3 reasons why Monash thinks ETFs trump LICs

Simon Shields converted his LIC into an active ETF in June and has no regrets.

Mentioned: Antipodes Global Shares ETF (AGX1), Monash Investors Small Comps Tr (Hdg) (MAAT), Magellan Asset Management Limited (MHHT), Antipodes Global Investment Company Ltd (), Argo Investments Ltd (ARG), WAM Alternative Assets Ltd (WMA), WAM Capital Ltd (WAM)

Monash Investors made history in June 2021 when it converted its Australian equities listed investment company to an active exchange-traded fund. The move was the final step in a long battle with a persistent discount to net tangible assets that had resisted share buybacks and better communication.

Four months on from the move, chief investment officer Simon Shields has no regrets. While the fund suffered deep outflows as a result, he says the exchange-traded fund (ETF) structure solves the discount issue while matching many of the benefits that listed investment companies (LICs) provide around tax and distributions.

“You get the best of both worlds with a unit trust [the legal structure used by most ETFs]. The structure is a real step up from what was available previously,” he says.

Morningstar spoke with Shields about the move and why he believes most investors are better served by ETFs. It comes down to three reasons: an end to discounts, favourable new rules around tax and distribution, and simpler performance reporting.

But the structure isn't for everyone, particularly those investing in smaller illiquid companies.

A solution to discounts

Shields says the new structure eliminated his LIC’s persistent discount to the value of net tangible assets (NTA)—at times as high as 16%.

Discounts to NTA—where shares trade below the value of the underlying assets—plague LICs. Their “closed-ended” structure means a buyer must be found in the market to match any seller, whereas a market-maker stands ready to buy or sell in the “open-ended” structure of ETFs.

Factors such as poor performance, unreliable dividends and a lack of engagement with investors and advisers can all contribute to a discount. In an ETF, these factors would lead to redemptions but in a LIC, they feed a discount.

A third of LICs traded at a discount to the post-tax NTA in August, according to Morningstar data.

Monash Absolute Investment Company Limited restructured to the Absolute Active Trust (Hedge Fund) (ASX: MAAT) in June. Since inception, the newly listed active ETF has returned 6.79%.

Other LIC managers trading at discounts are following in Shields’ footsteps. In July, Magellan announced it would change the Magellan High Conviction Trust into an active ETF—Magellan High Conviction Trust (Managed Fund) (ASX: MHHT). A month later Antipodes announced investors in its LIC, Antipodes Global Investment Company (ASX: APL), could swap shares for its active ETF—Antipodes Global Shares (Quoted Managed Fund) (ASX: AGX1).

The change comes with a cost. Shields estimates he lost roughly half the fund in investor exits and dividends—although some of this was from professional arbitrageurs rather than retail investors. Magellan lost about $140 million when its active ETF went live on 31 August.

Shields puts a positive spin on it. By allowing arbitrageurs to exit, the active ETF structure better aligns those that remain with the fund’s investment strategy, he says.

“We ended up with a whole lot of shareholders that weren't interested in the strategy, they just wanted to make a bit of money off the stock,” he says.

Tax and distributions

Shields says differences in tax rules between LICs and unit trusts mean investors have more of their money working for them in an ETF. Where LICs must pay tax on net realised gains, unit trusts can hold onto gains untaxed and reinvest them. That leaves more of an investor’s money in the market.

Then there’s the flexibility to distribute cash as the fund sees fit. By default, unit trusts must pass through all income, while LICs can vary their distributions to provide a steady flow of income to shareholders. That’s attractive to investors looking for predictable income and is traditionally promoted by LICs as an advantage of the structure.

However, a 2016 regulatory change—the Attribution Managed Investment Trust (AMIT) regime—gave unit trusts that adopted it discretion in how they distribute cash. In effect, ETFs can now elect to smooth their distributions just like a LIC.

“As someone who has been on both sides of the fence, I don’t think that the tax situation that a LIC faces is at all favourable for its shareholders,” says Shields.

But under AMIT, unit holders will still be taxed on the undistributed profit attributable to them, says Scott Whiddet, a partner at Pitcher Partners.

It should even out when investors sell because those distributions are added to a unit holder’s cost base, meaning lower capital gains taxes. But in the short term, it could leave investors in a situation where they have a tax liability without the cash to pay it off, says Whiddet.

To date, few ETFs have adopted the new regime. There’s a sense of inertia in the industry, according to VanEck director of operations and finance, Michael Brown.

Even without the new regime, investors are voting with their feet. Assets under management in ETFs have grown at roughly four times the rate of LICs since 2001, according to BetaShares.

Source: BetaShares

Performance disclosure

Finally, there’s the ease of determining performance in an ETF versus a LIC. The NTA of a LIC is an important measure of its wealth and performance, but LICs often report several measures depending on tax liabilities. For example, popular LIC Hearts & Minds references a pre-tax NTA, a post current tax NTA and a post-tax NTA.

Shields says this can create confusion for investors. He also claims it leads some LICs to report pre-tax measures of performance that also exclude fees, giving investors an inaccurate picture of returns.

“They’re giving you a pre-pre-pre everything figure,” he says.

Performance reporting at ETFs is more straightforward because tax is passed through to investors, Shields says.

Not for everyone

The prospect of outflows will make some LIC managers balk at transitioning to an active ETF. Others claim that certain asset classes lend themselves to the closed-end commitment of capital a LIC entails.

Sebastian Evans, chief investment officer at NAOS Asset Management says providing daily liquidity would be impossible for managers investing in small, illiquid, businesses, where it’s difficult to buy and sell assets on demand.

“If we converted to an active ETF and needed to liquidate our holdings it wouldn’t work. We have a 30% holding in a business. I can’t sell that in a day or two," he says.

NAOS’s three LICs traded with discounts to NTA between 10% and 17% as of 31 July.

Evans says there is no silver bullet for closing LIC discounts. He says NAOS regularly conducts on-market buybacks and has been working to improve the relationship with his 8,000-plus investors.

“I’ve learnt that performance is not everything. It’s half. The other half is brand integrity and trust. That gets you to a NTA and a premium,” he says.

“Look at Wilson Asset Management. Their performance is decent, but they trust Geoff with their money.”

Geoff Wilson of Wilson Asset Management runs a stable of LICs for whom discounts are not normally an issue.

His eight LICs have more than $5 billion under management on behalf of more than 110,000 retail investors.

Although two LICs trade at a small discount, they are priced at a premium on average, with some like flagship WAM Capital (ASX: WAM) trading as high as 37% above NTA. WAM Alternative Assets (ASX: WMA) was trading at a 10% discount in October 2021.

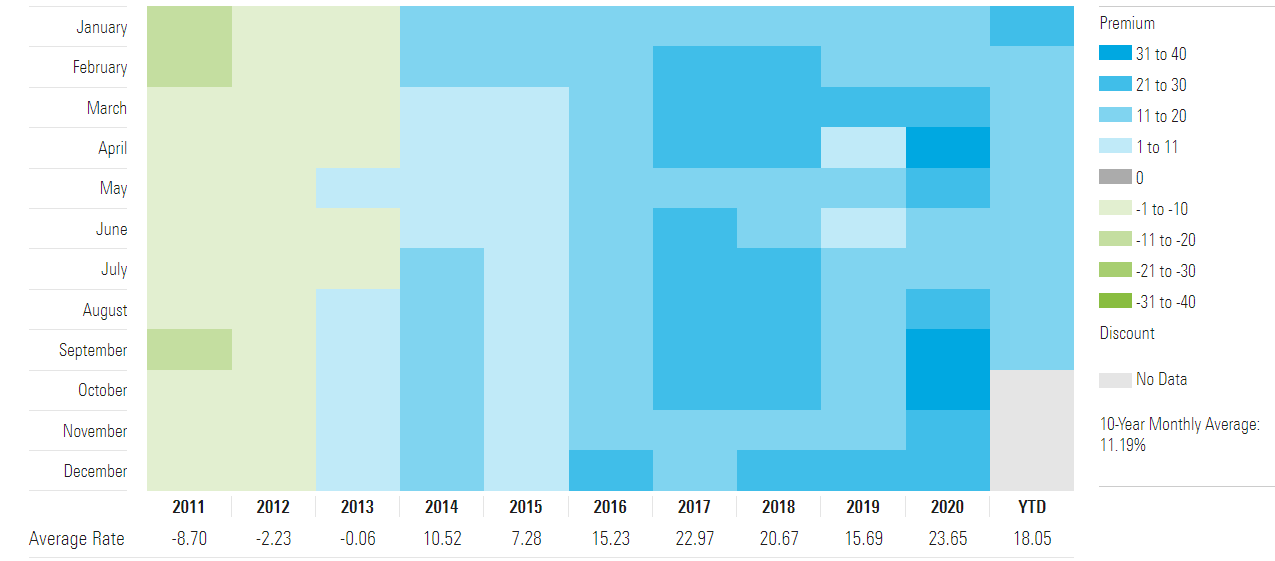

WAM Capital Ord Monthly Premium/Discount %

Source: Morningstar

Several other LICs also consistently trade at par or premium, including AFIC, Argo and Djerriwarth. These LICs are often decades old with billions under management and a massive base of loyal shareholders. Argo Investments (ASX: ARG) was founded in 1946 and has more than $6 billion under management.

An August report from Risk Return Metrics found larger LICs, especially in the Australian equity space, were more likely to trade at a premium to NTA.

Finally, LICs are still a superior vehicle for generating franking credits, says Whiddet. Active ETFs can only pass-through franking credits received from their portfolio. LICs can do that while also generating additional franking credits when they pay taxes.

Shields doesn’t think a LIC revival is likely, even if successful companies like WAM or Argo will persist. He predicts the vast bulk of new investment will continue to move into the ETF world.

“Having done the two its very obvious to me what’s better for investors,” he says.