Morningstar Guide to Portfolio Construction

A 4-step framework to align your portfolio to your goals

We have created the Morningstar Guide to Portfolio Construction to help you design a portfolio to meet your objectives in life. This guide will walk through the activities required to translate your goals into the inputs needed to construct a portfolio:

- Define your goals

- Calculate required rate of return

- Select asset allocation target

- Select investments

Define your goals

“By recording your dreams and goals on paper, you set in motion the process of becoming the person you most want to be. Put your future in good hands—your own." – Mark Victor Hansen

At Morningstar, we are proponents of goals-based investing. We don’t feel that the old approach of using wealth maximisation at retirement as the default goal serves individuals very well. The one-size-fits-all approach doesn’t take into account that each of us is unique with different goals and uses for money that occur well before retirement. At Morningstar, we are all about putting the investor first—not the investment.

There are countless ways to invest, but many investors do themselves no favours by failing to ask the most important questions first: What are my objectives? Why am I investing? Before you can research, plan, and implement an investment strategy, it’s critical to understand what you plan to do first.

Most people avoid defining objectives because it involves spending time thinking about the future in very specific and concrete terms. Failing to define objectives can have several consequences. The primary investing-related consequence is not having any sense of the actual return objectives needed to meet your goals. This leads to individual investors going into two default modes—risk avoidance where too many assets are kept in “safe” assets such as cash or wealth maximisation where too much risk is taken relative to the actual investment objectives and timelines.

Putting off this exercise will not actually change your financial situation but ignoring issues never make them go away. The mechanics of what needs to be done are straightforward. Simply decide on the following:

- What are my objectives in life?

- How much will it cost to fund these objectives? (remember inflation—Morningstar estimates 2.6 per cent each year as the cost of living increases)

- When do I need the money to pay for them?

- How much have I saved already to fund these objectives?

Defining Needs & Objectives

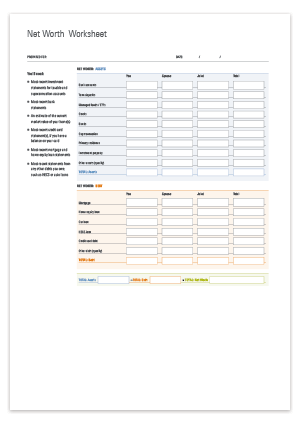

Step 1: Determine your net worth

The first step is to take stock of your net worth by gathering up your most recent investment statements or going online to retrieve your current account balances. Note that for some accounts, such as your bank account or Super accounts featuring publicly traded securities, you’ll be able to get a very current, very specific read on what those assets are worth. For other assets, such as the value of your home or investment property, you’ll need to do a bit of educated guessing. However, you may want to consider excluding the value of property in this exercise. Property investing is outside of Morningstar’s core competency. As a result, the models and suggestions listed in this guide are oriented towards publicly traded assets and may not be applicable to property.

In addition to your assets you will need to record any outstanding debts you have. If you are excluding your property assets from the worksheet please remember to exclude any housing-related debt as well.

Complete the Net Worth Worksheet to give you an idea of your assets and debt levels.

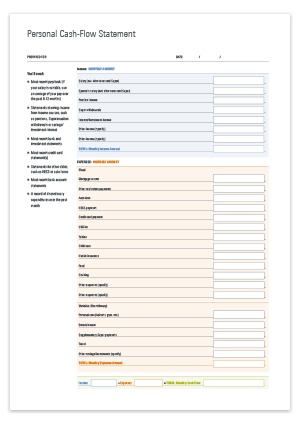

Step 2: Create a personal cash-flow statement

A personal cash-flow statement provides a point-in-time snapshot of what income comes into your household from your job and/or any other sources, as well as what you’re spending and saving. Only by examining your cash flows can you determine whether your spending and savings patterns align with your long-term goals.

Complete the Personal Cash Flow Statement to determine how your monthly earnings and spending are tracking.

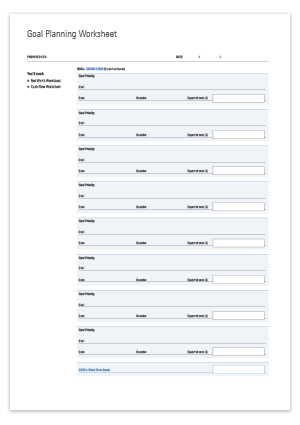

Step 3: Document your financial goals

The next step is to define and estimate the cost of each of your goals. For short- and even some intermediate-term goals, this should be straightforward. Estimating the cost of multiyear, long-term goals like retirement is trickier. The big wild card is inflation: While it’s currently quite low by historical standards, it is reasonable to assume at least a 2 per cent to 3 per cent inflation rate for longer-term goals. At Morningstar we have a 2.6 per cent yearly inflation estimate.

Complete the Goal Planning Worksheet to give you an idea of your different goals, when you hope to achieve them and how much they are likely to cost.

Step 4: Assess where you are

If you have completed the three worksheets you have a much better view of your financial position than most Australians. The output of these three worksheets should give you everything that you need to assess how you are tracking against your goals, the level of investment risk that you need to take to meet your goals and any lifestyle changes you may need to make to ensure you reach your long-term goals.

Calculate required rate of return

“Hope is not a strategy.” – Rudolph Giuliani

Using the required rate of return calculator, you can calculate what you need to earn to meet your goals. Try it on Morningstar Investor.

While past market performance may not be replicated in the future, if the return that you need to achieve your goals is dramatically higher than the all stock portfolio (9.4 per cent annually) it might be time to revisit your goals. You can either delay the timing of your goals, save more money or find cheaper goals. Go back to the Goal Planning Worksheet and the Personal Cash Flow Statement and try some different saving and goal scenarios.

