Sustainable investing landscape for Australian fund investors: Q1 2021

Flows to Australian sustainable investments remain robust. Sustainable fund fees competitive.

At the end of first-quarter2021, retail assets invested in sustainable funds as identified by Morningstar topped a record $27.9 billion. The rate of growth in the sustainable fund market continues to be robust, with $1.5 billion of estimated flows in the first quarter, the second-highest quarterly flows on record. Pleasingly, average fees charged for sustainable funds are competitive with mainstream fund peers. This quarterly paper highlights recent trends within sustainable retail investments in Australia.

Key Takeaways

- At the end of first-quarter 2021, Morningstar estimates that retail assets invested in Australasian sustainable investments were $27.903 billion, an 8 per cent increase compared with 31 December 2020 and a 54 per cent increase compared with 31 March 2020 . Estimated first-quarter flows of $1.534 billion was the second-highest on record, only topped by fourth-quarter 2020 flows of $1.851 billion.

- Inflows over the past year of $4.522 billion have been split predominantly towards active ($2.711billion, or 60 per cent) rather than passive ($1.810 billion, or 40 per cent)strategies.

- Based on the calculation of the asset-weighted net expense ratio of sustainable investments, it was found that, on average, Australians are paying slightly less for sustainable equity and fixed-income funds, when compared with traditional (non sustainable) funds. The cause of this can be attributed to the fact that there is currently a higher percentage of lower-cost passive investments within the sustainable investments universe in Australia, compared with the broader (traditional) market.

- The Australian sustainable funds market remains quite concentrated, with the top 15 funds accounting for 52 per cent of total assets in the sustainable fund universe. Australian Ethical and Vanguard remain the dominant Australasian providers of sustainable funds, each with about a 20 per cent market share.

- Forty-seven percent of sustainable funds placed in the top half of their respective Morningstar Category peer groups during the 12 months to 31 March 2020.

- Morningstar has identified 129 Australasia-domiciled (Australia and New Zealand) sustainable investments through our intentionality framework. Of these Australasia-domiciled funds, 97 employ some form of exclusion from investment in controversial areas, with a high number of funds excluding tobacco (96) and controversial weapons (90) (companies that derive a significant portion of revenue from nuclear weapons, land mines, cluster munitions, and so on).

- In November 2020, Morningstar launched its ESG Commitment Level Assessment, which expresses our analysts’ assessments of individual strategies and asset managers’ determination to incorporate ESG factors into their investment processes and organisations.

- At launch, Australian Ethical was the only Australian asset manager assessed to date to be awarded with our highest designation of Leader. Our second batch of ESG Commitment Level Assessment will launch on May 10, 2021.

Product Launches

Compared with Europe and the United States, the sustainable fund market is still relatively small in Australia. Through Morningstar's sustainable attribute framework, we identified a revised 13 additional funds that were launched in the year to 31 Dec 2020. With no new funds launched in the first quarter, Australasian retail investors have access to 129 Australasia-domiciled sustainable funds.

Australasia-Domiciled Sustainable Fund and ETF Launches

Source: Morningstar Direct. Data as of March 31, 2021.

The momentum of sustainable fund launches has lifted significantly since 2015.The year 2020 was the fifth consecutive year of double-digit fund launches. Recent fund launches have been split relatively evenly between new active and passive strategies.

The Regnan Global Equity Impact Solutions strategy has raised $142 million since its launch in fourth-quarter 2020. The launch of the Regnan fund was a positive development, given the lack of Impact investment option in the Australasian market.

The sustainable funds universe does not contain the growing number of Australasian funds that now formally consider ESG factors in a nondeterminative way in their security selection.

