Fund Spy: Australian ethical funds bridging the gap

The performance gap between these Australian ESG funds and their plain vanilla equivalent is narrowing, but gains are in lock-step with rising oil and commodity prices.

Mentioned: Generation Global Share (15813), SI Emerging Markets Leaders Sustain (17803), Pendal Australian Share (2726), Australian Ethical Australian Shr (3921), Robeco Emerging Conservative Equity AUD (40081), Stewart Investors Wldwide Sustainabty (40543), AXA IM Sustainable Equity (40549), Stewart Worldwide Leaders Sustainability (4672), Pendal Horizon Sustainable Aus Shr (6924), AMP Ethical Leaders International Shr O (6980), Pendal Sustainable Australian Share (8409), Perpetual ESG Australia Share (8649), Aristocrat Leisure Ltd (ALL), BHP Group Ltd (BHP), Santos Ltd (STO)

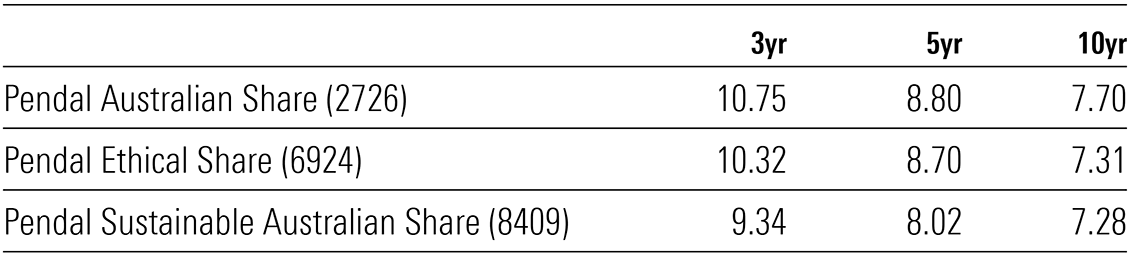

Many global ethical funds are beating their non-ESG varieties, or at least matching them. But the same pattern isn't playing out for the following Pendal strategies.

I compared the figures to those of six months ago, and the Gold Medal-rated Pendal Australian Share (2726) fund still edges out the ESG equivalent fund performance figures.

The performance margin between Pendal Australian Share and Bronze Medallist strategy Pendal Ethical Share (6924) has dipped from 150 to 43 basis points on a three-year annualised basis.

The gap in performance between the non-ESG and the ESG strategies remains quite flat over ten years compared to six months ago, with a 40-basis point margin.

Source: Morningstar

The returns from Pendal Australian Share fund—led by respected portfolio manager Crispin Murray—still beat the ESG and ethical funds—but just barely.

When we last ran this comparison in September, Pendal Australian Share returned 12.64 per cent, 8.35 per cent and 8.06 per cent over three, five and 10 years.

Pendal Ethical Share—also led by Murray—returned 11.13, 8.53 and 7.64 per cent.

Pendal Sustainable Australian Share (8904), which is not part of Morningstar's research coverage and is run by Rajinder Singh, underperformed further still, with returns of 10.9 per cent, 7.45 per cent and 7.6 per cent over the same timeframes.

Morningstar manager research analyst Donna Lopata notes that the relative performance of ESG-focused strategies can suffer when excluded companies outperform—gaming company Aristocrat Leisure (ASX: ALL) is one example.

Lopata says the stronger performance of Pendal Ethical Share versus the Pendal Sustainable Australian Share is largely due to energy and resources companies.

The Murray-led strategy received a boost from its holdings of Australian mining and energy companies—which are excluded from the Pendal Australian Sustainable Share fund.

Multinational mining conglomerate BHP Group (ASX: BHP) is the second-largest holding at 6.6 per cent.

Oil and gas producer Santos (ASX: STO) is also a top-10 holding, comprising 3.3 per cent of the total portfolio size.

Santos's share price has increased by more than 40 per cent since 2018, as oil prices have doubled and gas prices have continued ticking up.

BHP's share price has gained about 25 per cent over the past two years in line with rising commodity prices.

The limited universe of names available to Singh and his team on the Pendal Australian Share fund means fewer opportunities to beat the benchmark.

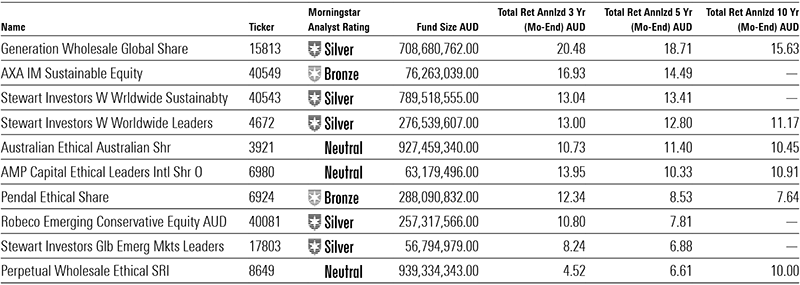

Even so, Pendal Ethical Share kept pace with its S&P/ASX 200 benchmark and outperformed its rivals in the large-blend Morningstar Category.

