The future of work still has an office: Morningstar

Commercial property sector can look forward to continuing demand for office space, says Morningstar's Alex Prineas.

Working from home. Video conferencing. A rush on desk chairs. The covid-19 pandemic transformed how Australians work, shifting focus from the CBD to the home office, and leaving city centres as ghost towns. But Morningstar equity analyst Alex Prineas doesn't think investors should quit the city. The office is set for a comeback

Prineas argues in a new special report on the Australian office A-REITs sector that fears of a long-term mass-exodus from city office towers are overblown. He acknowledges that a rise in flexible work policies will reduce demand for commercial office space, as many workers opt to work from home three-days a week, but doesn't think this will drastically reduce demand for office space.

Instead, employers who have increasingly packed their staff in like sardines over the last 30 years will ditch the crowded fit outs of yesteryear and opt for attractive spaces with a focus on health and distancing.

"If work-from-home adoption endures, employers will want to attract employees via functional and appealing workplaces," he says.

"We therefore estimate a large proportion of any space reductions achieved via adopting work-from-home will be offset by more space per employee."

"As commercial landlord Dexus points out, we think reverting to 2012 density is a realistic possibility, and we estimate this would more than offset space savings from WFH in the short to medium term, by which time supply will have had some time to digest to altered demand, and cyclical weakness should have abated."

Prineas adds that uncertainty in the commercial property market means any moves to reduce office space will happen incrementally, giving supply a change to adjust.

"Until there is more visibility, employers are unlikely to sign long-term leases cutting space to the absolute minimum," he says.

"Yet once the outlook is clearer, supply will likely have had time to adjust, the economy is likely to have recovered further, and headcounts likely to have grown.

"We believe businesses would be loath to shed office space, only to risk the disruption of another office move or new fit out if headcount grows, or if working practices end up replicating pre-pandemic norms more than allowed for.

Long leases mean employers will need time to take advantage of cost savings, says Prineas. The average lease for major office REITs ranges from 4 to 6 years, meaning there are employers on 10-year leases.

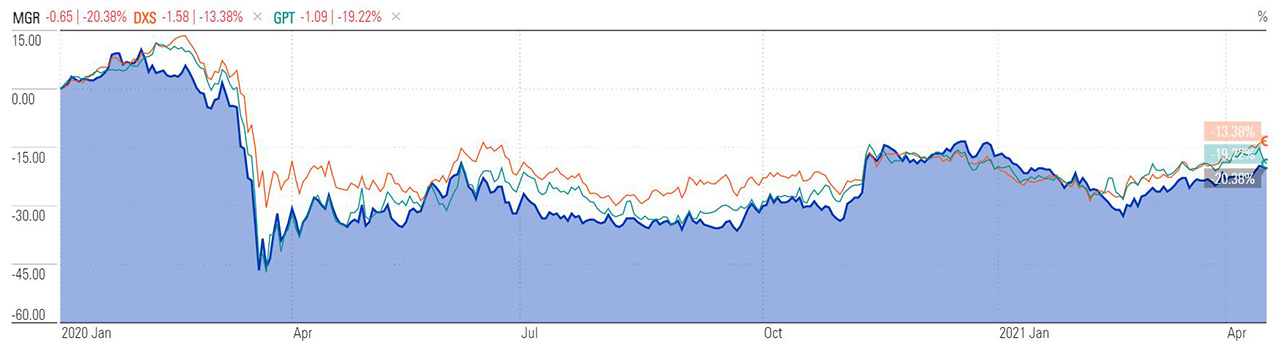

Morningstar has increased fair value estimates (FVEs) for Dexus (ASX: DXS), GPT (ASX: GPT) and Mirvac (ASX: MGR). Narrow moat Dexus closed Wednesday at $10.10, below the FVE of $10.55. No moat GPT closed $4.57, below the fair value estimate of $5.25, while Mirvac closed at $2.52, below an FVE of $2.85.

The retreat from CBDs in 2020 hurt the share prices of commercial property groups. Of the nine mentioned in the special report, only Charter Hall Group (ASX: CHC) has recovered to pre-pandemic levels.

Share price for Dexus, GPT, and Mirvac. 1 January 2020 – 20 April 2021

Source: Morningstar

While short term challenges remain for the sector, working from home is unlikely to have a calamitous effect on the balance of supply and demand for offices, says Prineas.

Remote working doesn’t always equal less office space

The bear case for commercial office space demand is two part. First, that a lengthy and painful recession means less bums on seats, and then eventually, that flexible working will mean less seats overall.

