Budget 2018: What it means for Aussie investors

An early return to surplus, minor changes to superannuation, and $140 billion in income tax cuts all featured in Scott Morrison’s pre-election budget.

An early return to surplus, minor changes to superannuation, and $140 billion in income tax cuts all featured in Scott Morrison’s pre-election budget.

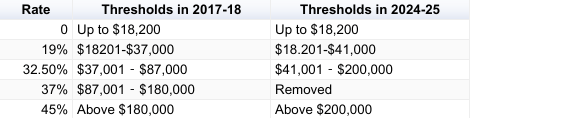

As expected, low- and middle-income earners are the biggest winners, receiving a tax offset of up to $530 per year. Australians earning up to $90,000 will pay a reduced income tax rate of 32.5 percent when the middle-income tax bracket cap increases from $87,000 to $90,000. Higher income earners, including those above the $180,000 top tax threshold will also pay less tax, but will have to wait until 2024 for full relief to come into effect.

A series of changes to default life insurance arrangements and fees are aimed at protecting the superannuation accounts of young people and those with low balances. Individuals with super balances below $6,000, who are under 25 years-of-age, or who have not received a contribution in 13 months must now opt-in to life insurance, instead of automatically receiving cover.

Passive fees will be capped for account balances below $6,000, and all inactive superannuation accounts under this amount will be transferred to the Australian Tax Office (ATO).

Other changes in the Protecting Your Super package include a banning of exit fees across all accounts and a new retirement income framework. This would introduce a retirement covenant requiring trustees to offer comprehensive income products for retirement (CIPRs), and a limited, one-year exemption from the work test for voluntary super contributions for people between the ages of 65 and 74, and with superannuation balances below $300,000.

Also confirmed: an increase the maximum number of allowable members in new and existing self-managed superannuation funds (SMSFs) and small APRA-regulated funds from four to six, from 1 July 2019. The Pensions Loans Scheme, which allows retirees to take out a reverse mortgage to top up their pension, will be extended to cover all Age Pension-eligible Australians.

Small business

The instant tax write-off for small businesses buying assets for under $20,000 will be extended to June 2019, aimed at further boosting business investment. The so-called "instant asset write-off measure" allows businesses with annual turnover of under $10 million to immediately deduct purchases of most assets under $20,000.

The 12 month extension of the offer is anticipated to improve cash flow for small businesses, and boost business activity and investment, according to the budget papers.

Treasurer Scott Morrison outlined a budget deficit of $14.5 billion in 2018/19 - the best result since Peter Costello's last budget - which will narrow to a $2.2 billion surplus in 2019-2020.

Aided by a strengthening economy and the best global growth in six years, tax revenues have been revised up by $8.2 billion for 2018-19 and $12 billion over the four years to 2021-2022.

Treasury is also sticking to its wage growth prediction of 3.5 per cent over three years - well above two per cent now, which is a pace economists have previously described as optimistic.

Tepid response from Australian Chamber of Commerce

The federal budget has drawn a luke-warm response from the business sector, with a key lobby group welcoming tax cuts but criticising the government's reliance on rising tax receipts.

Australian Chamber of Commerce and Industry CEO James Pearson says the budget is "heading in the right direction but business would have liked more ambition for long term budget repair".

"Overall this is a positive budget - but it leaves Australia more exposed than we would like to any deterioration in the global economic environment," Mr Pearson said in a statement.

SMSF Association welcomes red tape removal

SMSF Association CEO John Maroney welcomed the Budget's proposal to reduce the annual audit requirement to once every three years for SMSFs with a good compliance history.

He says it is a "fitting reward for trustees who strictly adhere to the regulatory regime". However, Maroney adds that it’s a strongly held Association position that an independent audit is essential to the integrity of the sector, and as such “we keenly await the implementation details of the proposal”.

According to Maroney, this proposed change in auditing procedure for SMSFs, when coupled with the expansion of SMSFs from four to six members, and the digital rollover measure announced earlier, help to cut red tape and improve flexibility for SMSF trustees.

"This continued regulatory stability for SMSFs is welcomed by the Association and is sorely needed as trustees still come to grips with the superannuation tax changes that took effect on 1 July 2017.

"We look forward to a much-needed period of stability for superannuation and working through the implementation of the superannuation changes with the Government and regulators.

