Easy-to-use financial planning software that reduces admin and speeds up advice delivery

Get up and running fast with AdviserLogic – no setup consultants needed.

Already have an account? Sign in.

Spend more time advising clients and less on tools

Rising costs, manual processes, and disconnected systems can slow down advice delivery and directly impact practice growth. Evolving regulations also increase compliance demands and admin pressure – stretching team capacity and making it harder to retain staff.

AdviserLogic streamlines your workflow with modern, interactive digital tools – helping you stay efficient, regulatory-compliant, and focused on client relationships.

Streamline your advice process

AdviserLogic’s digital advice module reduces errors and helps you generate high-quality, compliant advice faster. With an intuitive interface and embedded workflows, you can meet regulatory obligations and free up more time for client engagement and practice growth.

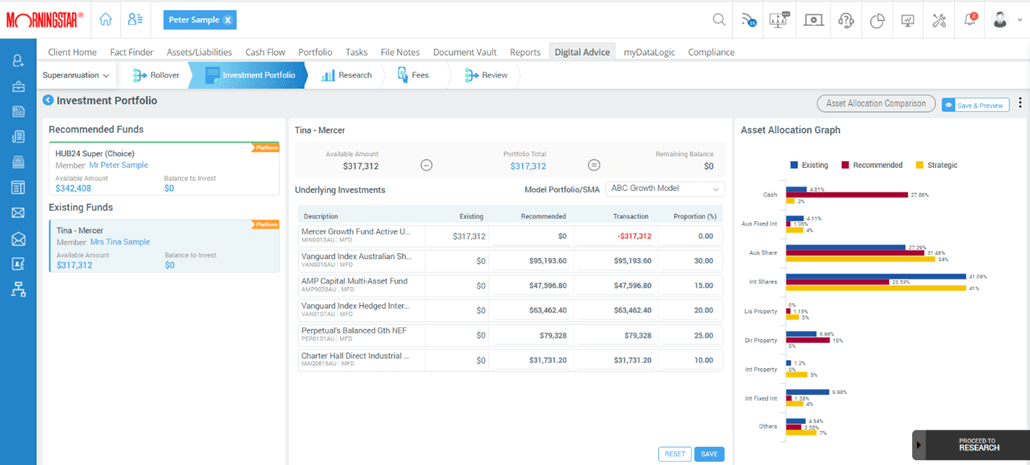

Research and build portfolios

With integrated Morningstar data and research, you can analyse portfolios, research investments, and substantiate recommendations confidently – helping clients reach their goals while meeting evolving regulatory expectations.

Trusted onboarding and ongoing service

Trusted by over 3,500 Australian financial advice professionals, AdviserLogic offers a tailored 45-day onboarding experience without expensive setup consultants or complexity. You also receive ongoing support through dedicated success teams, live training, e-learning, and Ava – AdviserLogic’s AI virtual assistant.

Ready to see for yourself?

Why choose AdviserLogic?

Meet Ava: Your 24/7 AdviserLogic Virtual Assistant

Ava is Morningstar AdviserLogic’s first AI chatbot, designed to instantly resolve your queries and enhance your support experience. Get smart, real-time answers anytime, anywhere – giving you more time to serve clients and grow your practice. And when you need extra help, our friendly support team is just a click away.

How Ava helps you:

