3 Aussie stocks with strong China ties

Hit by coronavirus and strained relations between China and the west, a trio of companies with large Asian exposure have had mixed fortunes in fiscal 2020.

Already-strained relations between China and western nations, including Australia, have escalated in recent months. This affects many large multi-national companies that are already struggling in the wake of pandemic lockdowns and travel bans.

In April, China increased tariffs on Australian barley and banned imports of beef from several large local suppliers in response to Australian Prime Minister Scott Morrison’s calls for an independent inquiry into the origins of COVID-19.

This was followed soon after by a China Ministry of Culture and Tourism alert urging citizens not to travel to Australia.

Among locally-listed companies with the largest exposure to China – outside of mining conglomerates – three companies stand out. Each of these companies count sales into China as a considerable driver of revenue.

Treasury Wine Estates (ASX: TWE)

Economic Moat: None | Morningstar Rating: 3-star | Price-to-Fair-Value: 0.90

Treasury Wine Estates, a global wine company that increasingly targets high-end consumers, benefited from a drop in the tariffs China imposed on Australian winemakers in the first half of 2019, at the same time as US wine exports to the country fell sharply.

Asia comprises around 45 per cent of group profit, and more than half of this comes from China.

But earlier this month preliminary fiscal 2020 results indicated full-year earnings growth would be down 21 per cent on 2019, to between $530 million and $540 million. This is far below management’s earlier projections for growth of between 15 and 20 per cent, and a January 2020 revision that forecast growth of between 5 and 10 per cent.

Fleck expects China sales to rebound back to low single-digit growth after falling 50 per cent in February and March versus a year earlier.

“While we’ve reduced our outlook for fiscal 2021, we continue to expect Treasury to enjoy top-line revenue rebounding to more than $4 billion in fiscal 2024 — $2.9 billion in 2019 — and adjusted operating margins of 28 per cent surpassing management’s aspirational target of 25 per cent,” he says.

The company is due to post full-year results on 13 August. Treasury shares have fallen more than 30 per cent since 1 January amid a wider market downturn from the coronavirus pandemic.

A2 Milk (ASX: A2M)

Economic Moat: Narrow | Morningstar Rating: 2-star | Price-to-Fair Value: 1.31

New Zealand-based milk and infant formula company A2 Milk has long been linked with Chinese consumers, especially in connection with professional "daigou" shoppers who legally buy the milk powder to sell overseas.

Infant formula comprises around 90 per cent of group earnings, and the same proportion of this business comes from China.

“As of the end of April, we’ve seen pretty good demand through this period,” Fleck says. This has been driven by consumers, particularly those in China, gravitating toward the brands they know and trust during the pandemic.

“Reported earnings are good, and margins are likely to be better than they were,” Fleck says.

Chinese regulatory changes introduced last year had already seen the daigou channel — literally, “those who buy for others” — slow markedly. Travel bans introduced to slow the spread of coronavirus have seen this dry up completely in recent months.

Fleck expects the improvement in sales driven by coronavirus to unwind over the medium term. “We view pantry stocking as pulled-forward demand for A2’s infant formula product, not a sustainable lift in long-term growth, and we’ve reduced our anticipated fiscal 2021 revenue growth rate to 18 per cent from 22 per cent,” he says

Trading at $19.50 at Wednesday (22 July) 3pm, A2 Milk shares are currently priced almost 30 per cent higher than Morningstar’s $15.20 fair value estimate.

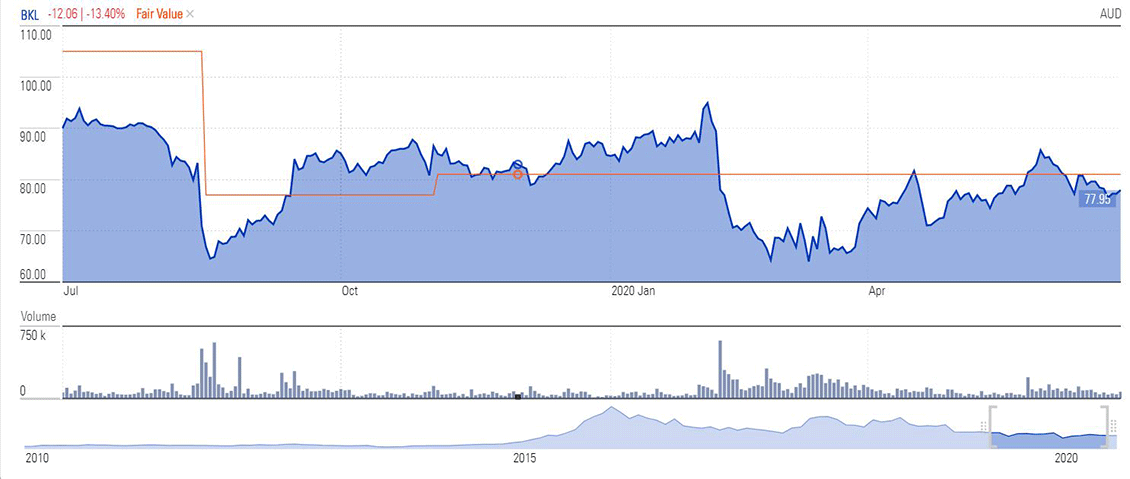

Blackmores (ASX: BKL)

Economic Moat: Narrow | Morningstar Rating: 3-star | Price-to-Fair Value: 0.94

Vitamin maker Blackmores also relies heavily on China, which comprises around 25 per cent of group revenue, but this exposure has been declining.

“They’d like to grow their presence in China, but they haven’t been able to successfully navigate the regulatory environment there,” says Morningstar healthcare equity analyst Nicolette Quinn.

The drying up of the daigou channel is partly responsible for reduced sales into China, but there are also other reasons for Blackmore’s lacklustre profit guidance ahead of its fiscal 2020 results.

“A whole lot of things feed into that guidance, including Blackmores vertically integrating for the first time and a rebranding campaign,” Quinn says.

“They essentially guided to making no profits in the second half of this year.”

But Quinn expects fiscal 2020 to be the trough of the turnaround, projecting relatively strong growth from this point over the next two to three years.

Trading at $73.86 at Wednesday (22 July) 3pm, Blackmores’ shares are currently slightly below Morningstar’s $81 fair value estimate.