Asset Flows

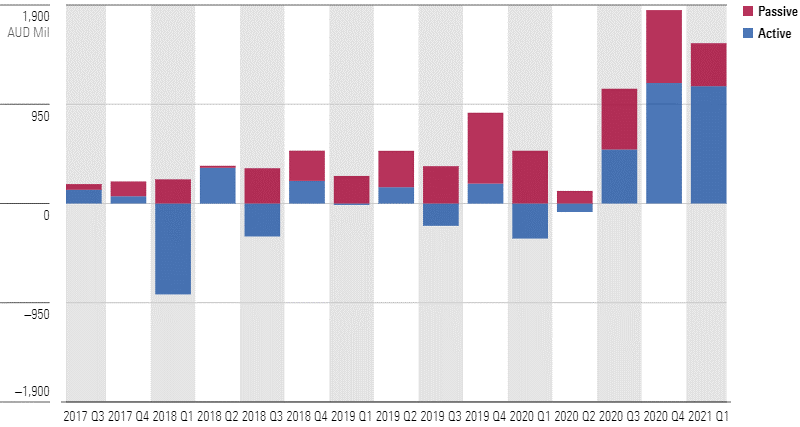

Estimated Net Flows of Australasian Sustainable Investments (AUD, Mil)

Source: Morningstar Direct. Data as of March 31, 2021. Excludes fund of funds.

Estimated first-quarter flows of $1.534 billion was the second-highest on record, only topped by fourth-quarter 2020 flows of $1.851 billion.

Inflows over the past year of $4.522 billion have been split predominantly towards active ($2.711 billion, or 60 per cent) rather than passive ($1.810 billion, or 40 per cent) strategies.

Five fund houses dominated fund flows, with BetaShares, Dimensional, Australian Ethical, Pendal, and Vanguard accounting for the majority of inflows for the quarter.

Equity managers captured the bulk of inflows over the March quarter, with $859 million, well ahead of the $376 million accumulated by allocation strategies and $253 million by fixed-income strategies.

Aggregate Fund Size

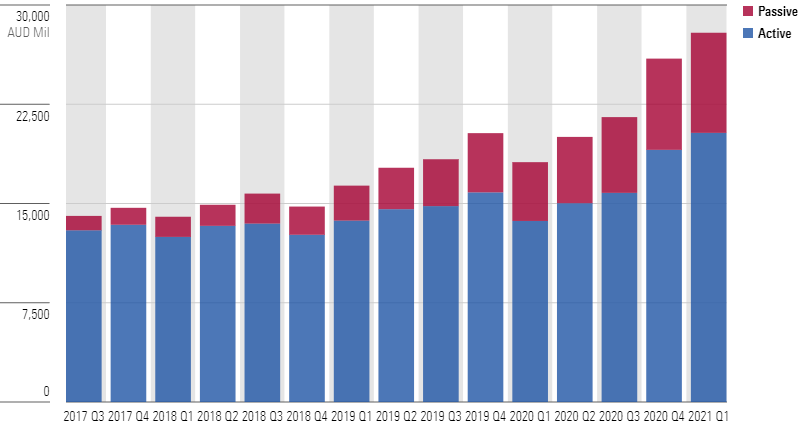

Aggregate Fund Size of Australasian Sustainable Investments (AUD, Mil)

Source: Morningstar Direct. Data as of March 31, 2021. Excludes fund of funds.

At the end of the first quarter of 2021, assets invested in Australasia-domiciled sustainable investments were $27.903 billion, an 8 per cent increase compared with 31 Dec 2020 and a 54 per cent increase compared with 31 March 2020.