• Get instant answers to your AdviserLogic questions - available 24/7

• Fast resolutions that keep you on track, even after office hours

• More time with clients, less time waiting for support

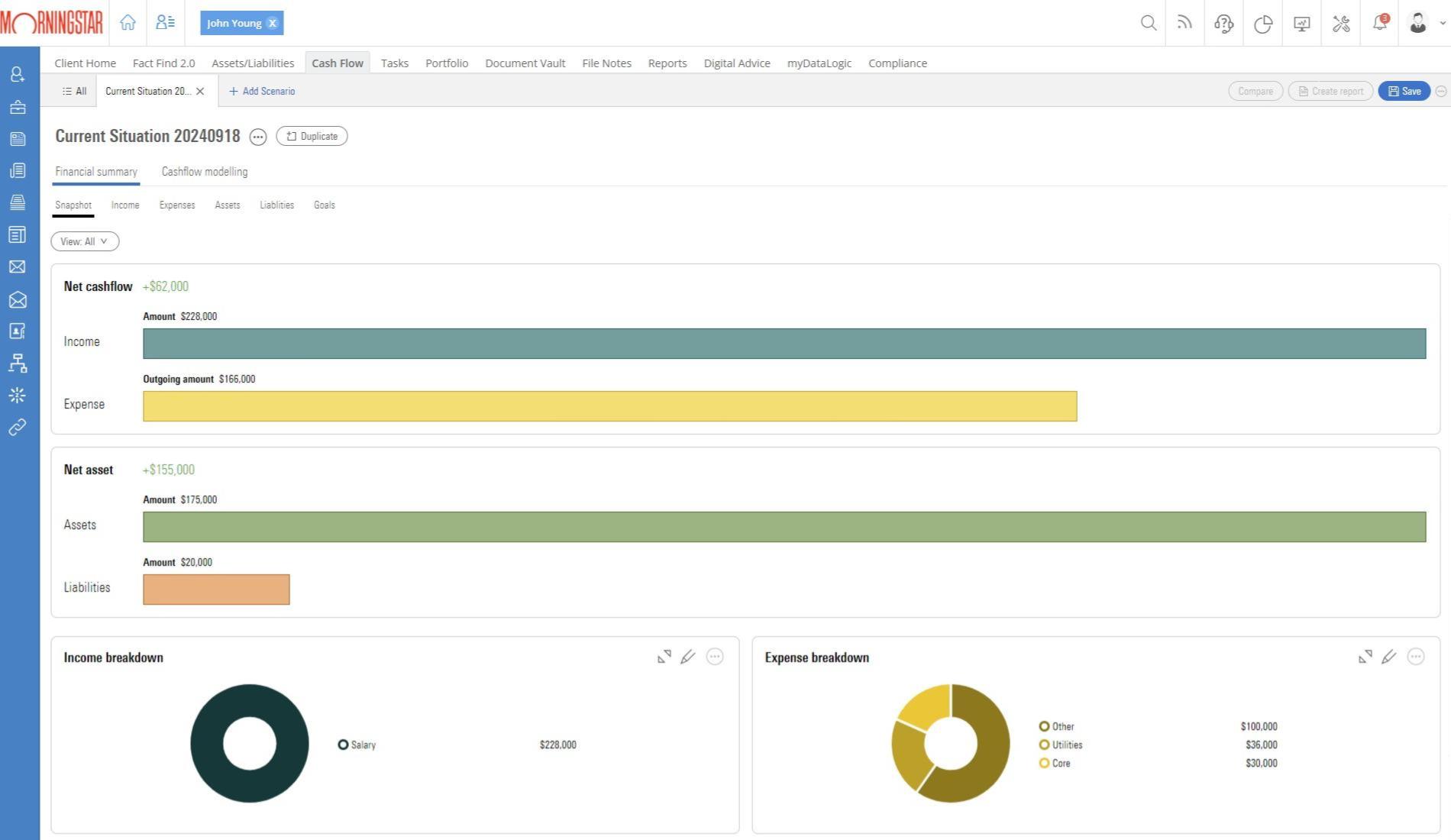

Engaging, Visual Cashflow Modelling

The Holistic Cashflow Modelling module helps you clearly demonstrate a client’s financial trajectory — from their current position to future goals — without the complexity of spreadsheets. This interactive, scenario-based approach builds trust and supports more meaningful, goal-focused conversations from the very first engagement.