A greater concentration of sectors and companies listed in Australia is regularly highlighted by Morningstar and other investment commentators—and Morningstar manager research analysts Lopata and Andrew Miles point to similar reasons in the case of ESG fund underperformance.

UK green ESG funds

On the other hand, on a global basis, ESG funds are beating non-ESG funds.

A recent cut of Morningstar data on UK funds showed clear outperformance of the ethically minded versions, as Morningstar UK editor Holly Black noted in September.

"The figures put paid to the concerns many investors have that investing sustainably means compromising on returns,” Black says.

"Indeed, in five of the six fund duos analysed by [funds distributor] interactive investor, the ethical offering outperformed over one and three years."

This aligns with the broader view espoused by Morningstar's head of sustainability research Jon Hale.

He has exploded some of the myths about sustainable funds, including relative underperformance and higher costs of ESG funds versus non-ESG funds.

"This myth got started around the turn of the century when many socially responsible investing funds were run by small asset managers that charged higher fees," Hale says.

Hale's 2017 analysis of fees across all US sustainable open-end funds compared with their peers found an even spread of costs falling within Morningstar's low and high rankings.

And since then, the costs have fallen further, partly in response to the rise of sustainable ETFs.

But investors shouldn't ignore ESG

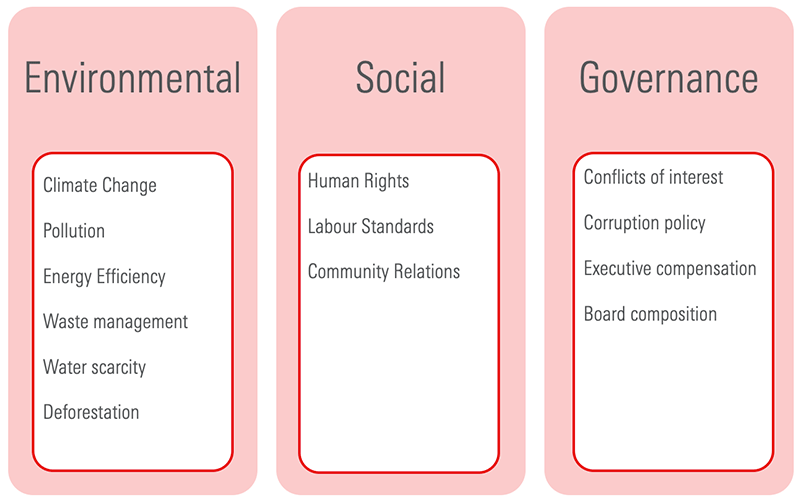

We're hearing a lot more about environmental, social and governance issues in the financial world, and companies are realising they can't close their eyes to them.

When people such as Jeremy Grantham, co-founder of fund manager GMO, dedicate so much of their time and money to speaking about ethical investing, investors pay attention.

Morningstar's Lopata, says there has been a change in tone of warnings about ESG for the investment world—particularly in the past few months, since fires ripped through swathes of Australia.

She refers to the Reserve Bank of Australia's financial stability report last September, which directly linked financial risk to climate change. "Their warning to investors and institutions to take account of and manage climate change risk needs to be heard," Lopata says.

"What stands out most to me is their reference to insurance claims for natural disasters in the current decade having been more than double those in the previous one."

On the social front—which includes human rights and community relations—Lopata refers to the Modern Slavery Act, including Australia's version, which was rolled out last year to formally outlaw human rights breaches such as child labour and detainment of workers.

A stark example of the financial and reputational risk of poor governance is the Hayne royal commission. This culminated in a bill of almost $10 billion in fines and reparations for Australia's largest financial institutions.

In line with the shifting narrative on ESG, Morningstar has revamped its sustainability rating system in the past couple of weeks. Morningstar’s globe ratings system, which is underpinned by company-level analysis from Sustainalytics, has been widened to include a more accurate measure of material risk, which is reflected in Morningstar's ESG rating of funds.

Five globes remains the highest Morningstar ESG ranking. A managed fund or ETF with this ranking is one that best manages material sustainability risks in its category.

Globe ratings are useful for comparing potential investments, whether they are intentionally labelled as sustainable or otherwise.

Morningstar takes three main steps to reach its globe rating:

- The total portfolio holdings for a Fund or ETF is considered in tallying its company-level risk scores into a Sustainability Score.

- A historical sustainability score is calculated based on the trailing 12 months.

- Lastly, those results are normally distributed relative to its Morningstar Global Category.

Source: Morningstar Direct

Though not all funds employ exclusions, some of the above funds specifically rule out holding stocks that are involved in industries such as adult entertainment, alcohol, animal testing and controversial weapons and armaments.