Asset Manager Market Share

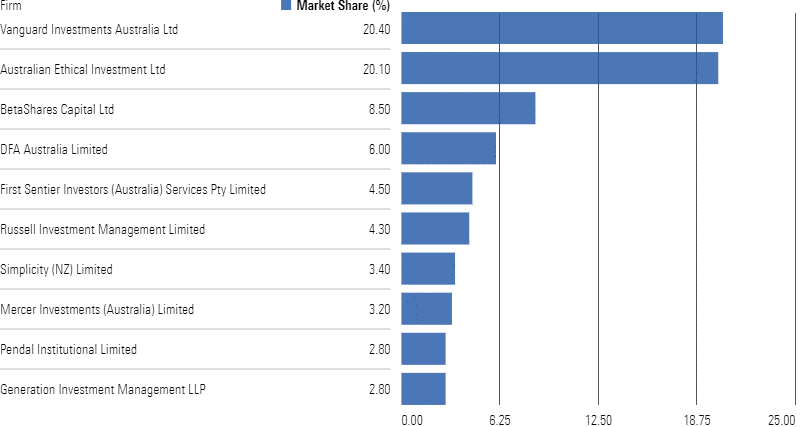

Estimated Market Share of Top 10 Managers of Australasian Sustainable Investment Funds

Source: Morningstar Direct. Data as of March 31, 2021. Excludes fund of funds.

The Australian sustainable funds market remains quite concentrated, with the top 15 funds accounting for approximately 52 per cent of total assets in the sustainable fund universe. At the fund level, two asset managers, Vanguard (20.4 per cent) and Australian Ethical (20.1 per cent), account for 40.5 per cent of all Australasian sustainable fund assets in the Morningstar database.

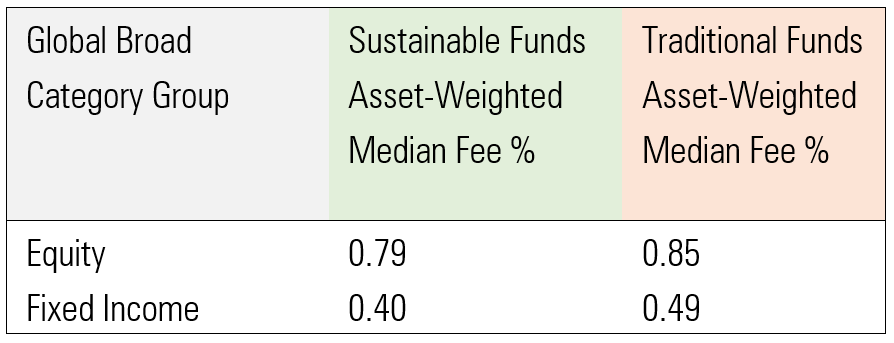

Are Australians Paying More for Sustainability?

To answer this question, we leverage a similar methodology used in Morningstar's Global Investor Experience report from 2019 to calculate the asset-weighted median net expense ratio for broad asset classes of funds inclusive of both active and passive products. We calculated these ratios for both sustainable investments (as defined by fund prospectus and through Morningstar's sustainable fund taxonomy) and "traditional" counterparts. The intent of using an asset-weighted expense calculation is to understand not just what fund manufacturers are charging but also what Australians are paying based on assets currently invested.

Asset-Weighted Median Expenses of Australasian Sustainable Investment Funds

Source: Morningstar Direct. Data as of March 31, 2021. Universe: Managed funds and ETFs, Australia-domiciled. Excludes fund of funds.

Through this calculation, it was found that in equity and fixed-income categories, the asset-weighted median net expense ratios for sustainable investments were 6 basis points and 9 basis points lower than traditional (nonsustainable) funds.

The cause of this can be attributed to the fact that there is currently a higher percentage of lower-cost passive investment within the sustainable investments universe in Australia, compared with the broader (traditional) market.

Admittedly, the relatively small number of sustainable funds identified leaves much to be desired in terms of determining a true indication of median net expense ratio. Morningstar will continue to keep an eye on this area as we see additional product offerings come to market.

