Value funds stage a comeback: ETF Review Q1 2021

Inside the best and worst performing Australian exchange-traded funds of the first quarter.

Mentioned: Vanguard Global Value Equity Active ETF (VVLU), Global X FANG+ ETF (FANG), BetaShares S&P/ASX Australian Tech ETF (ATEC), BetaShares U.S. Trs Bd 20+Yr ETF Ccy H (GGOV), Janus Henderson Tactical Income Actv ETF (TACT), BetaShares NASDAQ 100 ETF Ccy H (HNDQ), BetaShares Capital Ltd (CLDD), VanEck Global Clean Energy ETF (CLNE), BetaShares Climate Change Innovation ETF (ERTH), Hyperion Global Growth Companies ETF (HYGG), BetaShares Glb Banks ETF-Ccy Hdg (BNKS), Global X Physical Silver (ETPMAG), BetaShares Glb Energy Coms ETF-Ccy Hdg (FUEL), SPDR® S&P/ASX Australian Govt Bd ETF (GOVT), BetaShares Crude Oil ETF Ccy Hgd(Synth) (OOO), Perth Mint Gold ETF (PMGOLD), Vanguard Australian Shares ETF (VAS), Vanguard US Total Market Shares ETF (VTS), Global X S&P 500 Hi Yld Low Vol ETF (ZYUS)

Value-style and unloved sector exchange-traded funds (ETF) roared back in the first quarter of 2020 as signs of economic recovery and hope in the vaccine rollout shifted market dynamics. BetaShare's Crude Oil ETF (OOO), which placed last on 2020 performance charts, shot to the top of the list returning over 21 per cent in a single quarter. Talk about a comeback.

For the second quarter in a row, the Morningstar US Energy Index eclipsed the overall market, beating the aggregate index by over 28 per cent in the first quarter. Morningstar director of research, energy and utilities Dave Meats attributes the strong rebound to the rollout of COVID vaccinations.

"The reopening of the global economy should eliminate the stay-at-home orders and travel restrictions that have been suppressing demand for crude oil in the last 12 months," he says.

Value-style investing also made a comeback in the first quarter after almost a decade of underperformance. Vanguard's actively-manager Global Value Equity (VVLU) fund returned 20 per cent aided by strong showings from Kinder Morgan, General Motors and Walgreens Boots Alliance. Sectors which fell victim to the pandemic like banks (BetaShares Glb Banks ETF-Ccy Hdg BNKS) and energy (BetaShares Glb Energy Coms ETF-Ccy Hdg FUEL), delivered top returns.

ETS Securities' low volatility, high dividend-paying fund (ZYUS) had something to sing about, besting the MSCI USA NR index by 7.55 per cent. The fund has underperformed the index every year since its inception in 2015.

Best and worst performing ETFs Q1 2021

(Click to enlarge) Source: Morningstar. Data as at month end – 31 March 2021.

The changing of the guard unseated several growth funds which delivered exceptional performance through the pandemic. Tech-focused funds like BetaShares' Australian Tech ETF (ATEC) swung to a -8 per cent loss in the first quarter led by significant falls in its top holding Afterpay (APT). Morningstar equity strategist Gareth James says the first quarter tech rout was caused by a jump in long-term bond yields, leading to a reassessment of growth stock valuations. This caused a 12 per cent fall in the S&P/ASX 200 Information Technology Index, which significantly underperformed the 2 per cent rise in the S&P/ASX 200 index.

Funds linked to precious metals like Perth Mint Gold ETF (PMGOLD) and ETFS Physical Silver ETC (EPTMAG) also fell as the gold price correction gathered steam. The S&P/ASX 200 Materials sector underperformed the S&P/ASX 200 Index by about 2 per cent in the March quarter. This was primarily driven by gold stocks, which fell on average nearly 20 per cent.

