ETF market outgrows LICs investments

There is now more money in exchange traded funds than listed investment companies. But Morningstar analysts say bigger is not always better.

Mentioned: BetaShares Glb Rbtc & Artfcl Intlgc ETF (RBTZ), BetaShares Asia Technology Tigers ETF (ASIA), BetaShares Japan ETF-Ccy Hdg (HJPN), BetaShares Crude Oil ETF Ccy Hgd(Synth) (OOO), WisdomTree Physical Palladium ETC (PHPDl)

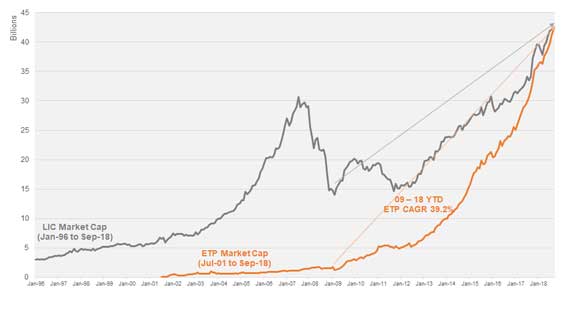

Australia's exchange traded fund industry has overtaken the listed investment company market for the first time. Assets under management in ETFs are now $60 million greater than LICs’, making ETFs the more popular ASX-traded investment product.

The Australian ETF industry reached a record high of $42.29 billion in assets under management in September 2018. This compares to the $42.23 billion LIC industry, according to the latest BetaShares Australian ETF Review.

The growth is particularly impressive when you consider the first LIC was launched in 1936, some 65 years before the first ETF was made available in 2001.

More striking has been the acceleration of the ETF industry’s growth following the global financial crisis, says BetaShares. Since 2009 to end September 2018, ETF assets under management have grown at a compounded annual growth rate of 39% versus the more subdued growth of the LIC market of 11.5%.

The ETF industry has also exhibited strong product growth since inception with the number of products on the ASX now double the number of LICs; 241 ETPs to 110 LICs.

Does bigger mean better?

Alex Prineas, associate director for manager research at Morningstar cautions that investors should not conflate funds under management with superiority. Economies of scale are great, but bigger is not always necessarily better, he says.

Growth of the Australian vs ETP Industry

Source: ASX, BetaShares

Prineas says that while the ETF market is larger than the LIC market, that the figures are primarily a comment on passive and systematic ETFs. "LICs are still doing much better than the active ETF market," Prineas says.

It is also worth noting that despite impressive growth, inflows into Australia's ETF and LIC industries remain dwarfed by Australian managed funds, which boast total assets under management of more than $1.63 trillion, according to Morningstar data.

Benefits of a closed-end fund

Prineas points out that the closed-end structure of LICs mean that fund managers do not have to worry about the impact of inflows and assets under management.

"The closed-end nature of LICs means that the better managed ones can focus their efforts on stewardship, not salesmanship," he says. "The captive capital enables LICs to take a long-term investment mindset."

Prineas attributes much of the growth of ETFs following the global financial crisis to the almost decade long bull market which has seen the US market rise more than 300 per cent.

"Compared to the LIC market, the ETF market has a much stronger weighting to global equities, and as the Australian dollar has declined, global equities have performed strongly," he says.

"If we do enter a bear market, no doubt we could see ETF outflows, purely because they are so liquid, and are a useful vehicle for short term traders."

BetaShares says a critical part of the relative appeal of the ETF industry is its cost-effectiveness. Their analysis shows the average asset-weighted fees in the ETF industry are 0.22 per cent per annum, versus an average level of 0.66 per cent per annum for the LIC industry – excluding any performance fees levied.

ETF industry evolving

But a parting is occurring in the ETF industry with newer products including active ETFs and thematic ETFs charging higher fees more comparable to listed investment companies’. The soon-to-be launched Fidelity Active ETF Global Emerging Markets Fund has a management fee set at 0.99 per cent, while the BetaShares Asia Technology Tigers ETF has a management fee of 0.67 per cent.

BetaShares chief executive Alex Vynokur believes the ETF industry will continue to grow more quickly than the LIC industry and expects the industry to double the size of the LICs within four to five years.

The ETF industry grew 1.6 per cent in the month of September, up $663 million, with 100 per cent of the growth being attributable to new money rather than unit price appreciation.

International equities continued to dominate net inflows, with $408 million, more than double broad Australian equities at $184 million. Fixed income ETFs grew $154 million.

Beware faddy fund launches

Product launches during September were significant, with 11 new products launched.

Prineas expressed concern with the number of product launches in recent months, particularly those which isolate a niche segment of the market such robotics, artificial intelligence, or single ESG factors such as diversity, describing them as "trendy" and "faddish".

10 latest ETF ASX listings

Source: Morningstar Australia

"ETF product launches are good for the point of view that they add to investor options, but you can have too much of a good thing. We at Morningstar believe strongly in diversification. If you're investing in a sector-ETF you're most likely excluding a big chunk of the market and you run the risk of jumping on a trend which is hot one year and not the next," he warned. "They are also likely to be more costly and less liquid."

Prineas adds that while he can see why people may want to be overweight a particular sector in their portfolio which may be under-represented in the local market, such as technology stock, investors would be better served by holding a global equity ETF.

More from Morningstar

• Make better investment decisions with Morningstar Premium | Free 4-week trial

Emma Rapaport is a reporter with Morningstar Australia, based in Sydney.

© 2018 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. This information is to be used for personal, non-commercial purposes only. No reproduction is permitted without the prior written consent of Morningstar. Any general advice or 'class service' have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), or its Authorised Representatives, and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Please refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a licensed financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782 ("ASXO"). The article is current as at date of publication.