Morningstar initiates coverage of insurance giant AUB Group, drops Mortgage Choice

Analysts have dropped coverage of a no-moat company with high uncertainty, replacing it with a moated stock they believe is undervalued.

Morningstar equity analysts have begun coverage of Australia's second-largest insurance broker network AUB Group (ASX: AUB) with a four-star rating, saying the company's aggressive takeover and partnership strategy will help it grow market share and premiums.

In a research note, equity analyst Nathan Zaia said AUB's recent stake in online insurance broker BizCover will allow the group to grow their share of the small to medium enterprise market (SME) and scale their business.

"BizCover's commercial insurance platform allows micro-SME clients to purchase some insurance products online without broker intervention," Zaia says.

"We see the ability to take share in the micro-SME market, where it has not been profitable for a broker to allocate resources, as a key investment motivation.

"We also believe the investment exemplifies AUB's use of scale to bring technology to benefit the entire network.

"All AUB brokers use a common broking platform, which will incorporate technology from BizCover to accelerate processing of low-value premiums.

"As some of these micro-SMEs grow and their insurance needs escalate, AUB can present those leads to a broker within its network."

In addition, Zaia says AUB's joint venture accounting network Kelly+Partners will act as a "lead generator" for the wider business, opening the smaller end of the SME market.

AUB spent $275 million on two acquisitions in late 2019 – a 40 per cent of insurance broker BizCover for $132 million and 100 per cent stake of Adelaide insurance brokerage MGA Whittles Group for $140 million.

BizCover is a self-service insurance platform targeting small and medium-sized enterprises which allows clients to purchase insurance products online without broker intervention. Late last year, AUB also acquired specialist brokers 360 Underwriting Solutions, exposing them to the tourism insurance SME market, and joined forces with accounting firm Kelly+Partners Group. Tourism divisions earnings have faltered due to the pandemic, but Zaia believes they will bounce back.

AUB owns stakes in more than 70 brokerage businesses, which collectively write over $3 billion in premiums. This equates to around 11 per cent of the intermediated insurance market in Australia, only trailing narrow-moat Steadfast (ASX: SDF) which covers over 30 per cent.

Zaia forecasts AUB to modestly grow its share of the Australian intermediated general insurance market, from 11 per cent in 2020 to 13 per cent by fiscal 2025. Revenues are derived from commissions, businesses it owns and a share of profits from associates and joint ventures.

Narrow moat

Zaia has placed an initial fair value of $19.50 on the small-cap stock. Late on Wednesday, the stock was trading at $18.09 – a 7 per cent discount to Zaia’s estimate. He believes the market is not recognising AUB's opportunities to grow premiums, improve operating leverage across the business and expand margins.

"It's a pretty capital-light business. There aren't huge amounts of investment requirements," he says.

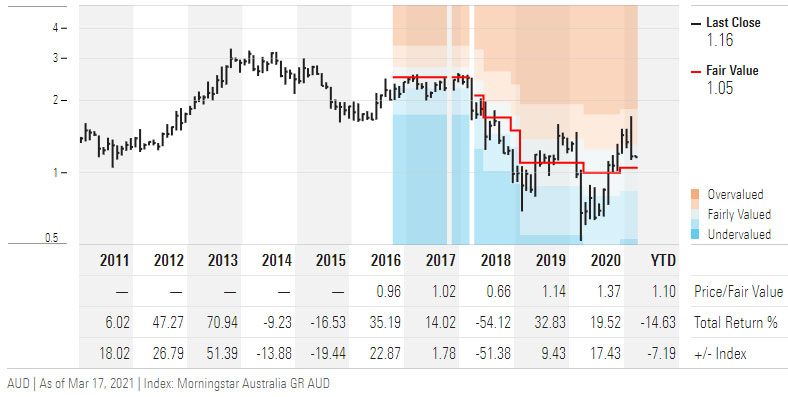

AUB Group | Share Price, 10 Yr

Source: Morningstar Direct; data as at 17 March 2021

Zaia says AUB carries a narrow-moat rating based on “switching costs”. These costs exist between the customer and the broker, and the broker and the AUB network, he says.

"The tangible benefits for clients to switch to an alternative broker are uncertain; and there are tangible risks or costs in moving from a broker who understands specific business need (and can align those to a broad range of insurance offering), versus one who does not.

"Brokers and underwriting agencies are incentivised to remain with AUB to access policies which are cheaper or have better terms and for the strong technological support. These benefits reflect AUB's scale and strong position in the Australian intermediated general insurance market.”

AUB's client retention rate is high, exceeding 90 per cent.

Australian funds with significant holdings in AUB Group include Perpetual Ethical SRI, UBS Australian Small Companies, Pendal Smaller Companies and Pengana Emerging Companies, according to Morningstar data.

And what of AUB Group's largest competitor? Zaia says Steadfast's business model is slightly different and could be superior in the long run. Steadfast allows brokers to join the network and pay a fee for access to technology and policies, without Steadfast taking an equity stake.

"We believe this helps add to Steadfast's scale benefits (marketing, technology, training, claims support, and insurer negotiations) and grows the pipeline of brokers which can potentially be acquired in the future," he says.

Steadfast is currently trading within a range Morningstar considers fairly valued.

Source: Morningstar Direct

Bulls Say

- AUB's scale and expertise in insurance products and services leave it well placed to benefit from higher insurance pricing.

- BizCover and the Kelly+Partners partnership see AUB placed to take market share in the smaller end of the SME market.

- The firm's acquisition strategy, both new investments and increased equity stakes, likely boosts EPS growth.

Bears Say

- Insurance volumes and prices are closely tied to the insurance cycle and general economic conditions. Downside risk could increase if Australia's growth outlook weakens.

- The insurance pricing cycle could weaken if excess capacity and competition in the global reinsurance market increases.

- If the Steadfast Client Trading Platform--which pays higher commissions--gains traction, AUB could find it hard to attract new brokers.

Ceasing coverage of Mortgage Choice

Morningstar’s initiation of AUB Group coincides with the removal of Mortgage Choice (ASX: MOC) from coverage in mid-April. Zaia says he doesn't think Mortgage Choice has an economic moat and lacks pricing power over lenders. He expects flat earnings over the next five years due to a relatively fixed operating cost-base and falling trail commissions.

"While spreading marketing and back office costs across a large broking network is advantageous, it has not prevented brokers from switching to competitors either for larger commissions or more leads," he says. "Customer switching costs are also low."

Zaia also believes the company is subject to regulatory changes which could affect returns and the ability to grow.

Morningstar begun coverage of the stock in May 2006. Coverage was dropped in March 2009, before being reinstated in October 2016.

Mortgage Choice Price v Fair Value

Source: Morningstar Direct