What happened to the Santa Rally?

Investors in Australia's largest companies were denied a late Christmas gift as the Morningstar Australia Index slid into negative December returns for a second year running.

Mentioned: AMA Group Ltd (AMA), Jumbo Interactive Ltd (JIN), Perseus Mining Ltd (PRU), Smartgroup Corporation Ltd (SIQ)

Investors in Australia's largest companies were denied a late Christmas gift as the Morningstar Australia Index slid into negative December returns for a second year running.

While December started off in positive territory, but by the second day of trade, the ASX 200 suffered its worst day since mid-August on renewed fears over global trade uncertainty, dropping 2.19 per cent.

And while there were positive days of trade, particularly for mining stocks surrounding optimism that a resolution to the US-China trade war and Brexit are finally close at hand, the market closed the New Year's Eve session with a sharp loss.

Morningstar Australia GR AUD Index returned -2.03 per cent in December 2019, making it the second worst trading month for the year after August's -2.16 per cent return.

The Morningstar Australia GR AUD index measures the performance of Australia's equity markets, targeting the top 97 per cent of stocks by market capitalisation.

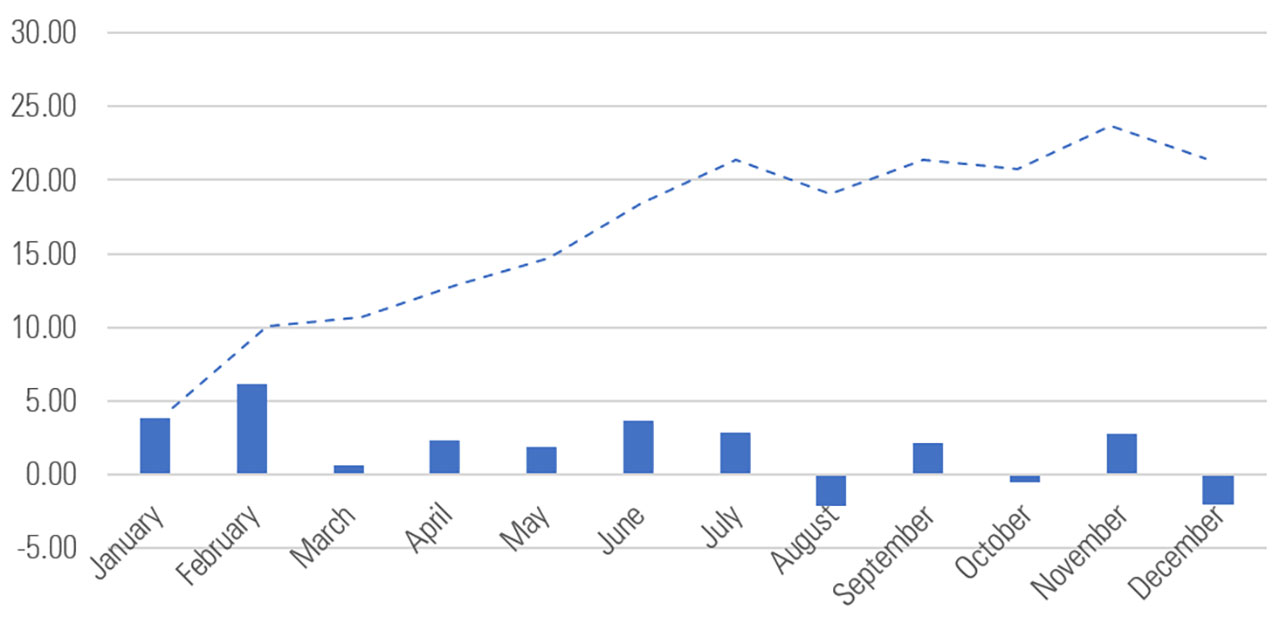

Calendar Returns 2019 | Morningstar Australia GR AUD Index

Source: Morningstar Direct

The result defied analyst expectations that the ASX would likely see a rally in December – generally around the Christmas and New Year period. And history was on their side. Data from Fidelity International shows that only six times in the past 27 years has the S&P/ASX200 delivered negative returns in December and has averaged 2 per cent.

The so-called December effect is thought to be triggered by a combination of US investors buying back into the share market after tax-loss related selling in the third quarter of the calendar year, optimism about the new year ahead, and light volumes around the year’s end, AMP Capital’s chief economist Shane Oliver said.

But the effect isn’t evident every year, and its intensity varies. Investors will remember all too well the 2018 fourth quarter dip, which saw markets end the year not with a bang but a whimper.

S&P/ASX200 Monthly Returns (%)

Source: Fidelity International, Bloomberg, November 2019

Santa brought presents for basic materials stocks, with the seven top performers for the month featuring in the sector. Gold miner Perseus Mining (ASX: PRU) was the top performer in December, returning 33.33 per cent.

On the naughty list: consumer cyclical companies AMA Group (ASX: AMA) and Jumbo Interactive (ASX: JIN) were the worst performers on the Index in December, down 27.82 per cent and 27.34 per cent respectively, followed by salary packaging and fleet management services provider Smartgroup Corporation (ASX: SIQ, -23.31 per cent) after announcing it would receive $4 million less in after-tax profits.

Morningstar Market Index Performance data for December 2019 shows the S&P/ASX 200 Resources TR AUD Index was among the few indices to deliver positive returns in the Australian Equity market at 1.43 per cent. It was joined globally by the FTSE 100 TR GBP Index, up 2.78 per cent in December, the S&P 500 TR USD Index, up 3.02 per cent, and the MSCI EM NR AUD, up 3.40 per cent.

However, for now, investors don't have much to complain about. Despite December's lacklustre performance, the Morningstar Australia Index is up 23.40 per cent for 2019.