Many of the thematic ETFs which dominated the list of 2020 performers are largely absent from the top of the Q1 2021 performance tables. These funds are used by investors to take tactical tilts on sector trends. In an article published last month, we noted that investors do so at great risk. The diversification investors get from broad market-tracking products like Vanguard Australian Shares (VAS) and Vanguard U S Total Market Shares (VTS) aren't apparent in thematic-based products, which track the performance of long-term trends like robots, cybersecurity and lithium. They are typically highly concentrated, and if the US experience is anything to go by, are launched at the top of bull markets.

Over the quarter, global interest rate rises affected the performance of ETFs in the technology and healthcare sectors. Those firms project a higher share of their future cash flows to come well down the road, so the present value of their cash flows, and the value of the stocks, can decline more severely when interest rates rise.

MORE ON THIS TOPIC: Thematic ETFs: why knowing how to spot one is half the battle

Whether the rotation to value will continue is unclear. Tech-linked ETFs like ATEC, ETFS FANG+ ETF (FANG) and BetaShares NASDAQ 100 ETF-Currency Hedged (HNDQ) were among the top performers last week, in line with gains from US mega-caps like Apple, Microsoft and Amazon. The vaccine rollout has hit several speedbumps including supply shortages, and fears surrounding rare blood clots linked to the AstraZeneca and Johnson & Johnson vaccines. Central banks reiterated their commitment to low rates, noting the improving outlook while cautioning that a full recovery remained distant. Meanwhile, the International Monetary Fund has lifted its 2021 global growth forecast from January’s 5.5 per cent to 6 per cent, a rate not seen since the 1970s. Uncertainty reigns supreme.

Bitcoin surge

Cryptocurrency ETFs don't feature on the ASX (yet) but it's worth noting that they dominated the performers' list (again) in Europe. Data collected by Morningstar senior editor (UK) James Gard shows the best performing ETF in March was the 21Shares Binance BNB ETP (ABNB), returning 35 per cent. The product seeks to track the investment results of the Binance Coin. Over the past year, Binance gained an outstanding 2,109 per cent, surging from $12 to $255 at the end of March. It was also the best performer in February.

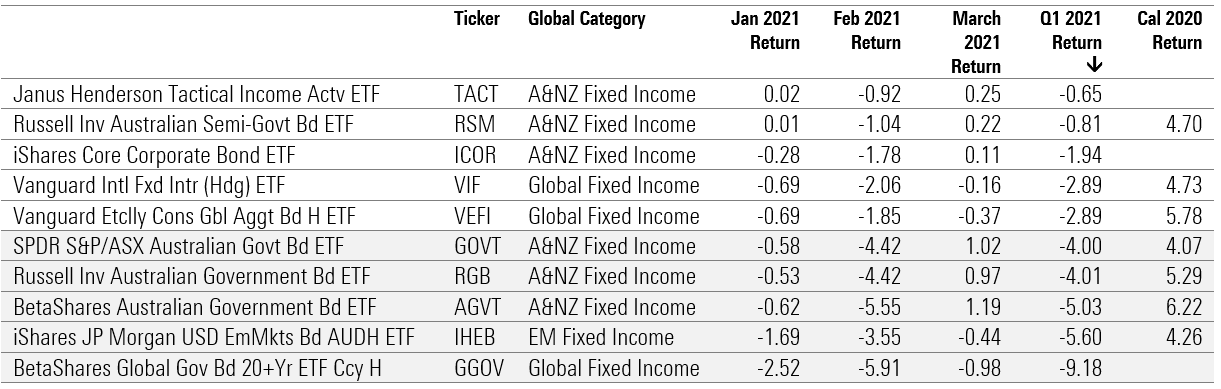

Victims of the bond market rout

ETFs tracking long-end Australian and global government bonds took a tumble in the first quarter thanks to rising inflation expectations. With economic conditions improving, investors are expecting rising inflation. This is materialising in the re-pricing of longer-dated bonds—for example, government bonds with a duration of at least 5 years and longer. This environment creates significant headwinds for bond managers to deliver positive returns, particularly for those strategies that are benchmark aware, says Morningstar senior fund analyst Matthew Wilkinson.

