Sustainable fund delivers chart-topping performance amid market turbulence

Equity funds have been hit hard in the Covid-19 sell-off, but it is those that avoided underperforming commodity-related companies, financials, and property fared the best.

Mentioned: GQG Partners Global Equity Fund (43212), Ausbil Australian Geared Equity (15329), Magellan Global Open Class (15699), Tyndall Australian Share Concentrated (19895), Hyperion Australian Growth Companies (3344), Tyndall Australian Share Wholesale (3987), Stewart Investors Wldwide Sustainabty (40543), AB Managed Volatility Equities (40678), Barrow Hanley Global Equity Trust (41377), Yarra Australian Equities Fund (4544), CFS Geared Share (4715), Dimensional Global Value Trust (5841), PM Capital Global Companies (6828), Perpetual Geared Australian (9835), BetaShares Managed Risk AUS Shr ETF (AUST), Cochlear Ltd (COH), CSL Ltd (CSL), Deutsche Telekom AG (DTE), BetaShares Global Sstnbty Ldrs ETF (ETHI), Fisher & Paykel Healthcare Corp Ltd (FPH), REA Group Ltd (REA), ResMed Inc (RMD), Seek Ltd (SEK), SPDR® S&P Global Dividend ETF (WDIV)

Is this the portfolio formula for keeping Covid-19 at bay? Defensive, high-quality holdings and a swag of cash? It seems so if the top performing global equity fund for Q1 is anything to go by.

The Gold-rated Stewart Investors Worldwide Sustainability (40543) retuned negative 0.58 per cent for the quarter, topping the Morningstar coverage leadership board and delivering returns 9.42 per cent above the MSCI World Ex Australia NR index.

Morningstar senior analyst Christopher Franz says Stewart Investor's strategy is to avoid companies with debt and focus on those that are steadily growing earnings from sustainable business models.

"While valuation is an important part of their process, a company’s quality aspects are more so," he says.

The resulting 50-stock portfolio little resembles peers. Instead, the fund is biased towards more-defensive consumer names, like top holding Unilever (UNA). Other major names in the portfolio include German chemical and consumer goods company Henkel (HEN3), Japanese pharmacy retailer Ain Holdings Inc (TYO) and German telco Deutsche Telekom (DTE).

The fund also holds a weighty amount of cash at 17.23 per cent of the portfolio.

The BetaShares Global Sustainability Leaders ETF (ETHI) also delivered strong performance for the quarter, down 1.07 per cent, largely due to its ESG filters which removed underperforming fossil fuel-related companies, preferencing large exposures to technology and healthcare.

Morningstar senior analyst Andrew Miles found four of the top five performers in the Global Equities category shared a similar quality growth style, which allowed them to largely avoid underperforming commodity-related companies, financials, and property.

"Stewart Investors (40543), GQG Partners (43212), and Magellan (15699) seek high-quality franchises that can earn above-average returns in a sustainable fashion through strong competitive positions, savvy management teams, and conservative balance sheets," he says.

"All are valuation-conscious stock-pickers but have been willing to pay up for, what they deem to be, quality."

Similarly, BetaShares' ESG filters remove fossil fuel-related companies and have large exposures to technology and healthcare.

Best performing global equity funds, Morningstar coverage, Q1 2020

Source: Morningstar Direct

But not all were so successful. Barrow Hanley (41377), SPDR S&P Global Dividend (WDIV), and Dimensional (5841) all have a value bias and underperforming, with overweight positions in underperforming cyclical sectors and underweight the more resilient sectors, like technology and healthcare.

"PM Capital (6828) is probably the most extreme example of sector concentration—financial services account for around two thirds of the portfolio," he says.

Worst performing global equity funds, Morningstar coverage, Q1 2020

Source: Morningstar Direct

The first quarter of 2020 will be remembered not only for the unprecedented tragedy of the coronavirus pandemic but for the exceptional and precipitous collapse of global financial markets. Returns in the first quarter of 2020 were negative in aggregate and across the major regions. Asia—excluding Japan—was the best performer, declining a little over 6 per cent.

Stylistically, value significantly underperformed the growth and quality benchmarks during the first quarter.

"Many value managers believed the margin expansion in 2019 would reverse as investors shunned expensive parts of the market, like technology," Miles says. "Instead, already cheap cyclical sectors like energy, mining, and financial services became even cheaper, while the expensive defensives and traditional growth names proved more resilient.

While the value factor has historically outperformed growth in the recovery after a bear market, such as the 1987 and 2000 dot-com crashes, Miles says there are no guarantees.

