Morningstar Guide to Investing for Women: Part l

Women are less likely to invest than men, and when they do, they invest later in life, are beset by jargon and often receive inadequate advice.

There are perks to many jobs—some offer an extra week off a year; others offer the flexibility to work remotely. One of the perks of my job is that it has given me exposure to financial products. This may not seem as attractive as a week away from the tools (be it a keyboard, a pen, or a hammer), but knowing how the financial decisions of today can lead to much better outcomes tomorrow has been invaluable to me.

My first job after graduating was at a financial planning firm. It was a job that gave me the tools to understand what my retirement would look like if I failed to invest. A stark choice emerged: if I continued the way I was going, I was facing every year of retirement reliant on a government pension. Until this point, I had never considered investing a topic I needed to think about until further down the track, if at all. It’s easy, particularly for women, to succumb to this sort of complacency.

Statistically, women are less likely to invest than men, and when they do, they invest at later stages in life, where time—and the lack thereof—can limit their ability to reach their financial goals. Countless studies point to the many variables preventing women from dropping a dollar into investments. The main deterrent to investing is the perception that it is confusing and complex. And it’s a costly misperception because it leaves women’s savings languishing in a low-yielding bank account or term deposit—potentially robbing them of a chance to achieve their financial goals.

As I wrote this guide, I reflected on my first investment outside of term deposits and what it took to make the final leap. Key to that first step was a desire to understand what I was investing in, the process I was exposing myself to, and of course what I expected my investment to achieve. Perhaps the catalyst was that first jolt I experienced on realising I wouldn’t be as self-sufficient as I thought in retirement—even after an entire working life of super contributions.

I hope this guide helps illuminate these concepts and arms you with practical tips for your journey to financial ease. Understanding what you need to achieve your financial goals (be it a comfortable retirement, owning your own property or starting a business) can often be a convincing argument for investing in itself. Whether you’re a first-time investor or a seasoned professional, I hope this guide gives you that ‘jolt’ to think about your goals and whether you are on track to achieve them.

Why an investing guide specifically for women is needed

The investing approach that most of the population takes is fairly consistent—do nothing and hope for the best. Most people react to calls to invest more about the same way they take advice to exercise more or eat better: they reluctantly concede the advice is probably correct, offer a litany of justifications for past behaviour followed by a flimsy commitment to make changes ‘at some point’. Investing shouldn’t be thought of as a chore. Investing is about independence. It is giving the gift of independence to your future self by knowing that a little delayed gratification today will have a large impact on your future. It is about the independence of not having to stress about unexpected expenses because you have an emergency fund. It is about the independence you get from taking care of your family and not being a burden to them in the future. Many women are turned off by investing because of the traditionally masculine language that is used to describe it: investing is frequently equated to competition, sport and combat. It is time to change these metaphors - investing is about the ability to care for yourself and those you care about.

There was some internal debate about creating an investing guide for women. The importance of saving and investing for your future is critical for everyone. Several sections of this guide lay out foundational investing concepts that apply to either sex. However, there are three issues that disproportionately affect women, which we aim to explore here.

The first is the outcome of failing to invest. As mentioned, women typically avoid leaping into investing; instead, they stick to cash and fixed income options, which offer less return on investment than other asset classes (over the long term).

The second is retirement. Career gaps, family, wages inequality, health: there are many reasons why women arrive at retirement with much less money than men.

And then there is financial advice. Working with a professional financial adviser can provide you with a sense of security that your money is properly working for you. But not all advisers are created equally. And there is a bias at play for advisers may often lean to more conservative options for women, which may be less lucrative than those proposed to men.

Why you should invest

Women and their relationship with investing

Warren Buffett famously said, ‘Investing is simple, but not easy’. Being a good investor does not necessarily mean hours spent researching a stock or investment or even being an industry specialist. The crucial trait of a good investor is discipline.

