Regulator descends on rapidly expanding active ETF market

The regulator is worried about the opacity of the active exchange traded fund market.

Mentioned: Platinum International ETF (PIXX), Antipodes Global Shares ETF (AGX1), Schroder Real Return (Managed Fund) (GROW)

Exchange-traded managed funds or "active ETFs" are ramping up in Australia, with over 30 now listed on the Australian Securities Exchange and many more in the pipeline.

In the words of Pinnacle's Chris Meyer, active ETFs combine the benefits of active fund management (the “active” part) with the convenience of being traded like a share on the stock market (the “ETF” part).

Unlike index tracking ETFs which attempt to mimic the performance of an index, active ETFs are managed by a team of portfolio managers who make decisions on the underlying portfolio allocation and aim to outperform the index.

Australian fund managers see active ETFs as a new distribution channel to seek access to the self-directed market. The latest Investment Trends/Vanguard survey shows SMSFs are increasingly using ETFs to diversify their portfolios, with the number of trustees intending to invest via the listed structure surging over the past year from 140,000 to 190,000.

But the industry came to a screeching halt on Thursday after the corporate watchdog announced it would block the listings of new active ETFs that rely on internal market makers while it conducts a review.

Australian ETP Assets (in USD billion)

Source: Morningstar Direct, Morningstar Research. Data as of 12/31/2018

In a notice to the industry, ASIC asked all exchanges to "cease admitting non-transparent investment products [ETFs] with internal market markers for the time being" while it considers "the appropriate regulatory settings in this changed environment."

Why the regulator is concerned

The regulator is concerned about the lack of transparency around the internal market making process and the potential of conflict of interest arising from the profits generated from it.

Stock prices change because of supply and demand. If more investors want to buy a stock than sell it, the price moves up. Index-tracking ETFs, on the other hand, like the Vanguard Australian Shares Index ETF (ASX: VAS), are priced based on the value of the underlying assets in the portfolio – or the net asset value (NAV). However, because they're traded on the ASX, the price can fluntuate, so there can be a tension between the NAV and the maket price.

To ensure there is a market for the ETF, and the price of the ETF remains relatively close to the NAV, ETF providers engage external market makers. External market makers like Susquehanna, Deutsche Bank and CitiGroup access the fund’s daily full portfolio holdings, which are made publicly available on their website, value the assets held within that fund, and set bids and offers in the exchange market.

External market makers are incentivised to provide liquidity and promote tight spreads around the NAV in several ways – including via incentives like trading fees when they achieve minimum quoting benchmarks each month, according to ASIC.

Active ETFs are also priced via their NAV but undertake the market making internally by appointing a market making agent. This is because fund managers of active ETFs claim that the daily disclosure of the fund’s portfolio holdings gives away their intellectual property with a fear that their competitors could simply replicate their portfolio. Therefore, the regulator allowed for delayed full portfolio holdings disclosure of three to four months subsequent to actual live prices being struck.

Australia has been a world leader in bringing non-transparent exchange-traded products to market, with the regulator developing special disclosure rules to enable funds from having to make their full portfolio holdings public on a daily basis.

To compensate for the delayed disclosure, active ETFs are required to publish an indicative net asset value (iNAV) during trading hours to provide investors with an indication of the value of the fund.

It is this structure which is worrying regulators. ASIC is concerned about the lack of transparency in the process, and the fact that it leaves the door open for abuse. Because the daily portfolio holdings is only viewed by the fund manager who acts as the market maker on behalf of the fund, external parties can't independently verify the value of the listed fund's underlying holdings.

"We have concerns that the profit generated from internal market making is not well understood by investors and may lead to inherent conflicts and unequal treatment among different groups of investors, if, for example, an unfavourably low bid price was set for selling members," ASIC said in an extensive review of the ETP market in August 2018.

"We consider that it is important for issuers to have appropriate frameworks around internal market making to manage conflicts, even when the amount of profit earned from internal market making is small relative to the size of the fund."

Additionally, the regulator is concerned that if profits made from internal market making activity are included in the fund's performance fee calculation, it would be a source of potential conflicts as it would "increase the incentive for the internal market maker to widen the spreads to generate a higher performance fee".