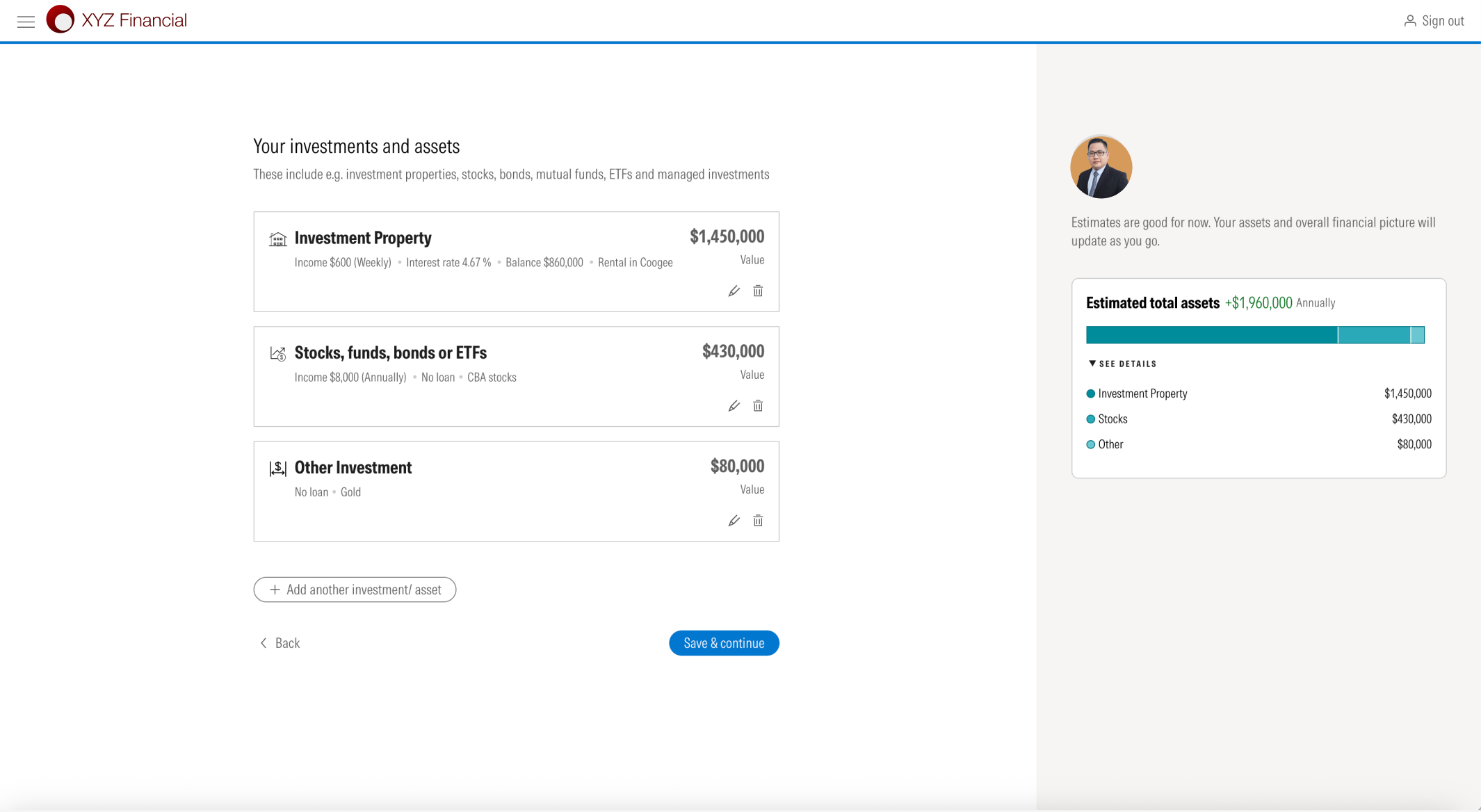

Digital Fact Find

Lengthy, complex forms can be intimidating and are a major reason clients drop off halfway. AdviserLogic’s Digital Onboarding Fact Find takes a different approach to speed up new client onboarding. It starts with a simple, welcoming experience and uses personalised prompts that encourage completion, giving you an accurate snapshot of your client’s financial situation before the first meeting. The Review Fact Find is also a significant time-saver. Clients can visually scan their financial information through a clean, structured summary delivered via a secure digital link. With no paper or email back-and-forth, clients simply update what’s necessary and send it back for the adviser to accept directly into the CRM.

Why clients stay engaged:

• Quick to complete - most clients finish in minutes

• Clean, intuitive design - easy-to-digest, interactive, and mobile-responsive

• Data flows straight to AdviserLogic CRM - no double handling

Efficient, Engaging Advice Documentation

Generate high-quality, compliant advice faster with AdviserLogic. Select pre-built strategies, compare products, and produce clear, client-friendly reports and visualisations. AdviserLogic guides you through required steps to help address compliance requirements, saving significant time in preparing and presenting engaging advice.