Not everyone was similarly affected. Those managers who stick mostly to government bonds like BetaShares Global Gov Bd 20+Yr ETF (GGOV) and SPDR S&P/ASX Australian Govt Bd ETF (GOVT) borne the brunt of this market environment. But those who run more flexible strategies, like Janus Henderson Tactical Income Actv ETF (actively managed) (TACT), have held up relatively well.

Best and worst performing bond etfs Q1 2021

Source: Morningstar. Data as at month end – 31 March 2021.

Vanguard extends its streak

Australia's ETF sector continues to grow. The industry has added around $8 billion in the first quarter of 2021 bringing total assets under management to an all-time high of $102.9 billion.

In March, equities led inflows. There was an even split of interest in Australian Equities ($618m of flows) and Global Equities ($618m), according to data from BetaShares. Outflows came from cash and exposure to precious metals (silver and gold), which delivered negative performance in March.

MORE ON THIS TOPIC: Tapping into sustainability and green energy

On a firm level, Vanguard attracted the highest flows year to date, capturing $1.5 billion – or 24.38 per cent of the industry. BetaShares followed closely behind, pulling in $1 billion (23.13 per cent). Global investing powerhouse Magellan faltered with outflows of $87.7 million from its funds this year. Its gold-rated Global Open Class fund had its worst year in a decade in 2020, delivering investors a negative return (-0.2 per cent) and underperforming both the Morningstar World Large Blend category (5.69 per cent) and the MSCI World Ex Australia NR AUD index (5.73 per cent).

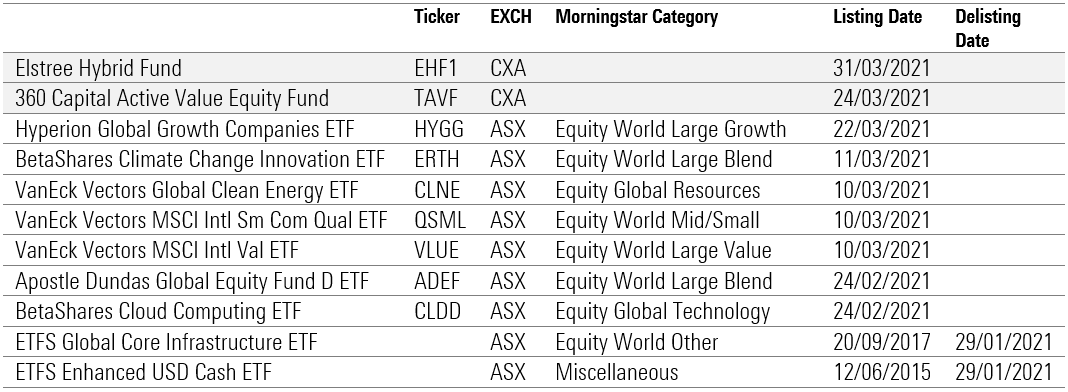

Thematics, active funds roll in

The exchanges' added nine funds over the quarter and delisted two, bringing the total number of funds listed to 230 (ASX) 14 (Chi-X). New funds focused on niche areas of the market like clean energy (BetaShares Climate Change Innovation ETF (ERTH), VanEck Vectors Global Clean Energy ETF CLNE) and cloud computing (BetaShares Cloud Computing ETF CLDD). As expected, actively managed funds also continued to stream onto the exchanges with products from Hyperion Asset Management, Apostle Dundas and Elstree, and 360 Capital. ASX data shows Hyperion Global Growth Companies ETF (HYGG) was the highest traded exchange-traded product in ASX history (nearly $8m) on its first trading day.

MORE ON THIS TOPIC: Will this be the year active ETFs succeed?

ETF Securities shuttered two funds in January—ETFS Global Core Infrastructure ETF (CORE) and ETFS Enhanced USD Cash ETF (ZUSD). The provider said CORE because it wasn't big enough to be cost effective and was offering higher than average bid-offer spreads due to limited secondary market trading.

Listings and delistings Q1 2021

Source: Morningstar. Data as at month end – 31 March 2021.