Transparency benefits investors

Morningstar’s director of manager research, Asia-Pacific Tim Murphy says Australian investors benefit when markets err on the side of transparency, and that it's reasonable for ASIC to review the industry to ensure participants are acting appropriately.

“There’s been strong growth in active ETF issuance with internal market making in recent years”, he said.

“Given this strong growth it’s prudent that the regulator reviews the market structure to ensure it remains appropriate.

“In general, we believe investors are better off with more transparency rather than less, so it will be interesting to see where the regulator lands on this issue”.

Active ETF providers who do not use internal market makers but instead choose to disclose their full portfolios to external market makers are unaffected by ASIC's notice. In these products, multiple external market makers can independently verify the value of the underlying assets.

Fallout from Deutsche restructuring

Chris Meyer, director of listed products with Pinnacle Investment Management, says additional forces are at play in the regulators decision to halt listings.

Firstly, he says Deutsche Bank's decision to divest from its Australian equities business has upset the industry.

"I don't think the regulator wants additional new product being issued while a big player in the market making of active ETFs is still transitioning to a new owner," he said.

Secondly, he says Chi-X Australia coming in as an alternative exchange has shifted the regulatory environment.

"There's a lot of issuers, particularly fixed income active ETFs, looking to go to Chi-X because they've claimed to have a different rule book on disclosure. If there's a potential for regulatory arbitrage, the regulator wouldn’t like that," he said.

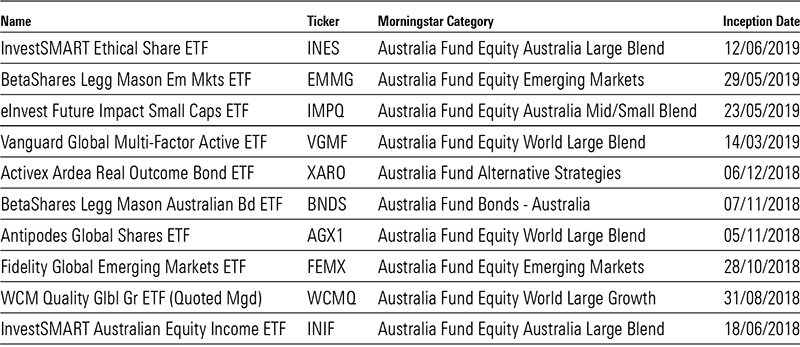

Actively managed ETFs listed on the ASX in 2018/19

Source: Morningstar Direct

Meyer says the regulator intends to undertake the review for the remainder of 2019. He says between 12 to 15 active ETFs are in the queue with a product disclosure statement ready to be lodged.

"In the early stages of any industry's development, it is a good thing to take stock and make sure that you're doing it the right way," he said.

"It's not great that it happens to then also affect a live industry and the development of new product. We hope this move by the regulator doesn’t have an unintended impact of the harming the confidence investors have in the ETF industry just as its gaining traction."

ASIC's notice comes as several countries allow for similar types of exchanged traded funds with looser transparency rules. Hong Kong became the fourth market to launch active ETFs last month, following Australia, South Korea and Canada. However, the rules differ in each market.

In the US, the Securities and Exchange Commission in May granted conditional approval for active ETFs to trade without disclosing their holdings each day. Active providers must still disclose daily holdings, but only to authorised participant representatives.

Magellan pioneered the new category of non-transparent active ETFs in 2015 with a listed version of the Magellan Global Equities fund. Since, several funds have thrown their hats in the ring, with 10 active ETFs launched in fiscal-2017-18 and nine in fiscal 2018-19. Today, there are 39 active ETFs listed on the ASX from a range of managers including Fidelity, Platinum, Montgomery, Antipodes Partners, Legg Mason, K2, AMP Capital and Schroders.

Morningstar analysts provide research and ratings on 10 including the silver-rated Magellan Global Equities ETF (ASX: MGE), the silver-rated Platinum International ETF (ASX: PIXX), the bronze-rated Schroders Real Return ETF (ASX: GROW) and the bronze-rated Antipodes Global Shares ETF (ASX: AGX1).