AMP Capital demerger draws a line under recent events: Morningstar

The move is a chance for the 172-year-old wealth group to put an unpleasant past behind them, says Morningstar analyst Shaun Ler.

Mentioned: AMP Ltd (AMP)

Lemony Snicket’s ‘A Series of Unfortunate Events’ spanned 13 novels. The AMP saga hasn’t hit thirteen yet, but it’s not for lack of trying.

A damning Royal Commission, the exit of chief executive Francesco De Ferrari —who oversaw multiple senior departures and a 50 per cent collapse in the share price— an internal revolt by female staff to sack the man at the centre of a sexual harassment controversy, and now a failed takeover deal with Ares Management.

Today’s announcement of the demerger of AMP Capital and its listing on the ASX in twelve months starts the next chapter.

The action will create two businesses, AMP Limited, a retail-focused wealth management, investment and banking group, and Private Markets, an investment manager focusing on infrastructure equity, infrastructure debt and real estate. AMP will retain a 20 per cent stake in private markets, and existing shareholders would receive shares proportional to their existing shareholding.

“The Private Markets business operates in growing, global markets in which investment management talent and strong client relationships are critical,” said AMP chair Debra Hazelton in a statement on Friday.

“While AMP Australia and New Zealand Wealth Management share the same commitment to clients, they are predominantly domestic businesses focused on wealth, banking and investment solutions for retail customers.”

Morningstar equity analyst Shaun Ler thinks the demerger draws a line under the recent events that have plagued management and the investment team, allowing them to move forward and grow.

“When they’re together, AMP Capital can’t go out there and win new mandates and money because people are concerned about what will happen with top management,” says Ler.

“The Australian wealth management business is turning things around, they are getting good flows in their top performing platform, but these scandals mean people don’t see it, and management can’t focus.”

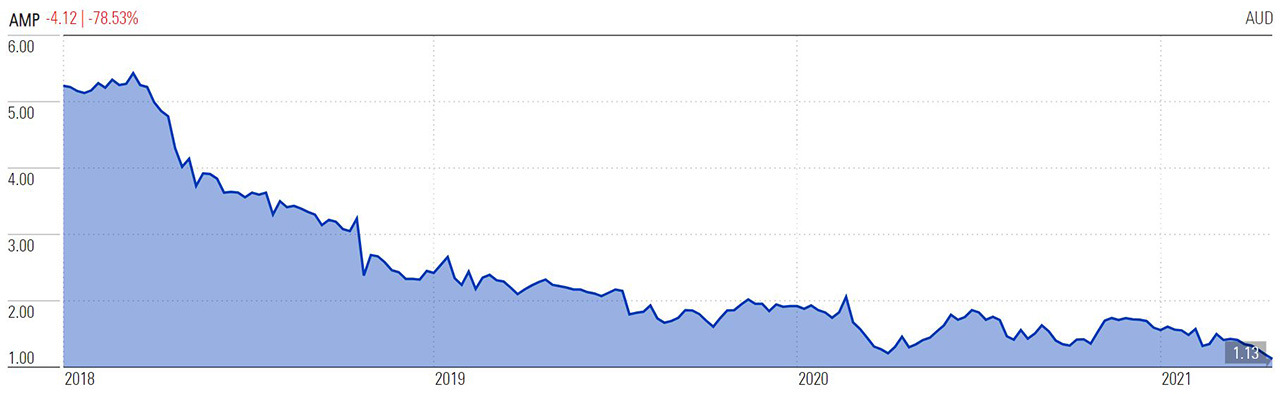

No-moat AMP (ASX: AMP) closed Friday $1.14, a 30 per cent discount on Morningstar’s fair value estimate of $1.60. The price was down 1.7 per cent from the opening bell.

AMP's dwindling share price (since Jan 1 2018)

Source: Morningstar Premium

Today’s news follows the April 1 announcement of chief executive Francesco De Ferrari’s departure, his tenue ends 1 July.

His plan to sell AMP Capital to US-based Ares Management was first watered down to a 60 per cent joint venture, before finally being rejected in favour of today’s demerger and listing.

“We have had substantial and constructive discussions with Ares regarding a sale, however, we have not been able to reach an agreement that would deliver appropriate value for our shareholders,” says Hazelton.

Value left in the business

Ler thinks the demerger will prove to be better value for AMP shareholders.

“It is better for AMP to spin off AMP capital and let the market dictate its value instead of fire selling the asset at an unattractive price,” says Ler.

The troubled head of AMP Capital’s Global Head of Infrastructure Equity, Boe Pahari, will leave as part of the demerger. He has been under a cloud of controversy since the AFR revealed the firm had settled a sexual harassment complaint against him.

The Board also announced it will restart a share buy-back of up to $200 million.

The news follows yesterday’s Q1 cashflow update. Both Australian wealth management and AMP Capital recorded net cash outflows, although down from Q1 2020. AMP Capital had external net cash outflows of $1.3 billion.

Ler is positive on the company's new term outlook following bouts of large adviser departures and sharp margin compressions play out over 2021-22. No leads on AMP's new corporate strategy were provided, but he expects newly instated chief executive Alexis George to continue the path of simplification.

"Adviser numbers and products on offer will likely shrink, cost-outs pursued and dividends may be limited in the near term to facilitate greater investment," he says.

"We forecast Australian Wealth Management to return to earnings growth after 2023 as its platform simplification completes, the adviser network stabilises, and net inflows likely resume."