Select asset allocation target

“On average, 90 per cent of the variability of returns and 100 per cent of the absolute level of return is explained by asset allocation.” – Roger Ibbotson

What is an asset class?

An asset class is a group of securities that have common characteristics that are distinct from other asset classes. These common characteristics refer to the underlying economic drivers of cash flows as well as how the asset is expected to behave in different market environments. Asset classes are traditionally divided into ‘income’ or ‘defensive’ assets, and ‘growth’ assets. Generally speaking, ‘growth’ asset classes, such as equities, property and infrastructure, are assumed to achieve higher returns on average than defensive assets. However, growth assets tend to have wider possible variation around that average. Conversely, ‘defensive’ asset classes, like cash and bonds, are assumed to have lower average returns than equities, but with less variation.

What is a portfolio and why does it matter?

A portfolio is simply a range of assets that are held by an individual or organisation. These assets can be individual securities such as stocks and bonds or professionally run collective investment vehicles such as managed funds, LICs or ETFs. In addition to financial assets an investment portfolio can contain real estate investments, direct investments in businesses, direct loans or even esoteric assets such as investments in wine.

Each of these individual assets that are placed in a portfolio have their own sources of risk and drivers of returns. We can break them down into those that are directly related to the individual security and those that are related to macro events. In the case of a single stock holding an example of the individual security level driver is a decision made by management while macro drivers would include the direction of the overall economy and decisions made by local and global political leaders.

It is this web of influences on the returns of these individual investments that will determine how your overall portfolio performs and more importantly will determine if you meet your individual financial goals for you and your family.

What drives portfolio performance?

There are two underlying drivers of how your portfolio performs. Top of mind for many individual investors is returns generated from security selection decisions. Less widely considered is the component of returns that can be attributed to asset allocation decisions. This emphasis on stock picking intuitively aligns with how many people see investing. Our minds like compelling stories—stories about companies, strategies and managers. These stories can help us tune out overwhelming details and make us more comfortable. Asset allocation decisions are never going to capture the imagination of the public. However, this foundational building block of portfolio construction is far more critical to the overall success of an investor. In the famous Brinson study first published in 1986, over 90 per cent of overall investment returns could be attributed to asset allocation decisions. While the exact proportion of returns that can be attributed to asset allocation decisions has varied across studies, it’s indisputable that it is large and too big to ignore for any investor.

A Morningstar Investor understands that successful investing is more than making one off buy and sell decisions. To help manage risk and deliver better returns, a holistic portfolio combines investments with different underlying drivers to achieve true diversification. We will take you through all the steps necessary to construct a portfolio and offer some suggested portfolios based on different return expectations and risk tolerances.

Find the complete Guide to Portfolio Construction on Morningstar Investor.

Risk and return expectations of different asset classes

To understand risk and return expectations of different asset classes, access the full guide on Morningstar Investor.

Selecting a portfolio

Now that you have some background information and a clearer picture of your goals, time horizon and required return it is relatively easy to select an asset allocation target. To assist with this process, Morningstar has created five different defensive/growth asset class combinations related to five different levels of risk: Conservative, Cautious, Balanced, Growth and Aggressive. These profiles give guidance on how you should allocate assets based on the return you need to achieve to reach your goals. You can also find them here on Morningstar Investor.

Select Investments

“Know what you own, and know why you own it.” – Peter Lynch

As stated earlier, asset allocation decisions can have a big impact on the overall returns generated by a portfolio. The other driver for investment returns is the performance of the actual investments that are selected for the portfolio. As a leading independent provider of investment research, Morningstar provides our readers with support in assessing new investment ideas, reviewing current portfolio holdings and / or validating third-party advice.

Here at Morningstar, we understand that it is not always easy understand what investments you should be selecting in line with your investment strategy. We have developed several tools to support investors like yourself with this process. We walk you through these features the following section – all of which can be accessed on Morningstar Investor.

Discover investments

Identify the right building blocks for your portfolio. Simply apply our new location and asset class filters to 5-star stocks, moat-rated stocks, medallist-rated funds and medallist-rated ETFs.

Fund Screener

The Morningstar Fund Screener is a tool that can be used to find investment trusts, superannuation funds, pensions and annuities by fund manager, category, assets, minimum investment and returns criteria. We also include the Morningstar Rating as a search criteria.

Morningstar Analyst Rating and Morningstar Star Rating

The quantitative Star Rating analyses the historical performance of a fund, looking backwards. It ranks funds from one to five stars, based on past performance—both return and risk (volatility). It uses focused comparison groups to better measure fund manager skill. As always, the Morningstar Rating is intended for use as one step in the fund evaluation process. A high rating alone is not a sufficient basis for investment decisions.

The qualitative Morningstar Analyst Rating is the summary of our forward-looking view of a fund. It is the outcome of a collaborative process based on a site visit, manager questionnaire, quantitative and holdings-based analysis of the portfolio, and an assessment of key issues identified by our analysts.

Goal-planning resources

Goal Planning Worksheet | Personal Cash Flow Statement | Net Worth Worksheet |

|---|---|---|

|  |  |

Read the full guide and access all these tools and more on Morningstar Investor.

Am I ready to invest? Your financial fitness checklist

Key points:

- Investing is easier than you think;

- But there are a few things you should get in order before diving in;

For too many of us, investing is on the to-do list for ‘sometime in the future’. I get it. It’s boring. And complicated. And boring. Still, it doesn’t have to be. In our full Morningstar Guide to Portfolio Construction, we walk through a 5-step approach to getting started. Read it on Morningstar Investor.

Wrap up

It’s easy to drift. Don’t let ‘someday’ never happen. Follow our simple 5-step financial health checklist and start making progress today.