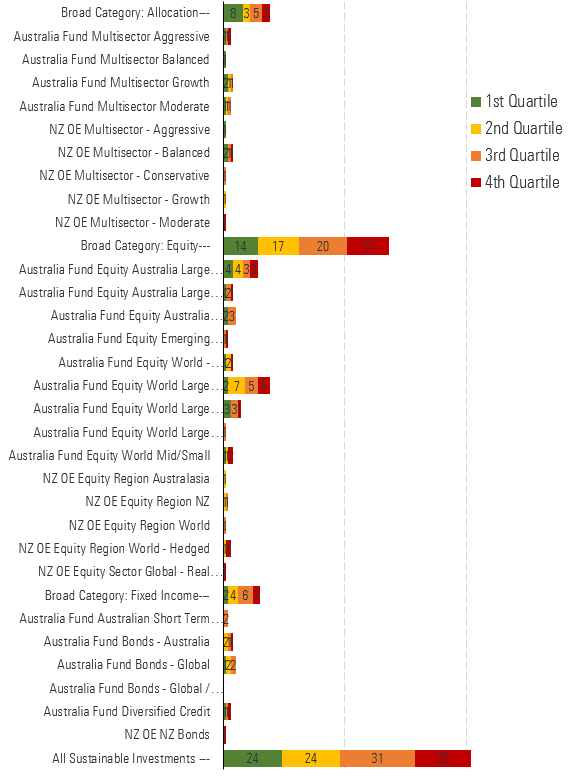

Performance of Sustainable Investments

Total-Return Quartile Ranks of Sustainable Investments by Morningstar Category, One Year to 30 Mar 2021

Source: Morningstar Direct. Data as of March. 31, 2021.

Over the one year to 31 Mar 2021, 47 per cent (48 of 102) of sustainable investments outperformed their peers within their respective categories. This underperformance can be intuitively explained by the general underweight to the fossil fuel sector that rebounded strongly since 2020 lows.

Product Availability

In 2020, Morningstar unveiled a framework for identifying sustainable investments to help investors understand the various approaches employed by fund managers. As a reminder, the framework is outlined in the following exhibit.

Sustainable Investment Attributes

The framework is not meant to measure magnitude or effectiveness but rather to identify scope. Morningstar defines a strategy as a "Sustainable Investment" if it is described as focusing on sustainability; impact; or environmental, social, and governance factors in its prospectus or other regulatory filings. It is a requirement that the theme is a central part of the investment process and not merely "considered." The framework is not mutually exclusive. It is important to note that there are several investments that incorporate multiple attributes while some attributes are independent from their overall label.

At the next level of granularity, "Sustainable Investment" funds are categorized into three distinct groupings. The above exhibit provides a breakdown of the three groupings', or Level 2, attributes. ESG funds are sustainable strategies with ESG Incorporation throughout the investment process. Impact Funds are strategies that seek to make a measurable impact alongside financial return on specific issue areas through their investments. Impact Funds are often focused on specific themes or use the 17 U.N. Sustainable Development Goals as a framework for evaluating the overall impact of the portfolio. They will seek to have a measurable impact along with financial returns around such topics as gender and diversity, low carbon/fossil fuel, community development, and other themes. Environmental Sector funds are those that invest specifically in the green economy by investing in companies that will contribute to this cause, such as renewable energy, green transportation, environmental services, and climate resilience. Further information on the sustainable investment attributes methodology can be found HERE.

