Three quality names for your portfolio

InvoCare, Brambles and Link Administration get big ticks from Morningstar.

The Nasdaq hit a new high Monday as investors shrugged off inflation worries and piled back into growth stocks. But for those investors who want equity exposure with a tad more certainty and a sustainable competitive advantage to boot we’ve made a list.

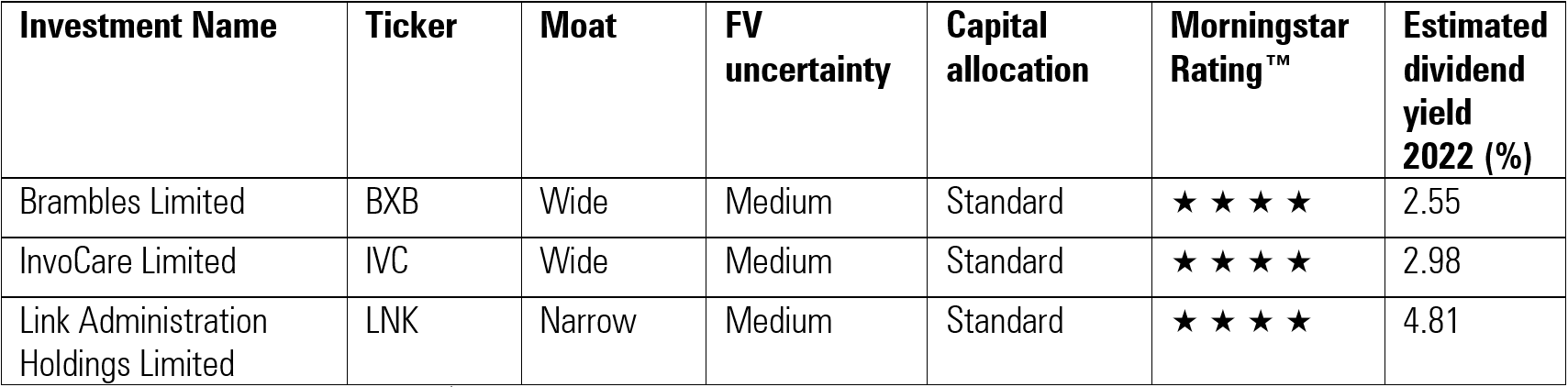

We’ve looked through the Morningstar Australia stock universe and picked out three undervalued names that score well on several measures of quality.

Our picks are all trading at discounts to their Morningstar fair value estimates and have a medium uncertainty rating, which assesses the predictability of a company's future cash flows.

The names also score at least a “standard” for capital allocation, so have a proven record of stewarding investor capital.

Most importantly they have economic moats, implying a ten-to-twenty-year competitive advantage.

The names straddle three sectors. For those looking for an industrial name for the reflation trade, there is pallet provider Brambles Limited (ASX: BXB).

For financials services exposure without the big banks, there is administration services provider Link Administration Holdings Limited (ASX: LNK).

Funeral operator InvoCare Limited (ASX: IVC) rounds out the list.

Of the three, Link is also forecast to a dividend yield over 4 per cent in 2022.

Three quality stock names

Source: Morningstar Premium

Brambles

Wide-moat Brambles is the largest and only global provider of pallet pooling operator. Companies rent pallets from them and Brambles handles their delivery, pick up and distribution. The firm recently divested itself of several underperforming non-core businesses to focus on pallet pooling.

“Competitive advantages, attractive margins, and high average returns on invested capital earn Brambles a wide economic moat,” says Morningstar senior equity analyst Grant Slade.

InvoCare

Wide-moat InvoCare is the largest funeral, cemetery, and crematorium operator in Australia and New Zealand, with more than a third of the revenue share in Australia. Covid restrictions have reduced demand for InvoCare’s services because of limited attendance at funerals and a shortened flu season, but Morningstar equity analyst Angus Hewitt thinks this will be temporary and that the industry is “fundamentally sound”.

“Death is one of few certainties in life, supporting steady demand for InvoCare's services,” says Hewitt.

Link Administration Holdings

Narrow-moat Link Administration provides administration services to the financial services sector in Australia and the UK, predominantly in the share registry and investment fund sectors.

“Client retention rates exceed 90% in both markets underpinned by inflation-linked contracts of between two and five years,” says Morningstar senior equity analyst Gareth James.

“The capital-light nature of the business model should enable good cash conversion, regular dividends, and relatively low gearing.”

Link Administration holds a 44 per cent shareholding in Pexa, which dominates the market for property conveyancing. Pexa is being listed on the ASX in an IPO Thursday.