain in superannuation, and other metrics in Fidelity's latest survey confirm room for improvement. Alva Devoy shows the charts on financial independence by gender, and identifies a role for financial advisers in addressing the imbalances.

Cuong Nguyen of PGIM shows three commercial property segments with strong tenants and prospects which are performing well. Similarly, many listed property funds are trading at a discount to the value of the underlying assets, presenting what looks like an attractive entry level for long-term investors.

This week's White Paper comes from VanEck on the sector concentration in the Australian equities index, exacerbated by a small universe of stocks. These factors should be considered by investors whose portfolios are dominated by Australian stocks.