"Capping fees on low balance superannuation accounts and introducing opt-in requirements for insurance in superannuation for certain fund members are positive measures that will ensure younger superannuation fund members do not have their account balances eroded unnecessarily."

Maroney believes older Australians would benefit from the budget's proposed expansion of the Pension Work Bonus program, the enlarging of the Pension Loans Scheme to include people on the full-age pension and self-funded retirees, and granting a one-year superannuation work test exemption for recent retirees with balances under $300,000.

"These measures are welcomed by the SMSF Association for providing more flexibility for older Australians to manage their retirement."

CPA Australia wants details

Accounting industry body, CPA Australia, is keen to learn details of the Federal Government's assumptions around additional revenue, which would fund the personal tax cuts and increased spending on infrastructure and aged care.

"The Budget includes a raft of income tax, GST and superannuation changes that will impact individuals, businesses and super funds.

"The government’s seven-year personal income tax plan promises much over a new glide path similar to the 10-year Enterprise Tax Plan. But, like the company tax cuts, the question is whether this plan will garner the support it needs to get through the parliament," says CPA Australia head of policy, Paul Drum.

New tax thresholds in 2024-25

Source: Budget Documents

Source: Budget DocumentsHe notes the ATO would receive additional funding to improve individual taxpayer compliance. "No doubt some of this will be for education and enforcement initiatives to address the overclaiming of certain work-related expense claims by individuals.

“For smaller businesses, the instant asset write-off has been extended for another year which is welcome, although it would be preferable that this measure be made a permanent feature of the tax system to help small businesses with their planning,” Drum says.

The Budget outlines measures, such as new compliance obligations for certain businesses. This extends the taxable payment reporting system to security and investigation services, road freight transport and computer design and related services. A new $10,000 cash payment limit will be introduced, which will apply to business payments.

"Related to the work of the black economy taskforce, there are to be tougher rules for illegal phoenixing activities, including increased liabilities for directors.

KPMG says small R&D firms disadvantaged

Companies will look outside Australia to invest in innovation and research if the government's new restrictions on tax rebates are legislated, according to KPMG.

The government has capped the amount companies can be refunded under its Research and Development Tax Incentive (R&DTI) scheme in a measure that will save an estimated $2.4 billion over the next four years, AAP newswire reports.

There will be a $4 million cap on cash refunds, and a sliding scale introduced under which increases in rebates are linked to how much a company spends on R&D as a proportion of its total expenditure.

The measures will deny thousands of companies R&D claims and force companies to consider relocating their research to countries with more attractive incentives, such as Singapore and New Zealand, says KPMG.

"Australia's destination as a desirable location to invest in R&D will be extinguished if these austerity measures are legislated," says the accounting firm.

While hurdles have been raised, the government has also increased the maximum amount of expenditure eligible for tax offsets from $100 million to $150 million.

The $4 million cap, due to start from July 1 this year, does not apply to spending on clinical trials – a measure likely to allay industry fears that trials may have been forced offshore.

The government on Tuesday said a $4 million cap on cash refunds will continue to provide "generous support" for small, innovative Australian companies and will contribute $2.4 billion to the budget over the next four years.

Under the current incentive introduced in 2009, a company can claim back 43.5 cents of every dollar spent on medical research.

According to biotechnology industry body, AusBiotech, 17 per cent of ASX-listed medical technology and pharmaceutical companies that claim refunds have already reached the $4 million cap, while another 9 per cent are in the "danger zone".

The overhaul comes after a 2016 review of the R&DTI found the program was "failing to meet its objectives" of encouraging research and development and generating the flow-on benefits for the Australian economy.

The cost of the rebate scheme was expected to be $1.8 billion per year when it was introduced in 2011/12 but in 2016/17 it cost around $3 billion.

More from Morningstar

• Make better investment decisions with Morningstar Premium | Free 4-week trial

Emma Rapaport is a reporter for Morningstar Australia.

© 2018 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. This information is to be used for personal, non-commercial purposes only. No reproduction is permitted without the prior written consent of Morningstar. Any general advice or 'class service' have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), or its Authorised Representatives, and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Please refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a licensed financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782 ("ASXO"). The article is current as at date of publication.