Investing basics: 5 steps women can take to improve their retirement readiness

The data are sobering about women's retirement preparedness but being pre-emptive can help stave off a shortfall.

Additional reporting from Emma Rapaport, editor, Morningstar Australia

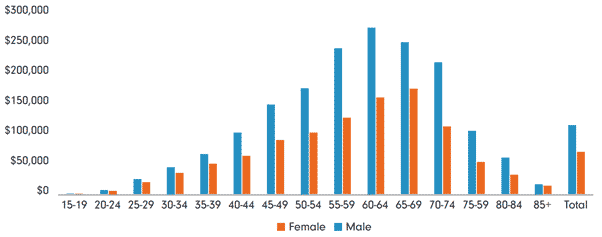

Women's superannuation is not so super. At retirement, Australian women on average have $157,050 whereas men have $270,710 – a gap of $113,660, according to data released by the Association of Superannuation Funds of Australia in 2018.

The gap between women and men extends to younger cohorts too. Women aged 30-34 have balances of $33,750, whereas men have $43,580. The gap is closing, albeit slowly.

The superannuation gender gap

Source: Association of Superannuation Funds of Australia

The reasons are manifold, but a few factors loom large. Women have lower lifetime earnings than men, due to wage inequality, a reluctance to negotiate for better pay and the fact that women are more likely to stop working or maintain a reduced schedule to devote time to caregiving for children, elderly parents, or both. Women in Australia earn an average of 14.6 per cent less than men, and in full-time roles that number rises to 22.4 per cent, according to the Financy Women's Index.

In addition, women must stretch those smaller average balances over a longer time frame in retirement as 65-year-old women outlive their male counterparts by two years, on average. That convergence of lower retirement balances and a longer retirement period helps explain why women are much more likely than men to be poor in retirement.

There’s no easy fix for the problem, but women should consider the following steps to help stave off a shortfall.

Take control of your retirement savings

Many Australians have no idea if they have a super. And if they do, they most likely don't know which fund they're with. In fact, more than 40 per cent of Australians have several superannuation accounts which are collectively costing us more than $1.96 billion in fees each year, according to consumer advocate Choice – fees which may well be unnecessary.

MyGov and the the tax office have made it simple for savers to discover how many super accounts they hold and consolidate. Consider transferring all your savings into one fund. This will help stop multiple fund fees from eating into retirement savings. And while you're there, take some time to understand exactly how much you're paying in fees, where your funds are invested, what insurance you hold, and your fund's long-term performance.

Related article: Investing basics: 3 easy steps to sort your super

Maximise contributions before, during, and after work disruptions

Much of the gender gap in lifetime earnings, and in turn retirement savings, is because women are much more likely than men to cut back on paid work or quit altogether to care for children or other family members.

Those life decisions are about more than money, and women don’t always have complete control over their employers or the duration of caregiving responsibilities. But to the extent that it is possible, women who anticipate that their work trajectories could be affected by caregiving should prioritise employers with family-friendly policies such as paid parental leave and flexible work hours.

The data also show that women’s earnings tend to peak earlier than men’s, no doubt in part because of caregiving responsibilities for many. That accentuates the merits for women taking advantage of the concessional (before-tax) tax treatment on additional super contributions. In addition to compulsory payments by your employer, these contributions could include salary-sacrifice payments or further amounts paid to super by your employer before tax.

Get off the sidelines

Research on women’s investing behaviours is all over the map: Studies have pointed to women investing more conservatively than men, trading less, being more patient, or being more goals-oriented. Other research indicates that once you control for income, women’s investing behaviour is very similar to men’s.

A few findings are consistent, though. One is that women tend to be more reticent to get their money invested. As Sallie Krawcheck, CEO and co-founder of the Ellevest investing service for women, put it, “Our rival is really cash. You know, that's our biggest competition. It's cash and inertia.” That tendency, combined with the fact that women live longer than men, on average, contributes to the likelihood that women will have a shortfall in retirement.”

Work longer

Many factors affect how long we’ll work--lifestyle and health considerations, as well as being able to stay employed and caregiving obligations. The fact that our retirement dates may be out of our control is why Morningstar contributor Mark Miller has referred to working longer as “a worthy aspiration, not a retirement plan.” And research from Morningstar Investment Management head of retirement research David Blanchett indicates that retirees who expect to work longer are often unable to do so. Our retirement dates are less in our control than we might like to believe.

That said, the financial (and possibly other) benefits of working longer are undeniable: Additional retirement-plan contributions, delayed portfolio withdrawals, a shorter drawdown period can all help bolster the viability of a retirement plan. The benefits of delaying retirement are especially great for women, in that interrupted work trajectories (for caregiving, see above) and longer life expectancies compound the stresses placed on retirement assets. For women hurtling toward retirement shortfalls, delaying retirement will be the single-most financially impactful decision they can make. That’s just one reason for maintaining work skills through investments in continuing education, combating ageism, and investing in physical health.

It’s also worth noting that “working longer” doesn’t necessarily mean sticking it out in a job that makes you miserable. If you can tick a couple of the working longer benefits outlined above--for example, delaying portfolio withdrawals even if you aren’t earning enough to make additional retirement plan contributions--that can still improve your plan.

Lay a plan for healthcare costs

Because of their longer life expectancies, women have higher lifetime healthcare outlays than men and a greater need for paid long-term care. Women are often the caregivers for their spouses; when their spouses predecease them, they require paid long-term care at a greater rate.

That accentuates the virtue of maximising retirement savings, of course, but women can take additional steps to ensure that high healthcare and long-term-care costs don’t imperil the sustainability of their retirement plans.

Related article: 4 steps to address the missing link in retirement planning