Nine back in the picture amid post-merger gains

Nine shares have surged after the entertainment giant posted a $140 million first-half post-merger profit and said streaming service Stan would soon be making money.

Nine shares have surged after the entertainment giant posted a $140 million first-half post-merger profit and said streaming service Stan would soon be making money.

Nine (ASX: NEC) copped $43 million in costs related to December's merger with Fairfax Media, but its pro forma (or projected) net profit rose 1 per cent, helped by a $93 million increase in Stan's carrying value and the sale of the NBN station in Newcastle.

Nine's pro-forma results consolidate the results for the former Nine and Fairfax businesses for the full six months, including the consolidation of Stan. Nine and Fairfax implemented their merger on 7 December last year.

Source: Nine Entertinament H119 Result

On Friday at 11am, Nine shares were trading at $1.56, approaching their highest post-merger price of $1.675.

Chief executive Hugh Marks said the company's overall result was a "testimony to the new Nine".

"Nine is uniquely positioned through the combination of the operating strength of our traditional media assets as well as an increasing exposure to the continued transition of the market towards digital media assets," he said.

Total pro forma revenue fell by $9.8 million, or 1 per cent, to $709.8 million.

The new conglomerate's loss-making regional publishing unit, ACM, remains in the shop window with Kiwi news site Stuff NZ after six months marred by drought and a soft advertising market.

Marks said ACM represented an opportunity for suitors to replicate the success of Nine's metro publishing transformation - where circulation and revenue had stabilised - to a regional audience. He said Stuff NZ was a stronger digital offering.

"As I stand here today, there will be interest in both businesses," Marks said.

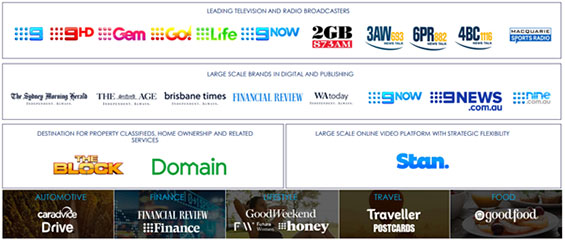

Nine currently owns or has a controlling stake in a free-to-air commercial network, radio broadcasters 2GB and Macquarie Sports Radio, metro digital and print newspapers in multiple capital cities, property classifieds business Domain and online video streaming platform Stan, amongst others.

Source: Nine Entertinament H119 Result

The company benefited from a change in national the "2 out of 3 " and "75 per cent reach" media ownership rules in October 2017, which cleared the path for Nine to pursue a $4 billion merger with Fairfax Media.

Marks said Nine is expecting a 10 per cent lift in full-year pro forma earnings to $420 million, with Stan tracking to post its first profit in FY20.

Morningstar equity analyst Brian Han was buoyed by management's decision to provide guidance during what he described as a destructive year for the company.

"The fact they were willing to give guidance shows how much confidence they have," he said.

Han acknowledged that some the acquired business had performed poorly, including Stuff.co.nz and the Australian community newspapers division, but was unfazed, saying that both are on the chopping block.

Han welcomed the result from Nine's broadcast division, which accounts for 54 per cent of group revenue, saying the segment did well in the context of a weak advertising market.

While Australia's lacklustre property market has kept real estate investment Domain flat, TV on demand service 9NOW is booming, with nearly 50 per cent of the catch-up market and a strong start to 2019 thanks to the success of Married at First Sight and the Australian Open.

However, the cricket factor reduced TV costs by 13 per cent, or $60 million.

Han was pleased by a strong result from Stan, now expected to be profitable by Q4 2019 year after growing subscribers to 1.5 million and securing a range of content supply agreements with Showtime, MGM, Sony, Disney and STARZ.

Revenue from metro print subscriptions, including The Age and the Sydney Morning Herald, rose 1 per cent to $86.4 million, while digital subscription revenue lifted 14 per cent to $27.7 million.

Print ad revenue was down 1 per cent to $71 million but digital ad revenue climbed 21 per cent to $32.7 million, lifting total revenue 4 per cent higher to $240.8 million.

Overall, Han said Nine managed to shake off the scepticism rife in the market throughout the merger.

"When Nine bought Fairfax, people were negative on the stock, but Fairfax's crown jewel's Domain and Stan are both doing reasonably well, and Nine is continuing to shed poor performing assets," he said.

Han says the company's long-term value remains "hostage" to how it competes against the onslaught of digital disruptors such as Google, Facebook, and Netflix, but says that at its current depressed price, the stock is undervalued.

Nine's statutory profit slipped 1.4 per cent to $171 million in the six months to December 31.

The company has maintained its interim dividend of 5 cents per share, fully franked.