Morningstar runs the numbers

We take a numerical look through this week's Morningstar research. Plus, our most popular articles and videos for the week ended 13 August.

70%

Dividends and franking credits made up roughly 70% of the S&P/ASX 200’s total return since 2011, writes Gareth James in his review of 10 franked income-stock ideas: “Dividends and franking credits comprised around 70% of the total return of the S&P/ASX 200 Index over the past decade, which highlights the importance of income to long-term Australian equity investment returns. However, the Australian market is relatively concentrated across financial and resources stocks, and arguably domestically focused. This means that a portfolio of Australian equities may be more highly correlated, or less diversified, than investors perceive.”

3%

The oil industry constitutes 3% of the S&P 500 today, down from nearly a quarter in the 1980s, in what legendary investor Jeremy Grantham calls the biggest loss of value in the history of the index: “It’s clear that if you ignore the E in ESG, you’re likely to wake up and find that the biggest industry loss of value in history is behind you, and you missed it. And wasn’t that subtle, by the way? There was never a year where people came out and said, ‘The oil industry is collapsing—watch your tails.’ By the way, in 1982, it was 23% of the S&P 500. But 10 years ago, it was 15%. And then irregularly—14%, 13%, 12%, 11%, 10%, all the way down to 3%—actually hit 2.5% for a while. That all happened without people pounding the drums that it’s going to happen… Very few people predicted the biggest loss of value in the history of the S&P.”

6 years

Morningstar has upgraded its fair value estimate for Telstra for the first time in six years, writes Prashant Mehra in his recap of last week’s earnings: “Telstra announced a $1.35 billion share buyback after the recent stake sale of its telecom towers business, and declared a fully-franked final dividend of 8 cents a share, including a special dividend of 3 cents... The quality of the result was encouraging, Morningstar director of equity research Brian Han said, after upgrading the telco’s fair value estimate for the first time in six years, up 5% to $4 a share.”

$5.20

Morningstar equity analyst Angus Hewitt says current share price weakness at Qantas is a buying opportunity for long-term investors, as he raises his fair value estimate for Qantas by 4% to $5.20: “Despite significant share price recovery since the depths of pandemic-induced pessimism, shares in Qantas and Air New Zealand still have plenty of runway left, both trading at discounts to our fair value estimates. We raise our fair value estimate for Qantas by 4% to $5.20.”

18%

Only 18% of respondents expect to have over 80% of their super remaining at death, writes Graham Hand in his recap of responses to the government's retirement income survey: "Only 18% of respondents expect over 80% of their super to be left over on death and 28% expect to have 20% or less. That shows significant expectation to spend the majority of super in retirement, with nearly half at 40% or less."

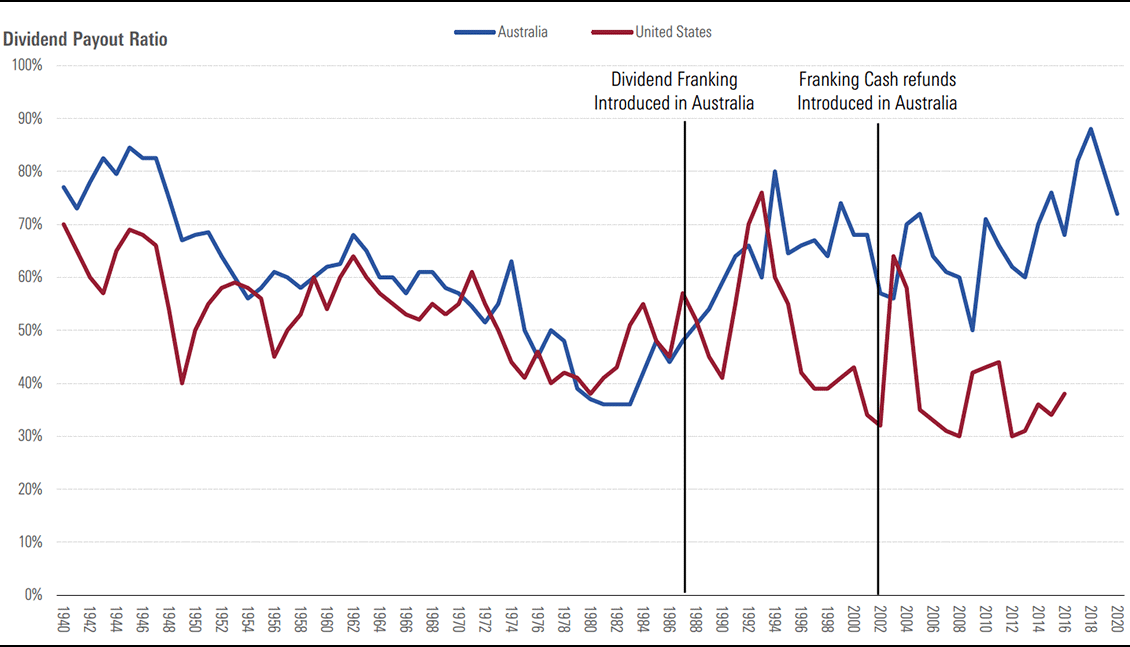

Charts from last week - Franking credits and short selling.

Franking credits made corporate Australia a haven for dividends (here)

Source: 'A history of Australian equities' 2019, Reserve Bank of Australia; Morningstar

Most popular articles

Top videos