But in the short term, falling unemployment and a stronger recovery means more white-collar workers streaming into office towers each morning.

Longer term, anyone prophesising a revolution needs to contend with how long flexible working has been around, says Prineas.

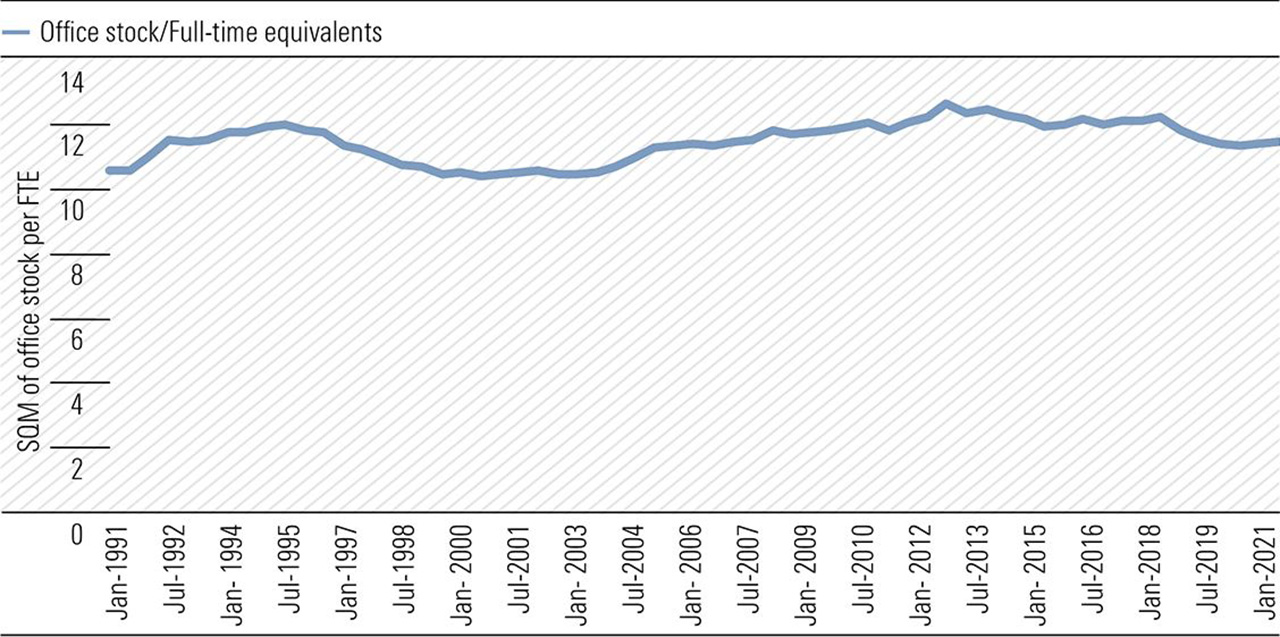

“Despite a substantial increase in both part-time employment and office density that have already occurred, the relationship between the size of the office market and the size of the employment market has remained fairly steady over time," he says.

Office capacity tends to track employment despite the rise of part-time work

Source: Property Council of Australia, January 2021 Office Market Report, Australian Capital Cities. Historical employment sourced from Australian Bureau of Statistics. Morningstar assumptions: each part-time job equates to 0.6 full time jobs.

Even if employees work three days per week in the office, which is broadly in line with recent surveys, it will only translate to market-wide space reductions of 5 per cent.

Part of the reason is employees often want to work the same days as their colleagues, says Alex Peck, co-founder of a commercial parking management technology company BaseUp.

"Companies need enough floorspace for their maximum occupancy day," he told Morningstar.

"We consistently see Tuesday, Wednesday, and Thursday as the busiest days in the office. But you need to have sufficient floor space for your workforce, even if Monday and Friday are less occupancy."

Peck added their data shows about 85 per cent of all employees come into the office once a week.

Smaller project pipeline means smaller supply glut

The pandemic is unlikely to create a serious glut of supply in the commercial real estate sector thanks to a smaller pipeline of new office projects.

Extra office supply should peak at around 6 per cent of the office market in 2023 says Prineas. That’s well below the 15 per cent of the early 1990s or the near 10 per cent following the global financial crisis.

Paradoxically, constructing new buildings could restrict supply in the short term. Limited space in the Sydney or Melbourne CBDs means new buildings often require knocking down or redeveloping older sites, taking them off the market for years.

Ultimately, the outlook is positive for a commercial property sector still struggling in the aftermath of the pandemic says Prineas.

“It’s certainly a headwind but it’s not a calamity for the sector."