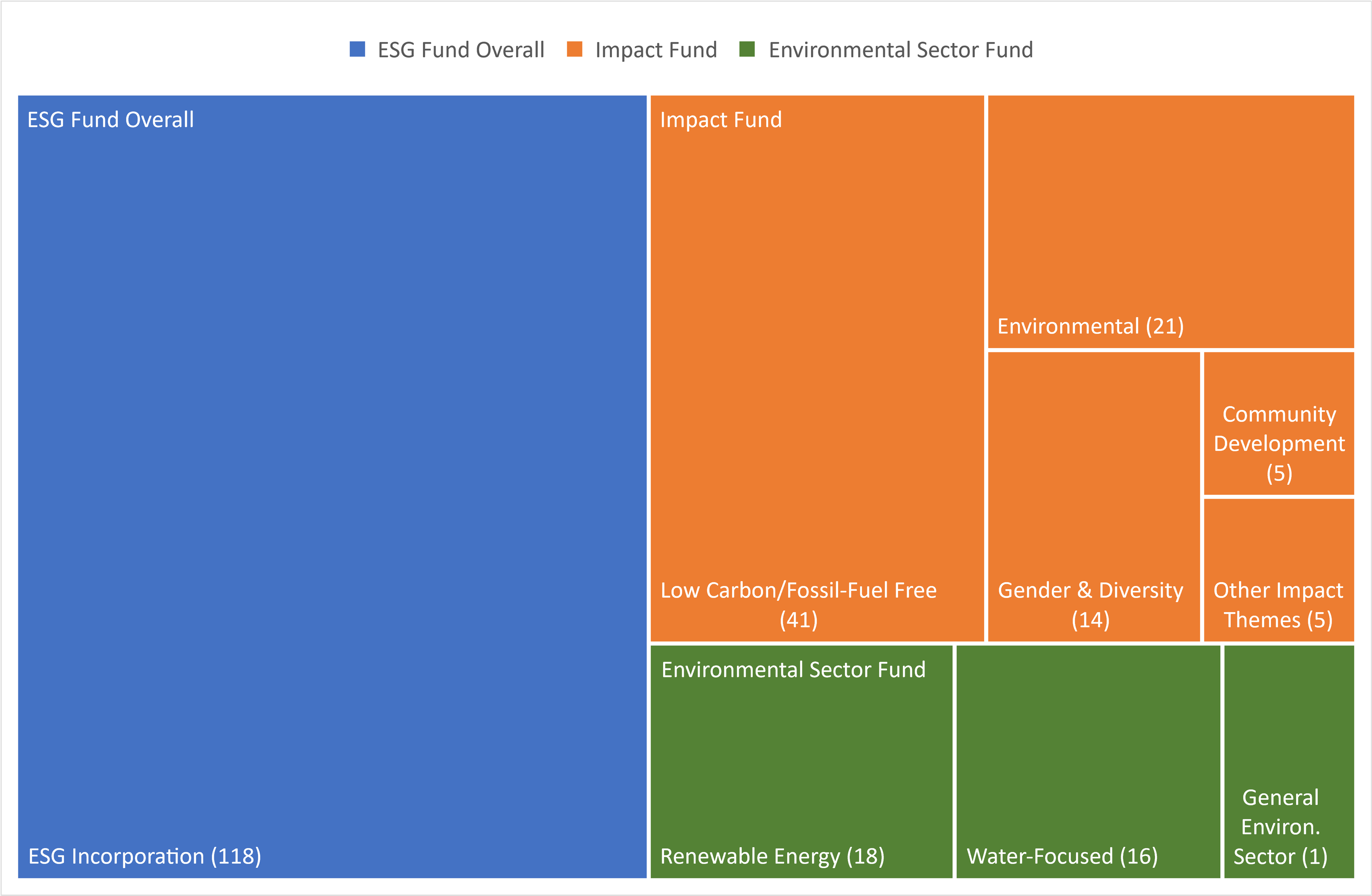

The following exhibit outlines the number and types of products available to Australasian retail investors, classified through the lens of our attributes framework.

Number of Australia-Domiciled Sustainable Investment Types

Source: Morningstar Direct. Identification of sustainable fund types are not mutually exclusive.

By and large, Australians have the most choice when investing in funds that use ESG Incorporation techniques, but there are fewer choices in terms of funds that invest in an Impact manner or when it comes to Environmental Sector Funds.