Access the full report: ![]() Best and Worst Performers in Global Equities in Q1 2020

Best and Worst Performers in Global Equities in Q1 2020

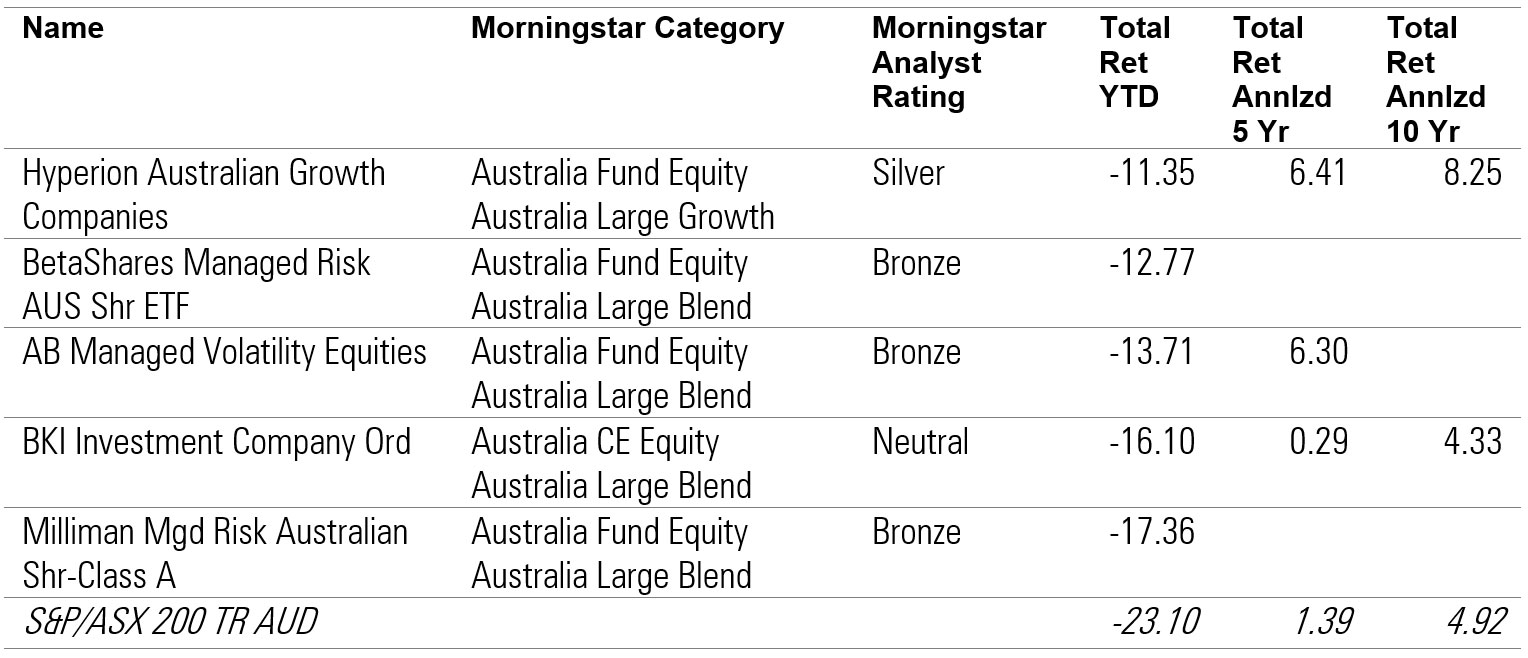

Australian equity: growth funds shine in first-quarter

In Australian equities, a similar theme played out. Silver-rated Hyperion Australian Growth Companies (3344) as the best performer for the quarter was similarly overweight high-quality names in the healthcare and technology sectors. The portfolio doesn't hold any energy stocks and is substantially underweight economically sensitive financials.

Analysts Ross MacMillan and Michael Malseed say the fund provided excellent downside protection during the sell-off. Year-to-date, it posted returns of negative 11.35 per cent, delivering 11.75 per cent above the S&P/ASX 200 TR index.

Fund CIO Mark Arnold and deputy CIO Jason Orthman say they have focused on reducing the cyclicality of the portfolio over the last few years, favouring robust businesses that are less sensitive to economic conditions, with good cash flow and the ability to take market share.

Domestically, they've increased exposure to healthcare names including CSL Ltd (CSL), ResMed Inc (RMD), Cochlear (COH) and Fisher & Paykel Healthcare Corp (FPH) and technology businesses that have recurring income. At the same time, they've reduced positions in businesses like SEEK (SEK) and REA (REA).

"These are still high-quality businesses, but they're sensitive the economic conditions," Arnold says.

Orthman added: "The portfolio tends to be reflective of modern businesses. If you've got a portfolio of companies that can help consumers and businesses operate online, that's very attractive."

The fund holds 13.80 per cent of the portfolio in cash.

BetaShares Managed Risk Australian Share ETF (AUST) and AB Managed Volatility Equities (40678) were also notable outperformers given that their strategies specifically aim to provide downside protection in volatile markets. "In this respect, they delivered true to label," analysts say.

