Uncertainty could see a shift to growth – then back again

Value has bounced back, but it might be too soon to call it a comeback. Uncertainty has returned to the market, writes Lewis Jackson.

After a long, cold winter, green shoots have emerged for value stocks. The Russell 3000 Value Index gained 27.8 per cent against the Russell 3000 Growth Index’s 8.5 per cent between 1 September 2020 and 30 March 2021.

But could this be a false spring? Growth stock are on the rise, raising questions about whether this reprieve for names benefiting from the economic reopening may be short lived.

Morningstar fund analyst Ross Macmillan isn't surprised by this turn of events. He says uncertainty about the economic recovery and interest rates could have markets see-sawing between growth and value for the foreseeable future.

“Every time you see long government yields rise, you'll see a rotation. If the market calms down and regains its feeling about growth stocks, it will rally back again,” he says.

“You're seeing this being played out on a daily basis when you look at the US indexes. The Nasdaq will rally for a few days, then the Dow, with its more traditional industrial stocks, will rally in turn. It's like a heavyweight boxing match, each round someone is winning, then it changes.”

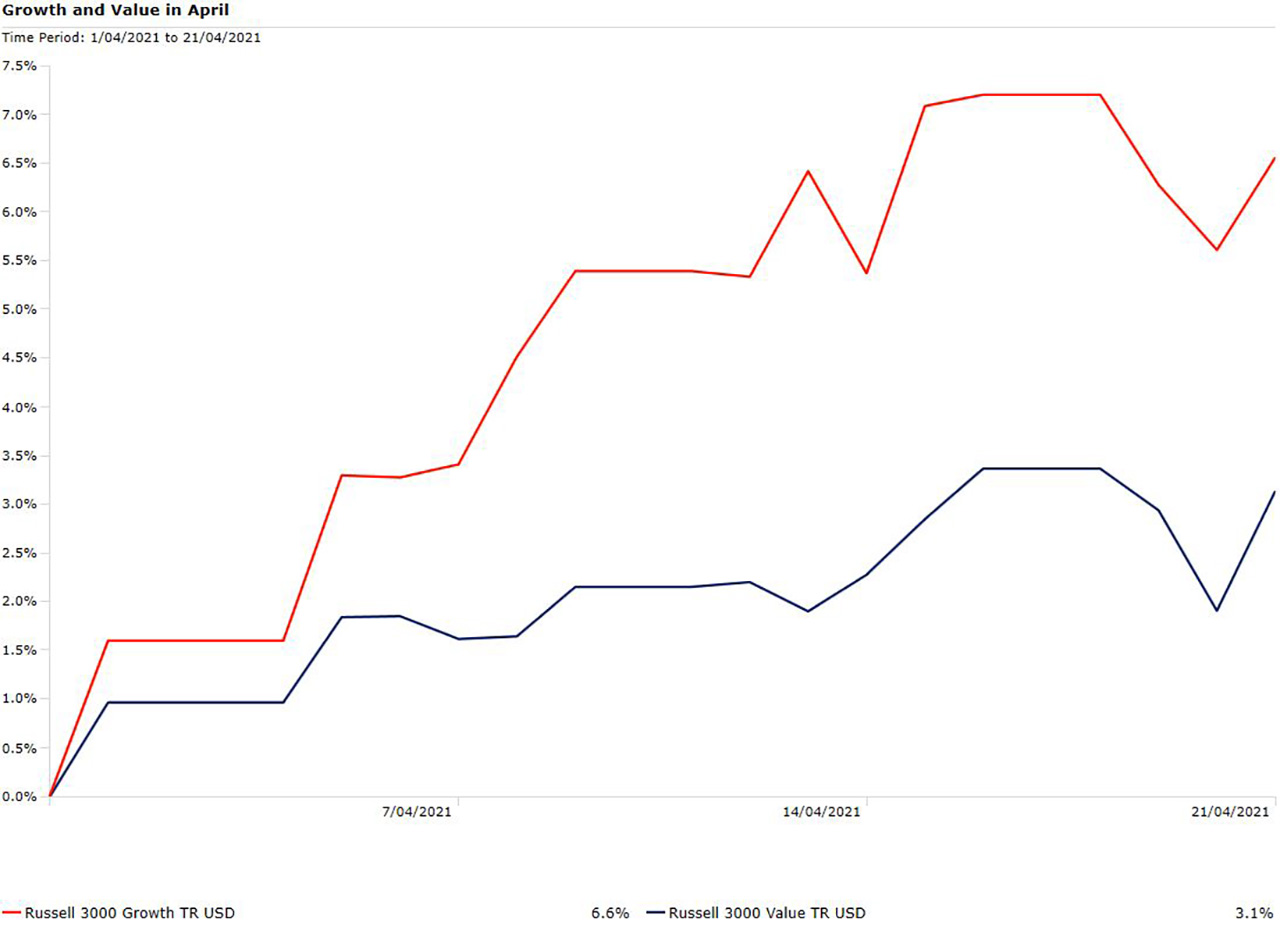

Growth stocks rally in April. Total return, percentage

Red - Growth. Blue - Value.

Source Morningstar Direct

Energy, financial services, and cyclical stocks helped value rally in Q1 2021, as expectations of a stronger recovery took hold. Among the top 10 best performing Australian ETFs were two bank ETFs, while the top performer was a crude oil ETF. The IMF now expects the world economy to grow by 6 per cent in 2021, up from its 5.5 per cent forecast in January.

The value rally also coincided with rising yields on government bonds, pushed higher by expectations that strong growth and rising inflation would force interest rates up sooner than expected. Yields on US 10-year bonds rose a 190 per cent between January and March this year. Higher interest rates would lower the present value of the future earnings that many growth stocks rely on.

But demand for growth stocks has revived, helped by falls in bond yields, and the repeated insistence from central banks that rates will remain low until 2023/2024. The Russell 3000 Growth Index doubled the return of the Russell 3000 Value Index in April, led by stocks like Apple, Microsoft and Amazon.

Meanwhile, global recovery plans are being buffeted by concerns over the AstraZeneca and Johnson & Johnson vaccines, while the domestic vaccination program faces delays.