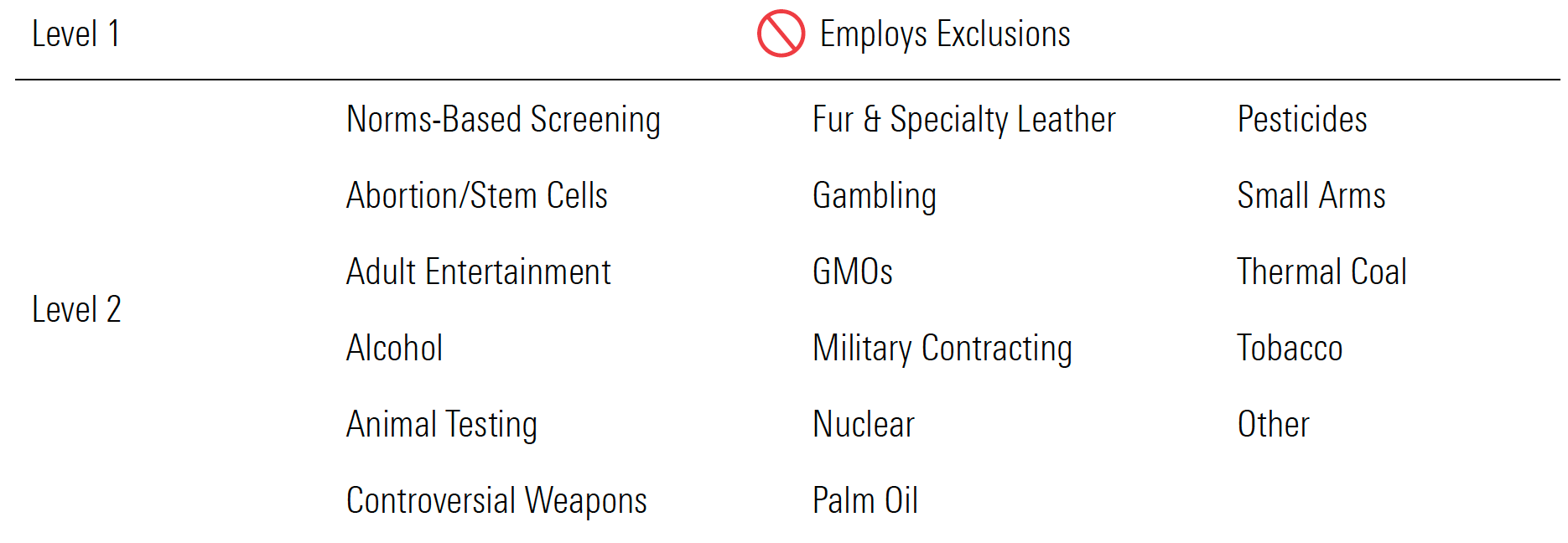

Exclusionary Attributes: Controversial Products & Industries

Exclusionary Screening by Controversial Area

Simultaneous to the release of the intentionality framework for identifying sustainable investments, Morningstar also began to identify funds that explicitly state exclusions from controversial investment areas, a process that is similar but distinct from our identification of sustainable investments. A fund does not need to mention explicit exclusions to be deemed sustainable, and vice versa. Morningstar looks to regulatory filings to identify funds that use exclusions.

Note that "norms-based screening" refers to the citation of international agreements typically involving human rights, child labor, or exposure to conflict zones (for example, the U.N. Global Compact and Universal Declaration of Human Rights).