Overall, growth managers held up better across both large and small caps, declining by slightly less than the benchmark. Meanwhile, the average value-manager return was poor.

Best performing Australian equity funds, Morningstar coverage, Q1 2020

Source: Morningstar Direct

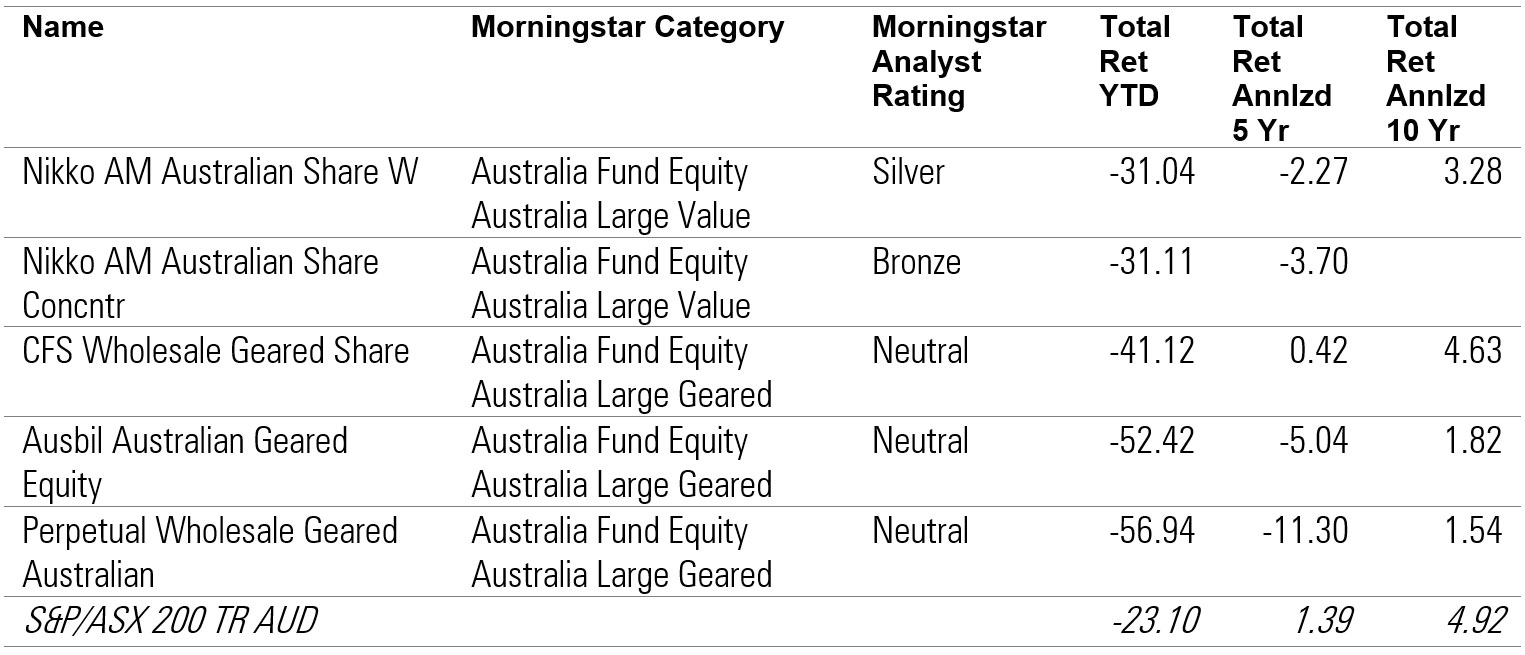

The three worst-performing strategies were geared strategies: Perpetual Wholesale Geared Australian (9835), Ausbil Australian Geared Equity (15329), and First Sentier (formerly CFS) Wholesale Geared Share (4715). These strategies use leverage to gross up equity-market exposure by 50-60 per cent, which amplifies returns on the upside and down, MacMillan and Malseed say.

Outside of geared strategies the next worst performers were value-orientated strategies: Nikko AM Australian Share Concentrated (19895), Nikko AM Australian Share (3987), and Yarra Australian Equities Fund (4544).

"The Nikko AM strategies traditionally have large weightings to the financial services, energy, and mining sectors, which were all negatively impacted by the faltering economic conditions, oil price collapse, and lower demand from China," analysts say.

Worst performing Australian equity funds, Morningstar coverage, Q1 2020

Source: Morningstar Direct

Access the full report: ![]() Stock funds weather a 50-year storm

Stock funds weather a 50-year storm

More in this series:

Bonds funds: ![]() Defending, or on the defensive

Defending, or on the defensive

Listed property and infrastructure funds: ![]() Mixed results as real assets suffer corona fallout

Mixed results as real assets suffer corona fallout