Morningstar expands global equity ETF coverage

Strategic beta funds are a key introduction while international equity is now the largest ETF category in terms of net assets, with $22bn under management.

Mentioned: VanEck FTSE Intl Prop Hdg ETF (REIT), Vanguard Global Multi-Factor Active ETF (), Global X India Nifty 50 ETF (NDIA), BetaShares FTSE 100 ETF (F100), BetaShares India Quality ETF (IIND), BetaShares Global Sstnbty Ldrs ETF (ETHI), iShares Core MSCI Wld Ex Aus ESG ETF (IWLD), SPDR® MSCI World Quality Mix ETF (QMIX), BetaShares S&P 500 Equal Weight ETF (QUS), iShares World Equity Factor ETF (WDMF)

Morningstar fund analysts have expanded their research coverage of exchange-traded funds as the demand for global equity products intensifies.

Market coverage now includes four strategic-beta ETFs, along with one traditional market-cap passive ETF, with focuses spanning quality companies, environmental leaders and fundamental value weighting.

The move expands Morningstar's qualitative analyst ETF coverage to 71.

International equity ETFs continue to be a popular investment for investors, with more than $1 billion flowing into in the category in the first half of 2019, Morningstar data shows.

2018 also saw international equities receive the lion share of flows, although today fixed income products are increasingly popular. There have significant flows into Australian bonds.

International equity is now the largest ETF category in terms of net assets, with $22 billion under management in July 2019 – or 42 per cent of the market.

However, growing market and economic uncertainty could shift sentiment, with US-based international stock ETFs posting the largest monthly outflow on record in August.

Several new international equities products have come to market this year including the BetaShares India Quality ETF (ASX: IIND), the BetaShares FTSE 100 ETF (ASX: F100), the ETFS Reliance India Nifty 50 ETF (ASX: NDIA), and the VanEck Vectors FTSE International Property (Hedged) ETF (ASX: REIT).

New listings for active ETFs (or exchange-traded managed funds) have also focused on offering access to international equities via the exchange, including the Vanguard Global Multi-Factor Active ETF (Managed Fund) (ASX: VGMF).

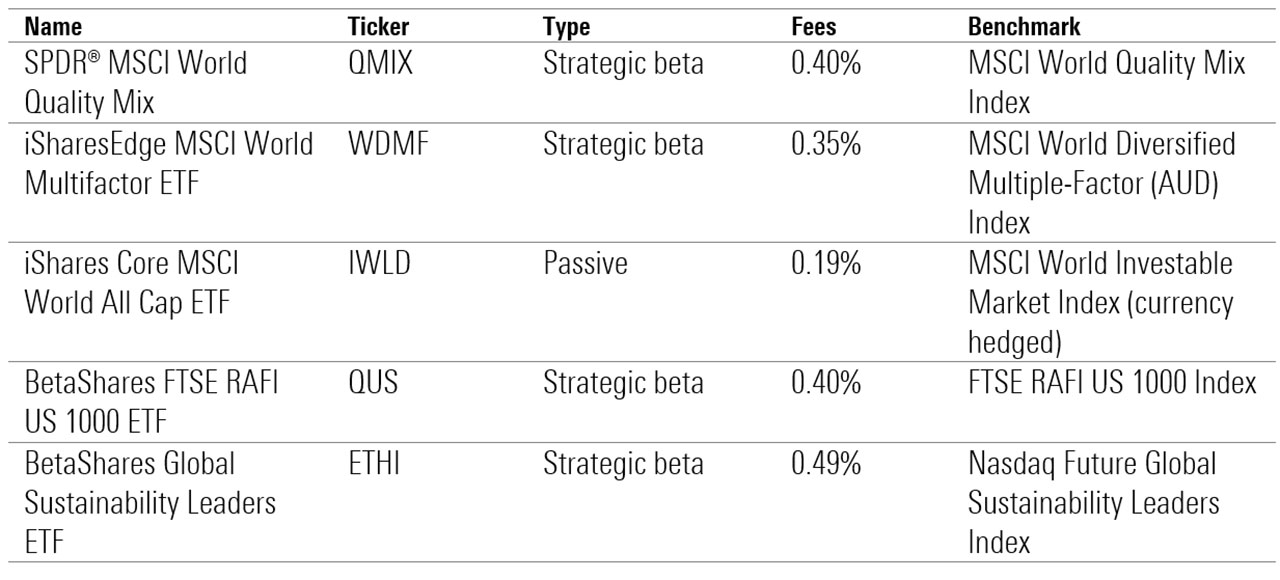

New international equity ETFs under Morningstar's coverage

Source: Morningstar Global Equity Sector Wrap September 2019

Following is Morningstar analyst Alexander Prineas’s take on the funds listed above:

SPDR® MSCI World Quality Mix (ASX: QMIX) | Bronze

Morningstar has initiated coverage of SPDR MSCI World Quality Mix QMIX with a Bronze rating.

“The ETF follows the MSCI World Factor Mix A-Series Index, built from three underlying benchmarks: The MSCI World Quality, Value, and Low Volatility indexes.

A body of academic research suggests stocks with these attributes should outperform in the long run.

We like the transparent and simple structure of having a distinct sleeve for each factor. It’s easy to assess which factors are helping (or hurting), and easy to understand why each stock is in the portfolio.

The sleeve approach may dilute exposure to the factors; for example, the cheapest stocks are unlikely to also be the highest-quality names. But each factor may deliver (or suffer) at different times, and the three sleeves provide welcome diversification along with the potential for long-term outperformance.”

iSharesEdge MSCI World Multifactor ETF (ASX: WDMF) | Bronze

“iShares Edge MSCI World Multifactor ETF WDMF is an attractive option to access global markets backed by sound academic research.

“The strategy is largely based on the Fama-French-Carhart four-factor model which attempts to predict stock market returns using factors—such as quality, value, momentum, and small size—that are expected to outperform.

“WDMF adds additional weight to stocks that have desirable factor characteristics and eliminates those that don’t. This process excludes more than two thirds of the universe compared with the broader MSCI World Index; however, the positive skews are reasonably modest with a 2 per cent active cap on any individual holding.

“The fund was launched in October 2016 and back-tested to 1998 showing exceptionally strong performance, although it’s still a bit too early to determine if the factor tilts lead to outperformance in the future.

“Still, the low cost, iShares strong indexing capability and sound academic theory lead us to initiate coverage with a Bronze rating.”

iShares Core MSCI World All Cap ETF (ASX: IWLD) | Silver

“Morningstar has initiated coverage of iShares Core MSCI World All Cap AUDH ETF IHWL with a Silver rating.

IHWL is an ETF that tracks the MSCI World Investable Market Index (currency hedged), which is like the better-known MSCI World but with an allocation to small-cap stocks.

As the name suggests, it aims to capture all investable stocks in developed markets given they meet size and liquidity requirements. This provides investors with an excellent passive option to access global markets at an astoundingly low 0.19 per cent annual fee.

No other currency-hedged global-equity ETF offers such a low price and represents exceptional bang for buck, especially considering the inclusion of small-, mid-and large-cap stocks in the one security.”

BetaShares FTSE RAFI US 1000 ETF (ASX: QUS) | Bronze

“BetaShares FTSE RAFI US 1000 ETF QUS offers an appealing middle ground between active funds and low-cost index options for US equities.

QUS tracks the FTSE RAFI US 1000 Index which was created by Research Affiliates, a respected and well-known authority in strategic-beta investing, which ranks companies based on their fundamental characteristics rather than their market cap.

QUS thus invests into the top 1,000 companies in the U.S.as measured by four key metrics: earnings, book value, sales and dividends. This typically results in the fund expressing value characteristics and avoids one of the key pitfalls of market-cap investing–favouring expensive stocks and shunning cheap names.

QUS represents great value at 0.40 per cent and that together with its sensible investment approach is why we’ve initiated coverage with a Bronze rating.”

BetaShares Global Sustainability Leaders ETF (ASX: ETHI) | Neutral

“BetaShares Global Sustainability Leaders ETF ETHI tracks the Nasdaq Future Global Sustainable Leaders Index, which was codeveloped by BetaShares and Nasdaq to provide Australian investors with passive exposure to global stocks that factor in key environmental, social, and governance, or ESG, concerns.

ETHI applies negative filters to screen out exposure to fossil fuel producers, gambling, tobacco, weapons manufacturing, climate change risk, and others. Additionally, ETHI positively filters for and actively invests into stocks that are climate leaders. This results in a highly concentrated portfolio of 100 stocks with substantial sector and country skews (approximately 75 per cent is in invested in the US), even when compared to other ESG and ethical funds.

For investors seeking exposure to an authentic ESG fund, ETHI is worth a look given the low fee of 0.49 per cent. But the low number of holdings and the lack of diversification relegate this option to a supporting position in a well-diversified portfolio, and for those reasons we’ve initiated coverage with a Neutral rating.”