Supermarkets' best days are behind them

The golden days for Australia's supermarket duopoly are coming to an end, says Morningstar's Johannes Faul.

It's been a dream run for Australia's supermarket duopoly Coles and Woolworths.

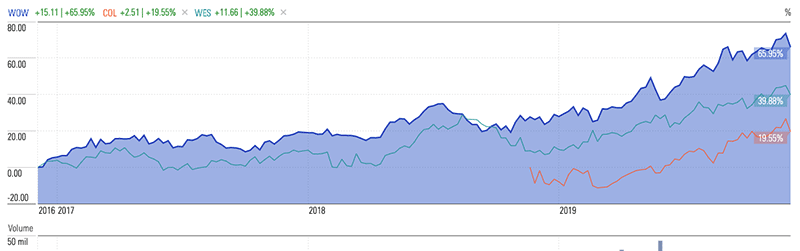

A year after Coles (ASX: COL) demerged from Wesfarmers (ASX: WES), shareholders in both companies should be happy. Shares in both companies have risen by more 30 per cent, soundly beating the ASX 200 index return of around 19 per cent.

And while Woolworth's (ASX: WOW) shares fell substantially in 2015 and 2016, over the last three years the company has delivered 64 per cent stock price growth to shareholders, climbing to 10-year highs in late November.

3-Yr Growth Chart | WOW, COL, WES

Source: Morningstar Premium

But Morningstar equity analyst Johannes Faul believes the good times are coming to an end. He warns in a new special report that competitive intensity in the Australian supermarket sector means a return to duopoly-like margins is unlikely.

Woolworths and Coles remain strong businesses, with competitive advantages stemming from their market-leading positions. This results in low costs of doing business, strong bargaining power and vast store networks offering convenience to customers.

"The current share prices imply Woolworths and Coles can both crank up their profitability towards all-time highs. The evidence to date, as well as the competitive environment, suggests otherwise to us," he says.

Faul says price competition from cut-price German grocer Aldi in the discounter channel and online from Amazon is forcing Australia's supermarket giants to compete more aggressively on price, impeding any meaningful margin improvement.

German hypermarket and the fourth-largest retailer globally, Kaufland, is also planning an Australian launch. The first stores will open in Victoria before it expands into South Australia and New South Wales.

Faul is forecasting earnings before interest and tax margins to remain relatively flat for the two largest incumbents, particularly given their sharper focus on food retailing after hiving off petrol retailing and hotel operations. Woolworths is set to demerge its liquor and pub operations in 2020.

Supermarket operations account for around 86 per cent and 88 per cent of group earnings for Woolworths and Coles, Faul estimates.

Stock loss – such as cashier and administrative errors, theft, damage prior to sale or perishing goods – may be a wildcard, Faul notes, and may be less pronounced than expected.

Material improvements in stock loss was a main driver for the improvement in EBIT margins to 4.7 per cent in fiscal 2017 from a low of 4.5 per cent in fiscal 2017.

Today, Coles is cheaper than Woolworths and is Morningstar’s preferred pick for investors seeking exposure to the Australian listed consumer staples sector. However, Faul views it as overvalued, adding that there are much more attractive investment opportunities in overseas markets.

Over the next two years, Faul expects a period of intense, but relatively stable competition. He says decreasing food deflation is pointing to an easing of direct price competition and discounting strategies.

Source: Morningstar Premium

After revisiting his projections from three years ago, Faul concedes he underestimated the relative strength of Woolworths versus rival Coles. But he believes both companies' earnings are less volatile and easier to predict than the overall market, noting his projections for combined sales and profit forecasts weren't far off the mark.

As such, Faul has increased WOW's structural EBIT margin advantage over Coles, leading to an 8 per cent increase in Woolworths' fair value estimate, up to $27.50 per share. Coles' fair value estimate has been lifted 4 per cent to $12.50.