Covid, competition and costs weigh on Telstra

Morningstar has cut its fair value estimate for the telco, whose 13pc fall in profit caps a year marked by twin crises.

Mentioned: Telstra Group Ltd (TLS)

Competition, delays in cutting costs and a potential $400 million bill from the coronavirus.

The reception is fuzzy for Telstra, says Morningstar’s Brian Han, who has trimmed his fair value estimate for Australia’s dominant telco for the first time in two years following its 13 per cent per cent fall in profit.

Since June 2018 Han has held a fair value estimate of $4.40 for Telstra (ASX: TLS) but despite what he sees as satisfactory earnings results, other factors have forced him to cut his fair value estimate by 14 per cent to $3.80.

“Management's near-term outlook is weak,” Han said in the wake of Thursday’s result, “with the midpoint of the fiscal 2021 total EBITDA guidance of $7.2 to $8 billion 11 per cent below our prior expectation.

“While it incorporates an estimated hit of $400 million from coronavirus, a recoup of that damage beyond fiscal 2021 is highly uncertain.

“A likely long-dated return of high-margin international roaming revenue, hiccups in the cost-out initiatives, and a stubbornly competitive landscape are all likely weight on earnings beyond fiscal 2021, necessitating an average 14 per cent reduction to our forward earnings forecasts.”

Han says that while work-from-home orders may boost demand for Telstra’s services in the short-term the return is unlikely to be significant and may be offset by higher servicing costs.

“However, in a relative sense, Telstra's earnings are more defensive than those in most other sectors, with its solid balance sheet and liquidity position providing further comfort it can ride out the current storm.”