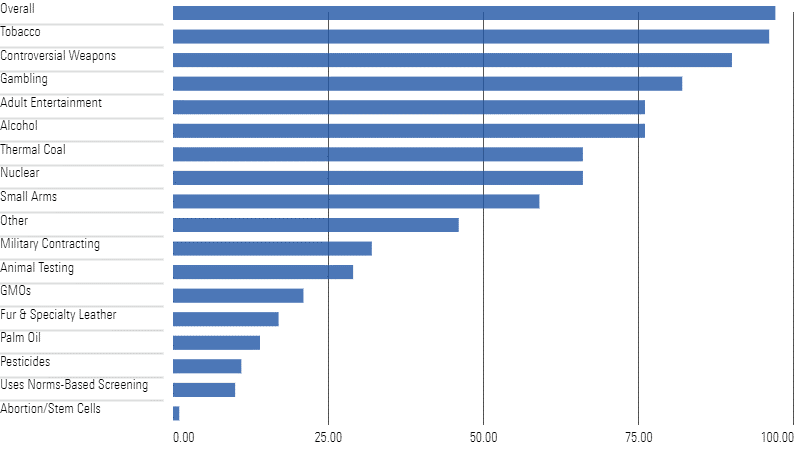

Number of Funds Using Exclusionary Screens

Source: Morningstar Direct

On this basis, Morningstar has identified 97 Australasia-domiciled funds that employ some form of exclusion from investment in controversial areas, with a high number of funds excluding tobacco (96) and controversial weapons (90) (companies that derive a significant portion of revenue from nuclear weapons, land mines, cluster munitions, and so on).

Gambling, adult entertainment, and alcohol are the next largest group of exclusions. Australians have limited choice in funds that exclude animal testing, fur/leather, palm oil, or pesticides.