Let’s start with some good news. In 2017, Fidelity conducted a study on nearly 8 million account holders. The study found two revealing differences in the saving and investing habits of men and women. The first is that women save more than men. Women saved an annual average of 9 per cent of their pay cheque compared to an average of 8.6 per cent for men. Not only did they save more, but women also made better investors. Women outperformed men by 40 basis points, or 0.4 per cent. This seemingly small difference in savings rates and investment returns can make a big difference over the long term.

Now the bad news. Women still lack confidence as investors. Fidelity asked the study participants who they believed was the better investor over the past year and only 9 per cent of women thought they had outperformed men. This lack of confidence has consequences. According to a study by Wealthsimple, women invest 40 per cent less money than men. When asked in a survey by Lexington Law what they would do with an extra $1000, men were 35 per cent more likely to say they would invest the money.

The first section of this guide will address the investing gap between men and women and answer a foundational question: why should you invest in the first place?

What you can achieve by investing

Shares versus bonds and cash over very long term—Australia

Source: Global Financial Data, AMP Capital

The above chart shows the returns of different asset classes over a long-term period; in this case, an investment of $1 in 1900 (with income reinvested). The green line shows Australian cash returns $238; Australian shares, the red line, shows a return of $532,739. No one has a 110-year investing journey, but the principle remains—investing has helped people grow wealth; and staying invested in an asset over the long-term is decidedly more lucrative. That said, the purpose of this chart is not to convince you to pull all of your cash out of the bank and put it into Australian shares. Rather, it illustrates that cash has almost always been seen as a ‘safe’ option—if you keep it there you’ll earn some interest and there’s little to no risk of losing your savings. There is always a trade-off when it comes to risk, and in this case it is the risk of not achieving your goals. Cash might feel like a comfortable option, but it may mean the risk of a less comfortable retirement or the risk of compromising on other lifestyle goals in the lead-up to retirement. A knowledge of some foundational investing concepts will help you understand how it pays off in the long-term and give you the impetus to get your own journey started.

How ’safe’ is keeping your money in the bank?

Your money may be safe in the bank but its purchasing power also risks being eroded by inflation. Inflation is the sustained rise in the price of goods and services over time. In other words, that dollar you possess today is worth less than a dollar tomorrow. As the value of money decreases, the price of goods and services in the economy increase. The most well-known indicator of inflation is the Consumer Price Index (CPI). CPI measures the percentage change in value over time of a basket of goods and services that an ordinary household might consume.

Why is this important to investing? Inflation is the reason why money sitting under your bed or in a bank account may not achieve your financial goals. In the past 20 years, Australia’s inflation rate has mainly stayed between 1.5-4.5 per cent per annum, with the majority of the years falling between 2-3 per cent. This figure is an average, guided by CPI and based on an ordinary household. Your personal inflation rate takes into consideration your individual circumstances and where you spend your money. This indicator gives you a better understanding of the rate your money needs to grow at to ensure your purchasing power doesn’t decrease.

Since we all spend our money on different products and services in different regions, it’s useful to think in terms of personal inflation. The inflation rate above doesn’t always apply to each individual’s circumstances. CPI is calculated on an ‘ordinary household’ in Australia, with the below allocations used in 2020.

What personal inflation rates mean for you is that your money must reach this benchmark at a minimum to be able to maintain its purchasing power in the future. The good news is that understanding your personal inflation rate gives you guidance about your potential investment objectives.

Many of the places we consider ‘safe’ to keep our money (i.e. the banks) don’t necessarily award interest equal to inflation, forcing you to look elsewhere just to maintain your purchasing power. Below is a list of some of the top banks and their interest rates on transaction accounts (as at 17 February 2020).

*Less than $50,000

** Account balances less than $49,999.

***5 month introductory rate of 1.55% for Westpac, 4 months for NAB, 3 months for ANZ

Few households would be serviced adequately by the interest rates offered on the above accounts.

Taking the jump into other asset classes can be daunting. But keep in mind cash and bank accounts are not entirely risk-free. Leaving your savings in a bank account compromises your purchasing power and subsequently your financial goals.