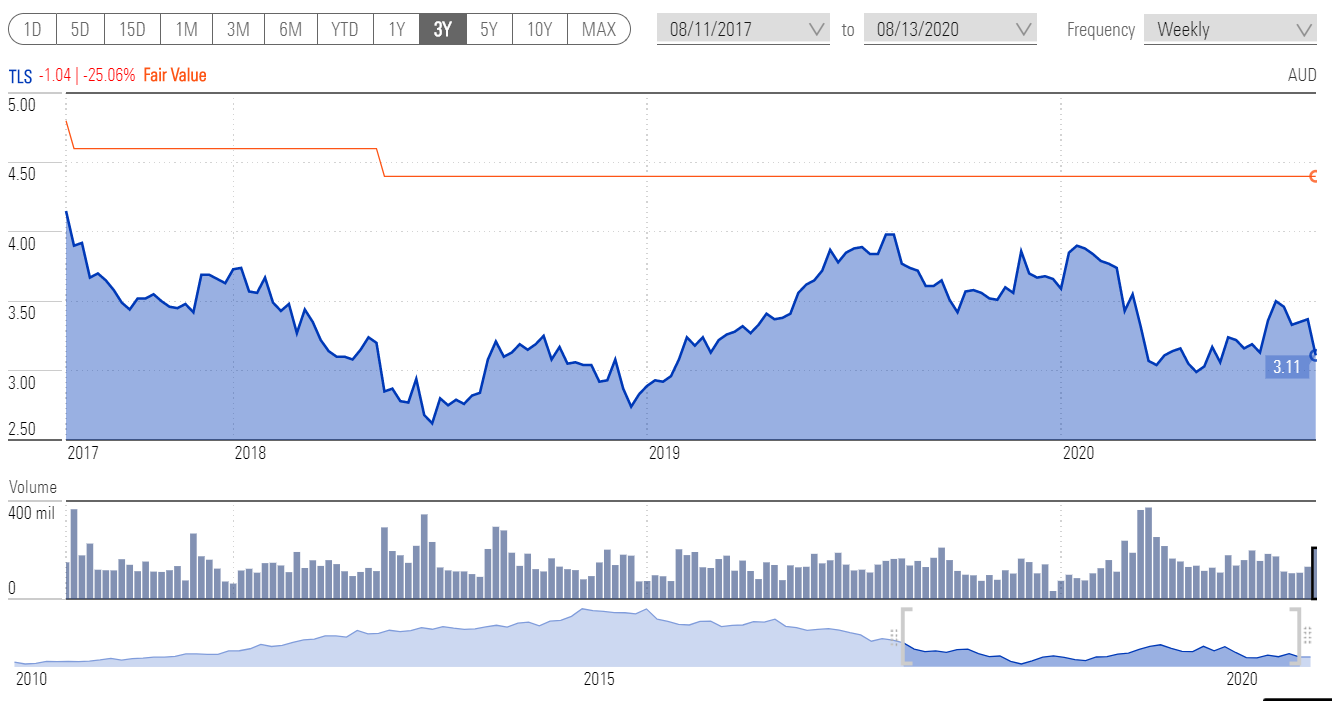

Telstra (TLS) - 3YR

Source: Morningstar Premium

13 per cent fall in profit

Telstra on Thursday posted a 12.6 per cent fall in annual normalised net profit and extended a pause on planned job cuts after a rotten year marked first by the summer bushfires and then the coronavirus.

Net profit for 2019/20 was $1.84 billion, down from $2.11 billion in the previous year, on revenue of $26.2 billion, which was in line with expectations.

Like-for-like underlying EBITDA totalled $8.4 billion, down 0.3 per cent.

The hit from the bushfires is estimated at $40 million, while the covid-19 impact was $200 million in 2019/20.

Telstra fell by more than 8 per cent on Thursday to close at $3.11. It is trading at a 18 per cent discount to Han’s revised fair value estimate.

‘Emotional and economic stresses’: Penn

Despite the “emotional and economic stresses” caused by covid, Telstra chief executive Andy Penn was upbeat about the year ahead.

Telstra has forecast underlying earnings of between $6.5 billion and $7 billion, assuming the $400 million covid hit, which takes into account the loss of international roaming charges because of border closures, the cost of customer support packages including unlimited data and free phone calls, and project delays.

It has cut underlying fixed costs by down $615 million over the year, leaving it on track to meet its goal of $2.5 billion in cuts in by fiscal 2022.

Overall, mobile revenue fell $461 million in 2019/20 while fixed-line revenue continued to be affected by NBN migration, alongside a continued decline in voice services.

"NBN wholesale pricing remains the largest negative impact on our fixed business," Penn said.

"Without some sort of long-term change ... the risk of retail price increases, reduced customer experience or customers moving onto other networks such as 5G will increase."

Key tests

One troubling factor for Han is the delay in Telstra’s productivity improvement program. It faces NBN earnings headwinds of up to $700 million in fiscal 2021 yet is only stripping out $400 million in the year—$100 million less than planned.

While the final dividend was kept at 8 cents a share, fully franked, Han says the “uninspiring” outlook has forced him to cut his dividend per share forecast by 2 cents a share to 14 cents in fiscal 2021 and fiscal 2022, before returning to 16 cents a year.

To sustain this payout, however, Telstra will need to generate EBITDA of $7.5 billion to $8 billion. Han says this was previously achievable but is now in danger from several factors, including an 11 per cent fall in 2020 fiscal second-half mobile earnings, persistently intense competition and an underwhelming reduction in fixed costs.

“The key test is how successful the Telstra board and management are in combating the margin-crunching impact of the NBN, execution of the $2.5 billion net productivity gain program by fiscal 2022 and how it responds to the current unprecedented competitive intensity especially in the mobile and broadband space.”

However, there is room for optimism. Han says the balance sheet remains in good shape, with net debt/EBITDA of 1.9 (versus 1.5 to 2.0 comfort range) and gearing of 52.7 per cent (versus 50 per cent to 70 per cent comfort range).

“The preliminary impact of covid-19 on Telstra demonstrates the relative resilience of its earnings and the comfort of its balance sheet,” Han says.

"The wildcard now is just how quickly Telstra recovers from all the covid-related damage to earnings and how it plans to get the cost-out program back on track, against a competitive backdrop that doesn’t seem to easing as we had previously anticipated."

Additional reporting: AAP

Morningstar Premium subscribers can read Brian Han’s full note here.

This article is part of Morningstar's Reporting Season 2020 coverage. The calendar will be updated daily to connect you with our equity analysts' take on the financial results.