An April poll by Goldman Sachs of 920 institutional investors found that while 45 per cent of respondents expect value equities will outperform growth over the next month, 39 per cent of respondents indicated that growth will outperform value.

Conflicting visions

Randal Jenneke, portfolio manager of the neutral-rated T. Rowe Price Australian Equity fund, thinks that betting on continued growth and inflation to lift value stocks at the expense of growth is risky.

“Current forecasts are predicting dramatic economic expansion in 2021, but except for Europe, this is where the acceleration ends. If these numbers are right, the cyclical rally will peter out in 2021,” Jenneke says.

“I believe we’ll see a short spike [of inflation] in the data in 2021 but the big question is how much of this is already priced in?

“If the inflation trade is a 2021 story, beware the rush of money that will look for sustainable growth on the other side. What was a good trade in November (Value that is), may not be right now.”

S&P Ratings Chief US Economist Beth Ann Bovino trusts central banks when they say inflation will not take off, S&P Global reports.

“The path of inflation is anchored by long-term inflation expectations. Globalization, the gig economy, and the Fed’s policy response framework are likely to continue playing outsized roles in forming such expectations.”

But a regime change in growth and bond yields that could help value stocks is coming, thanks to a restart in the global industrial cycle and potential for a multi-decade decarbonisation investment cycle, says Rameez Sadikot, a Portfolio Manager at Antipodes Partners.

“In the context of yields, the short-term effect of fiscal stimulus plus the long-term effect of investment in decarbonisation is likely to favour a positive growth environment,” says Sadikot.

“When that happens, we will see real yields rise as an outcome of a strong global economy."

"The market is putting a premium on growth—the valuation gap between low and high multiple stocks is close to dot com bubble levels. Higher real yields will trigger a narrowing of that gap.”

Still, he acknowledges any transition will not be straightforward.

“There will be volatility going forward, and there is no straight path through a reopening and decarbonisation spending.”

Over the long horizon, the differences between growth and value start to fade, says Morningstar director in fund research, Ben Johnson.

“From their December 1978 inception through April 11, 2021, the Russel value index gained 12.09 per cent annually while the growth index gained 12.11 per cent per year.”

“At face value, long-haul investors in either arrived at essentially the same destination.”