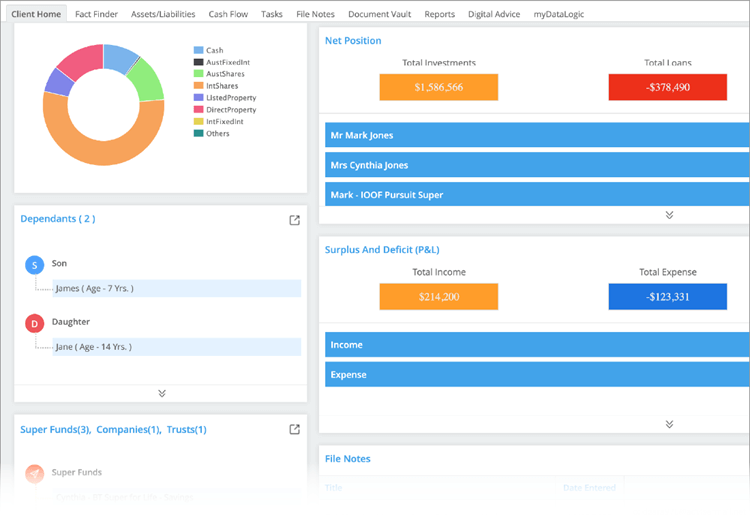

Powerful Technology and Reporting

By combining a modern CRM, streamlined digital advice tools, and integrated Morningstar research, AdviserLogic removes inefficiencies and closes system gaps – helping time-poor advisers work more efficiently, strengthen client relationships, and grow their practice with confidence. You can also integrate data from platforms, funds, insurers, and banks to streamline reporting and stay engaged across your client base.

Built-in Compliance Support

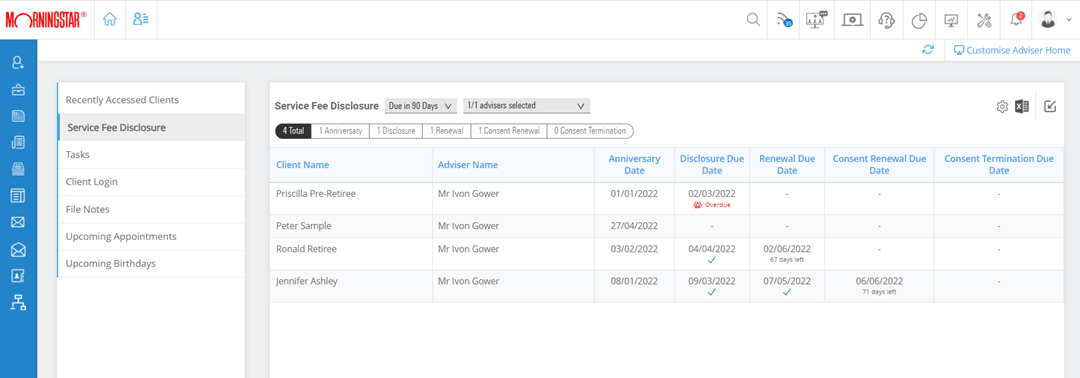

Keep all client records and file notes in one place to simplify and strengthen your record keeping. Integrate service delivery with our revenue management system and leverage Morningstar data and research reports to substantiate your advice with confidence.

Ready to see for yourself?

Get the most out of AdviserLogic

Dedicated Support

Our support teams will guide you through product set-up. Afterwards, they remain available to answer all your questions.

Setting You Up For Success

Get product walk throughs and time-saving tips with regular webinars hosted by our customer success team.

Manage Revenues

Integrate our revenue management feature to efficiently track and monitor payments.

Local Team of Specialists

Maximise your subscription with our team of product, industry and customer success specialists based in Sydney, Melbourne and Brisbane.

Independent Investment Research

Power your practice with a subscription to Morningstar‘s market leading research, recommendations, and reports.

Seamless integrations with your existing systems

Integrate your existing systems and third-party business applications using our open APIs and connect to over 2,000 applications with our Zapier integration. Our platform fully integrates with various third-party data feeds and applications to support the way you want to work.

Data and research

Third party applications

Zapier Integrations

Investment and insurance data feeds

See what our clients are saying about AdviserLogic

Daniel Irving, Director & Principal Financial Planner at Collective Financial Partners

“AdviserLogic has saved us countless hours of data entry and admin, giving us valuable time back with clients. The support we received from the Morningstar team has been outstanding. We love using Holistic Cashflow Modelling because it’s so user-friendly. For anyone thinking about changing their advice software to AdviserLogic, I’d say simply start tomorrow.”

Conaill Keniry, Financial Adviser | Director – What If Advice

"Unfortunately, we spend 80% of our time doing paperwork and 20% of our time actually talking to and helping clients. We were able to use AdviserLogic to do our own plans which really cut down the cost of running a business and enabled us to take control of the full advice process."