Merger and acquisition activity to increase ASX concentration

The proposed ending of BHP's dual company structure is likely to have the biggest impact.

The low interest rate environment is driving heightened merger and acquisition activity in the Australian equity market, with large-long term investors seeking yield assets, such as infrastructure, and private equity investors exploiting access to cheap debt.

Companies, like Canva, are also staying private much longer due to an abundance of capital in the privet markets, or are choosing to list overseas, such as Atlassian. Expanding equity market valuations are also encouraging scripbased acquisitions, such as the recently announced acquisition of Afterpay by Square.

We discuss several recently announced major transactions and their likely impact on the equity market below. However, the largest impact on the main Australian equity indexes is likely to be the collapse of BHP's dual company structure, which will increase the, already high, concentration of the largest stocks, as well as the indexes skew to commodities.

Collapse of BHP's dual company structure: Although we expect BHP to maintain a listing on the London Stock Exchange, the company intends to collapse its dual company structure which was created in 2001 following the merger of BHP Ltd and Billiton Plc. It is difficult to assess BHP's likely new weighting, particularly considering recent iron ore price volatility, but we estimate its weighting in the S&P/ASX 200 index could increase to around 9% from around 5% currently.

Square acquisition of Afterpay: Although the acquisition of Afterpay by Square will create a business with a market capitalisation of around $200 billion, we expect the market value of the Square Chess Depositary Receipts, or CDIs, listed on the ASX to be worth around $10 billion to $20 billion and that this would reduce the company's weight in the main indexes to less than 1% from 2% currently.

Woodside acquisition of BHP's oil and gas assets: Woodside had a weight of 1.4% in the S&P/ASX 50 Index as at June 30, 2021, however, we expect this to roughly double following its proposed merger with BHP Petroleum.

Santos and Oil Search merger: Santos has a 0.8% weight in the S&P/ASX 50 index as at June 30, 2021, however, the merger with Oil Search could increase this to around 1.3%, all else equal.

Acquisition of Sydney Airport: Sydney airport has a market capitalisation of around $22 billion and a weight of 1% in the S&P/ASXS 50 index as June 30, 2021, meaning its acquisition would not materially impact the sector composition of main indexes.

Acquisition of AusNet: While AusNet isn't in the S&P/ASX 50 index, the company has a sizeable market capitalisation of around $10 billion. This could double the market capitalisation of APA Group and increase its weight in the S&P/ASX 50 index to around 1.4% from 0.7% as at June 30, 2021.

Free float adjustments distort the definition of the market

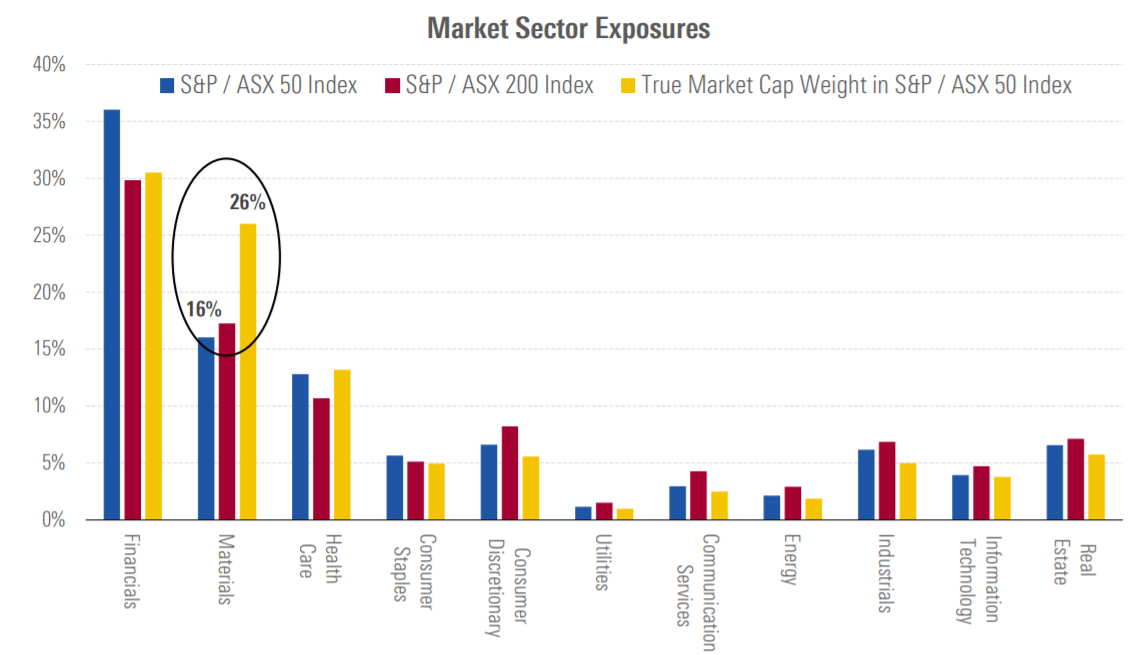

One of the challenges in defining the Australian equity market is the impact of free float

adjustments on the main indexes, particularly on the materials sector. The main Australian market capitalisation weighted equity indexes are "free float" adjusted, which means they only incorporate shares which are available to trade. This can mean companies in the index receive an index weighting based on a market capitalisation which is materially different to the true market capitalisation of the company.

The largest mining companies on the ASX, BHP, and Rio Tinto, both have dual company structures which result in a large proportion of their true market capitalisation being excluded from the main indexes (shown below). The is most evident for Rio Tinto, which has a true market capitalisation of around $160 billion but only around $37 billion is included in the S&P/ASX 50 index. The consequence is that the main indexes are effectively "underweight" BHP and Rio Tinto, which has implications for the earnings growth and total return outlook for "the market'.

BHP has proposed that its dual company structure will be discontinued which will increase its

weighting in the main Australian equity market indexes. Other large recently announced merger and acquisition transactions will also impact stock and sector weights within the

main Australian indexes. However, we expect the net impact of these transactions on the main indexes to be relatively minor.

Financials and materials stocks dominate the ASX by market capitalisation

Source: Morningstar Equity Research, www.spglobal.com