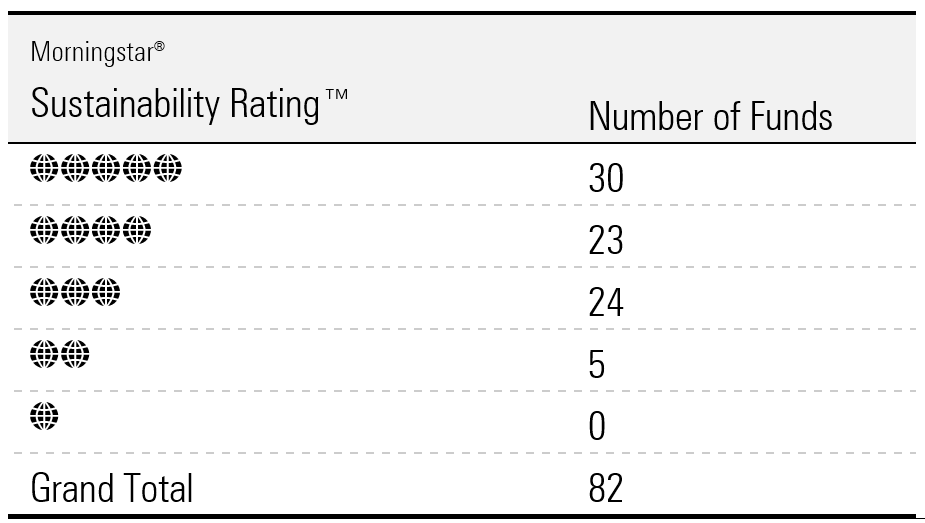

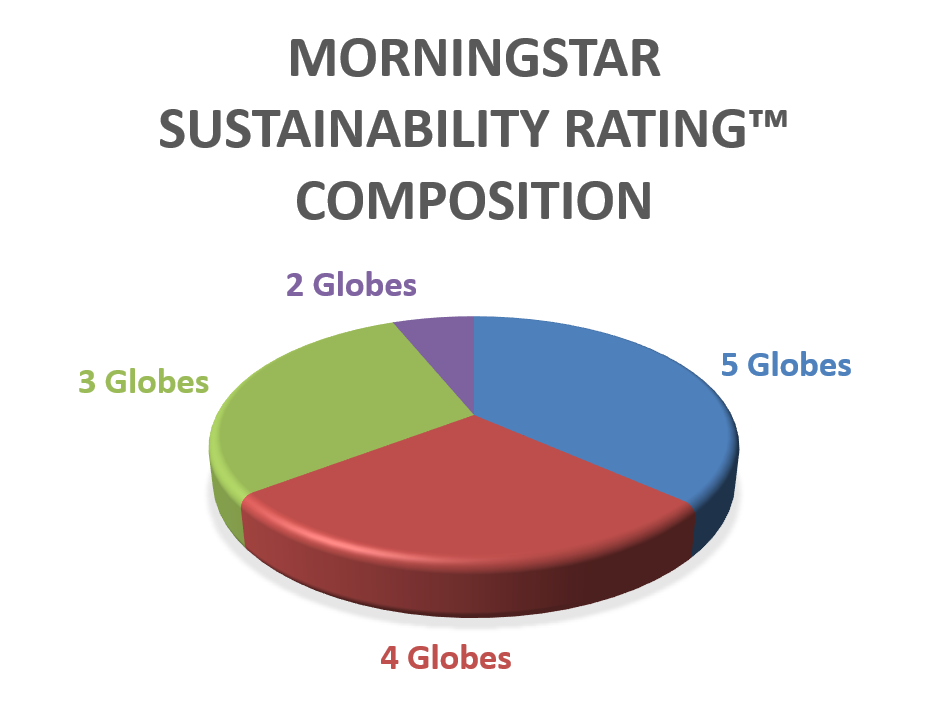

Morningstar Sustainability Rating™

Independent from the above taxonomy is the Morningstar Sustainability Rating™ (also known as the "globe rating"), which is intended as a measure of portfolio ESG risk relative to global category peers. Using individual company data from global ESG research leader Sustainalytics (a Morningstar company), Morningstar rates the degree of ESG risk found within a fund by looking to the fund’s holdings over the trailing 12 months and rolling up individual holdings’ ESG risk ratings with emphasis placed on more recent holdings information. The Sustainalytics ESG Risk Rating measures the degree to which a company's economic value may be at risk driven by ESG issues. In order for a fund to receive a Morningstar Sustainability Rating, there must be ESG risk scores on at least two thirds (66.7 per cent) of holdings. An investment does not have to be deemed sustainable under the identification framework for Morningstar to provide a Sustainability Rating.

Australasia-Domiciled Sustainable Investments

Source: Morningstar Direct | Ratings as of Mar. 31, 2020.

Australasia-Domiciled Sustainable Investments

Source: Morningstar Direct | Ratings as of March 31, 2020.

Although Morningstar’s identification of sustainable investments is separate from the assessment of ESG risk, the above exhibit shows that the majority (65%) of funds identified as sustainable investments (and qualify for a Sustainability Rating) in Australasia also tend to have lower levels of ESG risk and, hence, higher globe ratings. Only five funds have 2 globes and hence are assessed to have Above Average exposure to ESG risk. No funds have 1 globe.

Morningstar ESG Commitment Level

Morningstar has begun formally integrating environmental, social, and governance factors into its analysis of funds and asset managers. Morningstar manager research analysts analyze the extent to which strategies and asset managers are incorporating ESG factors as part of its new Morningstar ESG Commitment Level evaluation. Analysts assign a qualitative ESG Commitment Level to strategies and asset managers on a four-point scale of Leader, Advanced, Basic, and Low. The Morningstar ESG Commitment Level for strategies are determined by evaluating each strategy’s process, resources, and the asset manager behind the strategy.

The Morningstar ESG Commitment Level for asset managers is determined by assessing each firm’s philosophy and process, resources, and active ownership activities.

In November 2020, we published ESG Commitment Level assignments to a global set of funds and asset managers in a research paper, "The Morningstar ESG Commitment Level: Our first assessment of 100-plus strategies and 40 asset managers.”

The methodology for the ESG Commitment Level is available here.

The report is available here.

Morningstar will be broadening our coverage and making the ESG Commitment Level designation available in our products in the second quarter of 2021.

Morningstar's Q1 2021 Global Sustainable Fund Flows Report

In conjunction with the release of this Australasian sustainable landscape report, we have also published Morningstar’s Q1 2021 Global Sustainable Fund Flows report, which examined the global fund flows of 4,524 sustainable open-end funds and exchange-traded funds.

The report is available here.

Previous editions of this report: