Spending is shifting back to services; here's US equities to play it - Part 1

Beaten-down industries, such as airlines, hotels, cruise lines and gaming should benefit from a return to normal spending patterns.

Part 1 of a two-part series on US stock ideas to take advantage of the shift back to services spending.

In March 2020, restaurant reservations were canceled, vacations put on hold, and social distancing quickly became the norm. Consumer spending rapidly shifted into pantry-loading, electronics to support working from home, and home renovations.

Even as the pandemic continues today, many consumer patterns are shifting back to pre-COVID patterns. As consumer behavior continues to normalize, we expect that spending will return to prepandemic trends between goods and services.

That should help stocks in a number of beaten-down industries, such as airlines, hotels, cruise lines and gaming. The return to concerts and other public events should flow through to help drive profits higher at alcoholic beverage companies.

The slowing rate of economic growth, including the possibility of a recession, compounded by inflationary pressures, may constrict the overall level of consumer spending. But we don’t expect that these headwinds will derail the even larger trend for consumer spending to normalize, and shift back toward services and away from goods.

What will consumer spending normalization look like

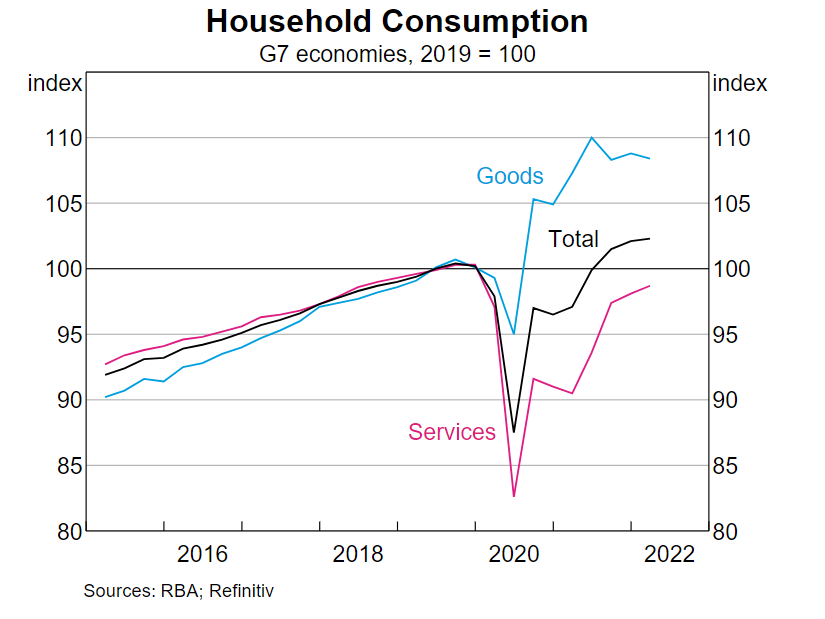

The emergence of the pandemic led to one of the most rapid shifts in consumer spending behavior in history. Purchases of both goods and services initially fell off a cliff in April 2020, but spending on goods quickly recovered and soared higher.

The cumulative amount of growth on goods spending since January 2020 peaked in early 2021 and has slightly declined, but the emergence of several COVID-19 variants in the past year has slowed the normalization of consumer spending behavior.

We forecast that the current deviation in spending on goods and services will converge back to their prepandemic trends by mid-2023. In the US this equates to a swing of about US$450 billion, and this shift could even be larger. Many households may be saturated with goods across several categories in which consumers pulled forward future demand. In addition, consumers may seek to make up for services forgone during the pandemic.

Where to invest to leverage off this normalization?

As spending shifts back to services, one of the areas that we think is best poised to benefit is the travel and entertainment industry. This sector includes air travel, cruise lines, gaming, hotels, and ride-hailing, and is supported by technology providers dedicated to the travel sector. In addition, there are other areas that we think will benefit from employees going back to work and consumers returning to public events.

Air travel

Leisure air travel has largely rebounded, but both business and international travel have lagged the overall recovery. While videoconferencing has become more commonplace, we project that business and international travel will return to prepandemic levels by 2024. While the stocks of all the airlines are currently undervalued, we think that Delta is best leveraged to benefit from the return of the business traveler and forecast that its operating margin will rebound to prepandemic levels in 2025.

Cruise lines

Early on during the pandemic few industries were as tarnished as the cruise lines. They initially canceled departures and shut down travel routes. In 2022, industry capacity has returned, and utilization has been quickly rebounding. For example, during its first-quarter earnings call, Norwegian Cruise Line NCLH reported its number of bookings improves throughout the rest of this year with the fourth quarter in line with the comparable 2019 period, and at meaningfully higher prices. Booking trends for 2023 continued to be positive with both booked position and pricing higher and at record levels compared with 2019.

Similarly, we think other undervalued cruise lines, such as Carnival and Royal Caribbean Cruises RCL, are poised to benefit from the same trends.

Gaming

Las Vegas is quickly recovering to prepandemic levels, and we think casino operators such as Caesars Entertainment and MGM Resorts MGM will benefit. With over 60 million members in its industry loyalty program, leadership in digital and sports gaming, and additional synergies to be derived from its merger with Eldorado in 2020, we think Caesars is the best positioned to benefit from the recovery in the gaming industry.

Hotels

As vacations were postponed and business trips canceled in 2020, on average the amount of revenue per available room dropped more than 60% across the hotel industry. Revenue and occupancy levels began to rebound in 2021, and in 2022 we expect that many hotels will return to 90% of their prepandemic levels. Generally, we expect the hotels under our coverage to return to prepandemic levels in 2023.

Hotel stocks held up relatively well earlier this year but were caught up with the rest of the market in the June selloff. While many of these stocks are fairly to slightly undervalued, we see the most upside potential in a hotel REIT stock, Park Hotels & Resorts PK. It is the second-largest US lodging REIT and is focused on the upper-upscale hotel segment. This stock is highly leveraged to the return of group, international, and business travel, and we forecast it will return to prepandemic levels in 2024.

Part 2 will cover the return to office theme and companies in the alcoholic beverage space among others.