Would the laggards please leave: Active managers on notice

Is your stockpicker trailing the rest and still charging hefty fees? Then speak up, says Morningstar’s Andrew Miles.

Mentioned: GQG Partners Global Equity Fund (43212), Magellan Global Open Class (15699), Franklin Global Growth A (16740), Harbour T. Rowe Price Global Equity (23925), Barrow Hanley Global Equity Trust (41377), PM Capital Global Companies (6828)

Morningstar senior analyst Andrew Miles says investors are within their rights to question the value of global equity active management after decades of underperformance, adding that some managers should consider bowing out gracefully.

Several large asset managers have cut their fees, and that’s a good thing, Miles says, because fees "play a significant role" in the divergent results between active and passive managers. The problem is however the cuts don’t go far enough in offsetting persistent underperformance.

"Investing in the average manager would have resulted in disappointing results, particularly if you picked a value-oriented approach," he says in Morningstar's latest Global Equity Sector Wrap, which looks back at three decades of manager performance relative to the index.

"While we’re not claiming it’s the ‘The Last Dance’ for all active managers, some should consider leaving before the lights come on."

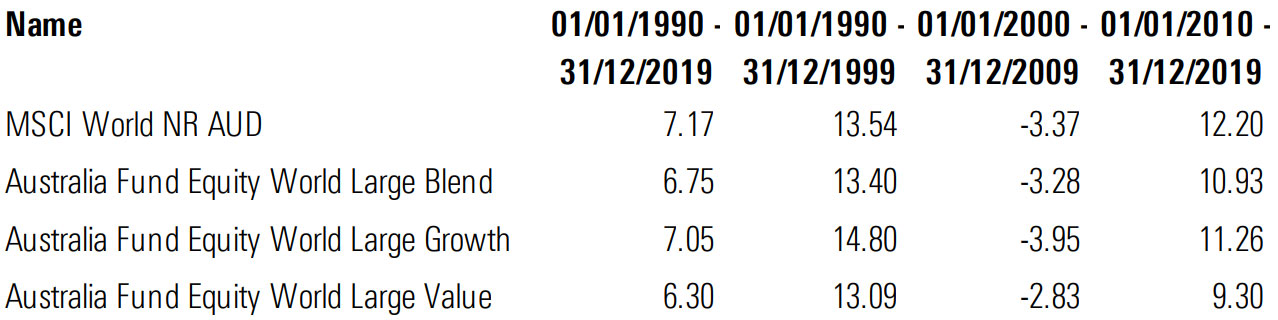

New Morningstar data shows global equity active managers have trailed their passive peers since the 1990s. This is true irrespective of style. Global blend, growth and value all underperformed the MSCI World Index.

Total return (in AUD) Jan 1990 – Dec 2019

Source: Morningstar Direct

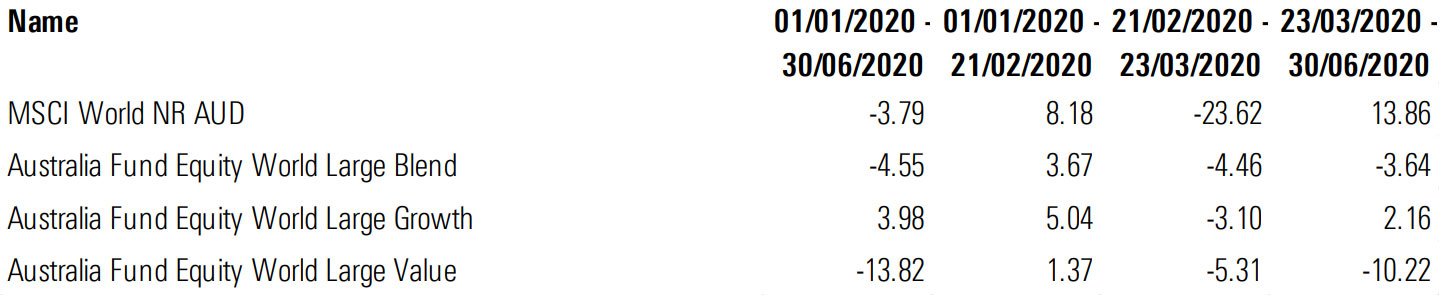

Active managers claimed that 2020 would be their moment to shine with volatility returning to the market. However, performance was mixed, Miles says.

Managers provided good downside protection in the swift market crash, but as Miles notes, many missed out on the ensuing bull market.

"From 21 February to 23 March, active managers defended admirably, only falling mid- to low single digits compared with the index, which cratered over 20 per cent as investors panicked.

"At this point, proponents of active management were probably feeling quite proud of themselves.

"Hopefully, humility prevailed because, for many, their glory was short-lived.

"A tsunami of liquidity sent markets into one of the fastest bull markets on record (from 23 March to 30 June).

"The index raced ahead of the average active manager, erasing the gains they had made during the sell-off."

The result – the average growth manager outpaced the index in the first six months of 2020, but both blend and value managers lagged.

Total return (AUD) first-half 2020

Source: Morningstar Direct

That's not to say all global equity managers underperformed. Those who avoided cyclical stocks like energy and financials and loaded up on high-quality companies did well – including medallist funds T.Rowe Price Global Equity, Franklin Global Growth, GQG Partners Global Equity and Magellan Global.

At the bottom of the table were the value-oriented managers.

MORE ON THIS TOPIC: Australia's best and worst equity funds in 1H20

"Dimensional, Barrow Hanley Global Equity, and PM Capital Global Companies suffered as their economically sensitive holdings underperformed in the sell-off," Miles says.

"Their relatively lower exposures to growthy technology names compounded the underperformance."

Growth's outperformance is not an Australia-only story. US growth-stock funds have emerged from the first half’s market turmoil with an even wider performance advantage over value strategies than they had at the start of 2020.

Waiting for the comeback

Morningstar associate director, manager research, Michael Malseed isn't willing to write off value yet, noting that predictions of the style's demise during the speculative tech-boom of the late-90s were "embarrassingly premature". Malseed imagines a scenario where cyclical stocks return to favour.

"As the economic downturn has been sharp and deep, the rebound could equally surprise," he says.

"The sugar-hit of massive fiscal stimulus may gain more traction in the event of a breakthrough vaccine or therapeutic.

"In such an event, deep cyclicals could rally hard, while any emergence of inflationary pressure as a consequence of all this money printing could see interest rates rise and apply the hand-brake on growth’s rerating."

Malseed's key takeaway for investors: "portfolio diversification is as important as ever".

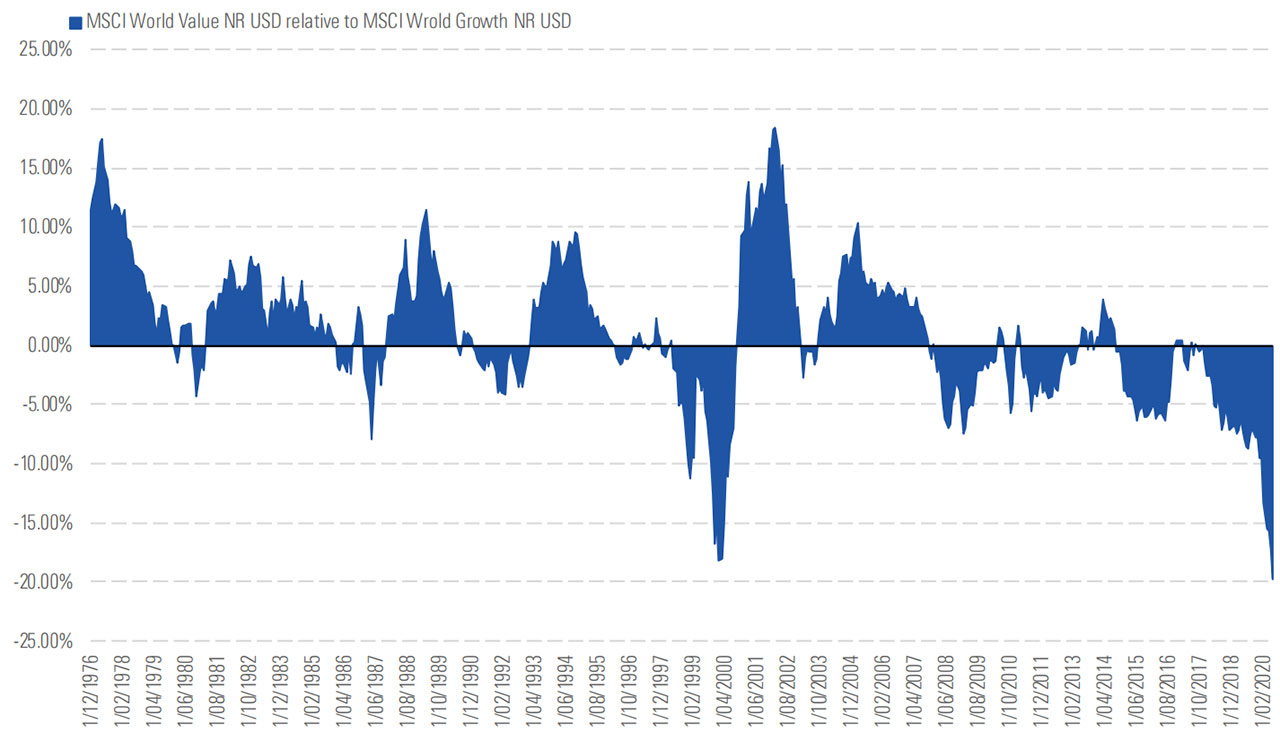

Fathered by The Intelligent Investor's Benjamin Graham and popularised by legendary investor Warren Buffett, value investing has suffered a "torrid period of underperformance" relative to growth since the GFC, Malseed says.

"The era of quantitative easing introduced in response to the global financial crisis has had little success driving consumer price inflation higher, but cheap money has led to significant asset price inflation particularly for entities perceived to have solid quality or reasonable growth attributes."

"This has narrowed the opportunity set for value investors and steered many into more cyclical and economically sensitive areas."

Value investors seek to purchase assets at prices that are substantially below the assets' true, or intrinsic, value.

Rolling 24-month relative performance of value vs growth

Source: Morningstar Direct. Data as of 31 July 2020

Malseed says the style's covid-related underperformance is disappointing but "not unexplainable", noting value managers' inclination towards energy and financial stocks.

"These two areas are highly sensitive to real economic activity and have been most exposed to the lockdowns aimed at suppressing the spread of the virus," he says.

Read Miles’ and Malseed's articles in Morningstar's Global Equity Sector Wrap (September 2020): Are We Watching the Active Manager’s Last Dance?; Questioning the Value of ‘Value’