Best and worst performing global equity funds in 2018/19

Magellan Global has taken the prize for the top returning global equity fund under Morningstar's coverage in 2018, leading the way through turbulent times.

Magellan Global has taken the prize for the top returning global equity fund under Morningstar's coverage in 2018, leading the way through turbulent times.

Overseen by Hamish Douglass, the Global fund (15699) returned an impressive 10 per cent over the year owing to a large cash allocation which protected the portfolio from the 4th quarter downturn in global markets, Morningstar's global equity sector active manager report card for 2018 showed.

"It was a slow start for Hamish Douglass and team in January to March, as their 19 per cent cash position and holding in Kraft Heinz were headwinds to performance," Morningstar senior analyst, manager research Andrew Miles said.

"At the end of the year, however, it was the same chunky cash allocation that protected the portfolio, enabling the strategy to only capture 70 per cent of the drawdown.

"An impressive feat, given many of the strategy’s largest holdings fell more than 10 per cent in the 4th quarter –Apple declining a whopping 28 per cent after the company missed revenue guidance owing to weak iPhone sales."

Key holdings include ![]() Apple (AAPL),

Apple (AAPL), ![]() Microsoft (MSFT),

Microsoft (MSFT), ![]() HCA Healthcare (HCA),

HCA Healthcare (HCA), ![]() Starbucks Corp (SBUX), and

Starbucks Corp (SBUX), and ![]() Visa (V).

Visa (V).

On the lowest rung of the ladder was Pan-Tribal Global Equity Fund (40679), which fell to a negative 14 per cent return for 2018 owing to heavy exposure to cyclicals and emerging markets, Miles says.

Around a third of active funds under Morningstar's global equity sector coverage beat the index.

10 best and worst performing global equity managers in 2018

Source: Morningstar direct

2018: Trump, tariffs and turbulence

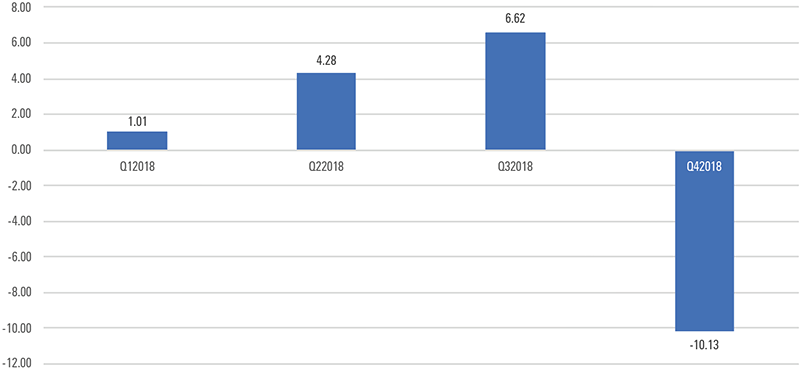

2018 was a bumpy year for global equities. The first three quarters generated increasing positive returns, finishing with a 6 per cent return in the September quarter. Strong US growth, Donald Trump’s tax cuts, and signs the sluggish European economies were coming to life buoyed markets.

"Investors were happy to bid up high multiple stocks to seemingly dizzying levels," Miles said.

"Companies like Netflix saw their share prices increase substantially despite an absence of expected profits in the short or medium term."

But as the investors started to price in rate increases from the Federal Reserve, and US-China trade conflict intensified, markets faltered.

"The stock market reacted severely, erasing the gains made in the first nine months of the year," Miles said.

Cyclical sectors detracted most – energy and technology being the worst offenders.

Quarterly performance of global equity market in 2018

Source: Morningstar Direct

Miles says that while cash is usually the best protection available against equity-market volatility, managers who demonstrated protection against market downside prefer “quality” businesses. These are companies with stable earnings growth, high returns on equity and low leverage.

2019: Global stocks rebound

The first half of 2019 tells a different story. Market sentiment rebounded after the Federal Reserve surprised with their comments on being in no hurry to raise rates. The Federal Reserve is now expected to cut interest rates another quarter point later this month.

Cyclical sectors including technology and financial services performed best in the rally.

Zurich Investments Unhedged Global Growth (17504) responded well, delivering strong performance due to its large exposure to financial services, Miles says.

10 best and worst performing global equity managers in 2019

Source: Morningstar direct

Only one manager that achieved top-10 performance in 2018 is at the top of the ladder for 2019 - Nikko AM Global Share (6272).

Miles applauds Nikko for what he describes as astute rotation.

"Portfolio manager William Low and team have used their flexible investment process to build a portfolio of high-quality companies that has fared better than most through the volatility," Miles said.

Platinum and Orbis found themselves at the foot of the ladder again in 2019. But Miles says Morningstar retains their belief that the people, processes, and parent organisations are best-in-class and this should be reflected in future outperformance through the cycle.

"We’ve spent a great deal of time over the review period understanding the reasons for this less-than-stellar performance," he said.

"While these periods are difficult to stomach, our long-term fundamental approach helps us keep conviction."

Investors urged to blend styles for smooth returns

Miles encourages investors to look at performance and consistency over the long term while seeking to understand the context for out or underperformance.

"Managers can amaze and dismay with short periods of top and bottom-quartile performance. It is, however, the managers that we think can deliver outperformance consistently that garner our highest ratings," he said.

"Investment styles can go in and out of favour over a market cycle."

For investors unwilling to endure periods of acute underperformance, Miles recommends blending managers with different styles to help provide a smoother return profile.