Australian sustainable investing fund landscape - Q3 2021

Flows into Australian sustainable investments continue to grow.

Flows into sustainable funds are going from strength to strength.

At the end of the third quarter of 2021, retail assets invested in Australasia-domiciled sustainable funds as identified by Morningstar were a record $38.077 billion. Asset managers Vanguard (21.6%) and Australian Ethical (18.4%) continued to dominate, accounting for 40% of all Australasian sustainable fund assets in the Morningstar database. A few highlights:

- At the end of the third quarter, assets invested in Australasia-domiciled sustainable investments were $38.077 billion, an 11% increase compared with 30 June 2021 and a 73% increase compared with 30 September 2020. Assets invested in Australasia-domiciled sustainable investments more than doubled in the two years since 30 Sept 2019.

- Estimated third-quarter flows of $2.613 billion were the second highest on record, only topped by the second-quarter 2021 flows of $3.375 billion.

- Four fund houses dominated third-quarter flows, with Vanguard's $623 million atop a group that included BetaShares ($452 million), Dimensional ($370 million), and Australian Ethical ($236 million).

- AMP Capital continued to bleed assets with net outflows of $69 million over the third quarter, the fifth consecutive quarter that the AMP sustainable product range was in net outflows—a stark contrast to the broader sustainable fund sector, which is experiencing record inflows.

- The Australian sustainable funds market remains quite concentrated, with the top 20 funds accounting for 56% of total assets in the sustainable fund universe.

- Fifty-two percent of sustainable investments with five-year track records outperformed their peers within their respective Morningstar Categories. This is encouraging for investors looking to build environmental, social, and governance portfolios that align with their values, knowing that they won't sacrifice returns when compared with investments in mainstream funds.

- Morningstar has identified 144 Australasia-domiciled (Australia and New Zealand) sustainable investments through our intentionality framework. Of these, 113 employ some form of exclusion from investment in controversial areas, with a high number of funds excluding tobacco (104) and controversial weapons (99) companies that derive a significant portion of revenue from nuclear weapons, land mines, cluster munitions, and so on.

- Compared with Europe and the United States, the sustainable funds market remains relatively small in Australia. No new funds were launched in the third quarter, putting 2021 at the slowest pace for fund launches since 2014.

- The Australian Securities and Investments Commission announced a greenwashing-related review in early July 2021 following regulation offshore, particularly in Europe.

No new product launches

Compared with Europe and the US, the sustainable funds market remains relatively small in Australia. No new funds were launched in the third quarter. This puts 2021 at the slowest pace for fund launches since 2014. As of 30 Sept 2021, Australasian retail investors had access to 144 Australasia-domiciled sustainable funds.

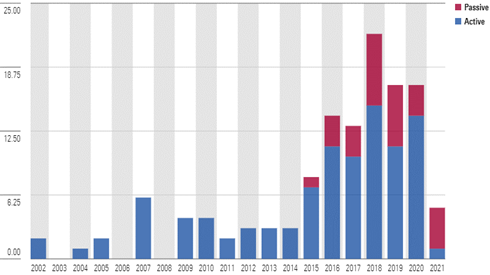

Exhibit 1 Australasia-domiciled sustainable fund and ETF launches

Source: Morningstar Direct. Data as of 30 September 2021

Despite the slow pace thus far in 2021, the momentum of sustainable fund launches has lifted significantly since 2015, and 2020 was the fifth consecutive year of double-digit fund launches.

The sustainable funds universe does not contain the growing number of Australasian funds that now formally consider ESG factors in a nondeterminative way in their security selection.

Active strategies most popular

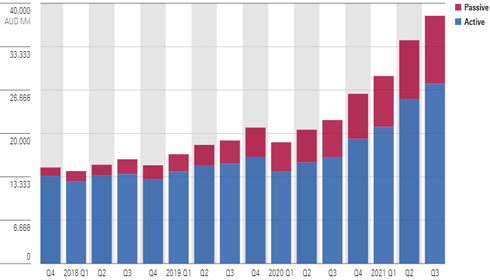

Estimated third-quarter flows of $2.613 billion were the second highest on record, only topped by the second-quarter 2021 flows of $3.375 billion.

Inflows over the past year of $9.288 billion have gone predominantly toward active ($6.178 billion or 66%) rather than passive ($3.050 billion or 34%) strategies.

Four fund houses dominated flows in the quarter, with Vanguard atop the group at AUD 623 million, followed by BetaShares' $452 million, Dimensional's $370 million, and Australian Ethical's $236 million.

Exhibit 2 Estimated net flows of Australasian sustainable investments (AUD, Mil)

Source: Morningstar Direct. Data as of 30 Sept 2021. Excludes fund of funds.

AMP Capital continued to bleed assets with net outflows of $69 million over the third quarter. This was the fifth consecutive quarter of net outflows for the AMP sustainable product range, a stark contrast to the broader sustainable fund sector, which is experiencing record inflows. Corporate issues at AMP and investment team departures at AMP Capital would likely explain the continuation of fund outflows.

Exhibit 3 Aggregate fund size of Australasian sustainable investments (AUD, Mil)

Source: Morningstar Direct. Data as of 30 Sept 2021. Excludes fund of funds.