Compounding and how to make it work for you

Compounding is ‘the eighth wonder of the world’. Albert Einstein’s timeless adage, in short, means earning a return on your previous return. Like a snowball rolling down a hill, your returns exponentially increase, or compound, over time. The combination of the return your money earns and the years that it is invested can be incredibly powerful. We will cover the different return expectations of different types of investments shortly. For now, let's concentrate on time. Time is something that any investor from a novice to an expert can control. Whether you are 15 or 50 the best time to invest is today.

The time you have remaining until retirement, or other financial goals along the way, drastically shapes your outcome. Below are two graphs illustrating the monthly savings needed to accumulate $1 million by age 65.

Start investing early: monthly savings needed to accumulate $1 million by age 65

Source: Morningstar Investment Management. About the data: The image represents the monthly savings necessary should the investor earn 7% per annum from a hypothetical asset. No adjustment has been made to account for inflation, fees, transaction costs, or taxes.

The graph on the left looks at the dollar amount needed at different ages. As you can see, it is not a linear progression. The older you are when you start investing, the more you need to save to reach the same end goal. The reason for this is explained in the graph on the right, which shows the split between capital (the amount you invest) and growth (the gains you make from investing).

The importance of investing as early as possible is particularly pertinent for women, who on average experience more frequent and longer career breaks, or non-earning periods. Research by Rest Superannuation shows women take career breaks earlier on in their career, at an average age of 33. The amount of foregone superannuation contributions at retirement alone compounds to an average of almost $160,000.

The lesson to be gleaned here is that planning and investing sooner allows your returns to grow and compound.

The power of compounding also derives from ‘reinvesting’ returns and income earned back into the asset. With some assets, such as property/land, this is more difficult to do. But other asset classes such as shares, funds and bank accounts have inbuilt mechanisms to allow investors to automatically reinvest their earnings.

The previous graph shows how time drives the amount you accumulate. The graph below shows the difference when you also reinvest your income. When the income earned from the investment is reinvested, it supercharges the amount of money you will have at the end of the investment period.

Compound investing: Hypothetical investment in asset paying 7% each year

Source: Morningstar Investment Management

Are you focused on the wrong type of risk?

Risk and return are fundamentally linked. The very act of investing is to take on a certain level of risk in the hope of earning a return on your investment. The more risk you take on, the more you should expect to receive. There is a myriad of risk measures on portfolios and individual securities and countless academic studies on risk and return trade-offs. But they’re usually of little use to individual investors. The risk of losing money is for many a reason not to invest. At first glance this makes sense. Nobody wants to lose money and any investment involves risk. What most people fail to consider is the point of investing in the first place. You invest not to just have more money but to have enough money to pay for a non-investing related goal—retirement, a house, etc. The real risk for investors is not short-term changes in the overall portfolio value but the risk of not achieving a long-term goal. I include equity investments in my superannuation because I’m trying to protect against the risk of being unable to support myself in 38 years when I access my super. The risk of my super having a lower balance in six months because of a market plunge is the least of my concerns. Any conversation about the riskiness of an investment must start with what you are trying to accomplish with the investment. To invest you need a goal.

Why are you investing in the first place?

