AGL's share price is in the doghouse. Can it make a comeback?

The fall in power prices, consumer discounts and renewable supply are heaping pressure on the narrow-moat generator.

Rock-bottom wholesale electricity prices, gas prices on the nose, and an influx of cheap renewable energy to the grid. Aussie energy generation and retailing powerhouse AGL Energy (ASX: AGL) has had a shocker of a year.

Net profits (NPAT) fell 27 per cent to $317 million in the first half. The company outlined a statutory loss of $2.3 billion which included a hefty write down of $2.69 billion. With a tough outlook, management is focused on reducing operating costs and sustaining capital expenditures.

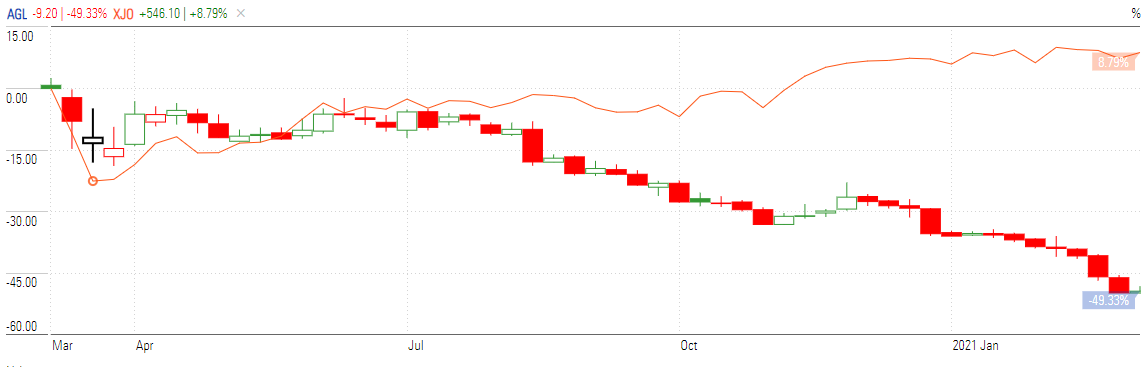

Investors have felt the effects. Shares have been on a downward trajectory since early 2020, dropping almost 50 per cent over the last year from around $20 to $9.4 today. Over the same period, the S&P/ASX 200 index is up almost 8.8 per cent. "What's happening with AGL?," a viewer asked at Morningstar's reporting season wrap webinar on Tuesday.

Morningstar senior equity analyst Adrian Atkins attributes the company's tough result to a significant fall in wholesale electricity prices, under pressure from falling gas prices, government initiatives to reduce consumer utility bills and new renewable energy supply coming onto the market.

AGL Price v Market | 1 Yr

Frequency: Weekly

Source: Marketmonitoring.morningstar. Data as at 02/03/2020

"Everyone panicked when wholesale prices were sky high," Atkins says. "A heap of developers started building their renewable (solar and wind) farms, rooftop solar fed back into the grid, and government got involved as well, subsidising renewable energy. All of this put a lot of downward pressure of prices.

"For AGL, the drop in price weighs heavily of their profit margins."

Challenging conditions

Another major factor was a drop in gas prices, which affected the cost of running a gas-fired power station, Atkins says.

"When the wind is blowing and the sun shining that depresses the wholesale price, but then when it's not, usually you get a price hike. However, that hasn't really been happening because the gas price is so low, so they just fire up some gas-fired power stations if they need it.

"For generators, either there's a heap of renewable energy, or even when there's not, there's heaps of gas around.”

Wholesale electricity prices have plunged in recent years, from well over $100 per megawatt hour in early 2019 to under $35 MWh in most major states now. AGL chief executive Brett Redman told the market in August that wholesale prices had been tipped to fall for some time, but that covid "meant it came down a lot quicker".

The AGL stock price, Atkins says, has broadly tracked in line with the wholesale electricity prices which traded at their lowest levels in five years in June 2020. He believes these headwinds are likely to keep AGL's earnings falling into fiscal 2023.

Source: ASXEnergy.com.au

Long-term view

Atkins believes there are reasons for investor optimism. Wholesale prices, he says, should rally back toward $80 over the next decade. “The futures market expects low prices to continue for the medium term, but we have a more positive outlook and expect electricity prices to return to $80 per MWh over the next decade,” he says.

His positive outlook is based on several factors:

"I think there'll be fewer wind and solar farms coming on the market. There's no incentive to bring on new power stations when the wholesale price is in the toilet.

"I also think new renewable generation supply will be largely offset by closure of ageing power stations, keeping demand and supply in balance.

"And more importantly, we expect rising gas prices to raise the floor price that gas-fired power stations are willing to operate at.”

Beaten-down Australian utilities look attractive

And higher gas prices will likely help electricity prices, Atkins argues. The domestic gas market is likely to start tightening from 2024 as Victorian gas fields deplete and Asian demand absorbs excess global LNG supply.

"What we need to see, and what I'm expecting, is the gas price to go up," Atkins says.

"Victoria has some gas fields that are depleting over the next three to four years. It looks like they're going to have shortages and have to start importing it from someone else – Queensland or LNG (overseas).

"To do that, you'd assume the gas price has to go up. As long as we get a higher gas price, then all those gas-fired power stations have to start demanding more money. It will still be a depressed price when the solar and wind farms are working, but when they're not, it should be a much higher price and that will bring the average up.

"There are difficult conditions in the near term, but I think improvements will play out over the next three to four years.”

AGL is currently trading at a 44 per cent discount to Morningstar's $17 fair value estimate, or within a 5-star range.

Energy transition looms large

But what about the long-term? Morningstar's head of equities Peter Warnes says AGL has weathered a lot of changes in the almost 30 years since he has been covering it, but that today it's facing its biggest test as the speed of change catches up to the aging generator.

"Climate change and how we as a nation generate our power…as far as the jury is concerned, they've all voted saying there's no such thing as coal-fired base power," Warnes told investors during Tuesday’s webinar. "It's all going to be solar and wind."

Warnes believes a time where solar and wind are the base load power source is still "decades away". "We still need coal, fortunately or unfortunately".

Atkins says AGL is between a rock and a hard place. He notes the company has some exposure to renewable energy but that incentives to grow their renewable operations are limited.

"They've sold wind farms and buy the power off the operators under long-term contracts," he says. "They've also invested in a fund they established in partnership with QIC called the Powering Australian Renewables Fund.

"The question is are you going to make money out of that and at these prices? You're not," he says.

"There is a huge amount of competition in the renewables space and AGL don't really have any competitive advantage.

"People are more likely to lose money investing in renewable energy at the moment. Plus, governments are incentivising new players to bring on generation, as opposed to the big guys."

Warnes advises investors "to be patient" and wait for prices to rebound.

"AGL is in a situation where wholesale electricity prices are low, low, low. They've got a big generation operation through their coal mines and a couple of wind power operations," he says.

"They're making money in the retail operation but losing money in the generation. Back a year and a half ago it was the exact opposite. Wholesale prices were through the roof and retail was ok.

"The franchise is still very powerful. They've got a very, very strong market share between themselves, Origin and Energy Australia (looking at the east coast).

"They're trying their luck with telcos and what have you, but I still think they'll be a big energy company for a quite a while."

AGL management has flagged a potential corporate restructure, with more details to come at the investor day later this month. Atkins believes AGL may be considering separating its generation and retail businesses to ring-fence perceived risk from its thermal power stations.