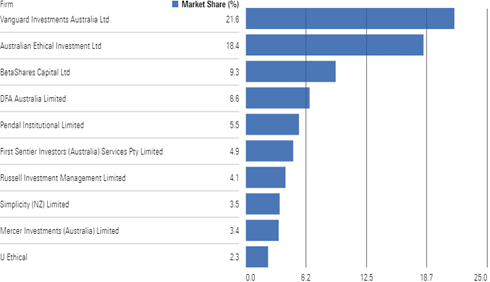

A concentrated space

At the end of the third quarter of 2021, assets invested in Australasia-domiciled sustainable investments were $38.077 billion, an 11% increase compared with 30 June 2021 and a 73% increase compared with 30 Sept 2020. Assets invested in Australasia-domiciled sustainable investments more than doubled in the two years since 30 September 2019.

The Australian sustainable funds market remains quite concentrated, with the top 20 funds accounting for approximately 56% of total assets in the sustainable fund universe. At the fund level, asset managers Vanguard (21.6%) and Australian Ethical (18.4%) continue to dominate, accounting for 40% of all Australasian sustainable fund assets in the Morningstar database.

Exhibit 4 Estimated market share of top 10 managers of Australasian sustainable investment funds

Source: Morningstar Direct. Data as of 30 Sept 2021. Excludes fund of funds.

Encouraging performance

Over the trailing five years ended 30 September 2021, 52% (31 of 60) of sustainable investments that have a track record that long outperformed their peers within their respective categories. This is encouraging for investors looking to build ESG portfolios that align with their values, knowing that they won't have to sacrifice returns compared to mainstream funds to invest sustainably.

Exhibit 5: Total-return quartile ranks of sustainable investments by Morningstar category, 5 years to 30 Sept 2021

Source: Morningstar Direct. Data as of 30 Sept 2021.

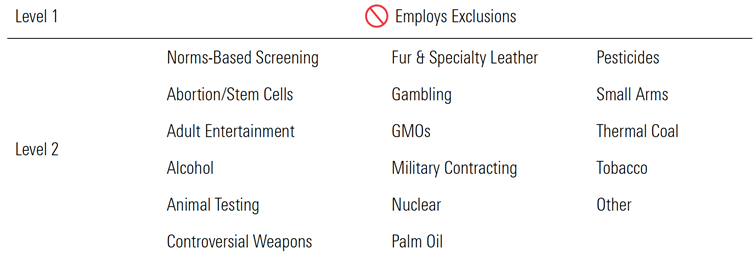

Exclusionary screening by controversial area

Morningstar identifies funds that explicitly state exclusions from controversial investment areas, a process that is similar but distinct from our identification of sustainable investments. A fund does not need to mention explicit exclusions to be deemed sustainable, and vice versa. Morningstar looks to regulatory filings to identify funds that use exclusions.

Note that "norms-based screening" refers to the citation of international agreements typically involving human rights, child labor, or exposure to conflict zones (for example, the UN Global Compact and Universal Declaration of Human Rights).

On this basis, nearly all Australasia-domiciled funds that Morningstar has identified employ some form of exclusion from investment in controversial areas, with a high number of funds excluding tobacco (104) and controversial weapons (99) companies that derive a significant portion of revenue from nuclear weapons, land mines, cluster munitions, and so on. Gambling, adult entertainment, and alcohol are the next largest group of exclusions. Australians have limited choice in funds that exclude animal testing, fur/leather, palm oil, or pesticides.

Exhibit 6 Exclusionary attributes: Controversial products and industries

Morningstar Sustainability rating

Independent from the above taxonomy is the Morningstar Sustainability Rating™ (also known —as the globe rating), which is intended as a measure of portfolio ESG risk relative to global category peers. Using individual company data from global ESG research leader (and Morningstar subsidiary) Sustainalytics, Morningstar rates the degree of ESG risk found within a fund by looking to the fund's holdings over the trailing 12 months and rolling up individual holdings' ESG risk ratings with emphasis placed on more recent holdings information. The Sustainalytics ESG Risk Rating measures the degree to which a company's economic value may be at risk driven by ESG issues. For a fund to receive a Sustainability Rating, there must be ESG risk scores on at least two thirds (66.7%) of holdings. An investment does not have to be deemed sustainable under the identification framework for Morningstar to provide a Sustainability Rating.

Source: Morningstar Direct, Ratings as of 30 Sept 2021.

Though Morningstar's identification of sustainable investments is separate from the assessment of ESG risk, the above exhibit shows that the majority (67%) of funds identified as sustainable investments (and qualify for a Sustainability Rating) in Australasia also tend to have lower levels of ESG risk and hence higher globe ratings. Only six funds have 2-globe ratings and hence are assessed to have Above Average exposure to ESG risk. No funds have 1 globe.

Regulatory update

ASIC announced a greenwashing-related review in July 2021 to ensure that financial products and investment strategies adhere to their green or ESG claims. This review was prompted in part by the increasing demand for ESG strategies, particularly from younger investors. This review follows ASIC's recent review of climate risk disclosures by large listed companies and follows recently adopted legal frameworks in the European Union and reviews on ESG disclosures from the US Securities and Exchange Commission.