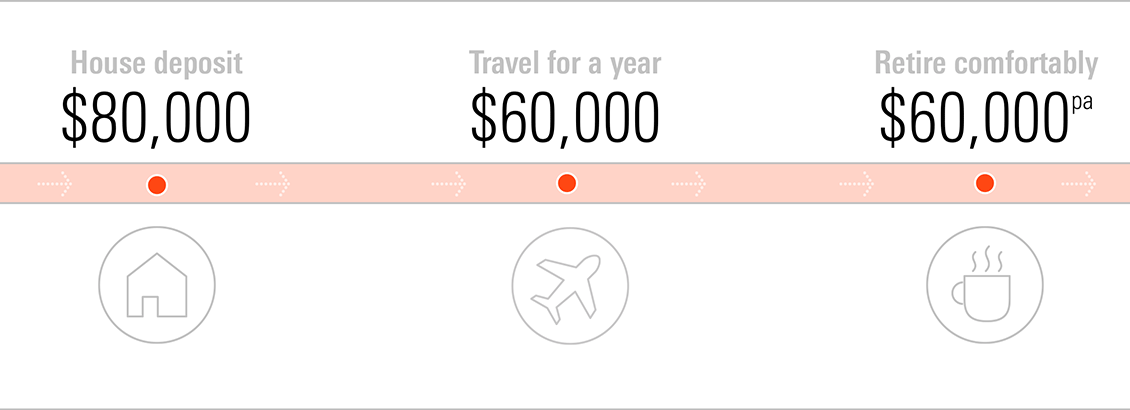

Investing for goals is crucial. It adds structure to financial plans—whether they be professional or DIY. Without them, there’s no guide to how much risk you must take on to earn the required return. The returns you need to achieve your goal will govern the type of investments that you should make. Goals can vary and don’t always have to be retirement-focused. Your goals can range from travelling for a year to buying a house to live in. It’s also okay if you don’t know what your goals are leading up to retirement—simply investing for a comfortable retirement and maximising your investments for future expenses can be a jumping-off point.

Financial independence

Financial independence has varying meanings depending on who you ask—foundationally it means long-term self-sufficiency. For women, financial independence has colloquially meant supporting yourself regardless of marital status. But it can also mean not having to rely on government handouts, a salary or the help of others, for the rest of your life.

When I looked up the definition of financial independence, most sources pointed to it being all-encompassing. Financial independence meant that you had no reliance on any other external source to provide for yourself, apart from your passive income.

Passive income is seen as the key to achieving financial independence. As the term suggests, passive income is regular money your investments pay you—like those listed in the table above.

When you’re working, you’re able to reinvest these earnings to continue compounding your returns. But once you stop work, you switch to relying on your investments for income—be it your superannuation, your other investments or both.

What this standard definition of financial independence does not consider is that deriving a passive income from your investments for your whole retirement is unfeasible for many. For that, you need a hefty capital base. This reality is something the investment industry can easily lose sight of—particularly when it comes to women’s circumstances.

You are able to decide what being financially independent means to you. This may be a goal of not living pay cheque-to-pay cheque or having an emergency fund for unexpected expenses. Ultimately, determining what you qualify as financial success is a personal decision, and what’s achievable is based on individual circumstances. In other words, financial independence, like most of personal finance, is not a template that can be used for every person reading this guide.

Part of being financially independent is looking at what goals you would like to achieve. Having a goal, or several goals, can help you plan for your retirement and add structure to your saving and investing.

The time value of money and achieving your goals

A crucial part of saving is what’s called the ‘time value of money’. At its core, saving money is simply an exercise in delayed gratification. Instead of spending money today a saver makes a conscious decision to withhold money for a future purchase. The time value of money is the mathematical concept that allows us to answer all sorts of interesting questions that are central to saving and investing. How much do I need to save every year to buy something that costs $50,000 in 10 years? If I have $100,000 in my super today, how much will that be when I retire in 15 years?

An investor must understand the three key variables that will affect their future level of financial security:

- the level of return

- time horizon of the investment

- the size of the initial investment

While these three factors may seem obvious, the key is their interplay. If you are looking to build long-term financial security it is obviously best to optimise all three variables--start young, save as much as possible, and earn a strong return. If this is not possible, start thinking about trying to get two out of three right. If you are like most people who would rather spend than save, there is a simple solution: start saving now and get your non-emergency fund money out of nominal assets such as bank accounts and into investments with higher potential returns. This will allow you to save less when you are older.

Are you investing the right way to meet your goals?

Thinking about a goal—whether it’s feasible and the rate of return you’ll need to achieve it—will inform the types of investments you should consider. Sometimes the required rates of return are unrealistic because you’re not allowing enough time and therefore income to accumulate. Or your savings rate may be too low. This means adjusting those factors until it makes sense for you (I can buy a property in 15 years, instead of 10 years), or adjusting expectations until it’s within reach (I can purchase a two-bedroom apartment instead of a three-bedroom home, within the same timeframe).

