Vanguard, iShares escalate ETF fee war

Some of Australia's largest providers of exchange-traded products are slashing fees as the battle for market share rages on.

Mentioned: BetaShares Australia 200 ETF (A200), iShares Core S&P/ASX 200 ETF (IOZ), SPDR® S&P/ASX 200 ETF (STW), Vanguard Australian Shares ETF (VAS)

Some of Australia's largest providers of exchange-traded funds are slashing fees on their Australian shares products as the battle for market share rages on.

First out of the block, BlackRock Australia almost halved the fee for its flagship ETF, the iShares Core S&P/ASX 200 ETF (ASX: IOZ) on Monday, from 0.15 per cent to 0.09 per cent.

The cut represents a 40 per cent discount for investors in the $1.2 billion ETF, effective 24 June.

Then, Vanguard yesterday lowered fees on a number of its funds and ETFs, including the Vanguard Australian Shares Index ETF (ASX: VAS) – currently the second largest ETF on the Australian market with $3.6 billion under management.

VAS investors will see their fees reduced almost 30 per cent from 0.14 per cent to 0.10 per cent per annum.

Vanguard points out that in practical terms, this means a $10,000 investment in the ETF will cost $10 plus trading costs.

Both providers said their respective scale benefits made the fee reduction possible.

"This change is part of the regular review of our pricing strategy, reflecting our continued growth and ability to leverage our scale for the benefits of clients,” Christian Obrist, head of BlackRock's iShares business in Australia, said in a statement.

"Vanguard takes a lot of pride in being able to pass along the benefits of increasing scale in our funds and driving costs down over time for our investors..." said Vanguard’s head of product and marketing, Evan Reedman.

But Morningstar associate director, manager research Alexander Prineas said something else could have been at play in the decision to slash costs.

BetaShares undercuts

The new prices bring IOZ and VAS's management fee within a stone's throw of the newest and cheapest broad market Australian equity ETF on the market, the BetaShares Australia 200 ETF (ASX: A200).

The A200 stormed into the market in May 2018 with its rock bottom 0.07 per cent annual fee – half the cost of the nearest Australian equity rival.

Within 12 months, A200 gathered a large book of about $500 million in funds under management, one of the fastest ascents in Australian ETF history.

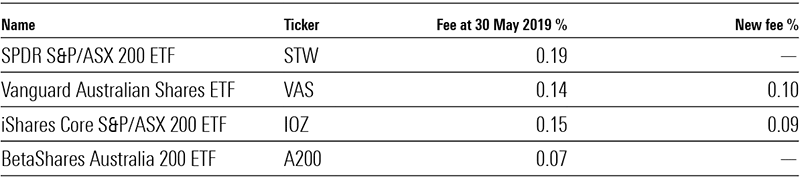

Table: Management fee changes

Source: Morningstar Direct

Prineas says the fee war has put pressure on product providers, particularly SPDR's S&P/ASX 200 ETF (ASX: STW) – the largest ETF on the market with $3.9 billion under management, with a management fee of 0.19 per cent.

"Incumbent providers face the tough decision of whether to follow with their own fee reductions to entice inflows, but potentially sacrificing some profit on the existing book of funds under management; or, maintain fees and profits, but potentially sacrifice new inflows," he says.

"That’s a particularly tough choice for SPDR because STW is the largest and longest running ETF in Australia.

"It also remains one of the most liquid ETFs thanks to its size and the fact that it tracks the most widely used benchmark, the S&P/ASX 200 index. But STW is now priced notably above other rivals," Prineas says.

A200 remains the lowest-cost Australian equity ETF by 22 per cent, but Prineas says it will be interesting to see whether the discount is enough to keep enticing money away from the incumbents.

Fees have been trending downwards across the three largest products – VAS, IOZ and STW – for several years. IOZ cut its fee to 0.15 per cent from 0.19 per cent in January 2016, making it the cheapest ETF that tracks the S&P/ASX 200 Index at the time.

Chart: Fee race to the bottom

Source: Morningstar Direct

Vanguard's Reedman acknowledged BlackRock's decision to position itself as a low-cost provider of an Australian shares ETF.

“While some issuers may offer lower prices on select products, Vanguard is committed to delivering high value and low cost across our broad range," said Reedman.

Are no fee index funds the future?

Competitive pressures are likely to escalate between these providers, if the US experience is any guide.

The Boston-based manager said it would provide investors with no fee exposure to US and international stocks from 3 August via two new index mutual funds, and reduce fees across its stock and bond index mutual funds.

At the time, Morningstar's director of fund research Russel Kinnel said Fidelity could afford to offer index funds below their cost because they will make it up with all the other funds and services clients will buy.

"Fidelity has a unique position in the industry in that it is a big player in both actively and passively managed funds," he said.

"In addition, Fidelity has always wanted to be the biggest and best. Other parts of the business remain quite profitable."

But for Vanguard and BlackRock, whose businesses are built around index investing, Kinnel says the move to zero-fee index funds will be much trickier.

Prineas says the landscape in Australia is similar in most respects, but has one key difference.

"Vertical integration is a feature of the local market as it stands, even though Australian banks have moved to divest their wealth and funds management businesses," Prineas says.

"The difference is that the major index fund managers in Australia are typically distinct from brokerage and platform providers, and are even competitors to them, unlike in the US where Fidelity offers active funds, index funds, and a trading and administration platform."

The prize for the cheapest ETFs in Australia was shared between Vanguard and iShares, who both offer US equity ETFs for an astoundingly low annual cost of 0.04 per cent. Vanguard has now reduced the fee for the Vanguard US Total Market Shares Indesx ETF (ASX: VTS) to 0.03 per cent.

Article updated at 3:54PM, Wednesday 26 June to reflect the VTS fee reduction.