Aussie airlines are ready for take-off, says Morningstar

We think shares in Qantas screen as attractive despite persistent lockdowns and travel bubble suspension.

This is a snippet from Angus Hewitt's report on Australia's airline sector. The full research report is available on Morningstar Premium.

The virus continues to wreak havoc on the global airline industry. Lockdowns, border restrictions, and social distancing measures have clipped the wings of airlines globally. And the restrictive approach to handling the pandemic has meant the recovery in air travel in Australia and New Zealand significantly trails most of the world.

However, we believe there is still plenty of runway left for both Qantas (ASX:QAN) and Air New Zealand (ASX:AIZ) despite share prices recovering strongly since the depths of pandemic-induced pessimism. They're both trading at discounts to our fair value estimates.

With the ongoing outbreak in Sydney, and suspension of the trans-Tasman travel bubble, the near-term outlook for airlines is bleak. We've lower our near-term earnings forecasts for both firms amid the ongoing outbreak in Sydney and the trans-Tasman travel bubble has been temporarily shut.

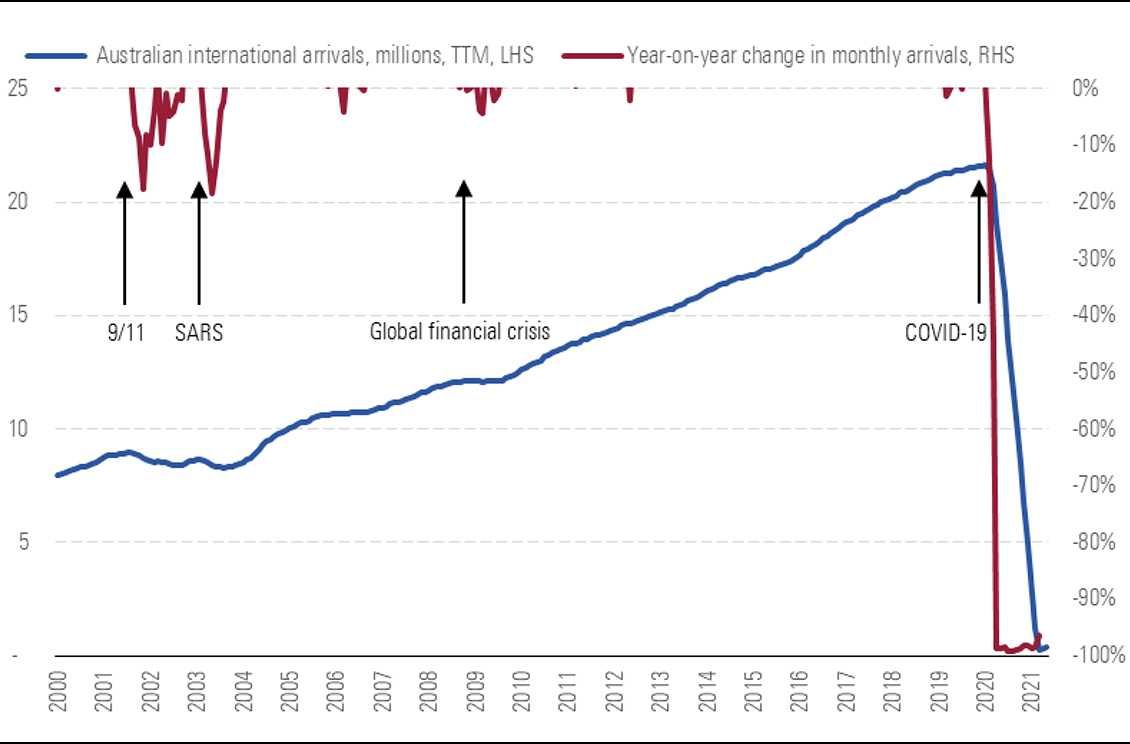

Prior demand shocks pale in comparison to COVID-19

Source: Australian Bureau of Statistics, Morningstar

But we maintain these are short-term issues. While investors and travellers could be forgiven for experiencing a little déjà vu, we anticipate lockdowns will become a thing of the past as the vaccine rollout progresses. The road map for air travel demand recovery is highly volatile, and although it will likely prove lumpy in reality, we expect pent-up demand to flow through as domestic restrictions gradually ease. We expect both firms have enough financial headroom to ride out the near-term turbulence and we see Qantas and Air New Zealand well-positioned to thrive in their respective markets as skies reopen.

Qantas' fourth-quarter fiscal 2021 domestic capacity was running close to 95% of pre-COVID-19 levels, from around 20% in the months of July and August 2020, and we estimate fiscal 2021 domestic capacity to reach around 60% of pre-COVID-19 levels on a full-year basis. Air New Zealand's domestic business recovered quicker, with fiscal 2021 capacity averaging 77% of pre-COVID-19 levels. We expect the international recovery to be more gradual and forecast negligible capacity for both airlines in fiscal 2021.

We expect international capacity to recover to pre-COVID-19 levels by fiscal 2024

Proportions of pre-coronavirus capacity, measured by available seat kilometres, or ASKs

Source: Company filings, Morningstar estimates

We think current share price weakness presents a good opportunity for long-term investors to look through the volatility and purchase these shares at a discount. The recovery of air travel will prove highly volatile, and we forecast international capacity not recovering to fiscal 2019 levels until fiscal 2024 for both airlines in our base case. But there is potential valuation upside should pent-up demand and the vaccine rollout lead to a quicker recovery in international flying.

We think much of the downside risk is already priced in. We expect the duration of the downturn is limited by the vaccine rollout as lockdowns and border restrictions become increasingly unnecessary, and balance sheet strength is sufficient such that Qantas and Air New Zealand can ride out potential lockdown extensions, avoiding material destruction of shareholder value.

But the roadmap will likely prove turbulent

We expect the recovery of air travel will prove highly volatile, and maintain our very high uncertainty ratings for Qantas and Air New Zealand.

We anticipate caution from travellers given potential health concerns of air travel, economic pressure following the end of JobKeeper in Australia, and ongoing uncertainty from COVID-19-related border closures. We also anticipate corporate travel to be more muted over our forecast period as video conferencing alternatives have become viable substitutes for many in-person meetings.

We expect competition will remain intense. Airlines globally lack economic moats for the following reasons: a long history of value destruction; a business model not conducive to rational pricing; lack of barriers to entry; the commoditisation of air travel; and low switching costs coupled with growing price transparency. We believe these conditions will persist.