Fed raises rates again, with a focus on talking tough

Powell stays hawkish on the inflation fight, but the markets are looking for a less restrictive Fed next year.

As widely expected, US Federal Reserve raised its key interest rate by 50 basis points in December, continuing with its effort to slow the economy and push inflation down meaningfully from its four-decade highs.

Comments from Fed Chair Jerome Powell following the decision signalled a determination to keep rates high until inflation is vanquished.

Powell’s comments contrast with a growing confidence in the markets that with inflation appearing to have peaked and, with two consecutive softer-than-expected readings on inflation, that the Fed will be able to stop raising rates early next year and begin easing monetary policy by the end of 2023. That expectation aligns with our call on both inflation and interest rates.

Amid the tough talk, the Fed tapered down the size of the rate hike, following four consecutive meetings of 75 basis point increases.

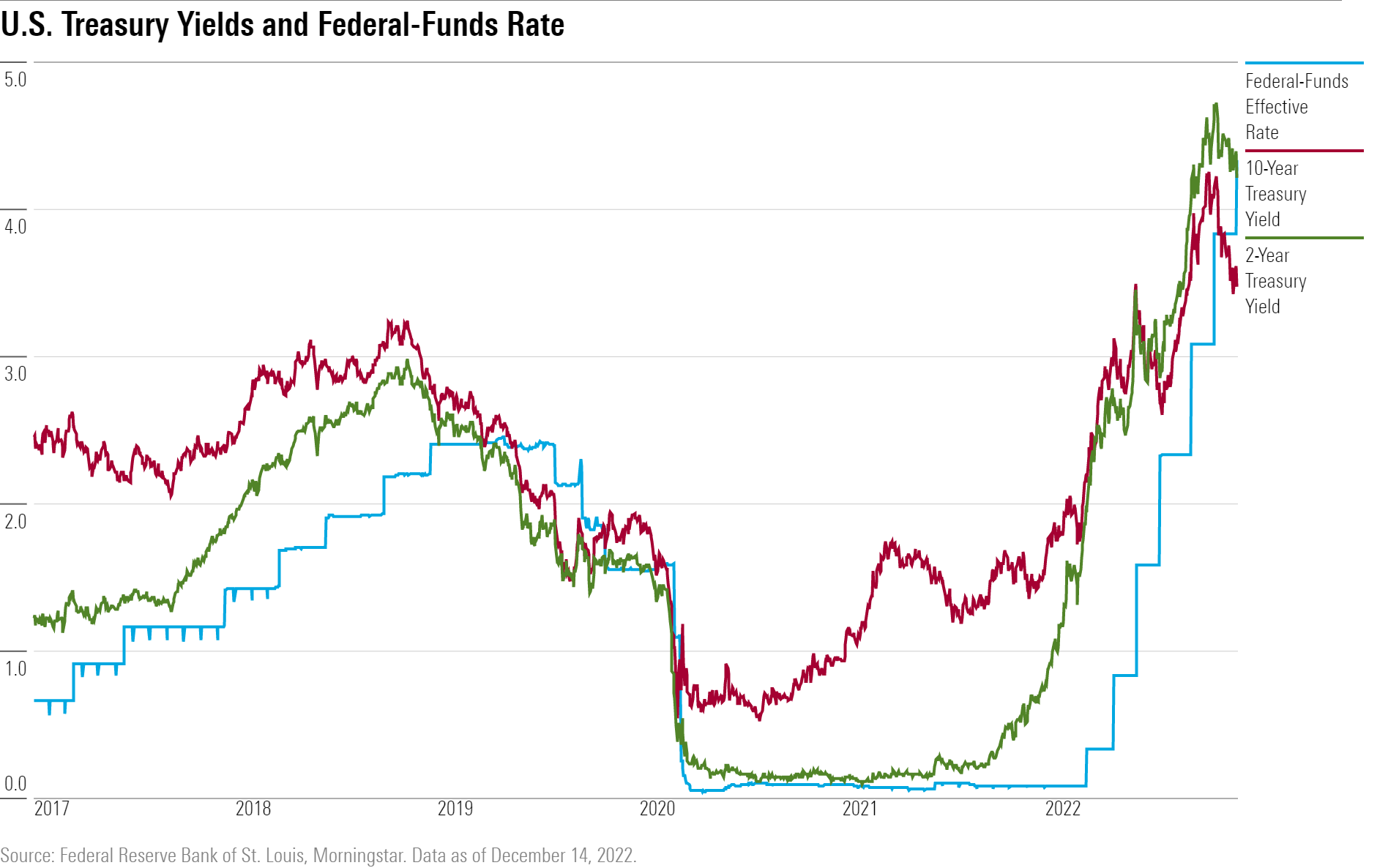

With Thursday's move, the federal-funds rate rises to a target range of 4.25%-4.5%, up from zero at the start of 2022.

When the Fed meets next in February 2023, we expect the rate-hike pace to moderate further to 25 basis points (in line with futures market expectations).

Focus now on the final destination

The key question now pivots from the speed of rate hikes to the eventual destination, as well as how long rates will remain on that plateau.

The updated projections from Federal Open Market Committee members show a median expected federal-funds rate of 5.1% in December 2023, up from 4.6% in the prior projection from September. This implies three more rate hikes of 0.25% in 2023 with no cuts through the end of that year.

Despite the increase in the Fed projections, bond markets hardly moved following the Fed announcement and Powell’s press conference.

Bond yields should move in line with the market’s expectation for the future path of the federal-funds rate. But market expectations now appear less attuned to what the Fed is saying than to incoming economic data, most notably the positive inflation data of the past two months.

Visible progress in the inflation data has caused a substantial drop in bond yields in the past two months, with the five-year U.S. Treasury yield falling to about 3.6% today from about 4.3%.

In effect, bond markets are baking in a more accommodative stance from the Fed down the line, despite the Fed’s own continued hawkish rhetoric. Indeed, futures markets imply a federal-funds rate range of 4.25%-4.5% in December, well below the Fed’s projection of 5.1%.

As Powell noted in his remarks today, the projections “do not represent … a decision or plan” that is set in stone. The projections are instead merely a forecast, and the Fed’s actual decision on future rate hikes will depend on the data on inflation and other macroeconomic variables.

When the Fed will cut rates

The drop in bond yields in the past two months reflects a partial convergence with our own projections.

Morningstar expects the battle against inflation to be won much sooner than the Fed anticipates, which in conjunction with weakening economic growth will call for rate cuts starting in the second half of 2023.

We expect rate cuts to continue steadily over 2024, with the federal-funds rate averaging just 1.6% in full year 2025 (as explained further in “Why We Expect the Fed to Cut Interest Rates in 2023″).

With that said, a continued fall in bond yields could create a quandary for the Fed.

The problem lies in the fact that the impact of monetary policy on the economy is ultimately determined by bond yields (along with credit spreads and other indicators of financial conditions), not the federal-funds rate.

The Fed is worried that if bond yields fall too much in the short run, economic activity could bounce back too quickly and prevent inflation from coming down to normal. We think this is why Fed projections currently look so hawkish, as the Fed is clearly trying to “talk” the market away from letting financial conditions ease too much.