Morningstar runs the numbers

We take a numerical look through this week's Morningstar research. Plus, our most popular articles and videos for the week ended 22 October.

$550 million

Investors moved just over half a billion dollars into the world’s first Bitcoin ETF on its debut day of trading last week, writes Katherine Lynch: “ProShares Bitcoin Strategy ETF saw near-record trading volume on day one and hauled in a huge $550 million from investors, one of the largest first-day takes for an ETF on record. In just one day, BITO surpassed all traditional currency-tracking ETFs in size.”

30%-40%

Move aside methane belching cows because the property sector produces around a third of all greenhouse gases, writes Cherry Reynard in her piece on assets that could be 'stranded' by climate change: “Tom Walker, co-head of global real estate securities at Schroders points out that between 30%-40% of all greenhouse gases come from the property sector and it therefore has a significant role to play in trying to achieve net zero around the world. He says that stranded assets are those buildings where the cost of retro-fitting them so they comply with legislation is greater than the value of the asset itself.”

$1.2 billion

Large consultancies made $1.2 billion working for government last year and Graham Hand shares some of the tips and tricks they use to squeeze clients for fees: “In October 2021, The Australian Financial Review reported that Accenture was awarded government contracts worth more than $340 million during the previous financial year, and Deloitte topped the Big Four list at $275 million followed by KPMG, EY and PwC. These five companies earned $1.2 billion in FY21. Let’s explore the consulting manual from one firm on how fees should be charged, so anyone who is a client of a major firm knows what is happening on the other side.”

0.8%

Annika Bradley explains why the average active manager charges 0.8% in fees, four times their passive equivalents: “the average annual investment management fee for an actively managed fund is just over 0.80% compared with 0.25% for a passively managed fund... The difference between active and passive investment management fee rates is largely due to the costs associated with investment research staff and, in some cases, what the manager thinks it can get away with charging based on past success or effective distribution networks.”

Charts from last week

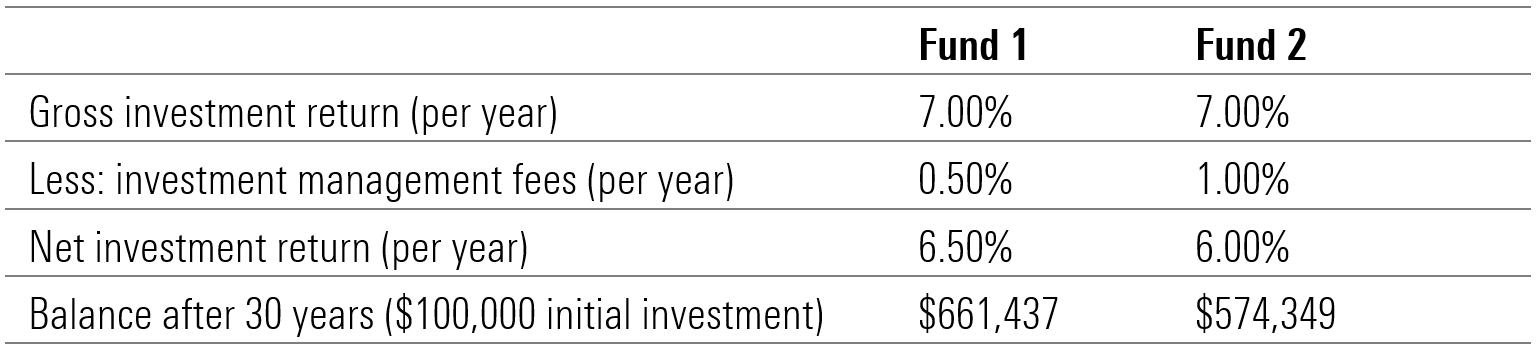

An extra 0.5% in fees could cost you $87,000 over thirty years (here)

Women's shoes and petrol jump in price in the June quarter (here)

Most popular articles

Top videos