Earnings season is about to start. Here's what to expect

Investors should treat with caution company results and keep in mind the covid fallout, says Peter Warnes.

"Don’t extrapolate from peaks or troughs". That's the short but sharp advice Morningstar head of equity research Peter Warnes imparted to readers of his Your Money Weekly newsletter heading into reporting season February 2021.

Echoing the themes of a year to forget, Warnes said investors should again expect to see the divergence we've all become familiar: some companies benefited from the lockdowns and massive government stimulus programs while others are clinging to life. Backward-looking results will reflect the height of the pandemic in the second half of 2020 where business operations bent to the second wave of infections. However, Warnes advises investors against concluding too much from peak and/or trough of earnings and instead focus of whether companies did well given the circumstances.

"We know that some companies have performed badly because of covid, like travel and hospitality, and others like iron ore miners and retailers have benefited," he says.

"But I wouldn't extrapolate from the peaks of lows of earnings, particularly as we know JobKeeper will be wound back after March.

"The conditions that these companies are reporting on reflect the peak of the pandemic—the lockdowns and the closed boarders—but also the peak of the government support and the stimulus."

Reporting season may on the horizon but Warnes' mind is firmly on the looming March 28 deadline when the JobKeeper support package ends. He believes that few managers will be game enough to issue concrete guidance as the era of big spending draws to its inevitable conclusion and economic uncertainty remains.

"We just don't know the implications of the withdrawal of support yet, and how household spending will respond," he says.

"Don't forget, unemployment still has a 6 in front of it, and while we've made some inroads, 800,000 Australians are without a job."

Prime Minister Scott Morrison ruled out extending the JobKeeper payment beyond the March deadline, telling the National Press Club on Monday: “You can’t run the Australian economy on taxpayers’ money forever. We are not running a blank cheque budget.” Under JobKeeper, businesses were receiving $500 per week for each staff member working at last 20 hours per week in January.

Warnes says investors must get used to the idea that the tailwinds that buoyed markets in 2020 could start turning.

"The government isn't going to pull the rug out from under the economy, but investors need to recognise that markets have gone up because more and more stimulus has been thrown at it every day of the week for the last six months," he says.

"It's not going to keep happening that way. There's been massive amounts of spending thrown at this pandemic, but it can't go on forever. There's record debt everywhere you look. The debt levels are frightening. We've got to realise that the level of debt across the globe is potentially going to take the wind out of the economic recovery."

Devil in the details

Within the retail sector, Warnes says top line sales will be robust. Investors, he says, should keep an eye on how margins have shifted for online retailers in particular as they claw market share away from brick-and-mortar stores.

"Australia Post had its biggest month in December, delivering more than 52 million parcels—but they've also had a lot of returns," he says.

"Customers are purchasing more items than they need, sending back the ones they don't want. It's the online businesses who have to fund the cost of that return. We've seen Amazon come out and ask customers to keep their items where the economics of returns isn't weighing up. All of a sudden you might see your gross margin all right, the sales will be there, but your net margin is pretty ordinary.

"The level of expectation is very high for retailers at this time to perform."

MORE ON THIS TOPIC: Opportunity shifts from retail to travel

Warnes says the payment of dividends is one area where management will struggle to manage the expectations game.

"If companies are cautious on dividends they may get smacked because the expectations was that they should have paid them out," he says.

"However, visibility isn't great and we're probably going to see more headwinds than tailwinds. Everything isn't hunky dory and this massive spending by government can't go on forever."

However, Warnes says payout rates could give investors an clue into the psyche of management and how confident they are about their future.

Back to basics

Reporting season can feel like a rollercoaster ride for investors, with fluctuations in stock prices arising from unexpected results. Share markets don't always react rationally to results. A company can report huge profits, but if they fall short of market expectations, the stock price may fall rapidly. On the flip side, a market overreaction can create buying opportunities for investors, although Morningstar director of equity research, Adam Fleck, says a myopic focus on the headline numbers can lead investors astray.

"There's a lot more to uncovering whether there's a buying or selling opportunity," Fleck says.

"Companies could report higher than expected profits, but it may have been a one-off item or short-term issue which is masking a long-term negative. The headline numbers don't always tell the whole story."

MORE ON THIS TOPIC: Investing basics: everything you need to know about reporting season

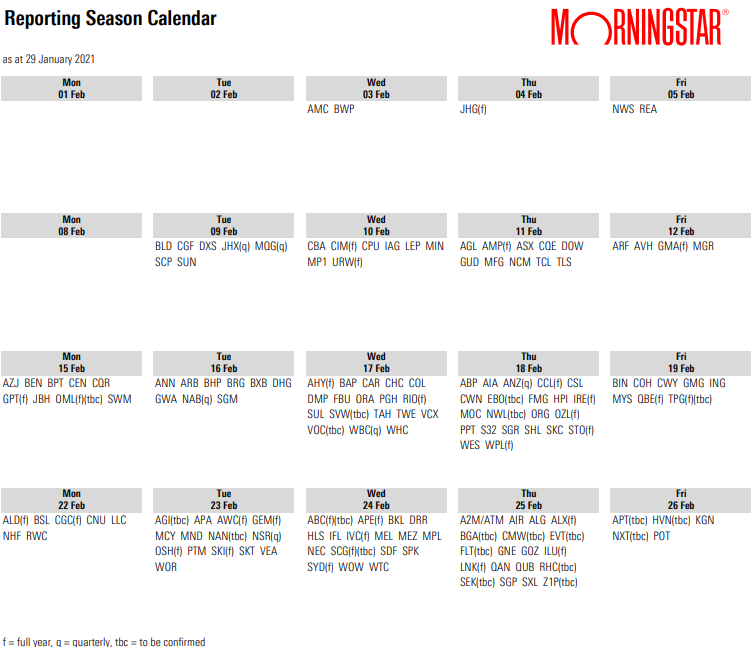

With the deluge of information, heavy media coverage and rapid stock price movements, it can be difficult to stay on top of the results. Morningstar has compiled a handy list of more than 150 companies under coverage that will release earnings results during the February 2021 Reporting Season.

Click to download

Source: Morningstar analysts, ASX announcements

Bookmark this page. We'll update this list daily with access to research notes from our Morningstar equity analyst team.

The editorial team will also be here to help you through the latest news as it rolls in. At the end of each week, we'll provide you with a summary of the most significant results from the week, alongside analyst commentary, so you don't miss a beat.

Peter Warnes will give his take on the season later this month. ![]() Premium subscribers can check out last season's insights here.

Premium subscribers can check out last season's insights here.

Follow the Morningstar ASX300 News Digest for the latest ASX company announcements.

Dates are subject to change as companies may alter their reporting date.