We can start by understanding where your goals sit and how much you need to achieve them. An example of a timeline might look like this:

Then, separate your goals into short-term (0-2 years), medium-term (3-5 years) and long-term (5+ years).

The first step is planning your budget with the ultimate goal of understanding your surplus—how much you have left to save and invest towards your goals after you have paid your expenses. It’s difficult to project variables that may change your budget (unexpected large expenses, promotions that result in salary increases, inheritance). The best way forward is to project based on current circumstances and update projections when those changes happen.

Expected returns are those you hope to achieve on your investment. Some investments, like managed funds, have guidelines on benchmarks they are looking to beat over the long term. Although not always accurate, average returns over the long term can provide some guidance on the asset and how it can fit in your portfolio. The corporate watchdog ASIC has provided some guidance on how different assets can fit into your portfolio based on expected returns and time frame.

1. Short to medium-term goals (0-5 years)

The assets listed below are examples of assets that are used to protect capital or diversify a portfolio.

2. Medium to long-term goals (5+ years)

The assets listed below would suit a time horizon of 5 or more years.

Why women lag in retirement and what to do about it

Will your super give you the retirement you’re looking for?

Investing for retirement is often the costliest and longest-term goal for many people. Saving adequately for retirement can be particularly fraught for many women for several reasons we will outline below. Before getting into them we should look at the Australian retirement system.

Compulsory superannuation has been in force in Australia for almost three decades, and it’s something we’re lucky to have as it accumulates as you work, with the purpose of providing an income stream in retirement. Superannuation was introduced to ease the burden on the welfare system and allow Australians to fully or partially self-fund their retirement.

However, it doesn’t always live up to this. Consider the scenario below in which you rely solely on your superannuation in retirement (you can do the same to see your personal outcomes through ASIC MoneySmart’s Superannuation Calculator).

First, the calculator addresses your projected balance at retirement—the capital from which you will be drawing an income. This depends on several factors, including your income, the age you want to retire, the fees and performance of your super fund and whether you make additional contributions.

Results

If we take an average 30-year-old woman with a retiring age of 65, earning an average annual income of $80,000 in a growth fund, she would have $580,000 in her superannuation by retirement age (this assumes there is no insurance or adviser fees attached to the account).

Source: ASIC MoneySmart

In retirement, this $580,000 will result in two self-funded years in retirement, with an income of $34,000 a year. Every year after, those two years will be supported by the age pension. Consider, however, that women, on average, live longer than men, and have smaller superannuation balances. In most cases now, the average worker is looking to fund a retirement in equal length to their working life. As our life expectancy increases, it comes with the happy problem of funding more years in retirement. Investing outside of mandatory super contributions is essential to ensure a comfortable retirement.

Source: ASIC MoneySmart

In theory, you’re looking for your superannuation and/or your investments to provide you with an income stream in retirement, without touching your capital (the dollar amount you have built in your super).

We’ll discuss a few options that suit different life stages, circumstances and risk tolerances. This will help you build to your retirement goal, and other financial goals along the way.

The impact of career breaks

We briefly covered how career breaks can erode your superannuation and savings in general. For women, childbearing and caring responsibilities form the largest portion of career breaks despite the advances in maternity leave benefits. However, the 18 weeks of paid parental leave that is legally mandated still falls short of 32 weeks that the average mother takes.

Under existing legislation, employers are not required to make superannuation contributions for employees on paid parental leave. This leaves a potential 32 weeks without any kind of superannuation contribution. For 14 of those weeks there is also no income earned. And it goes without saying that having children is one of life’s most expensive events. Considering gaps in superannuation must be a component of this preparation.

The result of one or more career breaks is often a lower superannuation balance at retirement. According to the Australian Financial Security Authority, the government agency for those in financial hardship, on average, women have a 42 per cent lower superannuation balance at retirement than men. However, this gap is likely be drastically underestimated as most 60-year-old men and women would have only had superannuation as we know it for a portion of their life. Assuming you start work at 22 years old and retire at 60 with 8 per cent annual returns, a woman would need to save an additional $513 a year to close this gap. The wage gap between men and women exacerbates the impact of one or multiple career breaks. To make up for combination of the wage gap and career breaks, women must contribute a little over 11 per cent a year to super instead of the compulsory 9.5 per cent. This doesn’t seem like a far stretch, but the impact of compounding drastically improves the retirement outcomes.

