Avita price spikes on fourth-quarter revenue upgrade

A return to normal has increased the incidence of burns and that means business for the spray-on-skin maker.

Mentioned: AVITA Medical Inc (AVH)

Morningstar analysts have maintained their fair value estimate for spray-on skin company Avita Medical (AVH) following an upgrade to its fiscal 2021 revenue guidance.

The dual-listed company lifted its fourth-quarter fiscal 2021 revenue guidance by 14 per cent to a revised range of US$9.5 million – US$9.7 million two weeks out from the fiscal year-end.

The revised guidance implies roughly 32 per cent sequential top-line growth in fourth-quarter fiscal 2021 over the more disappointing third quarter.

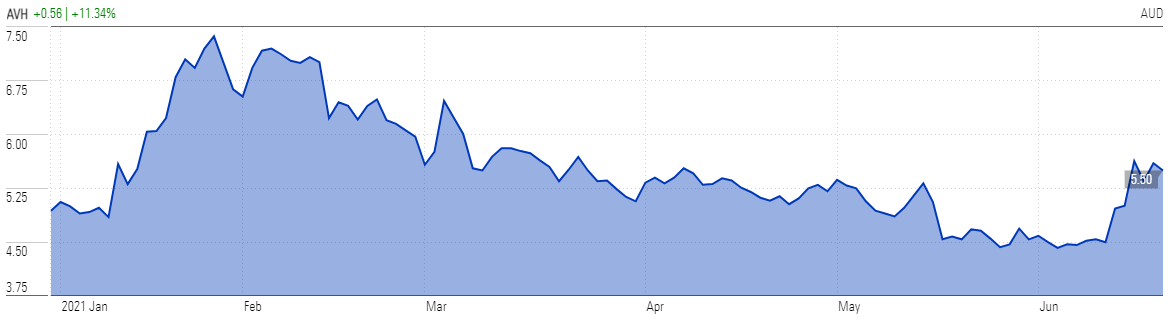

The news sent shares soaring 14 per cent as investors applauded the upgrade. After being on a downward trajectory since late January, shares are up 28 per cent since 10 June.

At last close of $5.50, Avita screens as undervalued for long-term investors, trading at a 21 per cent discount to Morningstar's $7.00 fair value estimate.

Avita Medical (AVH) | Price Chart YTD

Source: Morningstar

The new guidance range is made up of roughly US$6.1 million in RECELL commercial revenue and US$3.5 million in revenue associated with the Biomedical Advanced Research and Development Authority (BARDA), similar to government funding.

The upgrade follows earlier news of early approval of the spray-on-skin RECELL System for the treatment of excessive turns and paediatric patients.

Morningstar analyst Shane Ponraj now forecasts the company will report a US$28 million net loss for fiscal 2021, down from US$29 million previously, but retains his long-term estimates. He still expects Avita to burn cash until fiscal 2025 but anticipates no additional funding requirements in the lead-up to posting its first profit in fiscal 2024.

MORE ON THIS TOPIC: Avita still undervalued despite downgrade

As expected, the incidence of burns continues to normalise in the US, with more of the population returning to normal activities due to effective vaccination rollout.

"As people begin to return to normal activities after the confines of the covid-19 pandemic, we have seen an increase in burn accidents requiring treatment with the RECELL System in burn centres across the country," Avita Medical CEO Mike Perry said in an ASX statement.

In the near term (fiscal 2022), Ponraj anticipates reimbursement support for RECELL use outside of burn centres, and regulatory approval in Japan to begin distribution with its partner, Cosmotec. Longer-term, he expects the use of RECELL in vitiligo treatment and soft-tissue reconstruction to begin commercialisation in fiscal 2024 and fiscal 2025, respectively.

Morningstar's fair value uncertainty rating remains at "very high". Fourth quarter financial and operating results are expected on 25 August.