There are a couple of methods that can help you bridge the gap created by a career break.

1. Salary sacrifice while you are earning an income:

This guide is intended to be useful for women of all ages and that includes those past the years of their career breaks. You still have an option to salary sacrifice into your superannuation if you are earning an income. You can salary sacrifice $25,000 a year (total including employer contributions) into your superannuation as pre-tax contributions, taking advantage of the tax benefits this brings. The amount you can contribute will vary based on personal circumstances, but ASIC’s MoneySmart has a ‘Superannuation Optimiser’ tool on their website, as well as other calculators that can assist with understanding how contributions can affect outcomes.

2. Plan for super contributions as part of your career break:

This method ensures there are minimal changes to your superannuation balance but requires time and investment beforehand. When you are saving for a planned career break, ensure that superannuation contributions are included in the calculation process. Contribute as your employer would during the period. Remember, these contributions will be treated as non-concessional. If your pre-tax contributions are below $25,000 for that financial year, your superannuation fund can provide you with an ‘S290 form’—a notice of intent to claim or vary a deduction for personal super contributions. This will give you a tax deduction on your contributions made.

How varied health outcomes can affect financial preparedness

According to the Australian Institute of Health and Welfare, women experience distinctly different health outcomes to men. Their life expectancy is longer, but their ‘total disease burden’ is also higher as women are more likely to live with a chronic disease than die early from a disease. Women are also more likely to experience chronic conditions that require ongoing support.

As you reach retirement, you are far more likely to develop chronic conditions (half of Australian women have one or more) that requires specialist care. Australia has one of the best universal health programs in the world, but despite this it is not comprehensive when it comes to ongoing specialist care.

As you go further into retirement, dementia and Alzheimer’s disease become the leading cause of death for women. These conditions can require care for ongoing periods—all of which are a consuming financial burden.

Although these situations are mostly unavoidable financially, the impact can be minimised by investing early to ensure you are able to meet the healthcare costs associated with age. Exact amounts or dollar amount goals are hard to define for future healthcare costs, but this is another key reason why planning is crucial—not only because of the disparity in women’s wages, life expectancy, career breaks, superannuation balances and health outcomes, but because the culmination of these factors will often multiply in the form of lost investment earnings, and a lower quality of life in retirement.

Gender bias in financial advice

How well does the financial advice industry serve your interests?

Many investors, and women in particular, look to financial advisers for support along their investing journey. Among investors with personal incomes of at least $100,000 and / or investable assets of at least $500,000 USD, 56 per cent of female investors have a financial adviser. For men, this figure stands at only 42 per cent, according to a 2019 Morningstar report. On the surface this is very positive. We already know women need to invest more and are faced with unique challenges given longer lifespans and lower retirement account balances. Who better then to turn to than a financial professional to help address these issues? However, there are indications of pervasive gender bias in the financial advice industry, which affect the quality of advice women receive. Many women say they struggle to find an adviser who understands them. More than 60 per cent they are considering switching advisers compared to only 44 per cent of men.

A study by EY Global Wealth & Asset Management asked female investors what terms came to mind when they thought of the wealth-management industry. The women responded with "unwelcoming," "patronising," "male-dominated," and "full of jargon." In this and other surveys of female investors who have advisers (either male or female), many said they feel misunderstood by their adviser or that they think their adviser is uninterested in them. Many female investors also report instances in which their adviser leaned on common stereotypes, such as assuming that they had a low risk tolerance or focusing on sustainable investments despite never showing interest in the topic.

Academic studies show similar indications of gender bias. In an audit by Mullainathan et al., participants were instructed to visit financial advisers and pose as prospective clients. The researchers then recorded the advice given to each participant and found that people with identical portfolios were nevertheless treated differently based on demographic characteristics. Female investors were asked about their personal and financial situation less often than men, and women were also advised to have more liquidity, less international exposure, and fewer actively managed funds.

What to know when seeking financial advice

The torrent of disturbing allegations from the Hayne royal commission into the finance industry has prompted many Australians, both men and women, to question whether their interests are being served by financial advisers. Women in particular should approach any interaction with a financial adviser with a clear picture of what good financial advice looks like.

Studies show one way to increase the chance of getting good financial advice for women is to simply find a female financial adviser. According to a 2018 study from King Business School, women advised by a male financial adviser feel significantly less knowledgeable about their investment decisions and hold more than 14 per cent more cash in their portfolios compared to women with female advisers. In an industry where only 20 per cent of advisers are women this may be easier said than done. So what does good financial advice look like?

At Morningstar we believe in a goal-based total wealth approach to financial planning. Morningstar works with thousands of advisers around the world to help them provide better financial outcomes for their clients. There are many ways of providing goals-based and total wealth-focused advice, but the elements we have outlined should seem familiar if your adviser is following a similar philosophy. We listed four things to consider before investing: focus on goal attainment; total wealth approach; risk; portfolio construction.

1. A focus on goal attainment

The focus should be on long-term goal completion rather than on the performance of the investments that make up a portfolio.

The tone should be set from the first meeting with the adviser where the discussion should be about you, your family and your goals.

Additional meetings and communications from your adviser should follow the same script. Updates should focus on progress against milestones to achieving your goals and not on the performance of investments.

Remember that the actual investments in your portfolio are a means to an end and nothing more. Beware if the adviser rushes to complete a regulatorily mandated risk tolerance questionnaire so he or she can start talking about all the great investments you can buy. Your hopes and dreams matter more than the answers to hypothetical scenarios in the questionnaire.

2. A total-wealth approach

Context is a crucial component to financial planning. To establish the appropriate context the adviser must understand more about you than just the contents of your portfolio.

Before any conversation about investments, the focus should be on your career and prospects, your age, where you live, your family circumstances and any specific personal circumstances. This will allow the adviser to understand your total resources and limitations, which will provide a clearer perspective on what it’s going to take to accomplish your goals.

You should be wary if the first question your adviser asks you is how much money you are looking to invest.

3. Risk

The way your adviser defines risk is a crucial indicator of their overall philosophy of delivering financial advice.

We believe the common practice of focusing on risk preference fails to paint a complete picture. Your adviser should do more than simply ask you how you feel about taking risk (which is commonly done through a risk tolerance questionnaire).

Conversations with your adviser should focus on risk aversion—the amount of risk you should take given your available resources and the goals you want to accomplish. This is a far more complete picture of risk than just focusing on than the amount of risk you want to take.

The amount of required risk and your goals are fundamentally linked. The reason you invest in the first place is to meet your goals. The act of investing is a trade-off between risk and return. Taking on less risk with your investments may increase your risk of not reaching your goal.

4. Portfolio construction

Selecting investments should be the last step of your initial work with your adviser. As previously stated, the actual investments should only be selected once your adviser understands your circumstances and your goals have been clearly defined.

To understand how your adviser selects investments you can ask them how portfolio choices align to client profiles. It is operationally easier for an adviser to just have a single asset allocation target for each risk level. It is also unlikely that this approach will serve you well. Different goals have different risks and that should all be incorporated into the portfolio selection process.

As we described in the overview section of this guide, much of the public and regulatory scrutiny of advisers has been based on selecting investments that serve their interests rather than yours. A good adviser should be open to discussing why a particular investment was selected. One way to get reassurance is to validate the recommendation against an independent opinion. All advisers have access to independent research, including 60 per cent who can access Morningstar research. Ask your adviser for a second opinion.

The asset allocation and investments in your portfolio should change as you near your goals—they should not remain static simply because your risk tolerance has.

Goals-based portfolios often have a ’glide path’ that details how they should change over time. Remember that you have multiple goals with multiple time horizons and the investments dedicated to funding each of these goals can be very different (short-term vs. long-term).